China’s efforts to “de-risk” its economy from the West through massive investments in manufacturing and strategic technologies are exacerbating Europe’s industrial decline, experts and business leaders say.

Beijing’s push to achieve greater strategic independence from the West—which long predates EU plans of “de-risking” from China, as outlined by European Commission President Ursula von der Leyen in March 2023—comes amid weak Chinese demand for manufactured goods such as solar panels and electric vehicles.

This, in turn, pushed down global prices and led to accusations of “dumping” by European officials and business leaders.

“It’s a double whammy: China’s de-risking plus its lack of consumption are contributing to our deindustrialisation,” Alicia García-Herrero, a senior fellow at Brussels-based think tank Bruegel, told Euractiv.

She added China’s attempt to assert domestic control over strategic supply chains contributed to the fall in EU exports to China last year, adding this “especially” negatively impacted Germany, Europe’s largest economy whose export-led, manufacturing-intensive economic model has been openly questioned by EU and business leaders recently.

She added that weak Chinese consumption has also had “huge” downward effects on global prices, rendering European manufactured goods increasingly uncompetitive.

“We’re not selling to them, and they’re dumping stuff on us,” she said.

Philipp Lausberg, an analyst at the European Policy Centre (EPC), noted the dangers of China’s “neo-mercantilist” policies for the European economy.

“Everything strategic to them, they want to produce themselves. They want to be self-reliant but continue using free markets to export and get export revenues. And, of course, that is a problem for Europe.“

Eurostat, the EU’s official statistics office, reported that year-on-year industrial output fell 5.7% in the bloc in January.

Last week, the European Trade Union Confederation (ETUC), representing 45 million European workers, reported that Europe’s “increasingly rapid deindustrialisation” led to the loss of almost one million manufacturing jobs over the past four years.

The risks of de-risking

The analysts’ comments follow a report from the EU Chamber of Commerce in China, noting Beijing’s “far more comprehensive form of risk management… predates EU de-risking by quite some time”.

The Chamber’s president, Jens Eskelund, warned that Chinese oversupply is triggering a “slow-motion train accident” in EU-China relations.

The study also argued that the EU would pursue policies aimed at attaining diversification rather than self-reliance like in the case of China.

“There needs to be an honest conversation between the EU and China… because it is hard for me to imagine that Europe will just sit by quietly and witness [its] accelerated deindustrialisation” Eskelund said, as reported by the FT.

The remarks come as some high-profile Western CEOs, including Apple’s Tim Cook, meet Chinese officials in Beijing at the China Development Forum on Sunday and Monday (24 and 25 March).

In a speech delivered at the Forum on Sunday, International Monetary Fund (IMF) Managing Director Kristalina Georgieva openly encouraged China to steer the course of its economic model.

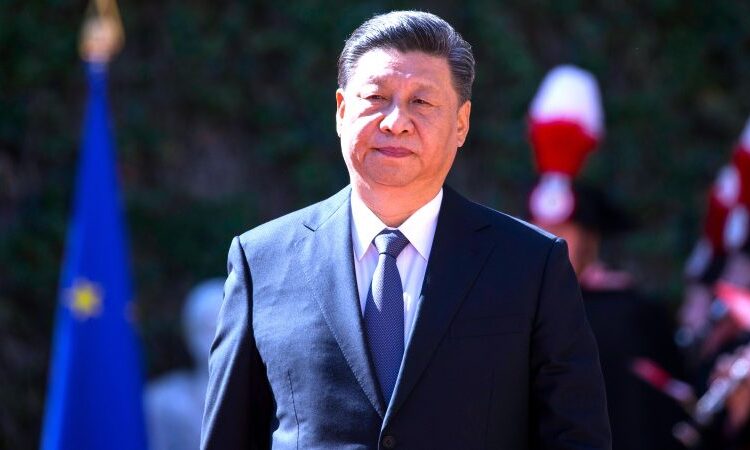

“China is poised to face a fork in the road — rely on the policies that have worked in the past or update its policies for a new era of high-quality growth,” she said, echoing Chinese leader Xi Jinping’s call earlier this year for the country to pursue “high-quality development”.

Georgieva explicitly called on China to implement measures to boost domestic demand.

“A key feature of high-quality growth will need to be higher reliance on domestic consumption,” she said. “Doing so depends on boosting the spending power of individuals and families.”

Bruegel’s García-Herrero, however, expressed scepticism as to whether Beijing will ultimately heed Georgieva’s call. She pointed to the fiscal restrictions imposed by China’s record levels of public debt and Xi Jinping’s previous warnings about the dangers of “welfarism.”

Lausberg further noted that boosting China’s domestic demand will not address the glut of Chinese manufactured products.

“If you look at those over-capacities, it’s literally impossible that […] Chinese consumers can consume all of it,” he said.

Securitising economies

Europe’s push for greater strategic independence from China came after the COVID-19 pandemic triggered massive supply-chain disruptions, while Russia’s war in Ukraine prompted the curtailment of energy imports.

It also comes amid rising tensions between China and the West, particularly over the status of Taiwan, a de facto autonomous island that Beijing regards as falling under its jurisdiction and Beijing’s strengthening of economic ties with Russia.

Alicja Bachulska, a European Council on Foreign Relations policy fellow, told Euractiv that it is impossible to isolate China’s and the EU’s respective de-risking efforts from the broader international context.

“China’s policies are not only based on the Chinese Communist Party’s domestic logic but also serve as a response to the international trends, with the securitisation of economic development being now the guiding principle and a new paradigm for Chinese authorities,” she said.

She added, “Countries all over the world [are] becoming more inward-looking and risk-averse against the backdrop of growing unpredictability.”

Earlier the is year, European Central Bank president Christine Lagarde, also noted that countries increasingly emphasise the importance of “security” over “efficiency” in their economic relations.

[Edited by Anna Brunetti/Alice Taylor]