While stock markets lick their wounds, currency traders brace for fireworks as the British pound responds to a rapid fall in UK inflation

- Stock markets in a holding pattern after a brutal two-day selloff

- U.K. CPI report may dial up Bank of England rate cut speculation

- British pound may fall further as rate spreads turn more negative

Wall Street has paused for a breath after two days of aggressive selling that pushed the bellwether S&P 500 stock index down 2.7%.

That marked the worst back-to-back performance in over a year. A pause in high-grade U.S. economic data and breathless headlines out of the Middle East may see the spotlight shift elsewhere for now.

As equities collect themselves, the currency markets are eyeing the next chapter in a story about increasingly acute monetary policy divergence between the U.S. and other major economies. While hotter-than-expected inflation has rapidly erased scope for Federal Reserve interest rate cuts, Europe seems to be getting closer to easing.

Cooling UK inflation may stoke Bank of England rate cut bets

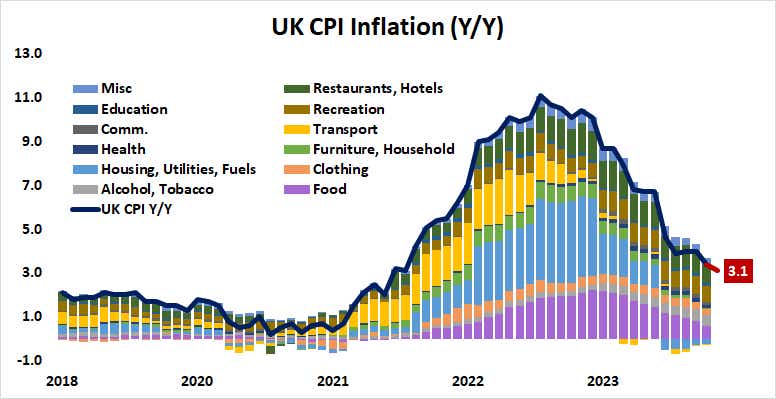

Incoming data from the United Kingdom is expected to show that costs grew at a sharply slower pace in March. The benchmark consumer price index (CPI) gauge is penciled in for a rise of just 3.1% year-over-year, marking the lowest reading since September 2021.

Continued progress looks likely. As with the Eurozone, discretionary spending categories—recreation and hospitality—are now the stickiest areas of price growth as the influence of food costs recedes. Trends in global food prices tend to appear in CPI with a lag of about seven months. As they continue to fall, this part of the basket will continue to dis-inflate.

Lingering problem areas are likely to be susceptible to slowing growth. Purchasing managers index (PMI) data shows that economic activity slowed in March, snapping a four-month upswing.

Numbers out this week showed the economy shed 156,000 jobs in February and the unemployment rate rose to 4.2%, the worst results since August 2023.

All this may amount to fodder for speculation about the sooner onset of Bank of England (BOE) interest rate cuts. For now, benchmark SONIA interest rate futures are pricing in 37 basis points (bps) in stimulus this year. That amounts to one standard-sized 25bps reduction set to appear in August, and a 48% probability of a second one by December.

British pound may extend losses against the U.S. dollar

This calculus is likely to turn more dovish if CPI data underpins the case for inflation to keep cooling. That will widen the spread between expected year-end rates in the U.K. and the U.S., pushing them in the greenback’s favor and punishing the British Pound.

Prices have broken chart support in the 1.2503-21 area, piercing the bottom of a range that has contained them since late November. That seems to open the door for a test of the 1.2342-84 zone, with a further break below that putting lows under the 1.21 figure into view. Establishing a firm foothold back above 1.25 may short-circuit bearish progress.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.