Dollar to remain reserve currency for a long time, US economy central to global story says Larry Summers

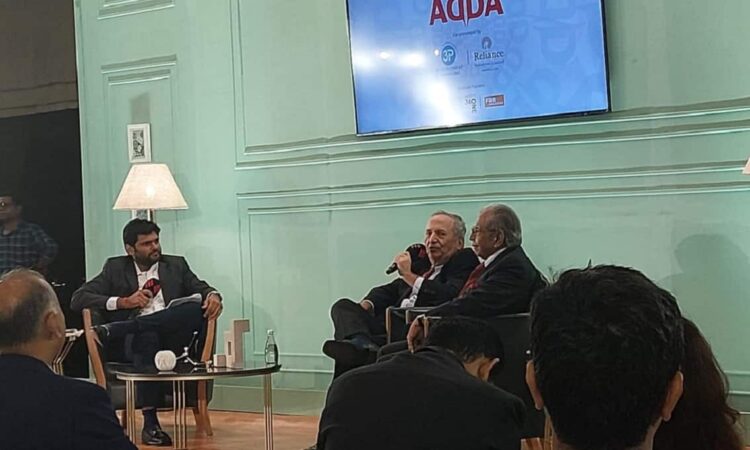

The US dollar has long been the global reserve currency but in recent times we have often read or heard about its dominance eroding. As countries increasingly look at reducing their reliance on the dollar, there are several other issues that need to be addressed also. Most importantly, it raises some key concerns with regards to the economic dynamics and the possible consequences there on. Speaking at the Express Adda in Mumbai on Tuesday in conversation with Anant Goenka, Executive Director, The Indian Express group, President Emeritus at Harvard and former US Treasury Secretary Lawrence H Summers ruled out any possibility of the dollar’s position changing anytime soon.

According to Summers, “If you look at the history of currency transitions, most notably the transition away from the British pound, as a reserve currency, I think the lesson is pretty clear. You don’t lose your reserve currency status until it’s far from your biggest problem. If we inflate our currency away, if we don’t maintain a stable legal environment, if we turn very strongly inwards, if we have high inflation, if we politicise the use of the dollar. Yeah, we could, the dollar could conceivably lose its role. But after all that had happened, it would be sort of the least of the United States problems. So I think if we keep the fundamentals of what we’re doing reasonably strong, and do things right, the dollar is likely to take care of itself.”

Deficit worries

The other concern that springs up immediately is how would the greenback be impacted if the deficit rises any further. Summers candidly replied to that concern with a touch of humour, “There’s a wisecrack that I used to utter. It’s a completely unfair wisecrack, but it sort of does make a point, which is Europe’s museum. Japan’s a nursing home, China’s a jail, and bitcoins are experiments.” He went on to explain that what it implies is that “if you take your money

US economy

The pace of economic growth in the US is another talking point. When asked if the role of the US economy has reduced compared to what it did 10 years ago, Summers gave some historical references to make his point. “If you look at the US share of global GDP, it’s really very high by historical standards right now, historical standards, the last generation, if you look at what in some ways is a better, more forward looking indicator, the share of the United States in total global stock markets. That number is higher than it’s been in a very, very long time. So I look at those things and I see an American economy that I think, for better or for worse, is likely to be fairly central to the global economy,” reiterated Summers emphatically highlighting how the US will remain very central to the global economy for a long time to come.