(Bloomberg) — The European Central Bank delivered the interest-rate reduction it’s been flagging for months — moving away from a record high — but stopped short of indicating more cuts may follow.

Most Read from Bloomberg

In the US, payrolls surged in May and wage growth accelerated, prompting traders to push back the expected timing of Federal Reserve interest-rate cuts.

India’s election amounted to a reckoning on Prime Minister Narendra Modi’s decade-long rule, illuminating a broader wave of discontent in relatively poorer parts of the country. The central bank left rates on hold following the smaller-than-expected victory for Modi’s party.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

Europe

ECB officials led by Christine Lagarde lowered the key deposit rate by a quarter-point to 3.75%, as expected. Having held it at 4% for nine months, they said the inflation outlook has improved “markedly,” though they’ll “keep policy rates sufficiently restrictive for as long as necessary” after also raising projections for prices.

The ECB’s preferred measure of euro-zone pay accelerated at the start of 2024, in the latest sign that price pressures in the region are proving stubborn. The ECB, which began lowering record-high borrowing costs on Thursday, is scrutinizing workers’ salaries as it weighs how the jobs market, corporate profits and productivity will affect inflation.

US

Nonfarm payrolls jumped 272,000 last month, beating all projections in a Bloomberg survey of economists. However, the unemployment rate — which is derived from a separate survey — increased to 4% from 3.9%, rising to that level for the first time in over two years.

Much of the worry over US commercial property has legitimately centered on the office market, where more than $38 billion in buildings were in distress as of March, compared with about $10 billion for apartments, according to MSCI. But multifamily buildings make up the biggest share of properties with potential distress — exceeding even offices — and unlike office buildings, largely backed by major financial institutions, much of the unraveling is centered on personal investors.

The prospect of a fresh round of tax cuts next year is helping Donald Trump woo Wall Street donors but threatens to add trillions of dollars to the national debt. The estimated $4.6 trillion cost of extending expiring portions of Trump’s 2017 tax cuts isn’t dampening Republican enthusiasm for renewal next year. Many simply reject cost projections, asserting that tax cuts pay for themselves through economic gains.

Emerging Markets

The collapse of Modi’s support in Uttar Pradesh, India’s most-populous state and a one-time party stronghold, amounted to a collective rebellion from millions of people left behind in one of the world’s fastest-growing economies. India’s 8% annual expansion has spawned a billionaire elite and a growing middle class, but the government has failed to deliver for more than 600 million Indians who survive on $3.65 or less a day — the official World Bank poverty line for low or middle-income countries.

Turkey’s inflation accelerated more than forecast last month, in what officials hope marks the worst of a yearslong cost-of-living crisis.

Once again, the Brazilian economy started the year with a bang, beating forecasts and giving President Luiz Inacio Lula da Silva reason to celebrate. This time around, the win is likely to be far less enduring.

Asia

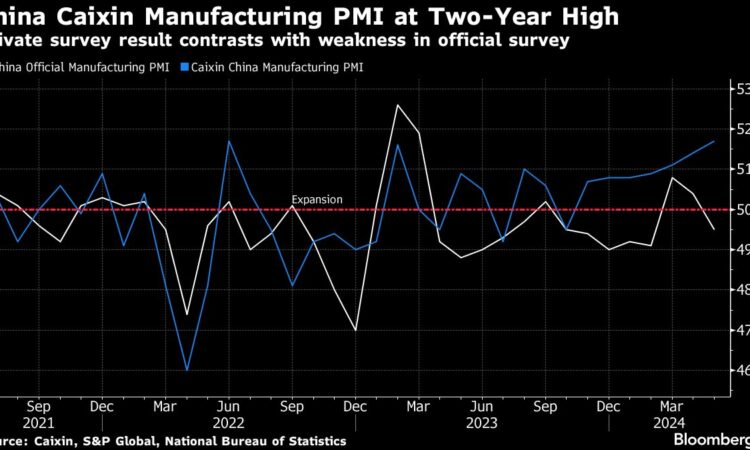

China’s manufacturing activity expanded at the fastest pace in almost two years in May, according to a private survey, contrasting with weak official data that dented the country’s growth outlook.

South Korea’s inflation eased more than expected in May, nudging the central bank an inch closer to joining global peers embarking on a path to a policy easing. For now, continued growth in exports, led by semiconductors and automobiles, is giving the central bank confidence the economy can cope with its current restrictive policy settings, which are also credited with supporting the won against the dollar.

World

Outside the ECB, the Bank of Canada also lowered interest rates, which may help reassure other central banks that they can launch into cuts before the Fed. India’s central bank left its benchmark interest rate unchanged, while Uganda, Lesotho, Kenya, Poland and Russia also held.

–With assistance from Beril Akman, Scott Carpenter, Patrick Clark, Christopher Condon, Steven T. Dennis, Prashant Gopal, Swati Gupta, Sam Kim, John Liu, Jana Randow, Sudhi Ranjan Sen, Andrew Rosati, Zoe Schneeweiss, Mark Schroers, Dan Strumpf, Fran Wang and Alexander Weber.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.