China’s economic slowdown pushes UK firms to take ‘wait-and-see’ approach to investments, but 2024 optimism returns

Of the 301 firms who responded to the survey, 60 per cent considered 2023 to be more difficult than last year, which was marked by lockdowns that hobbled labour and transport in China.

But respondents also showed a “slow return to optimism”, with 46 per cent “positive” about their 2024 prospects.

The largest proportion of British-invested companies, though, are still taking a “wait-and-see” approach by maintaining investment levels in China for the coming year, the chamber said.

Among the 13 per cent of respondents who anticipate decreasing investments in China this year and in 2024, an unusually high 72 per cent cited economic uncertainty as a cause, while another 35 per cent of the firms surveyed plan to increase investments.

British foreign direct investment stock in China was £10.7 billion (US$13.4 billion) in 2021, representing 0.6 per cent of the world total, according to the Department for Business and Trade.

‘The next China is still China’: Xi pledges to tear down investment barriers

‘The next China is still China’: Xi pledges to tear down investment barriers

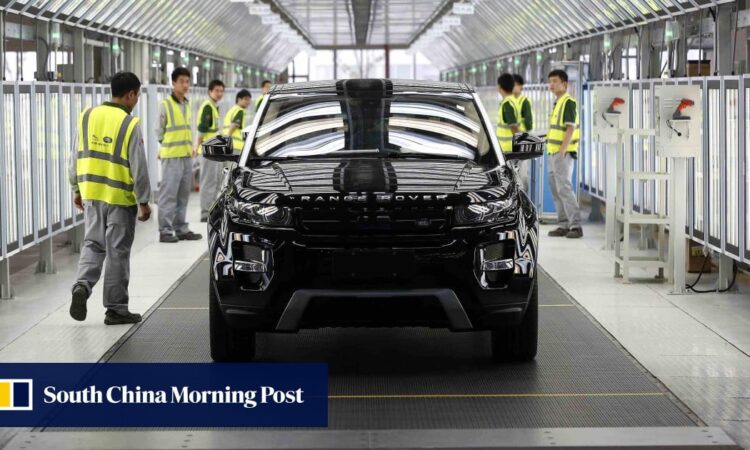

Shell, Standard Chartered and Jaguar Land Rover are among the British investors in China, while the British chamber network in China has a combined 850 member companies.

Investors from developed countries are delaying major new investments in China partly because of a “poisoning of China-US relations”, said Victor Gao, vice-president of the Centre for China and Globalisation in Beijing.

China and the United States have sparred over trade, technology and geopolitics since 2018, while Washington has pressured Western-allied nations to steer away from Chinese supply chains.

But the chamber survey detected interest among British firms in conducting research and development in “sustainability”, artificial intelligence and technological “advancement” due to being “encouraged by China’s growth objectives”.

“Navigating cybersecurity and IT regulations is now the top priority among British business respondents,” the chamber said.

British companies are already responding well to a perceived increase in “proactivity” by Chinese officials to hold more dialogue over regulatory issues, it added.

The survey also found a “marked improvement” in capacity to hire local staff, mainly due to an expanding talent pool.

But close to half of companies surveyed said they were not recruiting foreign talent after hiring from offshore became difficult last year because of regulatory issues during China’s Covid-19 lockdowns.

I hope China will take action more systematically and not wait too long

“There’s a lot of talk around potential opportunities, but a lot of firms need to see stronger growth prospects and better domestic policy clarity to improve their confidence,” said Nick Marro, lead analyst in global trade with The Economist Intelligence Unit.

“The geopolitical environment also isn’t helping, which is encouraging multinational companies to maintain their diversification push into other markets, particularly from a sourcing perspective.”

Chinese officials should help foreign investors by identifying problems on the ground and quickly relaying the issues to the central government, Gao said.

“China has not done a good job in explaining the real situation involved,” he said. “I hope China will take action more systematically and not wait too long.”