FTSE 100 seen lower, UK economy grinds to a halt and Tesco expects no profit growth this year

7.55am: PZ Cussons (LSE:PZC) reports solid growth in thirs quarter

PZ Cussons PLC reported 6.2% growth in third quarter revenue boosted by strong growth in sales of St Tropez US and the combined Imperial Leather and Cussons Creations portfolio.

The personal healthcare products and consumer goods manufacturer said revenue rose to £166mln in the period and that it expects adjusted profit before tax to be at least in line with current market estimates.

In a trading update for its third quarter, ended March 4, the company noted the Europe & the Americas region returned back to strong revenue growth and with significantly improved margin although Carex revenue declined in the period reflecting the reduction in the UK Hand Hygiene category more broadly.

Childs Farm is performing as expected and is on track for double-digit revenue growth in the year, on a pro-forma basis, the company said.

Asia Pacific performance has been driven by strong growth in Australia, reflecting continued successful revenue growth management activity and sustained share gains across our major brands while Africa trading was in line with expectations, with all Must Win Brands in good growth.

In Asia, Cussons Baby revenue declined slightly, in line with the overall category, reflecting increased pressure on consumer spending in recent months as well as some retailer de-stocking.

7.35am: Tesco sees flat profit in the year ahead

Tesco PLC (LSE:TSCO) (Tesco PLC (LSE:TSCO)) reported full-year revenue and operating profit at the top end of City forecasts but predicted flat profits in the year ahead.

The food retailer reported revenue in the 52 weeks to February 25 of £65.72bn up 7.2% from £61.34bn a year before while adjusted operating profit totalled £2.63bn down from £2.83bn in the comparative period.

Analysts had forecast revenue of £65.72bn and operating profit of £2.61bn.

On a statutory basis pre-tax profit halved to £1.00bn from £2.03bn while adjusted EPS was flat at 21.85p. The full year dividend was unchanged at 10.9p.

The grocer said like-for-like (LFL) retail sales rose 5.1% as volumes held up well despite the cost of living pressures with UK LFL sales up 3.3%, ROI up 3.3%, Booker up 12.0% and Central Europe LFL sales up 10.4%.

UK & ROI adjusted operating profit of £2.31bn was down 7% driven by the impact of lower year-on-year volumes and ongoing investment in its customer offer, with Save to Invest largely offsetting significant operating cost inflation.

Chief Executive Ken Murphy said he was pleased with the performance and “confident that we have the right strategy,” but he predicted flat profits in the year ahead.

“We expect to be able to deliver a broadly flat level of retail adjusted operating profit in 2023/24 and retail free cash flow within our target range of £1.4bn to £1.8bn, he said.

“We will continue to prioritise investment in our customer offer whilst doing everything we can to offset the impact of ongoing elevated cost inflation,” he added.

Tesco Bank profit is seen between £130mln and £160mln.

The grocer also announced plans for a further £750mln share buyback.

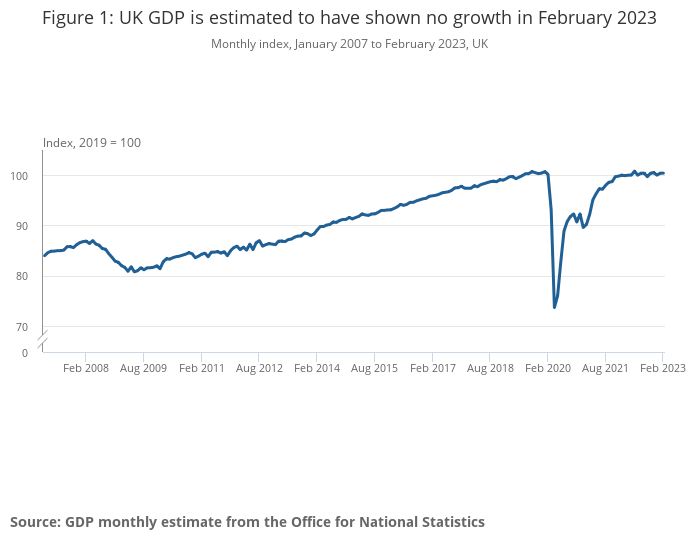

7.05am: UK economy grinds to a halt in February

The UK economy ground to a halt in February with monthly real gross domestic product (GDP) estimated to have shown no growth.

Falls in services and production were offset by growth in construction, figures from the Office for National Statistics showed.

This follows growth of 0.4% in January, revised up from growth of 0.3% before. Economists had forecast a rise of 0.1%.

Looking at the broader picture, GDP grew by 0.1% in the three months to February.

The services sector fell by 0.1% in February, after growing by 0.7% in January, revised up from 0.5% in the previous publication.

The largest contributions to the fall in services output in February came from education and public administration and defence; compulsory social security, industrial action took place in both of these industries in February.

Output in consumer-facing services grew by 0.4% in February, this follows growth of 0.3% in January with the largest contributor to this growth came from retail trade, except for motor vehicles and motorcycles.

Production output fell by 0.2% in February, following a fall of 0.5% in January, revised from a fall of 0.3% before.

The construction sector grew by 2.4% in February, after falling by 1.7% in January.

7.00am: FTSE seen lower after US slip back after FOMC minutes

The FTSE 100 is expected to dip at the open after US markets fell from earlier highs as the minutes of the latest Federal Reserve meeting showed officials fear the recent banking turmoil could tip the US into recession.

Spread betting companies are calling London’s lead index down by 16 points.

US stocks closed lower on Wednesday after earlier taking heart from cooler than expected consumer price inflation figures which boosted hopes that pricing pressures were easing and interest rates were close to peaking.

The Dow Jones Industrial Average closed down 38.29 points, or 0.1%, at 33,646.50. The S&P 500 fell 16.99 points, or 0.4%, to 4,091.95, while the Nasdaq Composite slipped 102.54 points, or 0.9%, at 11,929.34.

Minutes from the FOMC March 21-22 meeting showed several officials considered holding interest rates steady “to assess the financial and economic effects of recent banking-sector developments and of the cumulative tightening of monetary policy.”

But after judging that actions by the Fed in coordination with other government agencies had helped calm conditions in the banking sector they decided to press ahead with the 25 basis point increase with reducing inflation the priority.

In Asia, the Nikkei 225 index was up 0.3%, in China, the Shanghai Composite was down 0.3%, while the Hang Seng index in Hong Kong was down 0.7%.

Back in London and the early focus will be results from food retailer Tesco and a GDP reading for February.