Gravity works to restrain inflation if central banks don’t accommodate it with expanding money (with currency collapses and hyperinflations, as in post-WWI Germany and Austria). Price rises cut into the purchasing power of money balances, and activity weakens.

The 1939-1949 inflation period is more comparable to the events since the 2008-09 recession than the 1970s episode (the Burns Fed and declining productivity growth). That’s because the 1930s and ’40s chain of events also followed from a financial crisis and deflation, which then led to a quantitative easing response.

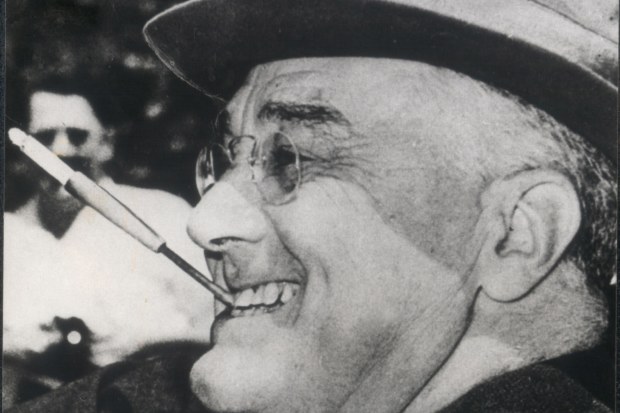

The inflation followed from the way Franklin D. Roosevelt dealt with the banking crisis of 1933 – just as the current issues began with the global financial crisis in 2008.

Roosevelt believed that the Depression would not be reversed without turning deflation into inflation. Similarly, the Fed’s aim after the GFC was to avoid outright deflation and to get inflation back above 2 per cent.

FDR closed the banks temporarily and made it illegal for private citizens and banks to own gold bullion. Gold was handed in and its ownership was transferred to the Treasury, which issued gold certificates to the Fed.

He then devalued the dollar against gold, from $20.67 to $35 an ounce in 1934 (a massive shift). Gold flowed to the Treasury and the Fed’s balance sheet ballooned via the size and value of gold certificates. As a share of GDP, the balance sheet was already rising due to the collapse in the denominator (nominal GDP fell 45 per cent from 1930 to 1933). It then rose much further.

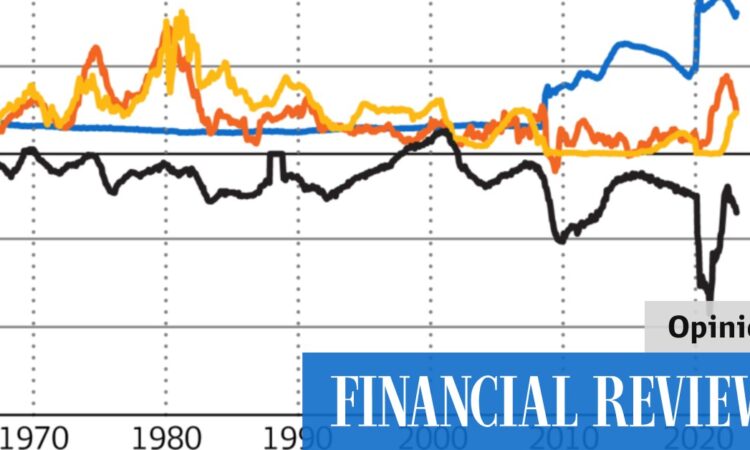

The Fed’s balance sheet rose to about 28 per cent of GDP by the end of 1940, despite a sharp reversal and rise of the GDP denominator. From 1934 to the end of WWII, real deposits in the hands of households grew by 159 per cent.

US inflation climbed to 10 per cent by 1941. FDR imposed price controls for the war, damping inflation. But when price controls were removed, inflation exploded upwards with the release of pent-up demand and post-war shortages (as it did after COVID). Inflation reached 20 per cent by 1947.

Inflation followed from the way Franklin D. Roosevelt dealt with the banking crisis of 1933.

Inflation fell back for two principal reasons: the gravity effect of the falling real value of money (minus 28 per cent from December 1945 to December 1948); and the rapid turnaround of the record FDR budget deficit to surplus in 1946 (Harry Truman was a fiscal conservative).

The US economy fell into recession by 1949.

The lessons from this period for the current policy dilemmas and outlook are worth noting.

First, pumping up the Fed balance sheet in a way that puts money into the hands of the public on a large scale, whether by gold certificates or COVID cheques, will cause inflation.

Second, artificial constraints such as price controls or COVID lockdowns only delay the inflation outcome.

Third, the secret of how the Fed’s balance sheet was normalised as a share of GDP is revealed: the Fed did not reduce the dollar size of its balance sheet after the war. Inflation over a long period reduced it as a share of GDP.

Fourth, the sudden implementation of fiscal stringency plays a key role in recessions and deflation.

Fifth, the destruction of purchasing power via inflation, if it is not accommodated, will starve demand and slow the economy.

With these thoughts in mind, how might things unfold in 2023 and beyond for bond and equity investors?

Under Joe Biden, there will be no fiscal contraction like that of Truman. The US still has a large budget deficit. The fiscal turnaround from 18 per cent of GDP to 5 per cent reflects the end of COVID restrictions and handouts as people got back to work.

The labour market remains firm.

Gravity has started to work on real money balances. US bank deposits as a share of GDP were 60 per cent of GDP in January 2019 and rose to 77 per cent by 2021. With inflation thus far, the stock still sits at 65 per cent today. Gravity is not biting yet.

The Fed balance sheet hasn’t fallen at this stage. Government debt is also relatively high. There must be some temptation to let inflation run longer by going slowly on rates. The FDR route to Fed balance sheet reduction is easier than selling Fed assets and causing a bond rout.

Real interest rates are still negative. Mortgages in the US are mostly at fixed rate. With rising nominal rates, existing borrowers don’t change their mortgages. It will take a long time for interest rates to bite via new loans only.

So, financial markets should get ready for rates higher for longer than hitherto anticipated due to the absence of factors to cause a sharp slowdown. The considerations here suggest a greater chance of stagflation.

Not that great for bonds or equities.