The Budget on March 6 will be the key political moment of this election year with ministers talking up the prospect of tax cuts. The speculation grew with the publication of figures showing we are borrowing less as a country than expected at the time of the Autumn statement.

Public sector borrowing fell to £7.8 billion last month, about half the sum from a year earlier and the lowest figure for a December since 2019, according to data published by the Office for National Statistics.

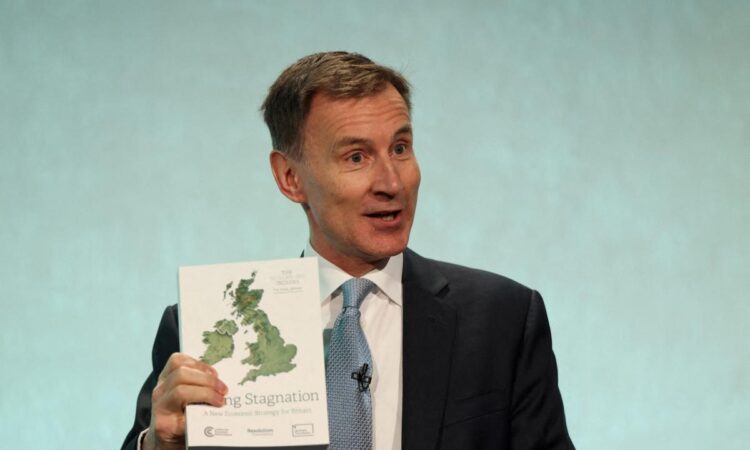

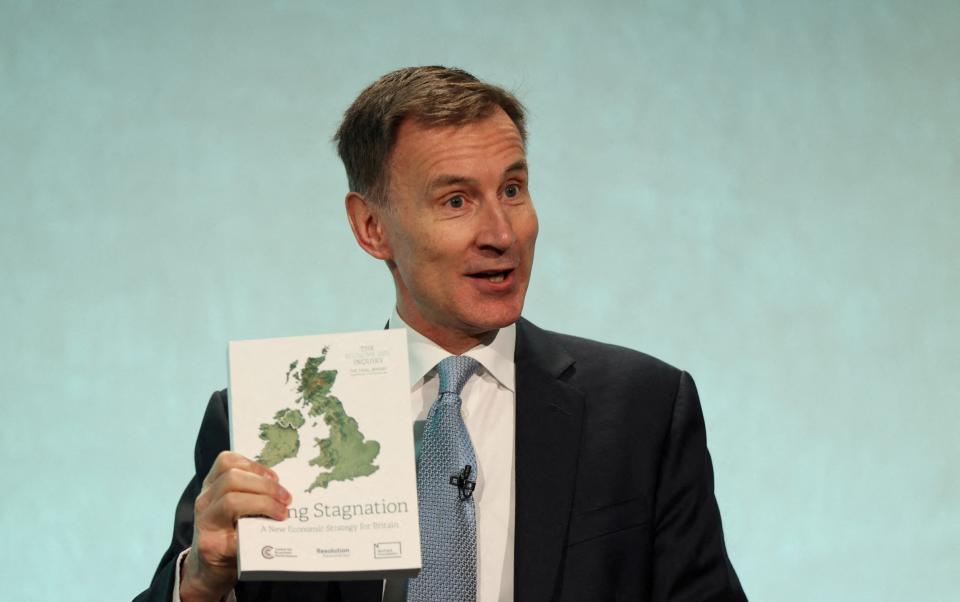

This is less to do with prudent management of the economy than a fall in interest rates, but it gives Jeremy Hunt so-called “wiggle room” within his own self-defined fiscal rules to cut taxes further. The Chancellor and his colleagues are frustrated they have not been given enough credit for cutting National Insurance Contributions.

But their difficulty remains that the overall burden has risen. Mr Hunt needs to end the freeze on allowances and ease the pressure on businesses substantially if these changes are to be noticed by voters. Yet he is reportedly being advised by officials to focus more on keeping immigration high and reforming planning as a better way of boosting the economy.

Moreover, the Government needs to resist pressure in an election year for more spending. Local councils are at the front of the queue for extra funds, with some claiming they are on the edge of bankruptcy. As our analysis today discloses, the great majority of English local authorities are planning inflation-busting council tax increases.

At least 30 plan to put up the charge by the maximum allowable five per cent in April. This threatens to wipe out any feel-good cuts Mr Hunt may be planning. The average charge for a Band D home will be more than £2,100.

In all these discussions there appears no longer to be any consideration of the other side of the ledger – spending. Instead of hiking taxes, local councils should be looking to run their affairs far more efficiently without threatening to close libraries or other amenities.

Increased funds have been promised to the NHS and to defence, which will leave other departments facing cuts, but these are unlikely to be spelt out before the election. In the meantime, national debt remains at historically high levels, close to 100 per cent of GDP, not seen since the 1960s with no prospect of reducing it without economic growth.This will be the battleground in election year.