New data from the Institute of Directors shows that business confidence in the wider economy remained low in August. However, business views about their own organisations’ prospects recovered some ground in August. Inflation expectations have also improved, but cost pressures, particularly wage costs, remain a major concern.

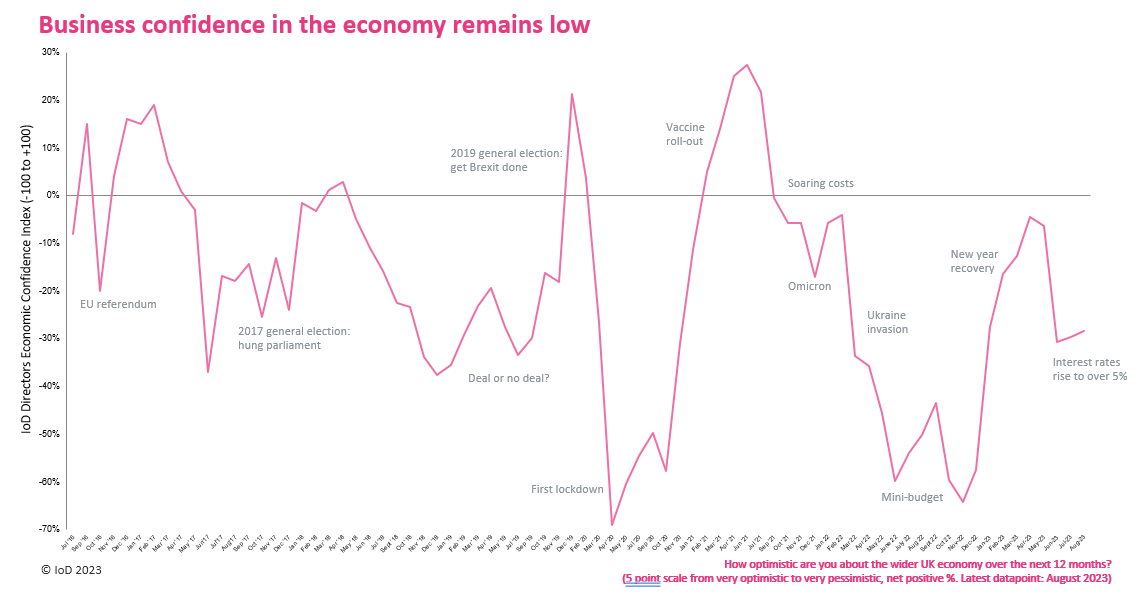

The monthly IoD Directors’ Economic Confidence Index, which is the most timely indicator of UK business sentiment, remained low at -28 in August. It had previously been rising in the first four months of 2023 but then fell to near its current level in June (-31).

Other indicators from August’s survey suggest that business leaders recovered some confidence in terms of prospects for their own organisations, although cost pressures remain high.

- The index of business leader optimism for the future of their own organisation rose to +34 in August, up from +30 in July, but still lower than the +44 recorded in May.

- Net investment intentions rose to +19 in August, up from +12 in July, but still a little below the +22 recorded in May.

- There was an increase in organisations planning to increase headcount, with net headcount intentions rising to +24 in August from +20 in July, the highest since December 2021.

- The proportion of business leaders who believe inflation has already peaked rose to 44% in August, up from 35% in July. In January 2023 the proportion was 24%.

- However, a massive 77% thought wages would increase in the year ahead, the highest proportion since the question was asked in January 2019.

Kitty Ussher, Chief Economist at the Institute of Directors, said:

“Business confidence in the UK economy has fallen sharply in recent months and today’s data shows that feeling of gloom has been maintained into August. In particular, business leaders are feeling the pressure of high energy bills and rising wages and interest rates.

“However there are also cautious signs for optimism. Our tracker data for August shows improvements in business leader intentions around their own levels of investment and headcount, with revenue expectations also rising along with an increasing sense that we are getting through the worst in terms of inflation.

“With energy prices expected to keep falling into the Autumn, it is therefore still possible that the economy could experience a soft landing where inflation falls sharply without tipping the economy as a whole into recession – as long as the Bank of England is careful not to tighten interest rates by more than is necessary.”

The IoD Directors’ Economic Confidence Index measures the net positive answers from members of the Institute of Directors to the question ‘How optimistic are you about the wider UK economy over the next 12 months?’ on a five-point scale from ‘very optimistic’ to ‘very pessimistic’.

New data points will continue to be made available on the first day of each month containing data obtained from a survey of IoD members that is in the field during the previous month.

Full survey results

688 responses from across the UK, conducted between 13-30 August 2023. 16% ran large businesses (250+ people), 23% medium (50-249), 21% small (10-49 people), 29% micro (2-9 people) and 11% sole trader and self-employed business entities (0-1 people).

How optimistic are you about both the wider UK economy and also your organisation over the next 12 months?

| Very optimistic | Quite optimistic | Neither optimistic nor pessimistic | Quite pessimistic | Very pessimistic | Don’t know | |

| Wider UK economy | 2.3% | 18.6% | 29.7% | 34.3% | 15% | 0.1% |

| Your (primary) organisation | 9.7% | 41.9% | 29.7% | 14.8% | 3.1% | 0.9% |

Which of the following factors, if any, are having a negative impact on your organisation?

| Broadband cost/speed/reliability | 13.2% |

| Business taxes | 32.3% |

| Compliance with government regulation | 29.0% |

| Coronavirus outbreak | 7.0% |

| Cost of energy | 39.4% |

| Cost/availability of finance | 21.4% |

| Difficulty or delays obtaining payment from customers | 16.7% |

| Employment taxes | 22.1% |

| Global economic conditions | 31.3% |

| New trading relationship with the EU | 31.7% |

| Skills shortages/employee skills gaps | 41.9% |

| Supply chain disruption | 16.6% |

| Transport cost/speed/reliability | 17.5% |

| UK economic conditions | 56.3% |

| None | 2.9% |

Comparing the next 12 months with the last 12 months, what do you believe the outlook for your organisation will be in terms of:

| Much higher | Somewhat higher | No change | Somewhat lower | Much lower | Don’t know | N/A | Net positive | |

| Business investment | 7.3% | 32.0% | 39.1% | 14.1% | 6.1% | 0.3% | 1.2% | 19.0% |

| Costs | 16.4% | 69.6% | 10.9% | 1.9% | 0.0% | 0.6% | 0.6% | 84.2% |

| Exports | 4.1% | 15.8% | 34.7% | 4.9% | 1.9% | 1.0% | 37.5% | 13.1% |

| Headcount | 3.4% | 35.3% | 45.1% | 12.5% | 2.3% | 0.1% | 1.2% | 24.0% |

| Revenue | 8.9% | 48.4% | 23.1% | 14.8% | 3.2% | 0.7% | 0.9% | 39.2% |

| Wages | 12.8% | 64.7% | 17.7% | 1.7% | 0.3% | 0.1% | 2.6% | 75.4% |

At what point, if at all, do you expect the rate of inflation in the UK to peak before starting to fall back again, or has it already peaked?

| Inflation has already peaked | 44.5% |

| Summer 2023 | 6.1% |

| Autumn 2023 | 10.2% |

| Winter 2023-2024 | 14.7% |

| Spring 2024 | 8.3% |

| Summer 2024 | 3.5% |

| Autumn 2024 | 3.9% |

| Later than Autumn 2024 | 2.3% |

| Never | 0.9% |

| Don’t know | 5.7% |