Biggest IPO this year? Softbank-owned chip-maker Arm passes UK PM Rishi Sunak’s offer, looking to raise billions on US stock market

Cambridge-based microchip designing giant Arm said that it has confidentially submitted a draft registration statement with regulators to sell its shares in the US. The firm, owned by Japanese conglomerate Softbank Group Corp, is reportedly looking to raise somewhere between $8 billion and $10 billion. This could be the biggest initial public offering (IPO) of the year.

Cambridge-based microchip designing giant Arm said that it has confidentially submitted a draft registration statement with regulators to sell its shares in the US. The firm, owned by Japanese conglomerate Softbank Group Corp, is reportedly looking to raise somewhere between $8 billion and $10 billion. This could be the biggest initial public offering (IPO) of the year, IANS said, citing a BBC report.

Arm designs the tech used in processors that run devices like gaming consoles and smartphones. Prominent chip manufacturers such as Taiwan Semiconductor Manufacturing Company, as well as renowned brands like Apple and Samsung, use Arm’s designs to build processors of their own.

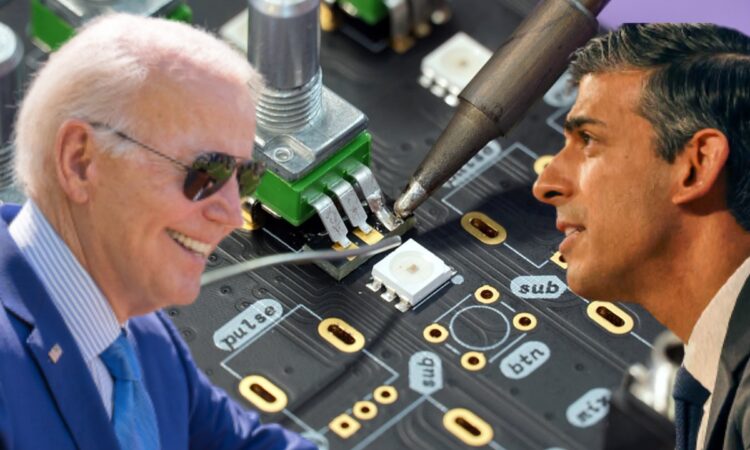

Sometimes called the “crown jewel” of UK’s technology sector, Arm was bought in 2016 by Japanese conglomerate Softbank in a deal worth €23.4 billion. The microchip designer had said in March this year that it was not going to list its shares in London, eyeing the US Securities and Exchange Commission (SEC). Reports in January had said that UK Prime Minister Rishi Sunak had been in talks with Softbank about a possible London listing.

The company’s announcement about listing on the technology-heavy Nasdaq platform did not reveal when the share sale could take place, the report said.

Arm’s decision raised concerns that the UK market is not doing enough to attract tech company stock offerings, with US exchanges seen to offer higher profiles and valuations.

Arm’s IPO push comes in the backdrop of a sharp decline in the number of stock market listings since Russia ‘s invasion of Ukraine. Apart from thsi, major tech companies have also seen the price of their shares take a plunge due to the pandemic . Despite these difficult circumstances in the global financial markets, Softbank is soldiering on with the multi-billion dollar sale.

add a comment