This continues to be one of the more confusing economic environments in history.

Every other day the narrative switches between an imminent recession and a soft landing.

Neither outcome would surprise me at this point.

Some economic indicators are screaming slowdown while others are giving an all-clear. This state of limbo is making it difficult to know what’s going to happen.

I don’t know what’s going to happen with the U.S. economy but it feels like there are a handful of economic numbers that will tell us how things go this year.

This is not an exhaustive list but gets us pretty close to telling the story of the 2023 economy:

Mortgage rates. Housing makes up roughly 20% of the U.S. economy so activity in this market will have a big impact on how things shake out this year.

With housing prices up 40% or so during the pandemic and interest rates going from 3% to 7%, mortgage payments became unaffordable in a hurry last year.

We’re back at roughly 6% now which helps a little.

The median existing-home price in the United States is a little more than $376k. Assuming 20% down, the mortgage payment with a 30 year fixed at 7% is around $2,000/month.

Moving down to 6% takes you down to $1,800/month or a drop of 10%. Each 1% decrease in rates knocks another 10% or so off the monthly payment (this obviously works in the opposite direction as well).

If mortgage rates go back to 5% or so and remain there, housing market activity will likely pick back up in a big way from all those millennials waiting in the wings to form households.

If mortgage rates go back to 7% or so and remain there, housing market activity will likely remain slow.

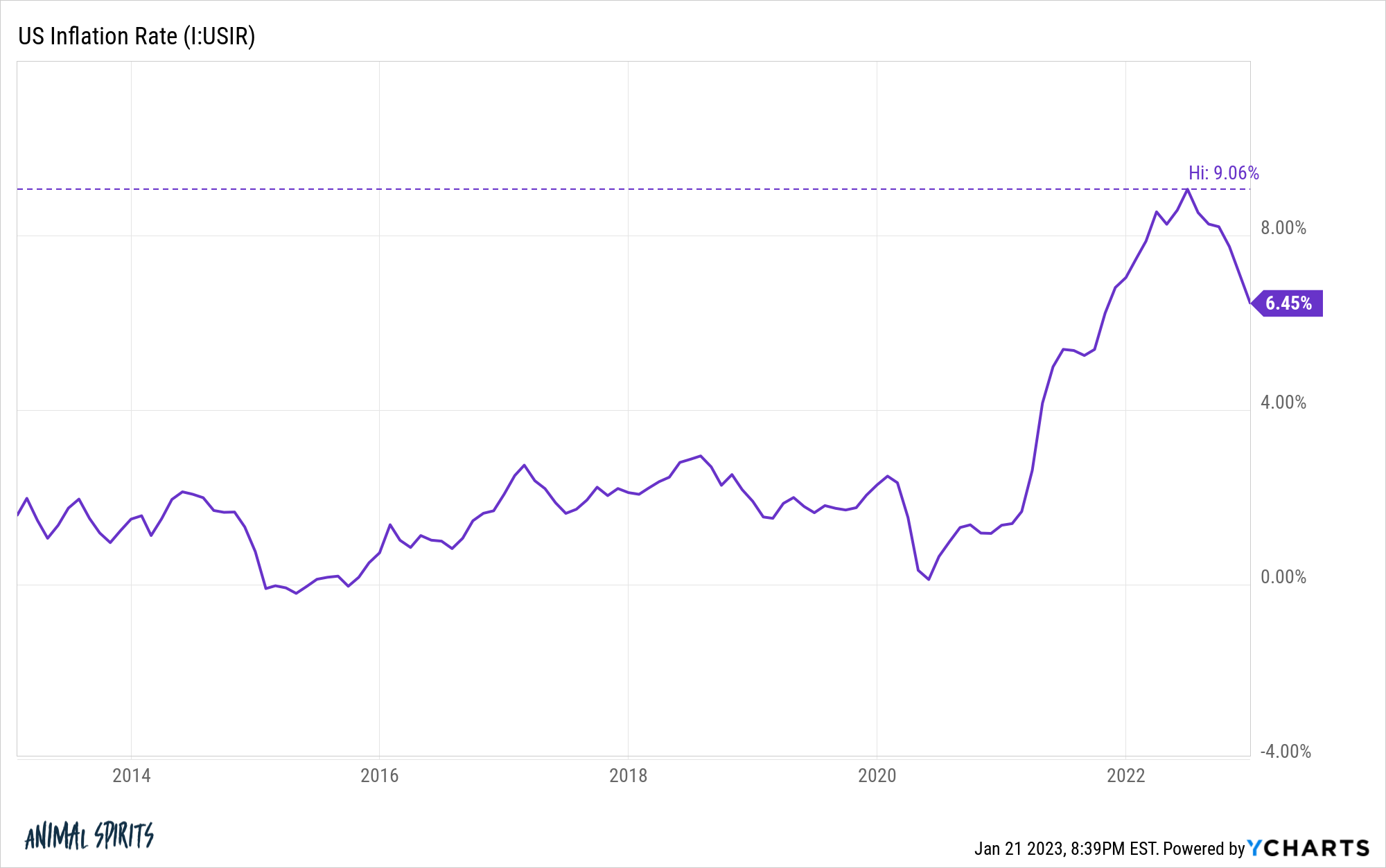

The inflation rate. Things are heading in the right direction:

This should (hopefully) continue trending downward especially once falling rents begin to show up in the numbers.

If inflation were to plateau or rise again that’s not good thing because it would likely mean the Fed would need to tighten policy even more and probably push us into a recession.

If inflation falls too much and goes into deflationary territory that’s also not a good thing because that would probably mean a recession too.

The hope would be inflation falls to the 2-3% range because of a soft landing.

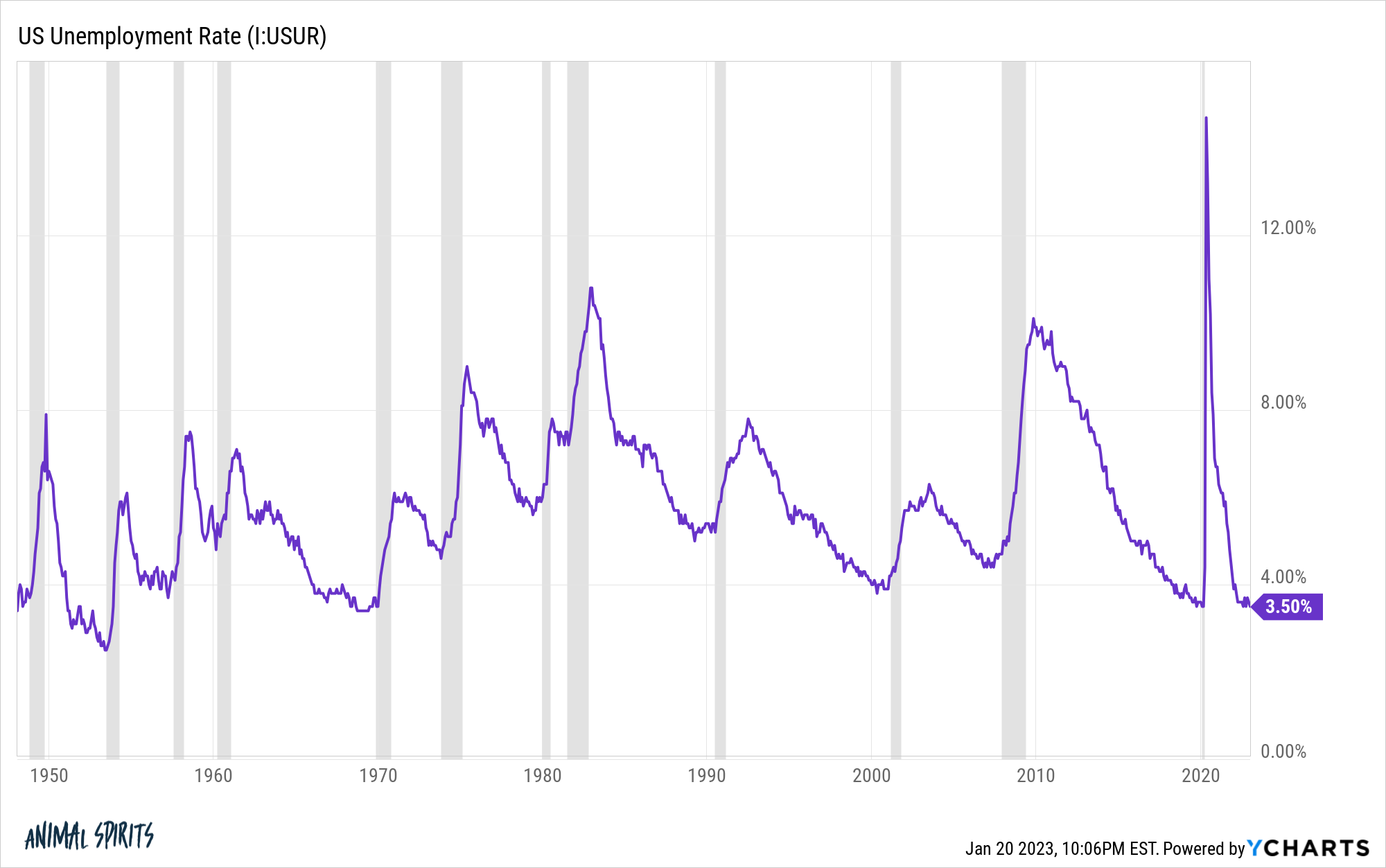

The unemployment rate. If the labor market remains strong the economy will remain strong.

It’s difficult to have a recession if it’s easy to find a job and earn more money.

Fed officials have stated numerous times that they would like to see the unemployment rate rise in order to slow inflation.

Their forecast is an increase from the current level of 3.5% to 4.6%. I think having this as your goal is playing with fire.

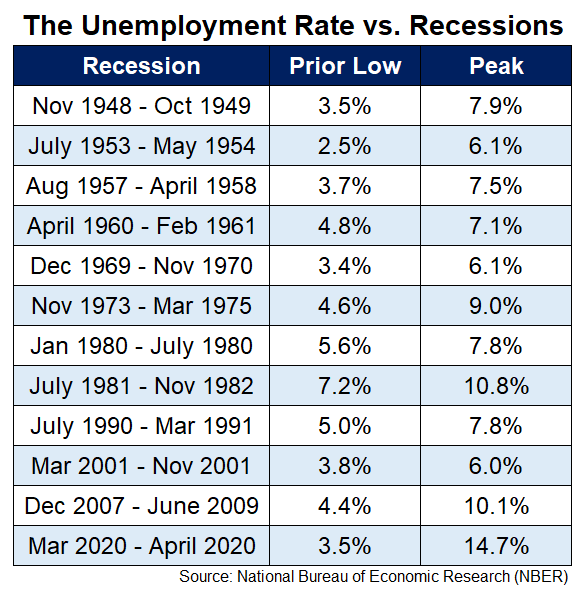

Never say never but history shows when the unemployment rate goes up due to an economic slowdown it shoots up far more than the Fed is forecasting:

Here is a breakdown of the jump in the unemployment rate in every recession since WWII:

The average increase in the unemployment rate since the late-1940s in a slowdown is 4.1%. Even if we exclude the outlier from 2020 from the equation the average rise in the unemployment rate is 3.4%.

The lowest increase in the unemployment rate was 2.2% in the 2001 recession.

If people start losing jobs in a big way that’s not going to be great for the U.S. economy.

If the labor market remains strong and the unemployment rate stays near record lows, that would be a good sign.

I still can’t believe the Fed wants to put people out of work on purpose.

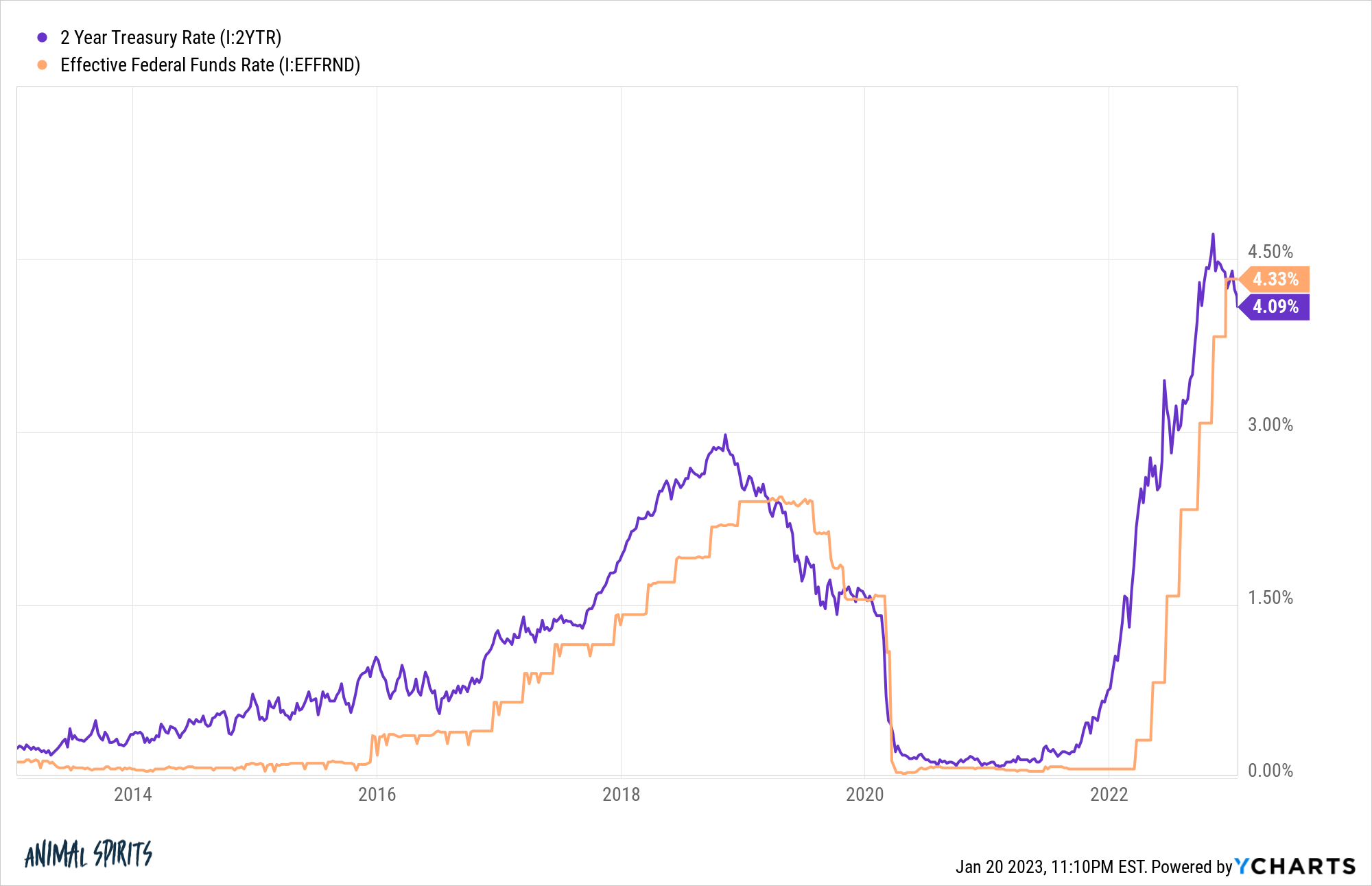

Fed funds rate. If the labor market remains strong the Fed is the biggest risk to the economy this year.

If they keep raising rates too aggressively that’s probably the biggest headwind to the economy because the probability of a recession is elevated.

The Fed cutting rates this year is probably also not a great sign either because it would mean they caused a recession.

The best-case scenario is probably one more 0.25% raise next month and then stand pat for the rest of the year.

If the Fed is able to keep rates steady for a while that could mean we’re in the midst of a soft landing.

The bond market is already rolling over so it will be interesting to see if that will be a leading indicator of the Fed’s hikes coming to an end soon.

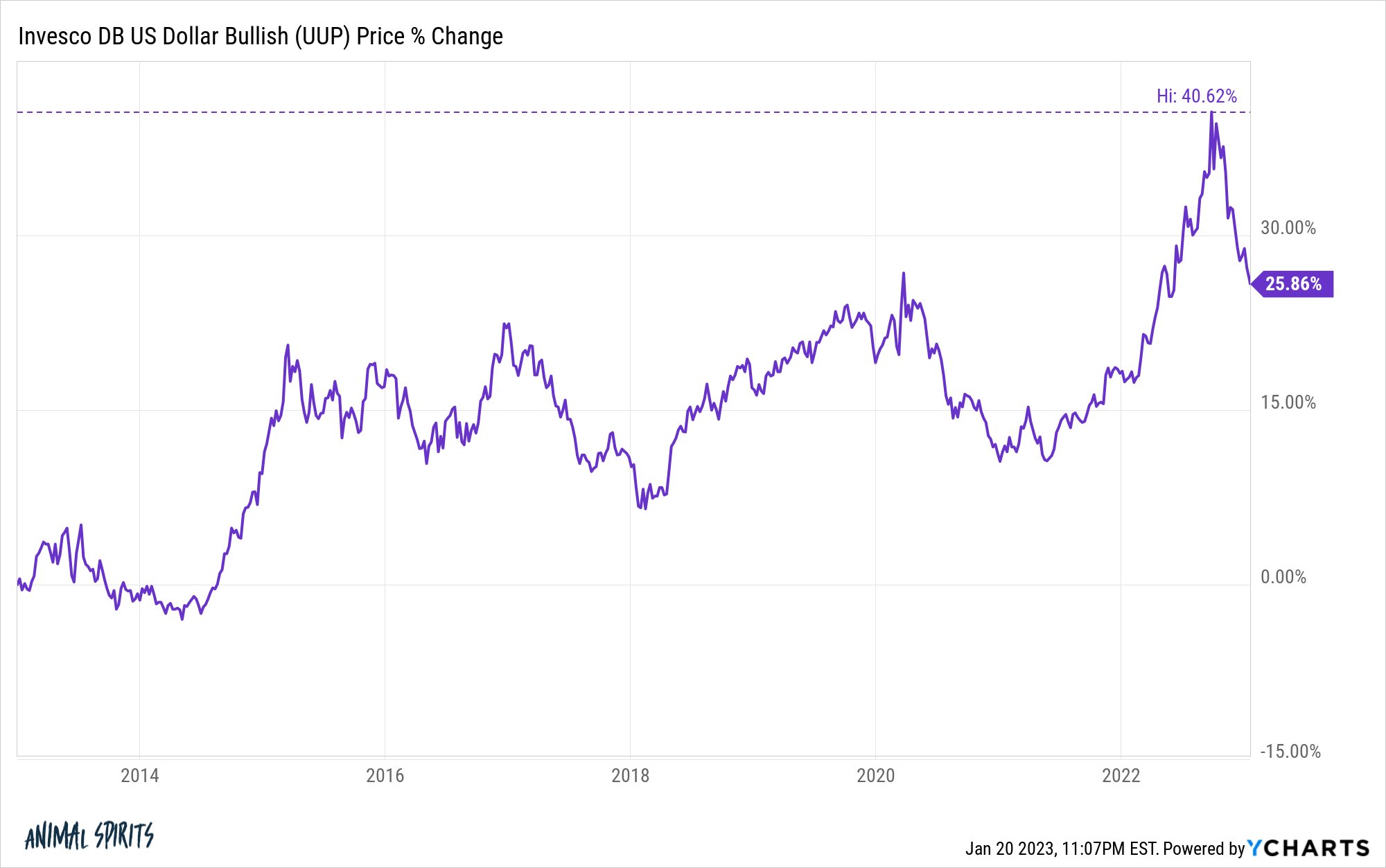

The dollar. The dollar has been in a bull market for a number of years now as the United States has been the strongest developed market economy for some time:

Currencies are notoriously cyclical but 2022 saw the dollar go parabolic as other economies around the globe struggled with even higher inflation than we experienced.

But in the 4th quarter of last year the dollar began rolling over in a big way.

A weaker dollar would potentially be a good thing for the global economy if it happened because other countries can avoid an economic slowdown as well.

The U.S. has been seen as the cleanest dirty shirt in the economic laundry hamper ever since the 2008 financial crisis. It would be nice if the rest of the world played catch-up.

This would be a good thing for corporations in the U.S. who have sales overseas along with U.S. investors who hold foreign stocks in their portfolios.

Of course, the hard part here, as always, is predicting this stuff in advance.

I have no idea what happens but it feels like knowing how these variables end up will be the key to this year’s economic performance.

Further Reading:

What Kind of Landing Are We Going to Get in the Economy?