ansonsaw

The WisdomTree Bloomberg U.S. Dollar Bullish Fund (NYSEARCA:USDU) gives investors exposure to the returns of the U.S. dollar relative to a basket of international currencies.

Hawkish Fed monetary policy should lead to gains of the U.S. dollar, especially if the bear market resumes in global assets, as the U.S. dollar is viewed as a safe haven. However, USDU’s gains may be dampened by the ECB’s hawkish stance, as short Euro is the largest exposure in the USDU.

Fund Overview

The WisdomTree Bloomberg U.S. Dollar Bullish Fund is an ETF that provides exposure to the total returns of the U.S. Dollar relative to a basket of international currencies. The USDU fund charges a 0.50% expense ratio and has almost $400 million in assets.

Strategy

The USDU fund combines a portfolio of currency forward positions with investments in short-term treasury bonds.

The USDU fund’s currency exposures are modelled after the Bloomberg Dollar Index. The index identifies the top 20 currencies in terms of global trading activity versus the U.S. dollar (defined by the Federal Reserve) or global foreign exchange volume (from BIS Triennial survey) and selects the top 10 currencies after removing those pegged to the U.S. dollar (i.e. Saudi Riyal and Hong Kong Dollar). The currency weights are derived from the average of the trading activity weight and foreign exchange volume weight, with a cap of 7% for the Chinese Yuan. Excess weight on the Yuan is redistributed pro-rata to the other currencies. Weights less than 2% are also removed and redistributed.

Portfolio Holdings

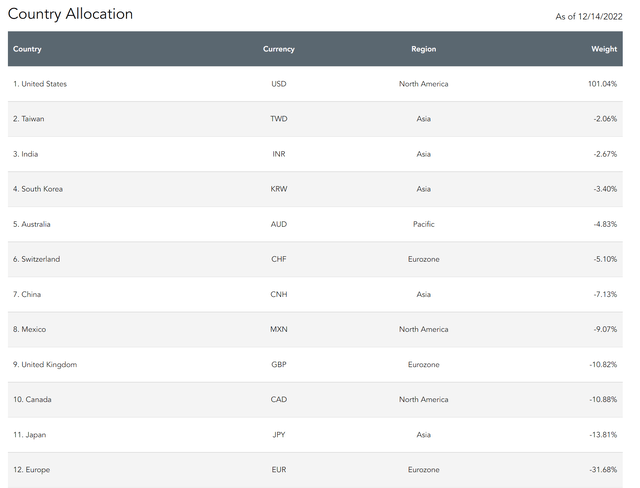

Figure 1 shows the USDU ETF’s country allocation, which is equivalent to the currency positions. Although the US does much more trade with China, due to the weight cap at 7%, the largest weight is against the Euro at 31.7%. Japan is the second largest at 13.8%, and Canada is third at 10.9%.

Figure 1 – USDU country allocation (wisdomtree.com)

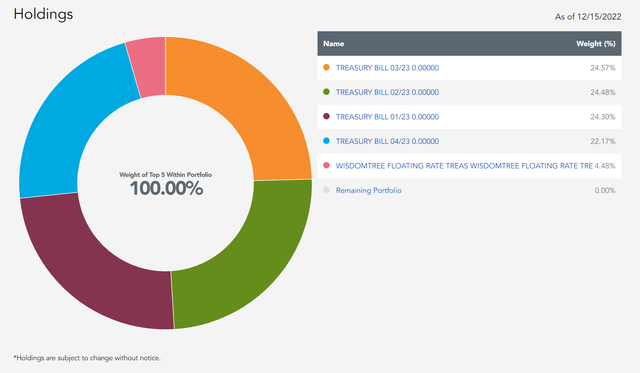

Against the portfolio of currency forwards above, the USDU fund owns short-term T-bills (Figure 2).

Figure 2 – USDU portfolio holdings (wisdomtree.com)

Returns

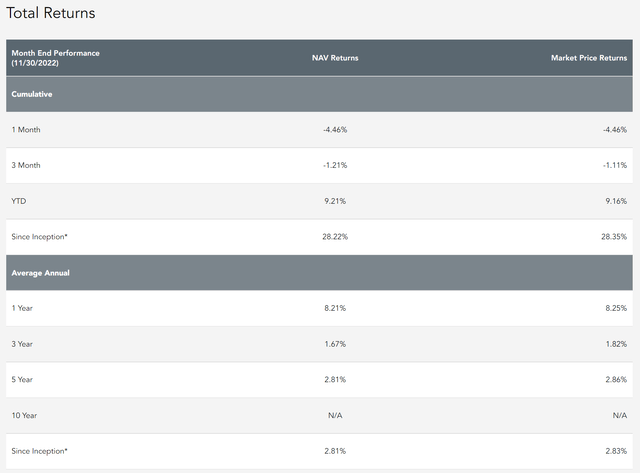

Figure 3 shows the fund’s total returns to November 30, 2022. Long U.S. dollar has been the trade of 2021/2022, as the U.S. Federal Reserve had been the most aggressive central bank in terms of tightening monetary policy, leading to an appreciation of the U.S. dollar versus foreign currencies.

Figure 3 – USDU returns (wisdomtree.com)

Distribution & Yield

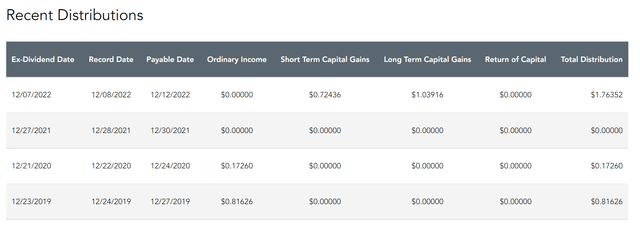

The USDU fund has a trailing 12 month distribution of $1.76 / share or 6.6% trailing yield. The distribution is the result of realized capital gains from the fund’s currency forward positions, as well as income from the portfolio of treasury bills (Figure 4).

Figure 4 – USDU distribution (wisdomtree.com)

Catalyst Rich Week For Currencies

The past week contained many important catalysts for the currency markets, with most central banks around the world announcing their last monetary policy decisions before the end of the year.

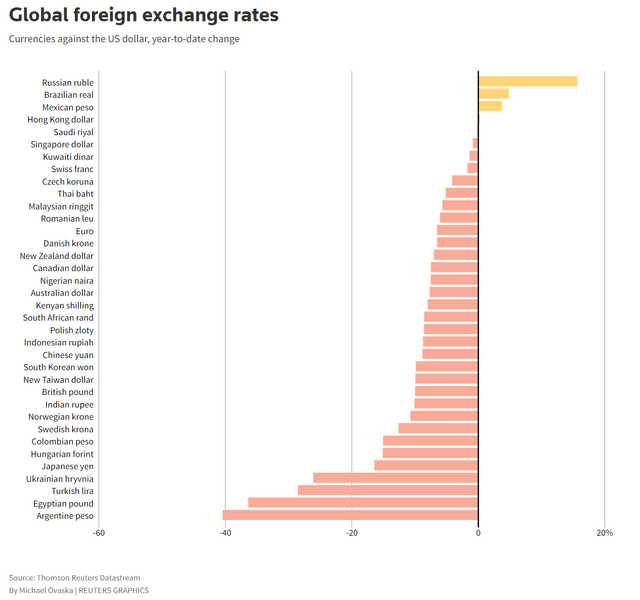

Monetary policies affect currencies as interest rate differentials drive fund flows. A large part of the U.S. dollar’s strength in 2022 was due to the Federal Reserve having a more aggressive monetary tightening policy versus other global central banks such as the BOJ (Figure 5).

Figure 5 – USD appreciated against most currencies in 2022 (Reuters)

Fed Higher For Longer To Combat Sticky Core Inflation

For the Federal Reserve, on December 14th, they announced a widely anticipated 50 bps rate hike, bringing their total rate hikes in 2022 to 425 bps. This is the fastest Fed rate hike cycle in history.

Importantly, Chair Powell emphasized the Fed is now more focused on the terminal Fed Funds rate and the length of time interest rates have to stay elevated, rather than the pace of rate increases, suggesting a downshift to 25 bps is possible as early as February.

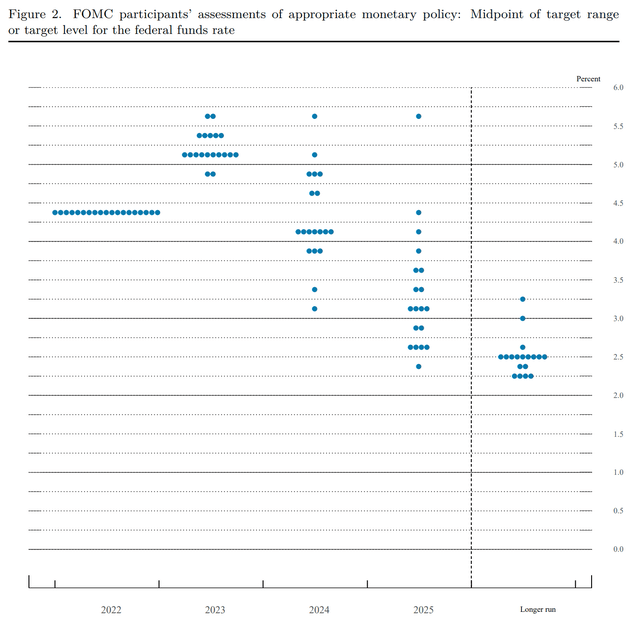

However, the terminal Fed Funds rate at the end of 2023 is still expected to be 5.1% by the median FOMC participant, as shown in their ‘dot plot’ (Figure 6).

Figure 6 – FOMC dot plot (Federal Reserve Summary of Economic Projections, December 2022)

The Federal Reserve also increased their estimate for 2023 year end PCE inflation to 3.1% vs. 2.8% in September, indicating they expect core inflation to be stickier.

This policy decision can be viewed as a mildly hawkish outcome, as the Fed maintained its ‘higher for longer’ rhetoric, despite the two positive CPI reports in a row. The higher PCE inflation estimate also hints that core inflation is sticker than expected.

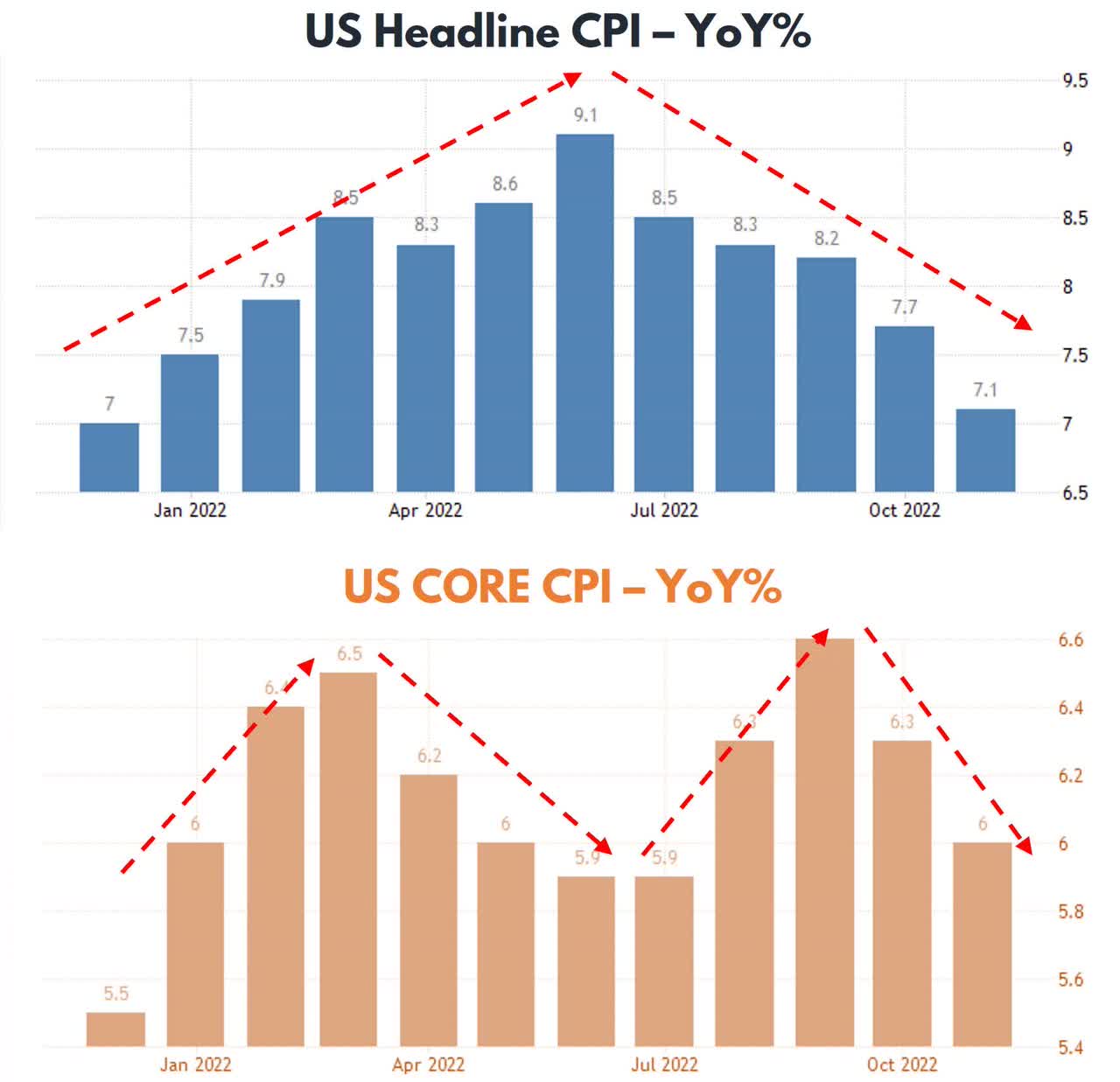

In fact, rapidly declining headline inflation and sticky core inflation may soon create the dynamic where headline inflation normalizes, but the Fed has to continue raising interest rates and/or maintain its rates higher for longer, because core inflation is becoming entrenched (credit to hedge fund manager Andy West for Figure 7 below).

Figure 7 – Headline CPI inflation is declining rapidly, but core CPI inflation is proving sticky (Andy West via Twitter)

All else equal, a hawkish Fed is bullish for the U.S. dollar.

U.S. Dollar Back To Support

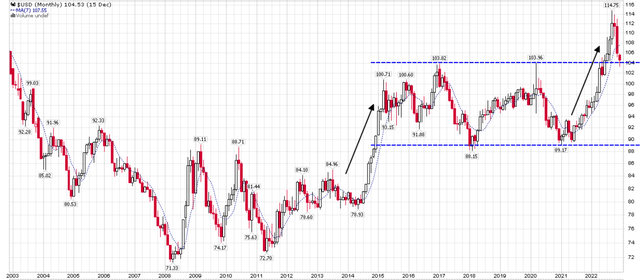

Taking a step back, we can see that technically, the U.S. Dollar Index (“DXY”), has retraced back to multi-decade breakout levels. If the U.S. dollar were to resume its uptrend, it should happen near current levels (Figure 8).

Figure 8 – DXY back to multi-decade breakout levels (Author created with price chart from stockcharts.com)

If Bear Market Resumes, Expect U.S. Dollar To Rally

Looking at Figure 8, we can see that periods of market stress is beneficial to the U.S. dollar, as it is the world’s reserve currency and is viewed as a safe haven. For example, the Great Financial Crisis saw the DXY index rally from the low 70s to 89 by early 2009. The global growth scare from 2014 to 2016 saw a rally from 79 to 100. So far in 2022, the DXY reached a peak of 115 in early October, coinciding with the depths of the current bear market.

If the global market rally from October is proven to be simply a bear market rally, then investors can expect the U.S. dollar to resume marching higher versus global currencies.

Risk To My Bullish US Dollar Call

As mentioned above, a hawkish Fed is bullish for the U.S. dollar, all else equal. However, a fly in the ointment to my call is that all else has not been equal. Specifically, as I highlighted in a recent article on the ProShares UltraShort Euro ETF (EUO), the ECB is rapidly catching up to the Fed in terms of their hawkish monetary policies.

On December 15th, the ECB also raised its interest rates by 50 bps. However, the ECB sounded much more hawkish than market participants were expecting. In prepared remarks, the ECB stated it expects to continue raising interest rates at a steady pace in the coming months. More importantly, the ECB chairperson, Christine Lagarde, commented in her press conference:

Anybody who thinks this is a pivot for the ECB is wrong. We’re not pivoting, we’re not wavering, we are showing determination and resilience in continuing a journey where we have. … If you compare with the Fed, we have more ground to cover. We have longer to go.

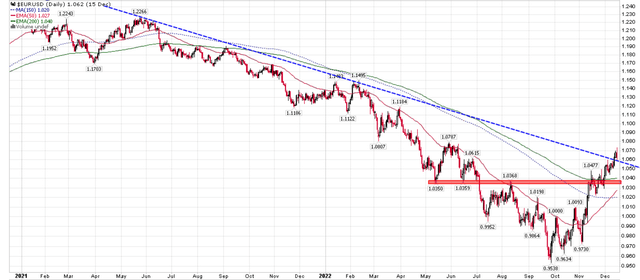

With the ECB arguable more hawkish than the Fed, it appears the EURUSD currency rate is breaking out of the downtrend I had highlighted in my EUO article (Figure 9).

Figure 9 – Euro breaking out against USD (Author created with price chart from stockcharts.com)

For the U.S. Dollar Index and the USDU fund, the Euro represents the largest currency exposure at 31.7%. If the ECB out-hawks the Fed in 2023, then the Euro may continue to rally against the U.S. dollar, dampening the expected positive gains in the U.S. dollar.

Conclusion

The USDU gives investors exposure to the returns of the U.S. dollar relative to a basket of international currencies. Hawkish Fed monetary policy should lead to gains of the U.S. dollar, especially if the bear market resumes in global assets. However, USDU’s gains may be dampened as the Euro benefits from a hawkish ECB.