STATE COLLEGE, Pa. (WTAJ) — While debate over the current strength of the United States economy has been at the top of fierce political rhetoric amidst an election year, economists may be looking to an unpredicted, but time tested economic indicator — lipstick.

Originally coined in 2001 by cosmetic giant Estee Lauder, the Lipstick Index indicates how close the United States is to a recession by analyzing sales of lipstick and other cosmetics. While you may assume that small, non-essential purchases would decline in times of economic hardship, the Lipstick Index contributes data to the contrary.

“Rather than buying a dress, rather than taking a nice, you know, long weekend, they were looking for sort of a quick pick me up that was inexpensive,” said Stephan Lewellen, an assistant professor of finance at Penn State Smeal College of Business describing the major, unpredicted uptick in lipstick sales Estee Lauder saw following the September 11 attacks, in the middle of a recession following the longest postwar expansion in U.S. history. “And so lipstick would be one of those types of things.”

Since then, economists have used the Lipstick Index to try to estimate economic health under the idea that right before a recession, people are going to reign in their spending but continue to make small purchases.

Economist Juliet B. Schor first explained this habit in her 1998 book The Overspent American, describing the behavior of women to purchase luxury brand cosmetics even in times of hardship as both a symbol of status and as a way to escape what could feel like harsh realities.

One explanation is that they are looking for affordable luxury, the thrill of buying at the expensive department store, indulging in a fantasy of beauty and sexiness, buying “hope in a bottle.” Cosmetics are an escape from an otherwise all too drab everyday existence.

Juliet B. Schor, The overspent American

During her research, Schor spoke to then-publisher of Mademoiselle, a women’s magazine published by Condé Nast, Catherine Viscardi Johnston who explained, “If they can’t afford a Chanel suit, they’ll buy a Chanel lipstick or nail polish and move up later.”

However, Lewellen said that the Lipstick Index, while often regarded as a lead indicator of economic health, has an imperfect track record.

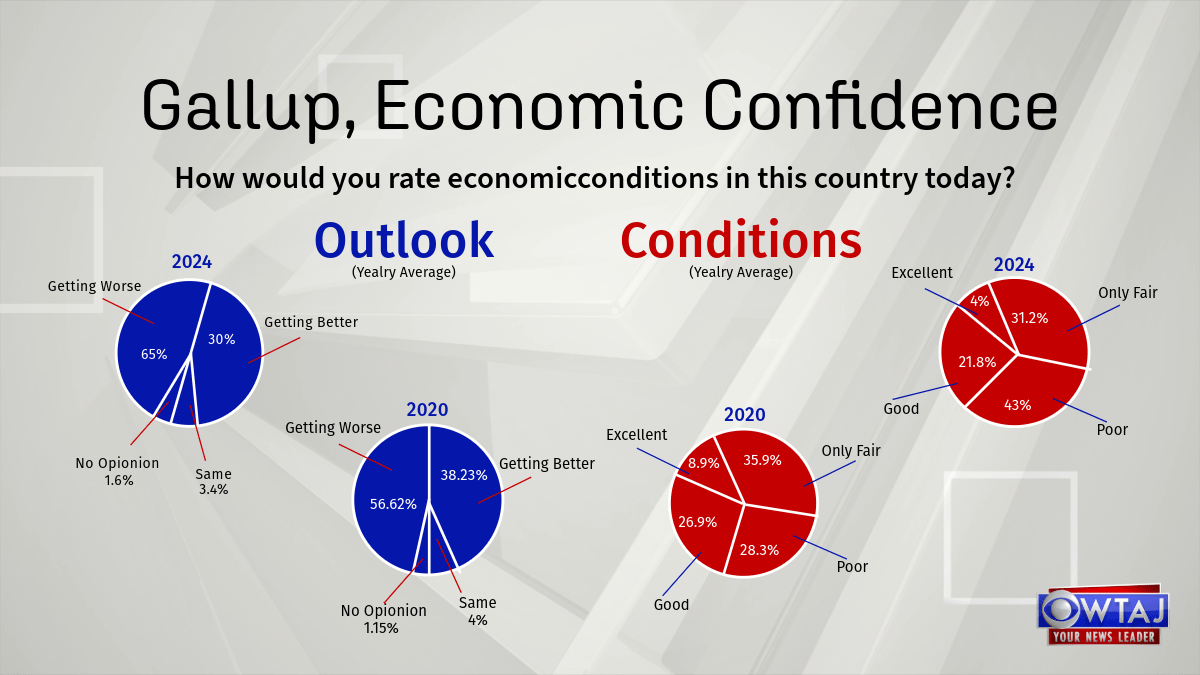

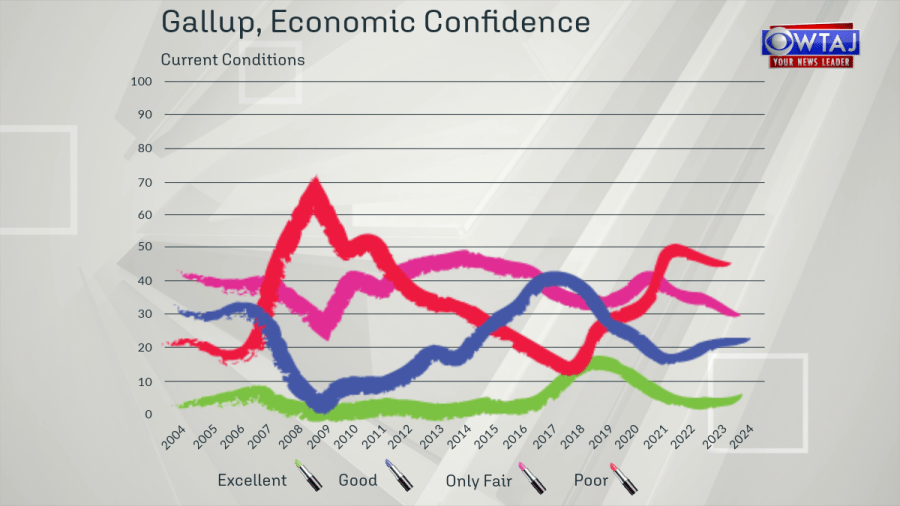

From April 2022 to April 2023, lipstick sales generated over $551 million in the United States, according to Statista. Lip gloss and other lip products accounted for an additional $331 million. While Gallup’s economic confidence index reflects that adults in the U.S. were the most pessimistic about the economy that they had been since 2009 in June 2022, a number that has been slow to rise, the U.S. has seen a slow growth in gross domestic product since the third quarter of 2023, only dipping by 2% and .06% in the first two quarters of 2022 respectively.

Raw data alone, even data that supports indexes economists have been using as indicators of economic health, are not always enough to predict economic trends.

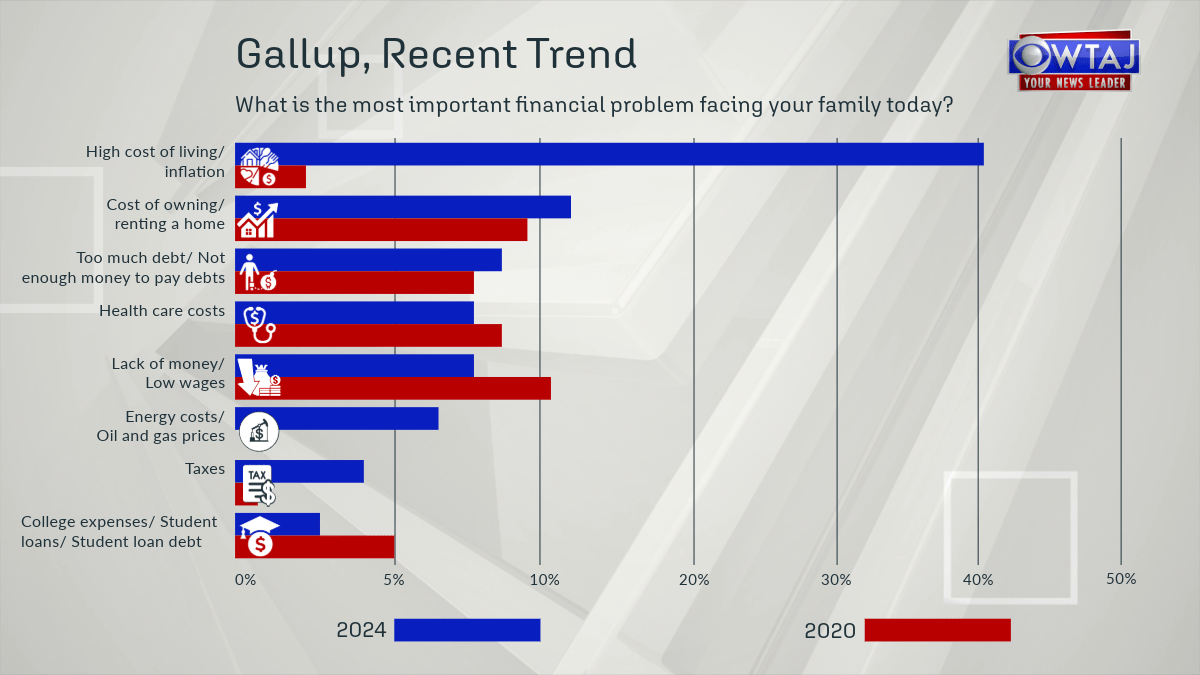

While indicators such as economic expansion, low unemployment rates and inflation rates slowing from their peak suggest that the U.S. economy is currently strong, 36% of Americans felt that economic issues are the nation’s most important problem and 46% of Americans rated the economy as “poor” in May, according to Gallup.

Lewellen said that the belief alone that the economy is poor, a belief popular among Gen Z and Millennials due to their personal financial situations, could potentially put the nation in a tricky economic position.

“So perception is half the battle,” Lewellen said. “If everybody thinks that there’s a recession coming, then people stop spending and you get a self-fulfilling prophecy.”

So is the U.S. heading towards recession? Lewellen does not believe so.

“The good news is that [perception] normally translates into a lower consumer sentiment,” Lewellen added. “And at least thus far, we haven’t really seen consumers saying this. We’ve seen consumers saying, ‘you know, my life is okay.’”

While sales of cosmetics are currently up, Lewellen does not think this is an indicator of a looming recession this time.

“Consumer sentiment is still strong. It’s been going up in general. The economy seems to be doing very well,” Lewellen said.

However, there are still some aspects of the personal finances that economists are not yet sure how to interpret when it comes to determining the long-term strength of the economy.

“The one sort of warning sign to me is not lipstick sales, but is actually delinquencies. So people are starting to be more delinquent on their credit card bills and on their auto loans. And that is something generally doesn’t bode well for a future of sort of economic growth,” Lewellen said. “But we’re still in the early days of the delinquency rises and so we don’t really know if this is just a blip or if there’s really a sort of statistical change that’s taking place in how people are paying off those loans.”

While Lewellen doesn’t think current conditions are pointing the economy towards recession, due to strong consumer sentiment, there are some tips to help keep your finances recession proof:

Have a budget and try to stick to it

For many people, budgeting can be difficult because it’s hard to make ends meet. Lewellen said the best thing to do when creating a budget is to ask yourself, “What are the things I really have to have that I really can’t live without?” and then, “What are the things that I could go without for a period of time.”

Your budget should account for all of your expenses that you cannot live without such as payments on your house or car, utilities and groceries.

Any expenses you think you can go without, consider going without them for a period of time and setting any money you save aside into a rainy day fund you can tap into in the event of a job loss or a dip in the economy.

“And then if the worst doesn’t happen, you can take that money and doing something fun with it,” Lewellen said.

Create a savings plan

Lewellen recommends speaking to a financial professional or someone who can help you see where you are in terms of your career, growth and goals if you’re able to.

With these things in mind, you can create a savings plan that will allow you to put money away for the long-term future. Even if you are unable to save now, a plan would allow you to try to save more money for the future.

Consider a job or career change

Being laid off from a job is often not something you can control. But something you can control is whether or not you stay with a company.

Get daily updates on local news, weather and sports by signing up for the WTAJ Newsletter.

If you are concerned about your job security, Lewellen recommends looking around the labor market for another company that might have more stability. You could also consider another career path where your skills might be transferable and there’s a lower risk of you being affected.

Lewellen said that a combination of your personal finances and position in the labor market are what will determine your ability to handle a recession.