The Sino-American rivalry plays a pivotal role in today’s global market, as well as the Chinese economy. The U.S. presidential election will significantly impact the price of assets, affecting Chinese manufacturers, importers, exporters, and currency stability. The key differences in the China policies of the two major candidates could indicate the future prospects of Chinese assets post-election [para. 1].

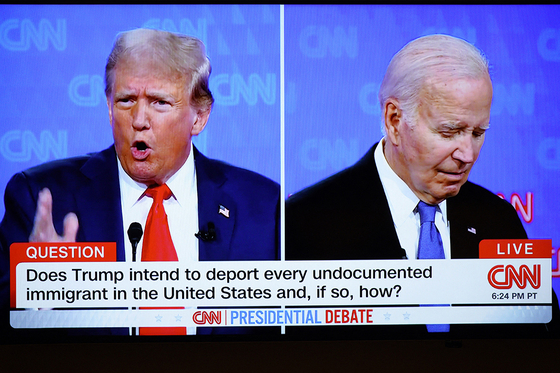

Donald Trump adopts a more hawkish stance on immigration compared to U.S. President Joe Biden and favors a conservative approach toward climate change, advocating for a return to fossil fuels. However, their differing stances on tariffs, tax cuts, and monetary policy will most significantly impact Chinese asset pricing [para. 2].

In terms of tariffs, both candidates support high tariffs, but Trump’s approach is more extreme. While Biden announced higher tariffs on Chinese imports, targeting new-energy vehicles, semiconductors, and solar cells, these increases affect about $18 billion worth of goods and are partially deferred until 2026 [para. 3][para. 4]. Trump proposes a universal 10% tariff on all goods entering the U.S., based on the belief that “all nations pose a trade threat.” Additionally, he suggests a 60% or higher tariff targeting Chinese goods, with specific industries facing unique tariffs [para. 5].

Studies indicate that tariff costs ultimately fall on domestic companies and consumers. A 1% increase in duties leads to a 0.3-0.6% rise in CPI, though Trump argued during the debate that a 10% tariff would not result in higher inflation. The ongoing electoral dynamics will affect global trade, capital markets, and supply chains, with the 10-year U.S. Treasury yield rising to 4.4% amid inflation concerns [para. 6].

The candidates’ domestic tax policies differ starkly, directly impacting “external demand” for Chinese assets. Biden’s Balancing Act raises income taxes on high earners and increases the corporate tax rate to 28% targeting large companies and multinationals [para. 7]. In contrast, Trump favors extensive tax cuts, advocating for extending personal tax cuts beyond 2026 and reducing corporate income tax from 21% to 15%, with the potential for these changes to be permanent [para. 8][para. 9].

According to China International Capital Corp. Ltd., the current effective tax rate of the S&P 500 index is close to 15%. If sectors such as energy, transportation, diversified financials, banking, business services, and durable consumer goods reduced their tax rates to 15%, the net profit growth rate for the S&P 500 index in 2025 could rise from the current market consensus of 13.7% to 17% [para. 10].

Finally, Trump’s views on Federal Reserve policy significantly differ from Biden’s. Considering Fed Chair Jerome Powell’s term ends in May 2026, Trump’s potential reelection could influence monetary policy execution, likely pushing inflation higher due to his tariffs, tax cuts, energy policies, and domestic investments [para. 11]. Trump’s unpredictability makes him a wild card for monetary policy and could lead to increased policymaker intervention in a high-inflation, high-interest-rate environment, breaking the tradition of presidential non-interference in monetary policy [para. 12].

Tang Ya, a financial commentator and former finance professor at Peking University, and Melody Cai, who helped translate this commentary, provided these insights. Caixin Global also invites readers to submit their opinions for publication [para. 13][para. 14][para. 15].

AI generated, for reference only