- Most indicators suggest the US economy is humming along.

- Consumers aren’t buying it, per the latest monthly survey of how Americans feel about the economy.

- These charts show how gloomy Americans feel, despite the numbers.

Indicators be damned: US consumers are still gloomy about the state of the economy.

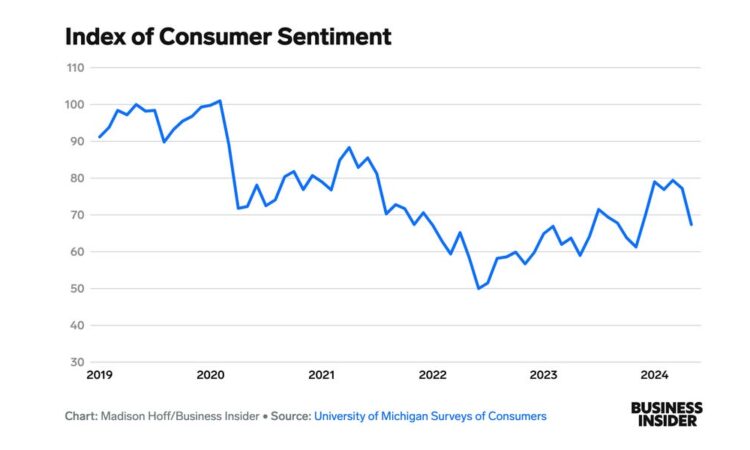

In the latest University of Michigan survey, the consumer sentiment index dropped a whopping 13% from April, after staying roughly the same since January.

“This 10 index-point decline is statistically significant and brings sentiment to its lowest reading in about six months,” said Surveys of Consumers Director Joanne Hsu.

Researchers found that consumers across demographics were worried that inflation, high interest rates, and unemployment would get worse in the year ahead.

Inflation worries were reflected in survey results that showed consumers predicted a 3.5% jump in prices over the next year, the highest guess about inflation since last November.

Americans have remained pessimistic about the economy since the COVID-19 pandemic caused unemployment to spike in the spring of 2020 and triggered the sharpest recession in decades.

Consumer sentiment started to rise in the year after the pandemic but tumbled in 2021 and 2022 as inflation took hold of the economy. Since June 2022, the consumer sentiment index has generally trended upwards but is still far south of where it stood before the pandemic, according to the University of Michigan’s data.

Losing faith

Leading indicators suggest the economy is still cooking, Business Insider previously reported.

Carson Group strategist Sonu Varghese said there are five signs that Americans’ financial situation is actually quite strong:

“Ultimately, here’s what’s important to keep in mind: Consumption makes up 70% of the US economy, and right now consumption is running strong,” Varghese said.

Varghese added that’s “thanks to” both “strong labor markets, which are pushing incomes higher to above the pace of inflation” and “higher net worth, which means households can spend more.”

But Americans aren’t feeling the strong economy.

While inflation has cooled from its heights last year, consumer prices still shot up due to the surge and remain high.

Meanwhile, the housing market has been rocky due to a lack of inventory and high interest rates caused by the Fed’s efforts to bring inflation back under control.

Now, the number of home mortgages that are “seriously underwater” — meaning their balance is at least 25% more than the fair market value of the house — is rising, new data from ATTOM.