ASML asks for more active involvement from the EU and its member states in the global technology battle

ASML wants more involvement from the European Commission and the 27 member states in its battle for free trade amidst the Sino-American technology war. While the US, China, and Japan call the shots, Europe may claim it’s in the Champions League of global economic security, but it’s not. ASML’s top EU diplomat in Brussels was abundantly clear in his analysis of the geopolitical and geoeconomic playing field in which the company is currently operating.

At a conference organized by the European Policy Centre, a broad group of experts was asked to reflect on the EU’s capacity to act as an economic security power. ASML’s Wouter Baljon was one of them. For good reason, his company is in the midst of a Sino-American technology war. The conference was a prelude to the presentation of an EU initiative on screening outbound investments and a proposal on export controls for four crucial technologies, including microchips, which is expected on January 24. The proposals form part of a package of tools aimed at de-risking its trading ties with China.

Why you should know

ASML is in the midst of a Sino-American technology war. The company’s top EU lobbyist explains how the Veldhoven-based chips machine builder wants to navigate this era and what it expects from the European Commission.

The main question for Baljon at the conference: is the European Commission helpful to ASML regarding economic security? And do we, as Europeans, have agency in this fight around technology? Baljon offered some sobering answers. “Europe is still in the la-la land of dual-use goods, while the US is all about curtailing China’s ability to make industrial progress. A certain humbleness would suit us.”

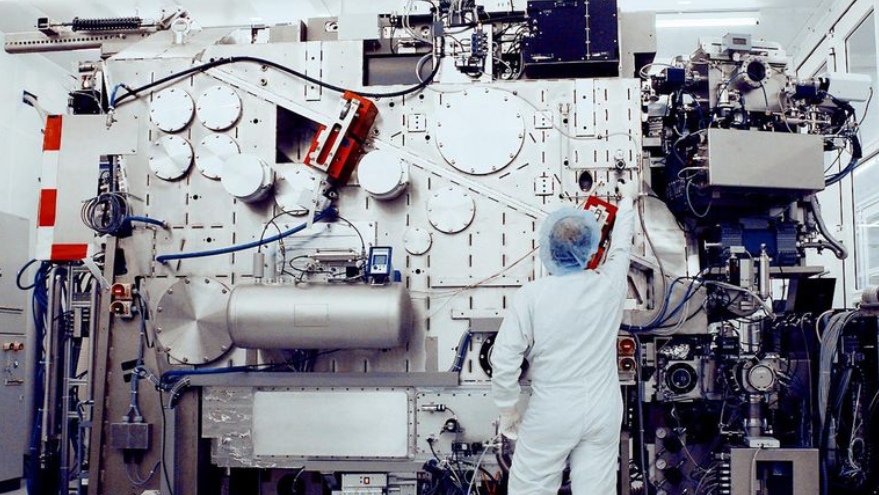

ASML has been forced to stop selling some advanced precision lithography machines to Chinese buyers at the behest of the Biden administration. Wouter Baljon is ASML’s top EU lobbyist. Last week, he used a panel discussion organized by the European Policy Centre to reflect on the consequences of his company being in the midst of – as he described it – “a chip equipment conflict that the United States unleashed on 7 October of 2022”.

Champions League

After that date, the conflict didn’t remain within the industry, Baljon said. “If you think about China announcing controls on gallium germanium graphite rare earth metals, China is trying to increase its leverage, and it’s not using it yet, but who knows what’s to come.” To clarify his point on economic security and geoeconomic statecraft, Baljon used a football analogy: “If you think about the Champions League of economic security and geoeconomic statecraft, we have to think of the United States, China, Japan. And then there’s the Europa League, the second tier, where we look at countries like Korea and Taiwan, and, at best, the EU as a collective.” And although Europe claims a place in the Champions League of high-tech, “we struggle to perform at the Europa League level.”

A certain ‘humbleness’ would help the EU act as a collective, particularly in high-tech, Baljon added. “We are not an incumbent, unfortunately, as the EU27. We are a challenger. We might speak of the ‘geopolitical commission’, but at this point, I think it’s only as geopolitical as the Franco-German axis allows it to be. We don’t even have the manpower to be in this championship.”

Baljon said the export control system has become an industrial policy instrument, not a security issue. “We still live in this la-la land that it’s about dual-use goods. It’s military-civil fusion. But if you look at what the United States is doing, it’s all about curtailing China’s ability to make industrial progress.”

Act collectively

The only solution, Baljon said, is for Europe to act collectively. “I’m not necessarily advocating for a bigger role of the European Commission, even though that would help, but European member states coming together and involving the industry more clearly.”

Baljon said the EU should not join “the American exercise”, but needs to make its own assessment of what it considers a meaningful way forward regarding its technology. “Let’s take the example of Taiwan. In the United States, the view is almost that there’s already war in the Taiwan Strait. So, the fact that ASML gets more than a third of its revenue from Taiwan is considered a risk in the US. Whereas I believe that in Europe, an open trade relationship with East Asia is not considered a risk per se.“

“Our customers produce chips; they do not put chips into missiles.”

Wouter Baljon, ASML

Baljon said it’s crucial to find out where the big member states stand on these issues and their willingness to enable the commission to support a company like ASML. “Our customers produce chips; they do not put chips into missiles. Chips are a commodity product; you can buy them in the open market, so you must think about what you can and can’t control. This is also part of the responsibility of the Chinese government and other governments across the globe, which is why multilateral fora like the Wassenaar Forum matter so much. This is where you can discuss what is desirable and ethical, and that’s why the erosion of multilateral forums is such a worrying development.”