Israel’s retaliatory bombing campaign has left more than 4,100 people dead, many of them also civilians, according to the Hamas-run health authorities in Gaza

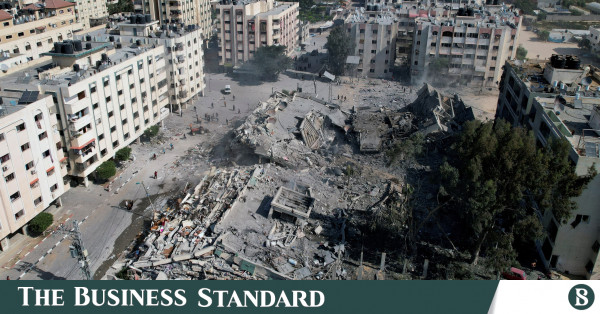

Palestinians gather around residential buildings destroyed in Israeli strikes in Zahra City, amid the ongoing conflict between Israel and Palestinian Islamist group Hamas, in southern Gaza City. Photo: REUTERS

“>

Palestinians gather around residential buildings destroyed in Israeli strikes in Zahra City, amid the ongoing conflict between Israel and Palestinian Islamist group Hamas, in southern Gaza City. Photo: REUTERS

The US Federal Reserve warned Friday that the recent attack on Israel and the ongoing Ukraine conflict could cause harm to the world economy and boost global inflation.

Israel has been conducting extensive air strikes on the Gaza Strip since 7 October, when more than 1,400 people, mostly civilians, were killed by Hamas during an armed attack on the south of the country.

Israel’s retaliatory bombing campaign has left more than 4,100 people dead, many of them also civilians, according to the Hamas-run health authorities in Gaza.

Ongoing exchanges of fire with Hezbollah along Israel’s northern border with Lebanon have raised fears that the conflict could spread to other countries in the region.

“The attack on Israel, in conjunction with Russia’s ongoing war against Ukraine, has ratcheted up geopolitical tensions,” the Fed said in its semi-annual report on financial stability.

“Escalation of these conflicts or a worsening in other geopolitical tensions could reduce economic activity and boost inflation worldwide,” it added.

Mitigating banking stress

In its report, the Fed also said that policy interventions earlier this year in light of the rapid collapse of Silicon Valley Bank (SVB) had “played a key role in mitigating the stresses in the banking system that emerged in March.”

SVB failed following a bank run by investors concerned by its exposure to interest rate risk in light of the Fed’s aggressive campaign of rate hikes.

A number of other US banks collapsed in the turmoil that followed, which also led to the merger, under pressure, of the Swiss banking giant Credit Suisse with regional rival UBS.

“Since March, volatility has abated and deposit outflows have largely stabilized,” for affected banks, the Fed said.

“But these banks nonetheless continued to face challenges navigating changes in depositor behaviour, higher funding costs, and reduced market values for investment securities,” it added.