Have we gone back in time to the 1970s? Then, as now, the UK experienced widespread industrial action, spiralling energy costs and rampant inflation. Add a war in mainland Europe to the mix and stagflation in the UK is becoming a real possibility.

David Crosthwaite is head of consultancy at the Building Cost Information Service

Although inflation may have peaked, it is remaining stubbornly high at around 10%, which is five times higher than the Bank of England’s 2% target.

There’s yet no real evidence of any policies to reduce levels to the 5% forecasted by year-end, apart from blunt interest rate rises that have the potential to choke off any growth.

While we may have avoided a technical recession so far, quarterly GDP growth is hovering around zero. These factors, coupled with high inflation, provide the ideal conditions for a stagnating economy.

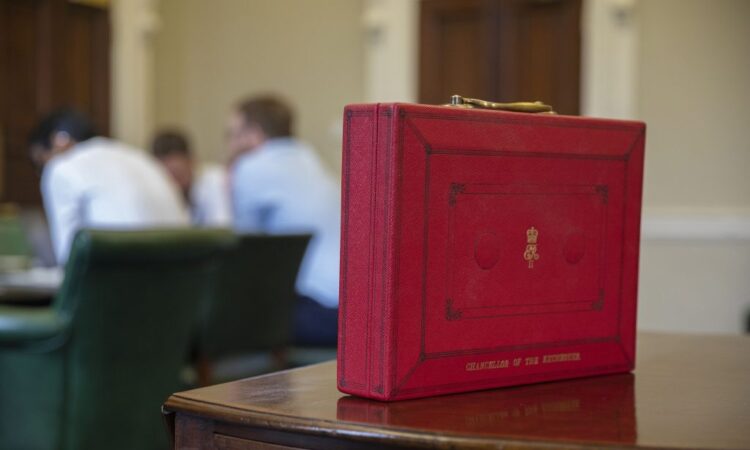

We really need to see the chancellor Jeremy Hunt take some bold steps in the budget this week and prioritise economic growth if we’re to avoid the lost decade syndrome seen in Japan, back in the 1990s.

Construction investment is often seen as a lever of growth, given the multiplier effect, and the chancellor has to announce some stimulus measures to get our economy moving in the right direction, or we’ll be bumping along the bottom for years.

Energy efficiency retrofit of the existing built stock may be one such measure, but this needs a credible delivery plan. The government desperately needs to commit to a properly funded medium term construction pipeline that will deliver growth.

If the UK is to maintain its position relative to other industrialised economies, we can’t have any more tinkering around the edges – we need policies that favour capital investment and tackle ingrained labour shortages.

- David Crosthwaite is head of consultancy at the Building Cost Information Service

Like what you’ve read? To receive New Civil Engineer’s daily and weekly newsletters click here.