- FTSE 100 falls, banks and mining stocks weigh

- NatWest slides, margins and deposits disappoint

- US markets expected to open lower, PCE figures to come

1.01pm: US stocks seen lower

Wall Street is likely to open down as strong tech-driven gains on Thursday fizzle out following mixed quarterly results from Amazon and as traders await key inflation data that is likely to influence the Federal Reserve’s decision on interest rates when the Federal Open Market Committee meets next week.

Futures for the Dow Jones Industrial Average shed 0.3% in Friday pre-market trading, while those for the broader S&P 500 index also fell 0.3% and contracts for the Nasdaq-100 lost 0.2%.

The main US benchmarks ended higher on Thursday, with a 14% rise in Meta Platforms’ share price supporting a 2.4% gain in the Nasdaq to 12,142, while the S&P 500 jumped 2% to 4,135 and the DJIA added 1.6% to 33,826 for its best trading day since January 6.

“US futures suggest Wall Street could give back some of those gains at the open stateside after Amazon’s cloud outlook disappointed,” commented Victoria Scholar, head of investment at interactive investor.

“After initially jumping 10% in the post-market session, Amazon fell over 2% after-hours following a mixed set of results. First-quarter group revenue hit $127.4 billion, outpacing analysts’ expectations. Advertising and Amazon Web Services also came in ahead of forecasts. However, it warned that cloud spending would slow in the current quarter amid ‘these tough economic conditions’,” she added.

Investors will also parse the first-quarter employment cost index (ECI), coupled with the Fed’s favoured inflation metric, the Personal Consumer Expenditure (PCE) deflator data, due this morning, said TickMill Group market analyst Patrick Munnelly

“Markets are looking for 1.1% print for the ECI which would represent a decline on an annual comparison basis. PCE inflation is also pencilled to retreat in unison with CPI data as the energy input continues to be supportive of lower inflation figures,” Munnelly added.

“Markets are expecting a decent pull back from the prior 5% print to something closer to 4%. However, the core number, excluding food and energy is expected to remain stubbornly elevated at the prior 4.6%.”

12.42pm: Exxon and Chevron post bumper profits

News of more big profits from two US oil giants.

Chevron Corp said first-quarter revenue fell due to lower commodity prices, though the oil major’s profit increased. For the three months ended March 31, the San Ramon, California-based oil and gas company reported net profit of US$6.61 bn, up 5.2% year-on-year from US$6.28bn. This was also higher than the profit in the fourth quarter of US$6.4 billion.

But revenue revenue fell 6.6% to US$50.79bn from US$54.37bn.

Exxon made US$11.4bn in profit in the first three months of the year, down 11% from the final quarter of 2022.

“It was a record first quarter coming after a record year and that’s despite the fact that energy prices came down,” said Kathy Mikells, Exxon’s chief financial officer. Analysts had expected the group to report profits of $10.3bn.

In pre-market trading in New York, Exxon shares rose 1% but Chevron eased 0.6%.

Back in London, and the FTSE 100 has edged higher but remains in negative territory, now down 11 points.

12.28pm: Sterling jumps versus yen as BoJ leaves rates unchanged

The pound has climbed to its highest level in almost six months against the Japanese yen after the Bank of Japan left its ultra-easy monetary policy unchanged, sparking a broad-based drop in the Japanese currency.

The yen also feel sharply against the dollar after the BOJ decision even though it scrapped a pledge to keep interest rates low.

Sterling rose 1.4% to around JPY169.47, its highest since early November 2022, while the dollar jumped 1.55% to JPY136.01.

It was BoJ’s first policy decision meeting under Governor Kazuo Ueda and the decision to leave rates unchanged was broadly as expected. The BoJ also removed its entire forward guidance on rates from the statement, which according to ING Economics means that it sees macro conditions as having changed meaningfully and monetary policy is now in need of a new approach.

ING felt the BoJ action was “well-orchestrated in the sense that it secures flexibility for future policy changes while curbing market expectations of an early rate hike.”

“Governor Ueda clearly messaged to the market that the BoJ’s easy policy will be maintained for a while as premature tightening could threaten the fragile recovery,” ING added.

“Inflation is key to determining the actual timing of a rate hike decision,” analysts at ING said, adding, “we maintain our BoJ call for a first rate hike in 1Q24 as we believe that Japan’s inflation rate should run a bit faster than the BoJ’s outlook.”

12.05pm: Diageo knocked by Remy Cointreau caution

Johnnie Walker and Baileys owner Diageo PLC (LSE:DGE) fell after shares in Rémy Cointreau dropped 10% after the Paris-listed luxury spirits maker said it expects sales to remain “stable” on an organic basis in 2023-2024, with a “strong sales decline” in the first half of the new financial year.

In a statement, the firm said the declines in the first half will reflect a “very strong fall” in the US and tough comparisons.

But it expects the US to rebound in the third quarter. The cautious outlook overshadowed a strong set of annual results which saw annual sales rise 10.1% to €1.55bn with price growth of 10.1% offsetting flat volumes.

Elsehwere, the FTSE 100 has tumbled along, around 20 points lower, but off earlier lows. Attention now switches to the US where more big corporates are unveiling results while PCE inflation data – the Fed’s preferred inflation gauge – will attract attention.

11.47am: First Republic rises on reports of rescue talks

First Republic Bank (NYSE:FRC) shares have advanced 8% in pre-market trading on reports that US officials are coordinating urgent talks to rescue the regional lender as private-sector efforts led by the bank’s advisers have yet to reach a deal.

The government’s involvement is helping bring more parties, including banks and private equity firms, to the negotiating table, a source told Reuters.

The bank was embroiled in the turmoil which saw the collapse of Silicon Valley Bank and Signature Bank in the US and the forced marriage of Credit Suisse with its Swiss rival UBS.

First Republic was supported by a US$30bn injection from a number of leading US banks but it failed to stop customers withdrawing cash.

Earlier this week First Republic reported a deposits fell by over US$100bn in the first quarter and it said it was exploring options including restructuring its balance sheet.

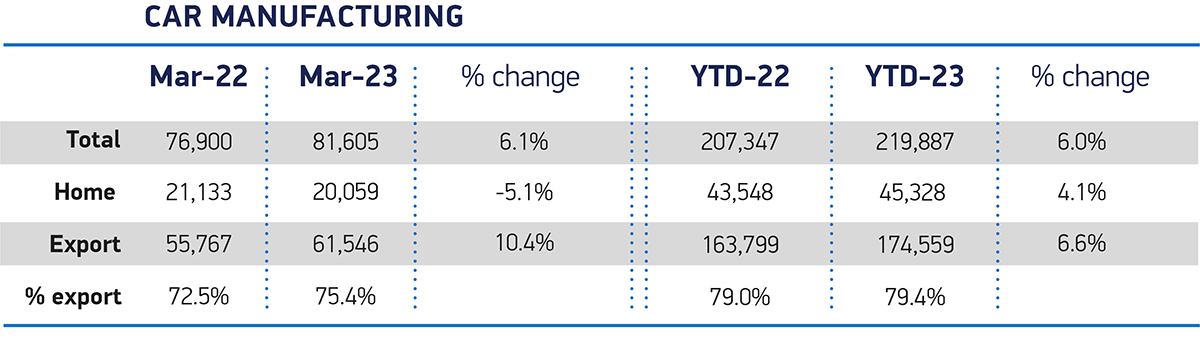

11.08am: Car production rises 6% in quarter one

UK car production rose 6.0% in the first three months of 2023, to 219,887 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

An easing in the shortage of semiconductors and other components helped as factories produced 12,540 units more than in the same quarter last year, driven by exports which increased 6.6% and represented almost eight in 10 cars made.

March rounded off the period with volumes up 6.1% to 81,605 as, again, exports drove growth, up 10.4% to 61,546 units, offsetting a 5.1% decline in car production for the UK as 20,059 cars were made for the domestic market.

At 63.6%, the EU took the largest share of exported cars, (39,172 units), as shipments rose 4.9%, while those to the next biggest markets, the US and China declined 4.1% and 8.3% respectively.

British car makers continued to manufacture the latest hybrid, plug-in hybrid and battery electric vehicles, with combined volumes of these models surging 75.0% in March to 32,546 units.

Four in 10 cars built in the month featured ultra-low or zero emission powertrain technology.

Mike Hawes, SMMT Chief Executive, said, “A second consecutive month of growth for UK car production gives cause for optimism, though volumes are still well below pre-pandemic levels.”

10.27am: Eurozone returns to growth in first quarter

The eurozone economy returned to growth in the first three months of the year as output expanded 0.1%, falling short of economists’ expectations as stagnation in Germany offset stronger performances elsewhere in the bloc.

The rise in eurozone gross domestic product was an improvement from the stagnation in the final quarter of last year, but it was below a 0.2% forecast by economists.

Output in the 20-country currency bloc rose 1.3% compared to the same period a year ago.

ING Economics said while the eurozone economy has now been able to avoid what a few months ago was probably the “best predicted recession ever,” the figures are “clearly no reason to cheer.”

Carsten Brzeski Global Head of Macro at ING said: “Looking ahead, a short-lived industrial renaissance and the gradual impact of recent wage increases could actually lead to a further acceleration of eurozone growth – at least in the short run.”

“In fact, it will again be a race between two opposing drivers: the positive momentum in industry and wage increases against the impact of monetary policy tightening and a looming US recession.”

“In true European tradition, neither of the two will win,” he suggested, adding “rhe compromise for the eurozone economy will be subdued growth going into 2024.”

9.45am: German economy stalls in first quarter

A raft of economic data over in Europe and it is a mixed bag.

In Germany, economic growth stalled in the first three months of the year as increased exports and investment offset weaker domestic demand.

First-quarter GDP in the eurozone’s largest economy was unchanged from the previous quarter, the federal statistical agency said, this was an better than the 0.5% fall in the fourth quarter but weaker than the 0.2% growth predicted by economists.

However, Italy’s economy, grew by a stronger than expected 0.5% in the first quarter (estimate 0.2%) while Spain’s economy also grew 0.5% in the period ahead of an expected 0.3% jump.

There was mixed news on inflation. In Spain, inflation rose to 3.8% in the year to April, below forecasts of 4.4% annual growth but in France consumer prices accelerated with a rise 6.9% on an EU harmonised basis in the year to April, compared with an increase of 6.7% the previous month. Economists had expected growth of 6.6%.

Back in London and the FTSE 100 is down 27 points at its worst levels for the day. In Europe, the CAC 40 in Paris has fallen 0.4% while the Dax is little changed after opening higher.

US markets also look set to give up a chunk of yesterday’s gains with futures pointing to a weak start on Wall Street.

9.17am: Smurfit Kappa climbs on positive outlook

Shares in Smurfit Kappa PLC climbed 2.7% after the packaging firm reported in line EBITDA but was positive on the year ahead.

Jefferies thinks the 2023 consensus for EBITDA of €2,050mln will be broadly unchanged but expect the shares to be higher today given the expectations had moderated ahead of the results following updates from US peers.

The broker noted positively the company “expect the demand environment to improve as the year progresses.”

“With a quality asset base and strong balance sheet”, Jefferies sees the firm as a “relative winner in the fragmented EU containerboard & box market, with its scale, customer & end market mix advantages.”

Jefferies reiterated a buy rating.

9.05am: Pearson rises after upbeat trading, buyback

Pearson shares remain well supported, up 2.9% after its trading update and news of a £300mln share buyback.

Shore Capital analyst Roddy Davidson said: “We are pleased to note the continued progress and momentum highlighted in today’s statement and remain fundamentally positive on Pearon’s suitability to capitalise on the strong growth potential across the global learning market.”

He noted his current forecasts suggest three-year aggregate adjusted EPS and DPS advances of 31% and 23%, respectively accompanied by strong cash generation which he pointed out was evidenced in the buyback plans.

He thinks the current valuation is “undemanding” relative to the growth prospects.

Reiterating a buy on the stock, Davidson said he sees 26% upside potential from current levels.

“We also view Pearson as a highly attractive strategic asset which could attract external interest.”

8.48am: Miners weigh on FTSE

The FTSE 100 remains the wrong side of the line with mining stocks weaker after the weak US GDP figures yesterday added to concerns of slowing economic growth.

The sector was not helped by cautious comments by JP Morgan. Shares in Antofagasta fell 2.9% as the broker downgraded the stock to underweight with a December 2024 price target of 1,230p while Rio Tinto fell 1.1% as the broker reiterated an underweight call.

The US investment bank prefers Glencore and Anglo American in the sector – both rated overweight although shares in both were lower alongside others in the sector.

The US investment bank thinks pivotal changes are underway in the directional drivers of global miners’ share prices.

It notes evidence that four years of iron ore supply constraints are easing and exports are expected to surge in the second quarter just as China is likely to impose restrictions on steel production.

The broker also expects free cash flow yields and shareholder distributions to decline in 2023 as capex increases.

The FTSE 100 is now down 11 points.

8.16am: FTSE slips as NatWest tumbles

The expected gains in the FTSE 100 failed to materialise as weak banking stocks following results from NatWest meant the buoyant gains across the pond were not reflected in the square mile.

At 8.15am London’s blue-chip index was down 8.86 points, or 0.1%, at 7,822.72 although the mood was brighter in the FTSE 250 which rose to 19,304.89, up 56.88 points, or 0.30%.

Banking stocks weakened after NatWest slipped 6.5% despite the high street lender reporting better than expected first quarter profits.

Analysts said the profit figure was offset by a fall in deposits and weaker net interest income.

Gary Greenwood at Shore Capital said the results showed “an earnings beat versus consensus driven mainly by a combination of better than expected non-interest income and lower than expected impairments.”

But he noted net interest income and margin “was weaker than consensus expected, which may disappoint the market, especially given the consensus appeared to have got a little carried away in its optimism.”

He also highlighted a modest deposit outflow which was worse than expected.

Richard Hunter, head of markets at interactive investor, commented “Set against the wider banking turmoil of recent months the solid and dependable, if a little unexciting, performance which NatWest has delivered is just what the doctor ordered for more risk-averse investors.”

Other banking stocks fell with Lloyds Banking Group PLC (LSE:LLOY) fell 2.4% and Barclays down 0.4%.

Better news for shareholders in Pearson. Shares rose 3% after the education published announced a £300mln share buyback and said it was on track to meet annual guidance.

Prudential was another share on the rise, up 3.3%, after it said sales had risen reflecting growth in China and Hong Kong as markets improved post-Covid.

Numis Corporation PLC (AIM:NUM) soared 67% as the bid from Deutsche Bank.

7.55am: Deutsche Bank swoops for Numis

A deal in the Square Mile to report. Germany’s biggest bank, Deutsche Bank has swopped for Numis Corp PLC in a £410mln deal.

The recommended all-cash bid values each Numis share at 350p each – 339p in cash, an interim dividend of 6p per share and an extra interim dividend of 5p conditional upon the deal becoming effective.

The price represents: a premium of 72% to last night’s closing price.

Numis said it considered the terms “fair and reasonable.”

7.51am: Prudential APE sales rise 35% as China bounces back

Prudential PLC (LSE:PRU) has also updated the market reporting annual premium equivalent sales rose 35% to US$1,559mln driven by growth in China and higher domestic in Hong Kong alongside growth in other business units.

“The strength of our distribution capabilities and the diversification of the business across country, product and channel contributed to our performance in the first quarter. 10 out of the 13 life insurance markets in Asia, as well as Africa, achieved double-digit growth in new business profit,” Chief Executive Anil Wadhwani said in a statement.

“Business momentum, particularly in Hong Kong, has continued to date in the second quarter and we maintain our prudent approach to asset allocation and credit risk,” he continued.

Prudential said new business profit was up 30% to US$743mln.

7.42am: Pearson on track and pledges £300mln buyback

Pearson PLC (LSE:PSON) said it was on track to meet annual guidance and announced a £300mln share buyback to start in the second half of the year as total group sales rose 2%.

In a trading update the education publisher reported performance in each of Pearson’s divisions “in line with or ahead of our expectations.”

The company said it was on track for delivery of £120mln of cost efficiencies this year.

Andy Bird, Pearson’s Chief Executive, said: “”Pearson has had a strong start to the year with results ahead of our expectations.”

Assessment & Qualifications sales grew 6%, English Language Learning sales increased 66%, Workforce Skills sales grew 8%, but Virtual Learning sales decreased 14% and Higher Education sales were down 5%.

Pearson said its financial position remains robust, with low net debt and strong liquidity.

7.33am: NatWest profit tops City forecasts

Strong numbers from high street lender NatWest Group PLC (LSE:NWG) this morning.

The FTSE 100 listed bank reported strong growth in revenue and profit in the first quarter but said deposits had fallen as competition hots up.

The bank described the performance as “strong” with operating profit before tax of £1.82bn, up from £1.22bn a year ago, and ahead of City forecasts of £1.6bn.

Chief Executive, Alison Rose, commented: “NatWest Group’s strong performance in Q1 2023 is underpinned by our robust balance sheet, our high levels of capital and liquidity and our well-diversified loan book.”

Total income jumped 37.2% to £1.04bn reflecting the impact of volume growth and yield curve movements.

The high street bank continued to benefit from a rise in net interest margin which climbed 7 basis points quarter-on-quarter to 3.27% while the return on tangible equity was 19.8%, nearly double last year’s 11.3%, but down from 20.6% in the fourth quarter.

It said guidance for current financial year remained unchanged.

But customer deposits reduced by £11.1bn, or 2.6%, in the quarter reflecting around £8bn higher customer tax payments, competition for deposits and an overall market liquidity contraction.

Lending to customers edged higher by 1.6% to £352.4bn reflecting £3.9bn of mortgage growth in Retail Banking and a £1.6bn increase in Commercial & Institutional.

The CET1 ratio improved 20 basis points to 14.4% while operating expenses jumped 12.5% due to higher staff costs and the exit from the Republic of Ireland.

A bad debt provision of £70mln was made but the bank said levels of default remain stable at low levels.

7.06am: Strong seen expected in London

The FTSE 100 is seen opening higher on Friday after US stocks motored ahead shrugging aside news of a slowdown in the US economy.

Spread betting companies are calling London’s lead index up by around 20 points.

On Wall Street, Meta was the standout performer with shares rising 14% after better than expected results driven by a surprise rise in advertising revenue. Amazon initially jumped after its numbers after the market close but shares fell back on an uncertain outlook for its Cloud business.

The Dow closed Thursday up 525 points, 1.6%, at 33,827, the Nasdaq Composite added 288 points, 2.4%, to 12,142 and the S&P 500 improved 79 points, 2%, to 4,135.

In Asia, In Tokyo on Friday, the Nikkei 225 index was up 1.0%. The Bank of Japan concluded its first meeting under new governor Kazuo Ueda, deciding to leave its ultra-easy monetary policy unchanged.

In China, the Shanghai Composite and Hang Seng index in Hong Kong were both up 0.8%.

Back in London, and results from high street lender, NatWest, and a trading statement from Pearson will be the early focus.