Welcome to EURACTIV’s weekly Economy Brief. You can subscribe to the newsletter here.

As euro area finance ministers gather in Luxembourg today (15 June) to discuss the digital euro, a leaked draft proposal seen by EURACTIV suggests that the European Commission is aiming for a digital euro available to everybody, which would open up new options for EU monetary and banking policy.

It’s actually quite exciting.

Instead of going for the conservative option of a central bank digital currency (CBDC) that is just used to make interbank settlements more efficient, a so-called wholesale CBDC, or going for a half-baked retail digital euro that banks would not be forced to offer to their clients, the Commission wants a digital euro that is available to everybody for free.

You can read about the details of the leaked draft proposal here, but the gist of it is the following:

Banks and other payment services providers will have to provide users in Europe with a free digital euro account and free transactions, transactions would be possible online as well as offline, and economic operators (except microenterprises) would have to accept the digital euro as a means of payment.

Moreover, the digital euro could also be distributed by postal offices or local and regional authorities.

Push banks to do more

Online payments within the euro area would become largely independent from banks.

Naturally, you can expect resistance from banks. They fear that customers might shift their deposits from traditional bank accounts to digital euro accounts, where they will be safer than the bank deposits.

However, any risk to financial stability, for example because too many bank deposits could be shifted out of banks too quickly, should be manageable since the inherently conservative ECB can impose limits on how much digital euros any individual can hold.

Under such a regime, we could expect the ECB to set the maximum holding levels quite low, before gradually easing them so that the financial system can adapt.

Crucially, the option of a free and safe digital euro bank account forces banks to offer customers value for their savings and start raising interest rates. While banks have profited from rising ECB interest rates in recent months, for example, they were very reluctant in passing them on to savers.

But one could imagine banks to behave differently if savers had a safe and convenient alternative.

Technical challenges

The digital euro also comes with its headaches, however, mainly regarding the tradeoff between protecting personal data and ensuring compliance with anti-money laundering (AML) rules.

At least on paper, the draft proposal’s approach of allowing for anonymous offline digital euro payments up to a certain amount while following normal AML standards for online digital euro payments makes sense. Whether the ECB will find the right technical solution to execute on these requirements is another question.

Another technical challenge will be for the ECB to make sure that it knows which digital euro accounts belong to the same owner without knowing the identity of the owner.

However, if these technical solutions that the draft proposal aims for can be found, the digital euro could also lay the groundwork for new ways of doing monetary policy in the future.

Preparing the financial plumbing

For now, the ECB is restricted in its monetary policy to influencing the interest rate banks get for their deposits with the ECB and to market operations like quantitative easing. Both have only worked imperfectly to stimulate the economy.

There are alternative ideas to stimulate the economy more directly, for example “helicopter money”, meaning the central bank would give money directly to people instead of pushing it into banks and capital markets.

The digital euro proposal would not directly give the ECB this new monetary policy tool. Under the draft proposal, the ECB will not have a contractual relationship with digital euro users and as it is used like digital cash, there is also no interest rate on it.

However, once implemented, the digital euro infrastructure could provide for the financial plumbing that could make new monetary policy tools like “helicopter money” more easily implementable.

More criticism

You can expect criticism to be levelled against the digital euro from people who are afraid that classic cash will be pushed to the sidelines, with the loudest fringe of this line of argument arguing that this is a great plot by the government to get rid of cash.

However, the Commission also wants to regulate the legal tender status of cash in a parallel legislative proposal to the one for the digital euro.

Another kind of criticism will come from economists and actors in the financial industry who don’t really see the need for a digital euro, given that euro payments work relatively decently and the gambling chips from the crypto casino do not seem close to dethroning the euro.

Maria Demertzis and Catarina Martens from the economic policy thinktank Bruegel, for example, argued in a publication earlier this week that the most sensible way to introduce a digital euro would be as a wholesale CBDC.

The proposal is certain to be attacked from all possible sides, for all the good and bad reasons alike.

However, the Commission should be commended if it comes out with a bold proposal to bring public money into the digital sphere without preemptively watering down everything that might be disruptive about it.

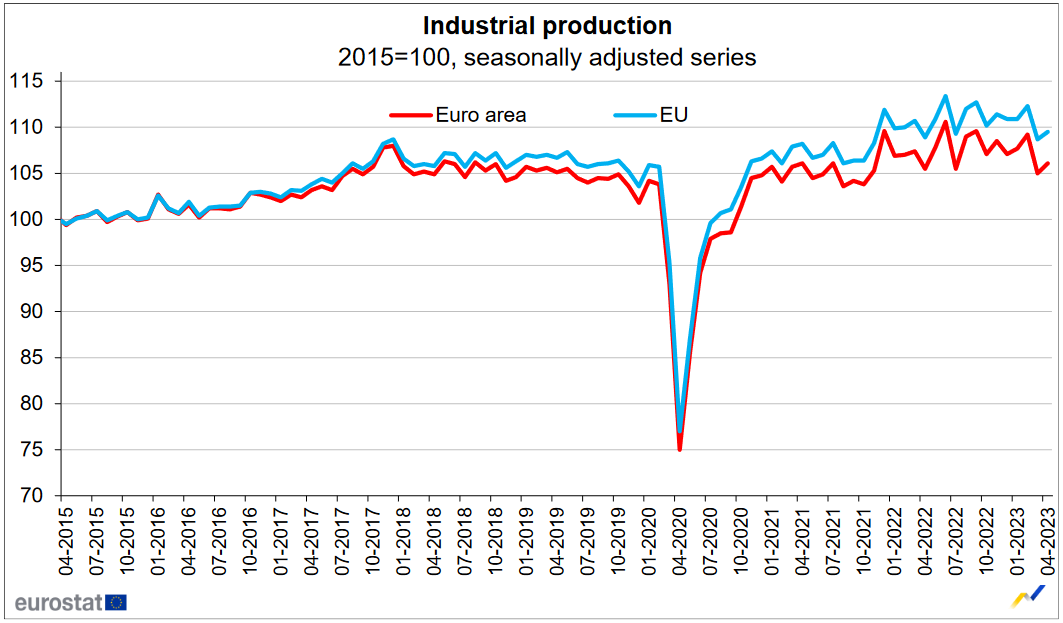

In this week’s chart, let’s have a look at industrial production in the EU. While it recovered well and quickly from the shock during the pandemic, the development has been very unsteady ever since.

According to Eurostat numbers, industrial production in April 2023 was slightly higher than in April 2022, both in the EU and in the euro area. However, the figures seem much jumpier than before the pandemic.

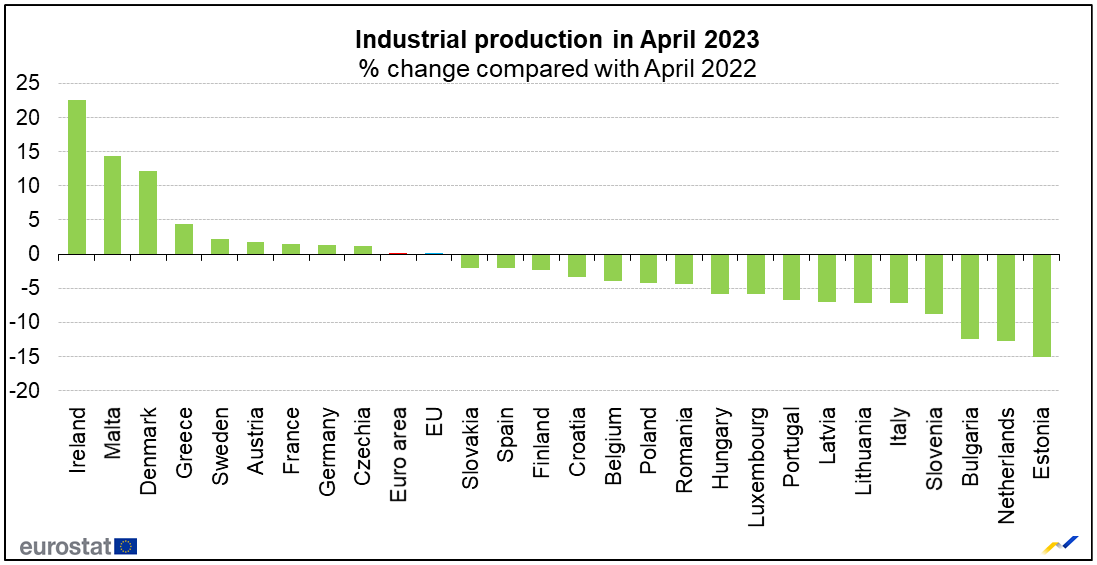

It is especially remarkable to look at the differences between EU member states. In the snapshot below, you see the yearly change in industrial production from April 2021 to April 2022.

Ireland has experienced a massive upward jump, while Central and Eastern European countries have suffered more, making a connection to the Russian invasion in Ukraine likely. While the invasion had already been ongoing a year ago, not all the sanctions had been in place yet at that time.

You can find all previous editions of the Economy Brief Chart of the week here.

Commission publishes sustainable finance package: On Tuesday (13 June), the EU Commission published a series of proposals to advance its sustainable finance agenda with EU Taxonomy delegated acts, a proposal to regulate ESG ratings providers, and a recommendation on how to facilitate transition finance. Already on Friday (9 June), the Commission had published its draft European Sustainability Reporting Standards for a four-week consultation period, causing disappointment among environmental NGOs that considered them to have been “watered down”.

Commission seeks to regulate financial data use and access. The European Commission is drafting new rules to regulate the access and use of customer data in financial services, in a bid to ensure customers’ control over financial data and allow consumers to access tailored data-driven products and services. The draft regulation, due to be published on 28 June and seen by EURACTIV, sets the rights and obligations for the access to and reuse of data in financial services, including balance of accounts, various types of investments, pension rights, and non-life insurance.

EU executive to push member states on child poverty measures. The Commission will urge member states to submit their national action plans to implement the European Child Guarantee against child poverty, Commissioner for Jobs and Social Rights Nicolas Schmit told EURACTIV in an interview. “It is regrettable that six member states have not presented their national plans,” he said, adding that he will ask these countries to “explain why they haven’t done so” in the coming weeks.

Spanish presidency to look at ways to unblock equal treatment directive. During a debate among EU ministers on Monday (12 June), Spanish ambassador Ignacio Morro said the upcoming Spanish EU Council presidency is “very prepared to explore any possible avenues that could take us to the approval” of the 2008 directive for equal treatment in non-employment settings. The proposed directive, which would prohibit discrimination based on religion, belief, disability, age, or sexual orientation when it comes to social protection, education, and access to housing, has been blocked in the EU Council ever since its proposal.

MEPs want competition policy to help fight high prices. As standard measures to fight inflation prove unpopular, particularly among left-leaning politicians, they place hopes on competition policy to help lower prices. “If certain sector excesses were addressed through competition law, this means that monetary policy would be relieved and could take a more cautious approach,” René Repasi, EU lawmaker of the centre-left S&D group, told EURACTIV. However, some experts warn not to overburden competition policy with political priorities. Read more.

EU Parliament wants legally binding ban unpaid traineeships. With broad, cross-party support, the European Parliament voted on Wednesday (14 June) in favour of an own-initiative report calling on the Commission to propose a directive to ban unpaid traineeships. Opposition was limited, coming mainly from the far-right ID group who said a directive on traineeships was another overstep into national competency, a trend they see continuing from the Minimum Wage Directive. Organised labour and youth groups took the vote as a victory that would help bridge the gap between young people who can afford to take unpaid traineeships and those that can’t. Read more.

Commission urges member state to boost support for the social economy sector. Member states should scale up support for the social economy sector, including through socially responsible public procurement and easier access to finance, the European Commission said on Tuesday (13 June), when it proposed a new Council recommendation. The social economy sector is made up of enterprises and organisations which reinvest most of their profits in sustainable goals or social causes and often have democratic or participatory governance.

Christian Lindner gathers fiscal hawks ahead of fiscal rules debate. Germany’s finance minister Christian Lindner (FDP) has teamed up with 10 colleagues from Central, Eastern and Northern EU countries to call for strict fiscal rules ahead of a debate among EU finance ministers on Friday (16 Jue). In an op-ed, the EU’s chief hawk argued that geopolitical challenges were no excuse for more debt. Remarkably, some traditionally hawkish allies like the ministers from the Netherlands and Finland were not among the signatories.

Damage functions (or why I am mad at economists). In this post, Madison Condon argues why she thinks some economists have done a great disservice to climate policy through the choice of their methods.

Europe can withstand American and Chinese subsidies for green tech. John Springford and Sander Tordoir from the Centre for European Reform caution the EU not to go too far in its ambitions to out-subsidise the US or China in fear of losing out in green tech. They argue that for most of the green technologies, the geograhical distance to the US and China will impose such a cost on trade that it will be profitable to produce in Europe anyway.

Additional reporting by Silvia Ellena, Jonathan Packroff, Quinn Coffman.

[Edited by Zoran Radosavljevic]