Despite anticipated ‘soft landing’ of the US economy, UNCTAD warns of stalling and divergent global growth

Geneva, Switzerland, 4 October 2023

The UN Conference on Trade and Development (UNCTAD) has warned of a stalling global economy, with growth slowing in most regions from last year and only a few countries bucking the trend.

UNCTAD, in its Trade and Development Report 2023, calls for a change in policy direction, including by leading central banks, and accompanying institutional reforms promised during the COVID-19 crisis to avert a lost decade.

UNCTAD Secretary-General Rebeca Grynspan said: “To safeguard the world economy from future systemic crises, we must avoid the policy mistakes of the past and embrace a positive reform agenda.”

“We need a balanced policy mix of fiscal, monetary and supply-side measures to achieve financial sustainability, boost productive investment and create better jobs. Regulation needs to address the deepening asymmetries of the international trading and financial system.”

Divergence amidst slowing growth

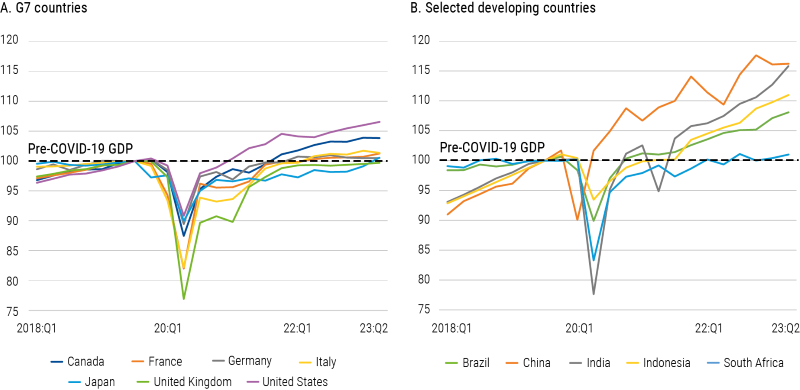

Real GDP levels, selected developing countries, first quarter of 2018 to second quarter of 2023

(Index numbers, Q3 2019 = 100)

The global economy is at a crossroads, where divergent growth paths, widening inequalities, growing market concentration and mounting debt burdens cast shadows on its future.

The Trade and Development Report 2023 spotlights these pressing issues and underscores the urgency of addressing them.

Globally, the post-pandemic recovery is divergent. While some economies, including Brazil, China, India, Japan, Mexico, Russia and the United States have demonstrated resilience in 2023, others face more formidable challenges.

In the context of slower growth and absent policy coordination, this divergence raises concerns about the way forward for the global economy.

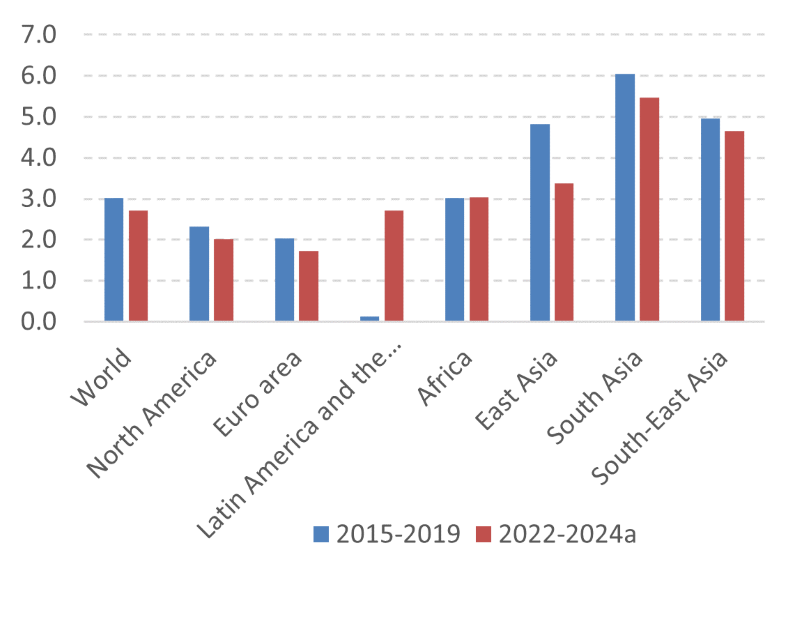

Building back weaker and separately

(average annual growth)

Despite rising interest rates, the United States economy has confounded more negative predictions, experiencing a measured economic slowdown so far, as inflationary pressures ease, thanks to robust consumer spending, eschewing fiscal austerity and active monetary intervention to stem financial contagion at the start of the year. However, the report warns of lingering investment concerns, especially in light of prolonged high interest rates.

Europe is on the edge of recession, grappling with a rapid tightening of monetary policy and strong economic headwinds, with major economies slowing down and Germany already contracting. Stagnant or falling real wages across the continent, compounded by fiscal austerity, are dragging down growth.

China, though showing signs of recovery from last year, faces weak domestic consumer demand and private investment. China, however, has more fiscal policy space than other large economies to address these challenges.

Growing inequality and weaker growth

Economic inequality remains a significant challenge, with developing countries disproportionately affected, including by the effects of monetary tightening in the advanced economies. This widening wealth gap further threatens to undermine the fragile economic recovery and the aspirations of nations to meet the sustainable development goals (SDGs).

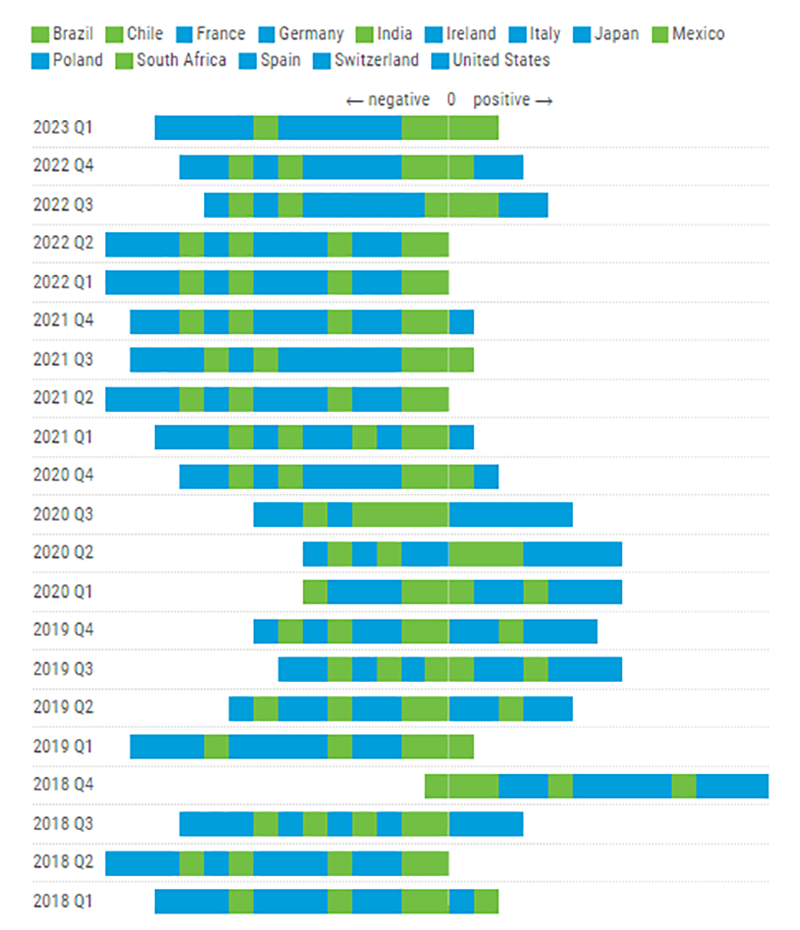

Wages have not kept up with inflation

(Quarterly change in average real hourly wages (Number of countries)

Notes: The sample is limited to 14 countries. Blue = developed economies. Green = developing economies.

Source: UNCTAD calcualtions based on data from the International Labour Organization and the Bank for International Settlements.

Debt burdens, the silent weight on many developing countries, remain a major concern. Rising interest rates, weakening currencies and sluggish export growth have combined to squeeze the fiscal space for essential needs, transforming the growing debt service burden into an unfolding development crisis.

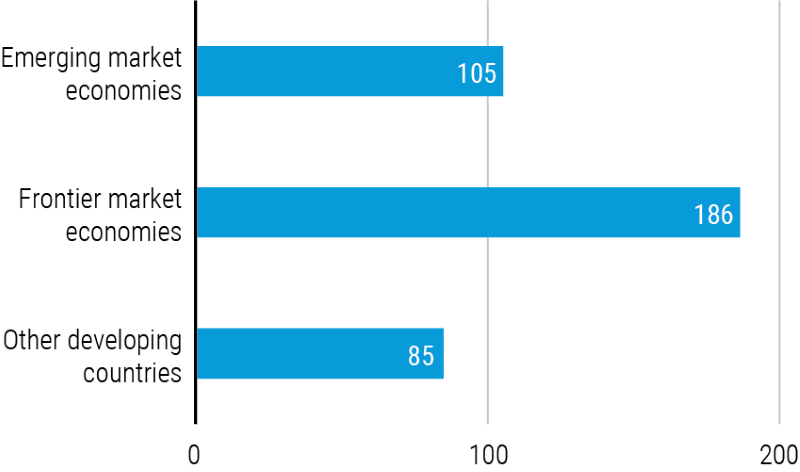

Evolution of external public and publicly guaranteed debt in developing countries 2010-2021

(percent increase)

Low or lower middle-income “frontier economies” have been hit hardest. Over the past decade, external public and publicly guaranteed (PPG) debt in these economies has tripled, straining public finances and diverting resources away from critical SDGs.

This trend was turbocharged by the compounding shocks of the pandemic and climate change. As a result, the PPG debt service surged for these countries from nearly 6% to 16% of government revenues in the decade following the global financial crisis. Nearly a third of frontier economies are on the precipice of debt distress.

Urgent measures are needed to prevent more countries from reaching the brink of financial distress, and worse still, tipping into default.

A call for a more balanced policy mix

To address these multifaceted challenges, the Trade and Development Report 2023 calls for a more balanced policy mix of fiscal, monetary and supply-side measures. Coordination between national and supranational authorities is needed to manage inflationary pressures and ensure price stability, foster an environment conducive to investment-led growth, implement measures to reduce income disparities, improve real wages and reinforce social protection systems.

Ensuring long-term financial sustainability is key, and the role of central banks needs to be expanded beyond inflation targeting to include a broader focus on long-term economic sustainability.

Soaring debt requires urgent multilateral solutions and a sovereign debt restructuring mechanism

Addressing the debt issue is paramount, as debt burdens are crushing too many developing countries, due to a combination of rising interest rates, weakening currencies and heavy conditionality. UNCTAD calls for meaningful reforms of the rules and practices of the international financial architecture, offering equitable and timely solutions for managing debt crises. The goal is to ensure these crises do not set back progress and development.

More transparent, regulated markets for a fairer global trade system

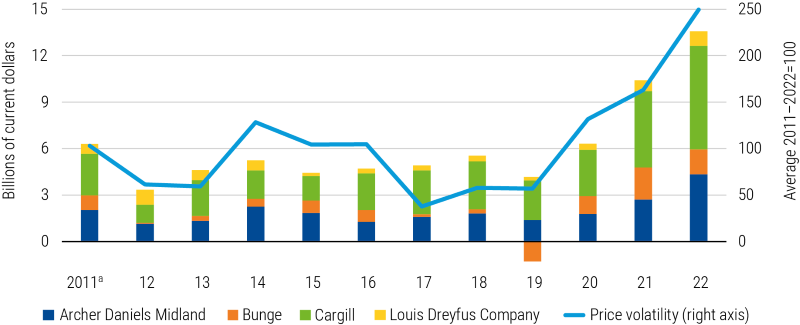

Market concentration in key sectors, such as trading of agriculture commodities, has grown since 2020, deepening the asymmetry between the profits of top multinational enterprises and declining labour share globally. In the food trading industry, patterns of profiteering reinforce the need to extend systemic financial oversight and consider corporate group behaviour within the framework of the global financial architecture.

Profits of the ‘ABCD’ food companies surge during periods of price volatility

To navigate this complex economic landscape, UNCTAD urges policymakers to consider these recommendations, and forge a path towards a global economy characterized by resilience, inclusivity and financial stability, ensuring global trade works for all.

About UNCTAD

UNCTAD is the UN trade and development body. It supports developing countries to access the benefits of a globalized economy more fairly and effectively and equips them to deal with the potential drawbacks of greater economic integration.

It provides analysis, facilitates consensus-building and offers technical assistance to help developing countries use trade, investment, finance and technology as vehicles for inclusive and sustainable development.