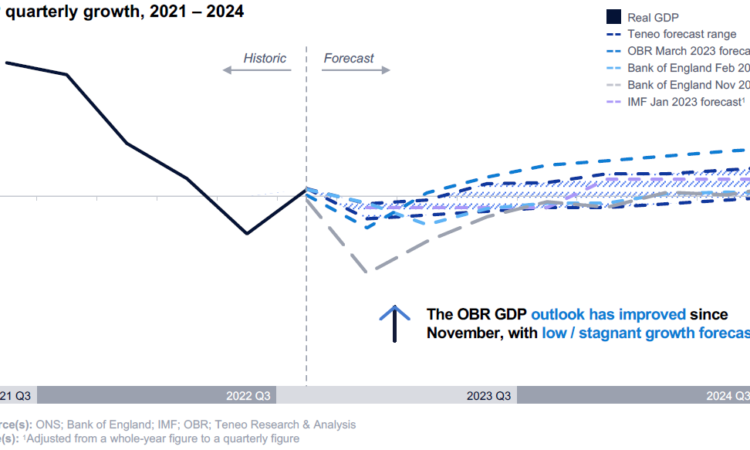

The UK narrowly avoided recession in 2022, and the most recent forecasts suggest low/stagnant growth, with the UK ultimately avoiding a technical recession that appeared inevitable in November when the country was still reeling from the impact of the previous Government’s “mini budget.”

While inflation is forecast to fall, we feel this is unlikely to be a smooth path to the 2% target, despite this currently being forecast by the Bank of England. Our view is grounded in a belief that structural challenges to the UK economy, including an ageing population, wage pressures driven by inflation and a tight labour market, and energy price pressure in H2, mean inflation proves more challenging to unwind.

Consumer confidence has risen slightly in light of the improving economic situation, with those on lower incomes seeing wage rises of c. 6%, partially shielding them from sustained high inflation. Our emerging view is that upper-middle-income households are likely to be those most severely impacted and, therefore, experience the greatest shifts in purchasing behaviours for the following reasons:

- They have received limited support from the government, which has been more targeted towards lower-income households;

- A significant proportion have exposure to mortgages, which have seen significant increases in payment terms due to rises in interest rates; and

- They typically work in positions and sectors that have seen the lowest wage increase (e.g. public) and are at the highest risk of redundancies (e.g. digital).

Headline figures indicate strong Christmas retail trading data on a like-for-like basis against 2021; however, this masks the fact that 2021 was a COVID year, and volumes have, in fact, fallen.

Despite the negative outlook, 2023 presents an opportunity due to changes in consumer purchasing behaviours. However, to be successful, brands must remain closely attuned to their existing customer’s needs, which we believe to be focussed squarely on a renewed quest for value (not necessarily price) and a desire for personalised offers, flexible loyalty programmes and bundled offers.

Macroeconomic Context

GDP Forecast

Our most recent forecast estimates that the UK economy will not experience a technical recession; however, low or zero growth is expected for at least 12 months.

Factors Easing the Downward Pressure on Forecast GDP

- A warm winter and Europe sourcing alternative energy supplies reduces the price pressure on energy

- The Bank Rate expected to peak at 4.5% rather than 5.0% previously forecasted

- A stabilising economy following a change in government, with interest rate spreads reducing

- China’s reversal of their zero COVID policy will likely bring relief to supply chain bottlenecks

Inflation Forecast

While inflation is likely to fall in 2023, there is a strong possibility that it proves more difficult to unwind to target levels than is being forecast by the BoE and OBR.

Why Inflation May Persist in 2023 and Beyond

- An ageing population leading to net attrition in the workforce, raising labour input costs

- Significant pressure on wage hikes driven by strikes and general labour market tightness

- The potential for energy prices to rise in Q4 due to Europe being unable to build their reserves, along with increased energy demands from China

Employment

Unemployment levels remain low at 3.7%; however, labor shortages persist due to a significant increase in inactivity in the working-age population.

The March budget focussed on a number of policies to stimulate workers re-entering the labour force:

- More generous pension tax allowances

- Additional help with childcare costs of younger children for working parents

- Disability support and welfare measures

These changes are expected to primarily stimulate a return to work for those who have taken early retirement and people looking after children. While some support is provided to those long-term sick, we anticipate this group to be more challenging to encourage back to the workforce.

Long-term sickness is the single largest driver of workplace departure, accounting for 60% of the rise in working-age population inactivity.

Wage Growth

Real wages have fallen across all income levels, and while high-income households remain the most protected, low-income households have been partially shielded by high wage growth.

Consumer Impacts

Consumer Confidence

Consumer confidence has remained at near historic lows since the middle of 2022; however, sentiment has improved since September.

“Despite the cost-of-living squeeze, 63% of consumers say they are confident in their household finances and 70% say they are confident in the ability to live within their means, both reaching their highest levels since July 2022.”

– UK Consumer Spending Report Jan 23, Barclaycard

Comparisons to the GFC

This period of economic turmoil differs from the Financial Crisis in a number of areas. Critically, the expectation is that stagnation will be more prolonged and real incomes will face the largest decline in decades; however, unemployment is expected to remain low.

Household Impacts

Upper-middle-income households are likely to face the largest drop in real disposable incomes, meaning this group is also expected to see the most significant shifts in purchasing behaviours.

“Inflation has hit the squeezed middle earners the most as they are most affected by higher rates and mortgage costs, but will not have benefited from the support packages.”

– Prof. Adrian Pabst, Deputy Director for Public Policy, NIESR

Mortgage Repayments

Over 2023, five million households are expected to see large increases in their mortgage repayments, with an additional c.8% of income required to service them on average.

Consumer Reactions and Opportunities

Retail Sales

Headline sales figures point to strong like-for-like consumption growth in Q4 2022, but this masks the fact that sales volumes fell considerably.

“Christmas exceeded expectations, but it would be wrong to be too triumphal… Headline figures are gross figures rather than net, fuelled by inflation when the retail sales volume is down by 6%.”

– Fraser McKevitt, Head of Retail and Consumer Insight, Knight Frank

Consumer Spend

Consumers are responding differently today compared to the GFC1; they cut back on affordable luxuries such as eating out, but protect spending in areas that they value, such as sustainability.

Key Differences Between Consumer Purchasing Behavior, Today vs. GFC

- Consumers intend to cut their spending on eating out, whereas this expanded during the GFC by 10%

- The decrease in holiday spending is not as severe as during the GFC (where it fell by c. 40%), likely due to a demand hangover from the pandemic

- Sustainability and other social issues remain high on consumers’ agenda, expanding even at times of reduced real income

Trade-Down Behaviors

In times of reduced real disposable income, consumers adjust their interactions with the retail sector and businesses must stay attuned to shifts to ensure they can respond tactfully.

Consequences of a Decrease in Disposable Income

- Trade-down to cheaper retailers

- Reduce frequency / volume

- Trade-down to less-premium product lines within the same brand

- Stop spending

Geographical Difference

- UK consumers are more willing to trade down, as evidenced by currently exhibiting one of the highest rates of private label goods consumption in the world (43%)

- In other parts of Europe, consumers tend to drop the frequency of purchase rather than compromise on brand

Key Implications

At an overall level consumption is likely to decrease in 2023, but there is still an opportunity for businesses to capitalize on the changes in consumer purchasing behaviours.

The views and opinions in these articles are solely of the authors and do not necessarily reflect those of Teneo. They are offered to stimulate thought and discussion and not as legal, financial, accounting, tax or other professional advice or counsel.