Last week, we learned that in the third quarter of 2023, real GDP grew at a 4.9 percent annual rate. Meanwhile, total personal consumption expenditures (PCE) inflation was 0.4% in September, increasing 3.4 percent over the past twelve months. Core PCE inflation, which excludes volatile food and energy prices, was 0.3 percent in September and is up 3.7 percent over the past year.

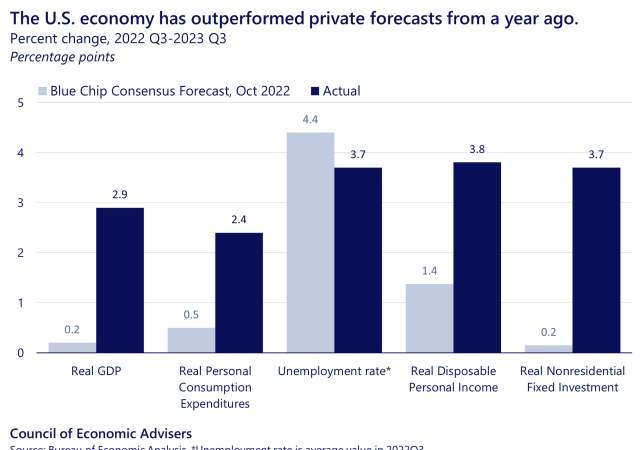

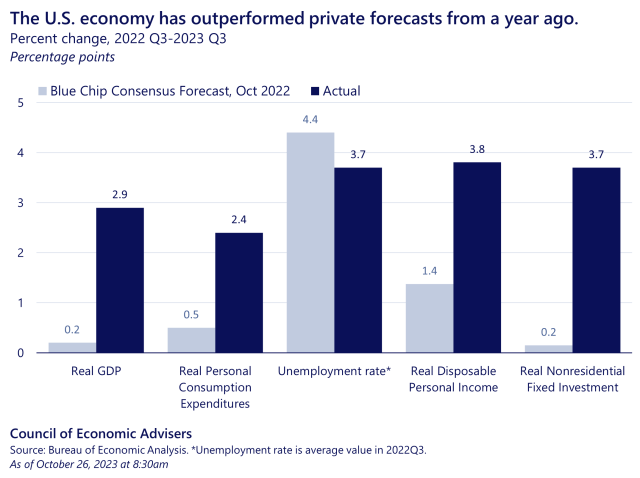

A year ago, financial news outlets were reporting that the market expected an imminent recession. One declared that the probability of a U.S. recession within 12 months was 100 percent. Almost a year to the day later, the Wall Street Journal reported that according to its own survey research, “Economists are turning optimistic on the U.S. economy. They now think it will skirt a recession…” In fact, over the last four quarters, real GDP has grown at a healthy 2.9%, far surpassing the consensus 0.2% growth projected last year, shown in the first two bars in the chart.

Consumption spending makes up two-thirds of the U.S. economy on average, so as the U.S. consumer goes, so goes the U.S. economy. The second set of bars shows that the biggest surprise in the performance of the economy since this time last year has been that the US consumer has continued spending robustly: real consumption spending grew almost 2 percentage points more than expected at this time last year (2.4% vs. 0.5%).

This was driven in part by the remarkably strong labor market: Unemployment remained very low at 3.7 percent in Q3, far lower than the 4.4 percent expected (third set of bars). The strong job market performance was buoyed by expanded labor supply. Indeed, prime-aged labor force participation rate hit a 20-year high. The tight labor market produced large income gains for American households, with disposable income growing by 3.8 percent (instead of the forecasted 1.4 percent (fourth set of bars).

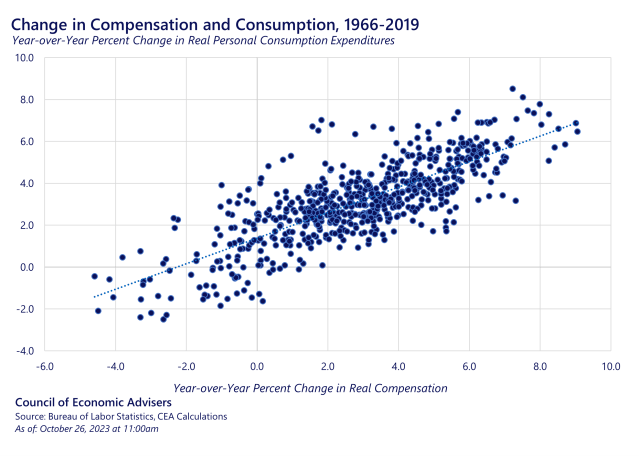

The roughly $11.6 trillion per year in aggregate real compensation received by U.S. workers is a function of both their real hourly compensation and their aggregated hours of work. In this regard, the 14 million jobs created since President Biden took office not only have provided opportunities and greater bargaining clout to working Americans, but also have played a key role in boosting aggregate spending, which drives positive growth outcomes that have led to the correction in the market’s recession calls.

And this is seen very clearly in Figure 2 which shows the tight fit between labor market earnings and consumer spending by plotting the relationship between the year-over-year percent change in aggregate compensation and aggregate spending, adjusted for inflation. The figure uses data from the mid-1960s through 2019 to avoid the sharp disruption to both variables from the pandemic. The correlation of 0.79 quantifies this very simple, but close, relationship, one which roughly predicts that if we continue to see real income gains for workers, we can expect continued healthy growth in consumer spending.

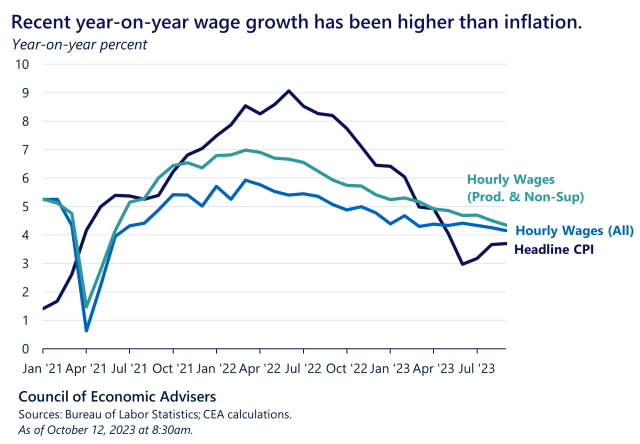

Falling inflation is another crucial piece of the equation. Overall CPI inflation is down 60% from its peak in June of 2022; and recently in Q3, core PCE inflation—the gauge tracked closely by the Federal Reserve—was 2.4% (annual rate). The slowdown in inflation amidst the strong job market is one reason why real wages are rising on a year-over-year basis for the past five months, as shown by the green and blue lines compared to the black line in the chart below. Nevertheless, inflation needs to fall further still to support household budgets, strengthen the buying power of workers’ paychecks, and continue to support consumption and GDP growth.

Another important factor boosting GDP growth over the last year has been President Biden’s investment agenda. This has pulled in hundreds of billions in private capital, much of which is going towards building American factories to support clean energy and semiconductor production. Returning to the last set of bars in the first figure up top, private non-residential business investment was far stronger over the last year than expected by forecasters (growth 3.7% versus a forecasted 0.2%).

Going forward, while the tailwind from consumer spending is helping to boost the current expansion, such investments will continue help to boost future growth, domestic job creation, and U.S.-based productive capacity.

Every economy faces tailwinds and headwinds, but in the face of many strong headwinds, the U.S. economy has proven to be consistently resilient. The American consumer, backed by a persistently tight labor market and recently rising real wages, is one salient force behind this economic resilience.