Britain now less like the US or German and more like ITALY OR GREECE to lenders says ex-Bank boss as he claims it is ‘disingenuous’ for UK politicians claim economic turmoil is a ‘global phenomenon’

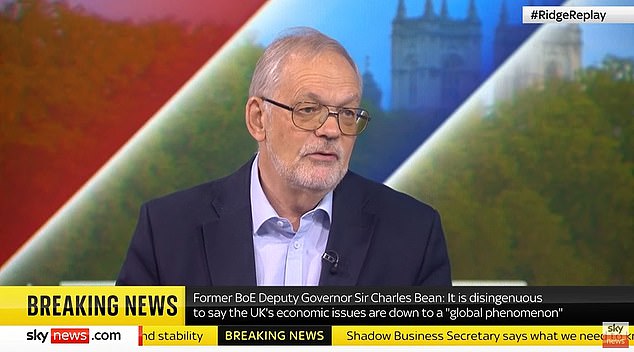

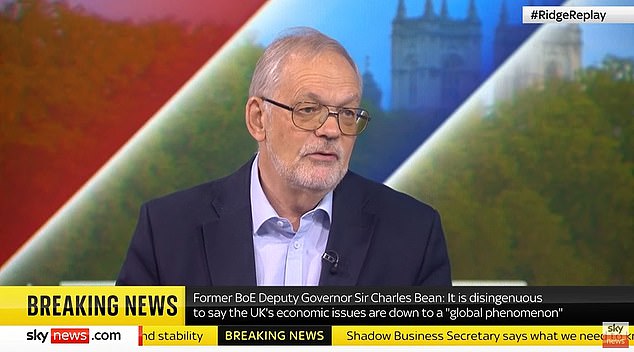

- The central bank’s former deputy governor Sir Charles Bean spoke out today

- Said it is ‘disingenuous’ for ministers to say market turmoil is ‘global phenomena’

- UK economy ‘has gone from looking like US to looking more like Italy or Greece’

The UK economy is now alongside Italy and Greece in terms of risky bets for lenders and politicians are not being honest about the problems facing the nation, a former Bank of England chief warned today.

The central bank’s former deputy governor Sir Charles Bean said it is ‘disingenuous’ of the Government to say the market turmoil is ‘all a global phenomenon’.

He hit out today after Jeremy Hunt replaced Kwasi Kwarteng as chancellor in a bid to calm panicky markets.

The last three weeks since the mini-Budget have seen waves of unrest, first in the sterling market and then, most recently, in gilts – government bonds.

Ministers have been keen to blame the issues, plus the wider cost-of-living crisis and interest rate rises affecting mortgages, on events including the war in Ukraine.

But Sir Charles told Sky’s Sophy Ridge on Sunday: ‘Frankly I think it is disingenuous to say it’s all a global phenomenon – it’s not.

‘There is a global element and if you look at the general level of interest rates, they have risen by about three percentage points since the beginning of the year.

Three-quarters of that, two-thirds maybe, is the world and what’s happening in the Ukraine but the rest of that is a UK specific phenomenon and it’s particularly developed since the mini-budget so it is clearly driven by that in my view and basically, we’ve moved from looking not too dissimilar from the US or Germany as a proposition to lend to, to looking more like Italy and Greece.’

The Mediterranean countries have long been seen as among the least stable in the EU, with Athens suffering its own debt crisis in 2007-8 that led to the longest recession of any advanced economy ever.

The central bank’s former deputy governor Sir Charles Bean said it is ‘disingenuous’ of the Government to say the market turmoil is ‘all a global phenomenon’.

It came as Mr Hunt spent the weekend trying to reassure the markets that the UK was economically sound.

He warned of major public spending cuts to come today but tried to reassure families there would be no return to the austerity years.

Amid claims that Tories are still plotting to replace the Prime Minister, Mr Hunt is expected to follow up her Friday climbdown on increasing Corporation Tax by axing the mini-Budget’s plan to cut the basic rate of income tax by 1p to 19p.

Within a day of taking the keys to No11 the new chancellor’s actions mean none of the three main strands of the ‘Trussonomics’ package from just three weeks ago remains. As well as Friday’s Corporation tax reversal – it will now rise from 19 per cent to 25 per cent – the decision to axe the 45p income tax rate for the highest earners was embarrassingly reversed during the Conservative Party Conference.

Appearing on BBC One’s Sunday with Laura Kuenssberg, Mr Hunt said he wants to keep as many of Liz Truss’s tax cuts as he can but all options remain open.

Telling Sunday with Luara Kuenssberg that ‘the Prime Minister’s in charge’, he said: ‘We’re going to have to take some very difficult decisions both on spending and on tax. Spending is not going to increase by as much as people hoped … taxes are not going to go down as quickly as people thought and some taxes are going to go up,’ he said.

And he also said no Government department would be immune from ‘efficiency savings’, as he signalled spending cuts to come.

Asked if it was a return to the austerity brought in by the 2010 coalition, he said: ‘I don’t think we are going to have anything like that this time.’

The Chancellor, who spent Saturday also meeting with Treasury officials, had earlier insisted that he and the Prime Minister were a ‘team’ – but said she and sacked former Chancellor Kwasi Kwarteng went ‘too far, too fast’ with their mini-Budget.

Some MPs backed the PM to go on today, saying a change in policy was needed more than a change in leader. But other suggested Hunt’s appointment and decisions could be the final nail in the coffin for Ms Truss’s short period in power.

Conservative MP Robert Halfon stopped short of calling on Liz Truss to quit as Prime Minister, but launched an extraordinary attack on her Government as he called for a ‘dramatic reset’ over the coming days.

Speaking on Sky News’ Sophy Ridge on Sunday, Mr Halfon said: ‘I worry that over the past few weeks, the Government has looked like libertarian jihadists and treated the whole country as kind of laboratory mice on which to carry out ultra, ultra free market experiments.

‘And this is not where the country is. There’s been one horror story after another.’

Advertisement