For nearly a decade, U.S. trade policy has been remade in the image of a single man: Robert Lighthizer. As President Donald Trump’s trade representative, he turned the United States away from six decades of support for a rules-based, multilateral trading system and toward a robustly nationalist approach. Lighthizer’s successor under President Joe Biden, Katherine Tai, has continued on the path he laid out. Even as most of Trump’s former officials have denounced him as unfit to be president again, Lighthizer has kept the faith—seeing in Trump, as many others do, a flawed vessel for some greater public good. He remains one of Trump’s top policy advisors in the 2024 campaign and would be set for a bigger job—likely Treasury secretary—if Trump wins in November. Lighthizer’s mission of transforming not just U.S. trade policy but broader U.S. international economic policy is just getting started.

Lighthizer’s influence was on full display last month, when Biden traveled to the headquarters of United Steelworkers, North America’s largest industrial union, in Pittsburgh, in the political battleground state of Pennsylvania. Following the visit, the administration announced plans to sharply increase the tariffs on certain Chinese imports that were first imposed, at Lighthizer’s urging, by Trump. This week, following a review by Tai’s office, the administration slapped a 100 percent tariff on imported Chinese electric vehicles and raised the rates on Chinese-made semiconductors, lithium-ion batteries, solar cells, steel, and aluminum. Tai has also launched a new Section 301 investigation—a 1970s-era tool of U.S. trade unilateralism revived by Lighthizer—into Chinese subsidies for the shipbuilding industry. More tariffs are likely to follow. And Lighthizer himself has been counseling Trump to devalue the strong U.S. dollar if he is elected in order to boost U.S. exports—advice that has been widely read as an audition for the Treasury post.

Lighthizer’s growing influence is a warning to U.S. trading partners—including the country’s closest allies—that the aggressive nationalism of Trump’s trade policies is not a passing phase. Instead, the United States has made a choice across both political parties to embrace an “America First” approach to international economic policy. The implications of that choice will play out for years, and likely decades, to come. That makes Lighthizer—following a career spent mostly as a voice in the wilderness decrying the U.S. embrace of free trade and multilateral rules—the man in the middle.

Lighthizer is an unlikely figure to have become the architect of the next generation of U.S. international economic policy. Born just after the end of World War II, he spent most of his career as a lawyer protecting the U.S. steel industry against foreign competition. Once the anchor industry of U.S. manufacturing, steel is now a rounding error in an economy dominated by information technology, a growing green industry, and the exploding international trade in services, including higher education and tourism. But the lessons he learned from steel—that U.S. trading partners engage in predatory practices, including by subsidizing production and dumping goods below their cost, that have stolen U.S. jobs and hollowed out manufacturing—have now become gospel for trade officials in both parties.

Lighthizer’s 2023 book, No Trade Is Free, is a searing indictment of the many decades of consensus on the benefits of trade liberalization. From Franklin D. Roosevelt to Barack Obama, U.S. presidents believed that negotiated reductions of global trade barriers would make the United States and the world richer and safer. Lighthizer always disagreed. But after a brief stint at the Office of the U.S. Trade Representative during the Reagan administration, he fell into obscurity, resurfacing every so often at congressional hearings, most notably to warn against admitting China to the World Trade Organization (WTO), which happened in 2001. His book, written after Trump’s 2020 election defeat, is an “I told you so” to the U.S. trade establishment. Reducing tariffs and binding Washington’s hands through global trade rules was, he writes, “a starker, more indisputable failure than even I could have predicted,” leading to the loss of U.S. manufacturing, the stagnation of Americans’ wages, and a U.S. strategic position that has deteriorated sharply against China. But, he argues, the “political establishments of both the Republican and Democratic parties, under the influence of multinational corporations and importers, were unwilling or unable to recognize their mistakes.”

As Trump’s trade representative for the entire four years of his term—a rare accomplishment under a mercurial president—Lighthizer was able to turn the United States onto a different course. He slapped tariffs of up to 25 percent on steel and aluminum imports from much of the world, imposed similar tariffs on three-quarters of China’s exports to the United States, and strong-armed Canada and Mexico into a renegotiation of the North American Free Trade Agreement. These moves were largely popular at home—Democrats rallied behind the new United States-Mexico-Canada Agreement over provisions that tightened labor law enforcement in Mexico and required more production in the United States. The Biden team has also kept the China tariffs in place, despite strong initial opposition from Treasury Secretary Janet Yellen.

U.S. Trade Representative Robert Lighthizer stands alongside U.S. President Donald Trump after the latter signed actions to impose new tariffs in the Oval Office at the White House in Washington on Jan. 23, 2018. Jim Watson/AFP via Getty Images

But Lighthizer is just getting started. What he envisions, in the simplest terms, is a United States that worries far less about being a stabilizing force in the global economy and far more about pursuing its own narrow economic interests. As Treasury secretary, he would have many more tools at hand to carry out that mission.

The key metric for Lighthizer is one that conventional economists rarely pay attention to: the trade deficit. The United States has run a deficit in goods and services every year since 1975, topping out at a whopping $951 billion in 2022, although trade deficits were much higher relative to the size of the economy in the mid-2000s. Most economists, however, consider the trade deficit to be a function of national savings rates—the necessary consequence of high U.S. consumption and low private and public savings—and therefore largely immune to government intervention on the trade side. Lighthizer disagrees, seeing the deficit as a direct transfer of U.S. wealth to competitors, most importantly China, that can be corrected through forceful government action.

He would make it a goal of U.S. policy to balance trade with the rest of the world, not just China. The implications are enormous. One tool, which Lighthizer has reportedly proposed to Trump, is a concerted effort to weaken the U.S. dollar against other currencies. Other things being equal, a cheaper dollar would reduce the prices that foreigners pay for U.S. exports, make imports more expensive for Americans, and help bring trade closer to balance. The dollar, however, has long been overvalued, partly because of its role as the global currency of choice; more recently, it has been soaring in response to a strong U.S. economy and conflicts in the Middle East and Europe that have sent investors running for the safe haven of U.S. assets. Details are scant, but Lighthizer appears to be envisioning a reprise of actions taken by U.S. President Richard Nixon in 1971 and Ronald Reagan in 1987: imposing or threatening tariffs on trading partners unless they agree to take steps to revalue their currencies against the dollar. Given the scale of global financial flows today—a multiple of the level of when Reagan wrestled down the dollar—the consequences of messing with the stability of the currency are hard to predict.

Lighthizer similarly envisions an overhaul of the U.S. tax system to promote the competitiveness of U.S.-based manufacturing. For complicated historical reasons, U.S. exports have long been harmed by the U.S. tax system. Europe and most other countries rely heavily on value-added taxes (VAT), from which goods and services leaving the country are usually exempt. U.S. taxes, on the other hand, are largely income-based, and such taxes are not reimbursable under global trade rules. A U.S. company exporting to Europe pays both U.S. corporate income taxes and the local VAT on its sales in Europe—which puts products made in the United States at a competitive disadvantage. Lighthizer wants that to end by making the corporate tax system “border adjustable” to emulate the advantages of a VAT. Such revisions would have to run a congressional gauntlet, however, and have failed in the past due to pushback from large U.S. importers such as Walmart. Expect a Treasury Secretary Lighthizer to make another run at it.

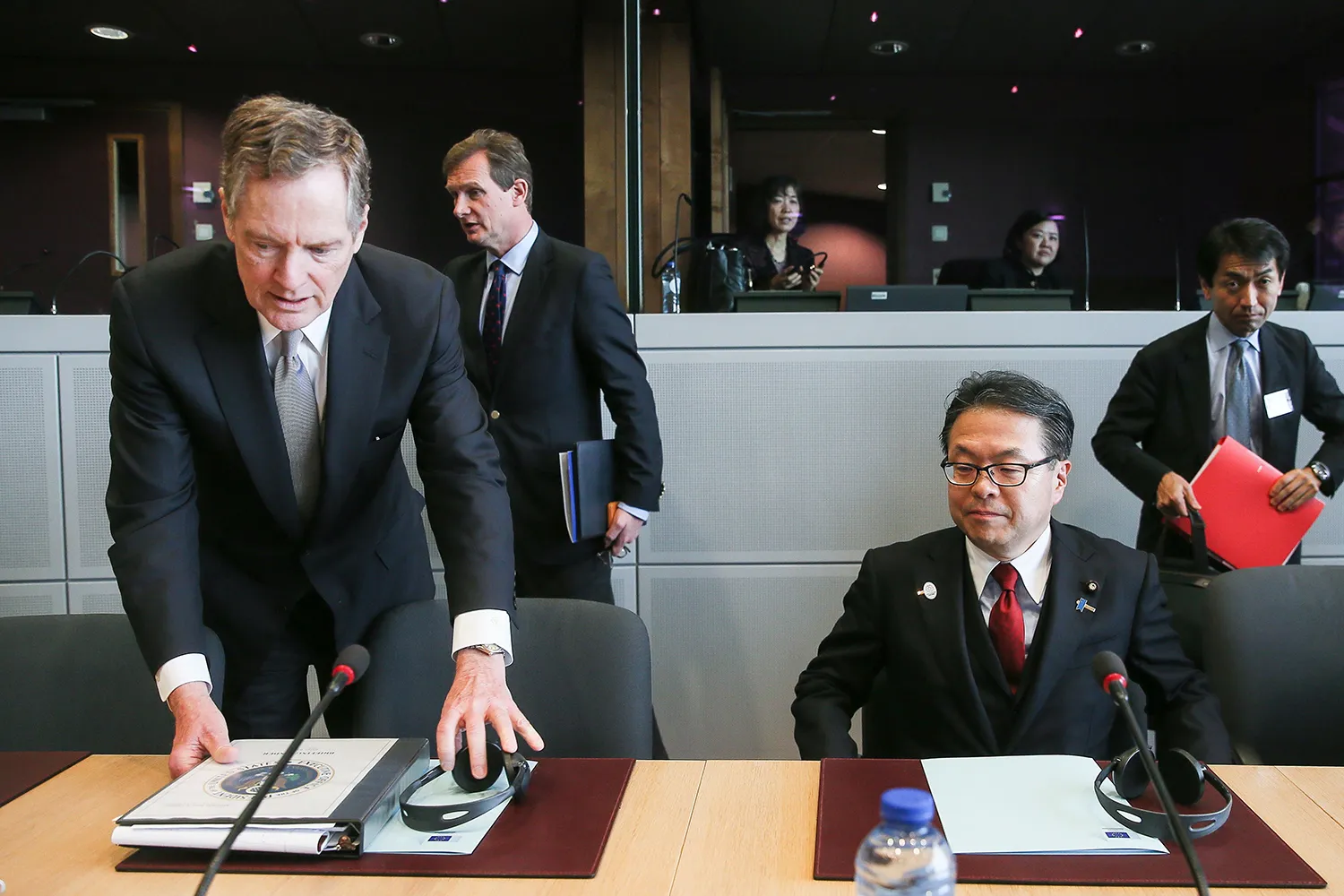

- Lighthizer and Japan’s Economy Minister Hiroshige Seko prepare to meet with the European commissioner for trade in Brussels on March 10, 2018, after the United States imposed tariffs on steel and aluminum. Stephanie Lecocq/AFP via Getty Images

- Trump, flanked by Vice President Mike Pence and Lighthizer, speaks during a signing ceremony for the United States-Mexico-Canada Trade Agreement at the White House on Jan. 29, 2020. Drew Angerer/Getty Images

But Lighthizer’s favorite tool remains the one most clearly controlled from the White House: tariffs. Writing in the Economist in March in defense of Trump’s announced plan to impose sweeping new tariffs if he is elected, he argued that the United States’ “bold experiment” with eliminating tariffs “has failed.” New tariffs—at least 10 percent across the board, in addition to some higher, more targeted duties—are needed “to reduce America’s trade deficit and to speed up its reindustrialisation,” he wrote. “Experience suggests that this will succeed and that high-paying industrial jobs will be created.” His book suggests how far such an effort might go. Tariffs should be imposed on all imports “at a progressively higher rate year after year until we achieve balance.” In other words, a 10 percent minimum on all trade is only the opening bid.

He would further seek to eliminate an obscure provision known as de minimis—the value below which imports are exempt from customs entirely. With the 2015 Trade Facilitation and Trade Enforcement Act, Congress increased that rate from $200 to $800, with the goal of eliminating costly paperwork for smaller shipments of consumer goods. The change happened just as international online ordering was taking off. Consider the Chinese fast-fashion giant Shein, which has grown from a tiny business in 2015 into a giant with at least $30 billion in annual sales that now controls nearly 30 percent of the U.S. fast-fashion market—without a single U.S. store or brand. Downloads of Shein’s shopping app rose from fewer than 3 million globally in 2015 to more than 260 million last year. The company’s business model involves shipping Chinese-made clothing directly to American consumers duty-free because of the de minimis exemption; shipping giants such as FedEx and UPS are happy to cooperate. Lighthizer argues that the provision gives many Chinese companies duty-free access to the U.S. market without requiring any reciprocity.

Lighthizer’s influence will remain, no matter who wins in November. Biden has tried to walk a line between promoting U.S. manufacturing and seeking common ground with allies, who fear growing U.S. protectionism—foreign concerns of which Lighthizer has long been dismissive. But in an election year, the Biden administration’s evenhandedness is disappearing. At the behest of U.S. Sen. Sherrod Brown from Ohio, a Democrat who faces a tough reelection battle in a Trump-leaning state, Biden has promised, for example, to block the proposed takeover of U.S. Steel by Japan’s Nippon Steel. The Japanese company has already pledged to honor all union contracts, move its U.S. headquarters from Houston to Pittsburgh, and not cut jobs or move production overseas. But U.S. labor unions remain opposed to the deal, so Biden has said he will block the takeover on specious national security grounds, a move that is sure to infuriate the most important U.S. ally in the Asia-Pacific.

The areas of common ground between Lighthizer and the Democrats are much deeper than most people recognize. Consider climate change—many Republicans, including Trump, are skeptical of the science and opposed to any government actions to reduce the use of fossil fuels. But Lighthizer strongly favors extra tariffs on carbon-heavy imports, a policy that the European Union is already rolling out and that is now being seriously explored by the Biden administration. Lighthizer favors a carbon border tax that would impose additional tariffs on emissions-intensive products—including cement, fertilizers, and aluminum—with the argument that to do otherwise is to benefit countries producing goods “using much more carbon than we would tolerate here,” he writes in No Trade Is Free.

Under Tai and an emboldened Labor Department, the Biden administration has also become more aggressive in using trade tools to sanction human and labor rights violators around the world. Lighthizer would go much further than that. In his book, he proposes that all imports should be blocked unless the exporting companies adhere to U.S.-level standards for environmental protection, labor rules, and worker health and safety.

The biggest target for each of these initiatives is, of course, China. It was the Trump administration that launched a U.S. policy shift on China, treating it less as a trading partner and more as a hostile adversary. Lighthizer, who played a key role in this shift, minces no words, arguing that China is “the greatest threat that the American nation and its system of Western liberal democratic government has faced since the American Revolution.” He cites as evidence China’s huge economy, almost the size of the United States’, which makes it a far more capable adversary than the former Soviet Union—let alone Nazi Germany or imperial Japan. Lighthizer would seek something close to a full economic decoupling; as a first step, he recommends eliminating China’s “most favored nation” status, granted by Congress in 2000 to permit Beijing’s entry to the WTO. That would give the president a completely free hand to slap discriminatory tariffs on China.

From left: Pence, Lighthizer, and Trump before signing a trade agreement with Chinese Vice Premier Liu He at the White House on Jan. 15, 2020.Jabin Botsford/The Washington Post via Getty Images

Few on the Democratic side propose to go that far. So far, the Biden team is trying to distinguish between strategic trade with China in products such as semiconductors and new EV technologies that may need to be restricted and most ordinary consumer goods, which can be traded freely. The administration’s strategies—circumscribed with the phrases “small yard and high fence” and “derisking”—still envision a lot of room for mutual gain in U.S.-China trade. But the more China comes to be seen as a threat, the more compelling Lighthizer’s comprehensive decoupling logic will become. Any form of U.S. trade with China is likely to enrich China, potentially making it a more formidable adversary down the road. In an election year, especially, calls for nuance in the U.S.-China relationship are likely to be drowned out.

But while the influence of Lighthizer’s agenda will grow and endure in both parties, the disruptions could be more modest than many observers fear. When Trump imposed his tariffs, the global trade system proved more resilient than once seemed likely, producing only a modest downturn in U.S.-China trade and small uptick in inflation. But there is also a growing danger that a little bit of U.S. protectionism suddenly escalates into something much more harmful. Lighthizer’s colleague-in-arms during the Trump administration, former Director of Trade and Manufacturing Policy Peter Navarro—currently in prison for refusing to cooperate with Congress’s investigation into the Jan. 6, 2021, Capitol attack—wants the United States to demand tariff reciprocity across the board. Any country that refused to reduce its tariff on a product to U.S. levels—Europe’s 10 percent tariff on passenger cars would have to fall to the U.S. rate of 2.5 percent—would face offsetting tariffs. (The Europeans would then likely retaliate by offsetting the United States’ 25 percent tariff on imported SUVs.) The Democrats, too, are eager to slap an array of new tariffs on a host of clean energy products, including wind turbines and EVs; last month, Tai told a congressional committee that the administration would take “early action, decisive action” to protect the U.S. EV industry.

The growing popularity of protectionism in both parties suggests there is much more to come. If other countries respond in kind, which is all but certain, it is easy to envision the sort of damaging trade and currency wars that have not occurred since the 1920s and ’30s.

To be sure, there is no rule that history must repeat itself. The United States could simply be in the midst of correcting trade policies that went too far and too fast in the direction of liberalization, leaving some U.S. industries and workers vulnerable to predatory competition. A middle ground is certainly possible. But all the evidence suggests that the United States is in serious danger of heading too far and too fast in the opposite direction. Should that be in doubt, just take a close look at what Lighthizer—the most important figure in U.S. trade policy to have emerged in our lifetime—has done, is saying, and still plans to do.