Recent talk that China, India and Russia are settling purchases of oil in non-dollar denominations has generated speculation that the dollar’s days as the world’s reserve currency are ending.

The recent discussion around the end of the dollar’s dominance is bereft of any linkage to the reality of international finance.

This is nothing new. There were similar discussion during the financial crisis 15 years ago and, more recently, during the cryptocurrency bubble.

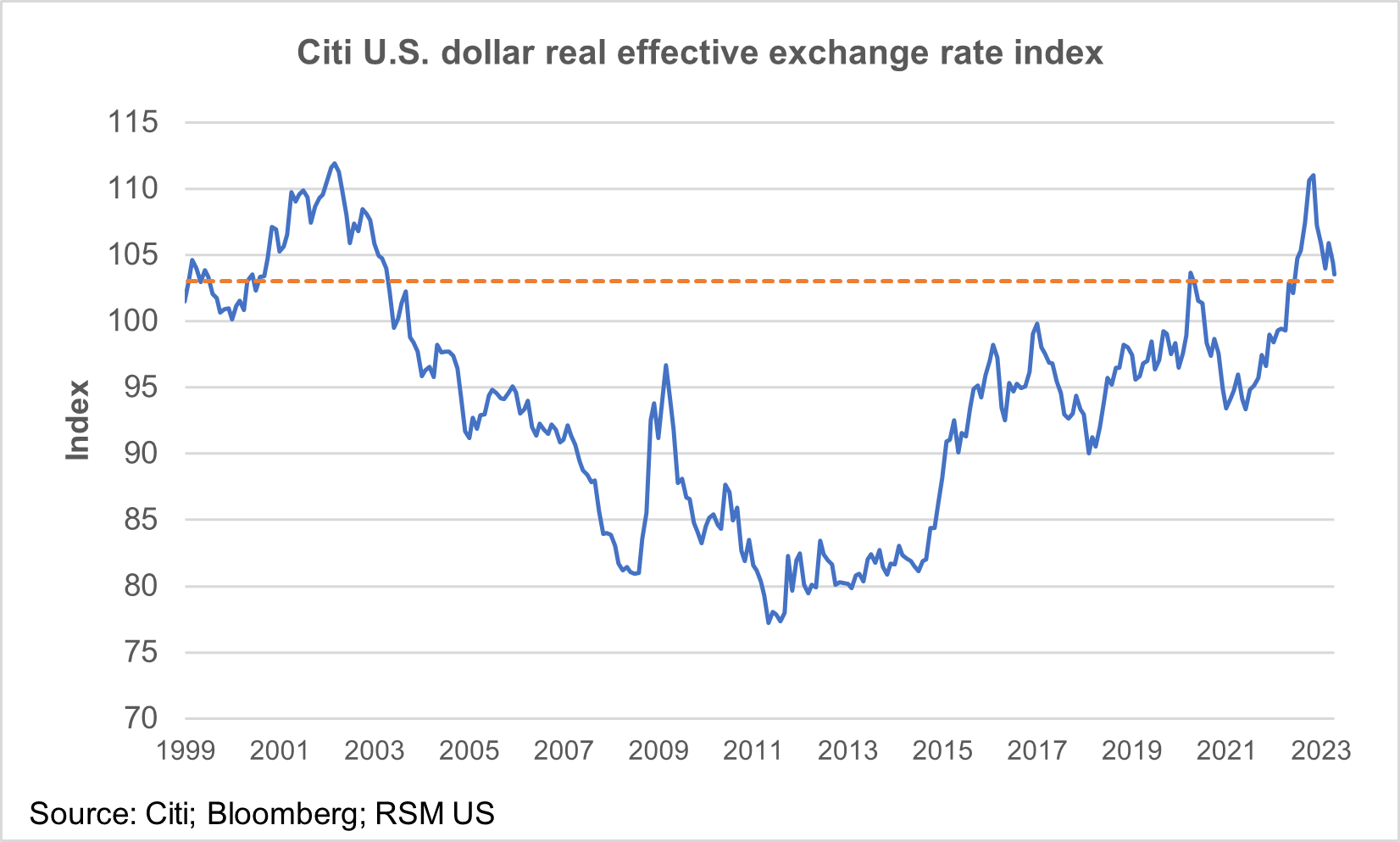

Now, most measures of dollar valuation suggest continued dollar strength.

Using Citi’s real effective exchange rate index, the American dollar stands at 103.81, below its recent peak of 111.90 in October. Yet 103.81 is well above where it has been for most of the past 20 years. The index measures the value of the dollar where 100 is neutral.

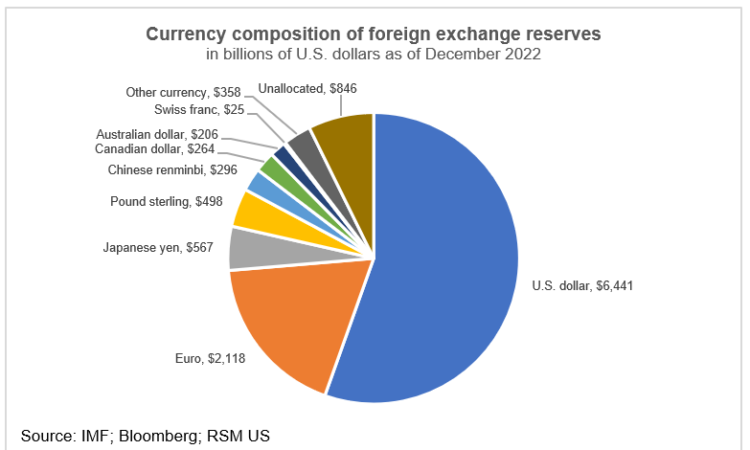

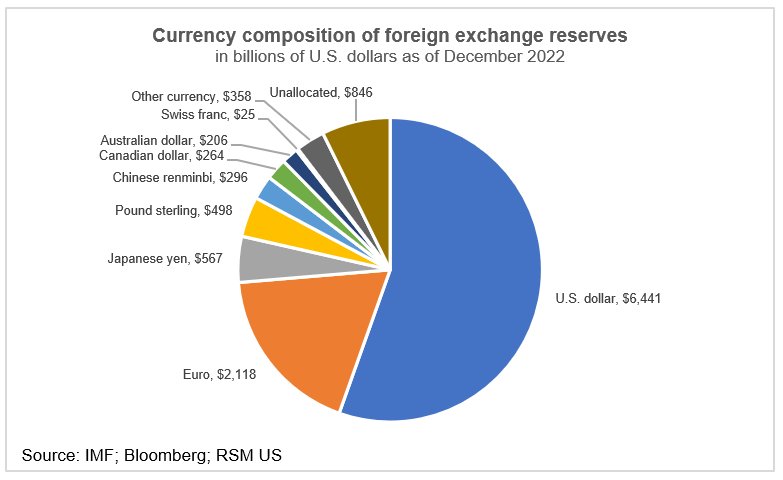

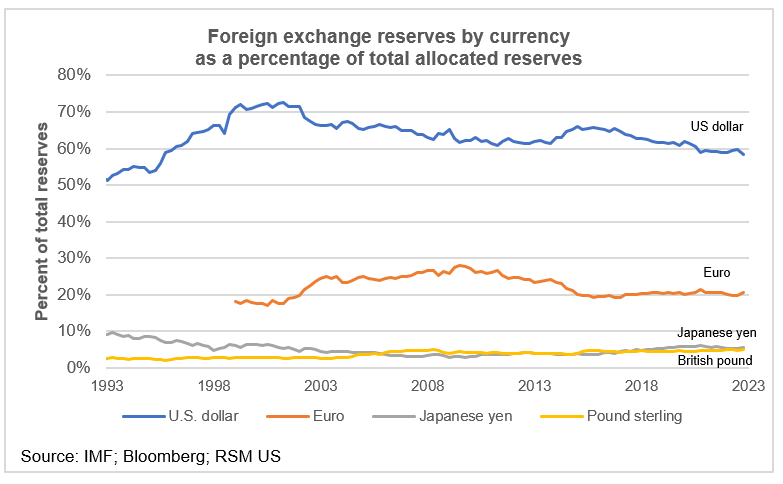

The dollar accounted for roughly 60% of global currency reserves at the end of last year, which is down from its recent peak of just above 70% in the first part of this century but well above the 50% of 30 years ago.

We find the recent discussion around the end of the dollar dominance bereft of any linkage to the reality of international finance and understanding of the dollar’s role as the anchor of the rules-based order that governs global economics.

Economies like China that run surpluses need dollar-based demand from the United States to make up for their own weak consumption and high savings rates.

Rather, the recent conversation is stoked by global grievances about the relative disparity of economic power and the dead end in which some economies find themselves.

While these economies may desire an end to the dollar’s dominance, they are experiencing major setbacks on their own. Calling for an end to dollar preeminence is premature at best.

The global financial system rests upon the stability of the dollar and the large trade deficit the U.S. runs.

In essence, the United States exports dollar stability for goods and services at a cheaper price and enhances the welfare of its citizens.

In return, the major trading economies get to hold a currency that is sounder than they possess—think of the Chinese yuan, which relies upon the depth of global liquidity markets based on the dollar to maintain that country’s currency regime. That reliance, in turn, reinforces the dollar’s hegemony.

In short, the economies that run surpluses need that dollar-based demand from the United States to make up for their own weak consumption and high savings rates.

China is a case in point. For China, which accounts for 2.7% of global reserves, to become a true reserve currency, it would have to liberalize the yuan. Such a loosening would result in a decline in the ability of the regulatory authority to control credit, relinquishing any control of its capital account and current account.

China would have to be willing to alter its economic framework so that its economy plays the same role as that of the United States. Given China’s current political arrangements, that will not happen. And the dollar will remain dominant.

Moreover, the soft power of the United States is too often discounted. The rule of law, foreign direct investment—with the notable exception of China and Russia—as well as the dollar’s support of the rules-based order all reinforce U.S. economic and financial power.

Global foreign exchange data

The vast majority of international trades, almost 90%, are invoiced in U.S. dollars or euros, according to a recent analysis by the Federal Reserve Bank of New York.

As of the end of last year, the U.S. dollar accounted for 60% of total allocated currency reserves held by central banks.

That corresponds to the 80% of total foreign exchange reserves allocated to the dollar and euro held by central banks at the end of last year. The dollar accounted for 60% and the euro 20%.

China, Russia, India and Saudi Arabia are not in any economic shape to support such a change in the rules-based order.

Despite the global economic growth over the past three decades, the current order is simply not going to change at the scale necessary to supplant the American dollar and the global order that rests upon its foundation.

There are only three other economies that have some the qualities needed to support a reserve currency: the euro area, Japan and the United Kingdom.

But none of those have financial markets with the depth and liquidity to form the backbone of international finance and trade.

In the early 2000s, the percentage of dollar and euro reserves was as high as 90%, with the gradual decline since then most likely because of increased trade among smaller economies and, more important, their reduced reliance on the foreign issuance of debt.

The IMF also notes that as stockpiles of foreign currency reserves grow, the case for portfolio diversification has grown as well.

Currencies of smaller economies that have not traditionally figured prominently in reserve portfolios but offer high returns and stability— like the Australian and Canadian dollars, Swedish krona and South Korean won—account for three quarters of the shift from dollars.

Other IMF analysis notes that the dollar is the dominant reserve currency by default. The absence of an alternatives to the safety of dollar-trade invoicing, international funding markets, and the large supply of guaranteed Treasury bonds suggests that the dollar’s role in the global economy is secure.

What determines a reserve currency

A reserve currency needs to be stable and safe, a store of value and a medium of exchange, and widely accepted and trusted.

This is according to an analysis by Vivek Joshi writing in India’s Sunday Guardian, who also notes additional societal and economic criteria for a global reserve currency. These include:

- The stability of the political system of the issuing country.

- The size and prospects of the economy.

- Global integration of its markets and economy.

- A transparent and open system.

- A credible legal system.

- The quality of its sovereign debt.

- The ability to bear costs associated with a reserve currency.

- The size, depth and liquidity of financial markets.

There is good reason for the shared dominance of the dollar and the euro, and, to a lesser extent, the Japanese yen and the British pound.

They represent the major economic centers of the world and operate within the rule of law.

There is good reason that other currencies do not yet qualify. They are either too small (Switzerland), operate under totalitarian regimes (Russia and China), or allow for protectionism (India).

Finally, a reserve currency needs to be market-based, free-floating and, most important, stable. That rules out cryptocurrencies that are prone to wild swings and live outside the regulatory system.

There have been two major reserve currencies in modern times: the British pound until World War II, and the American dollar for the past 75 years.

The euro has gained status since its inception as a single currency in 1999, now bolstered by the increase in transaction demand for the euro from developing economies in Eastern Europe and Africa.

Stability of the dollar

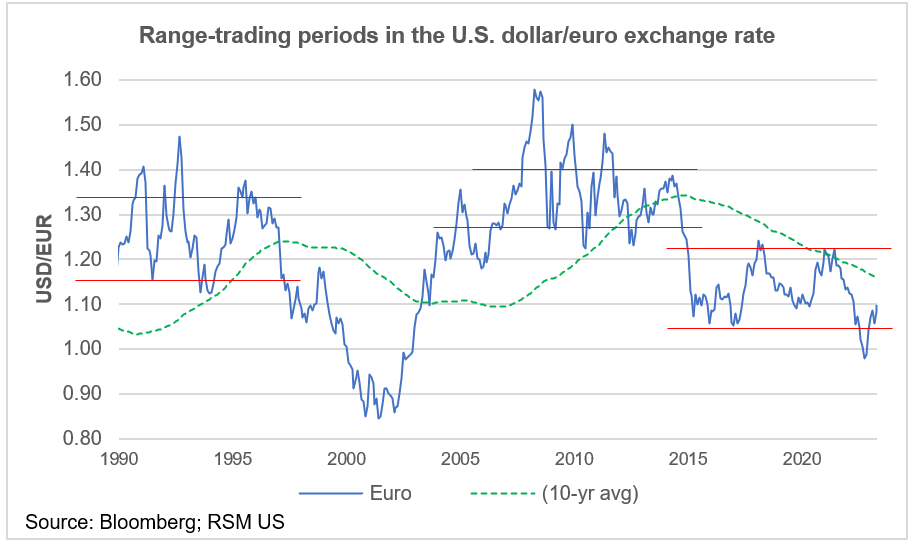

The traditional U.S. dollar index is the weighted average of the exchange rates of six developed economies: the euro area, Japan, the United Kingdom, Canada, Sweden and Switzerland.

The euro has a weight of 58% in the dollar index and a correlation coefficient of 0.98 based on monthly values of the dollar index and the euro since 1980.

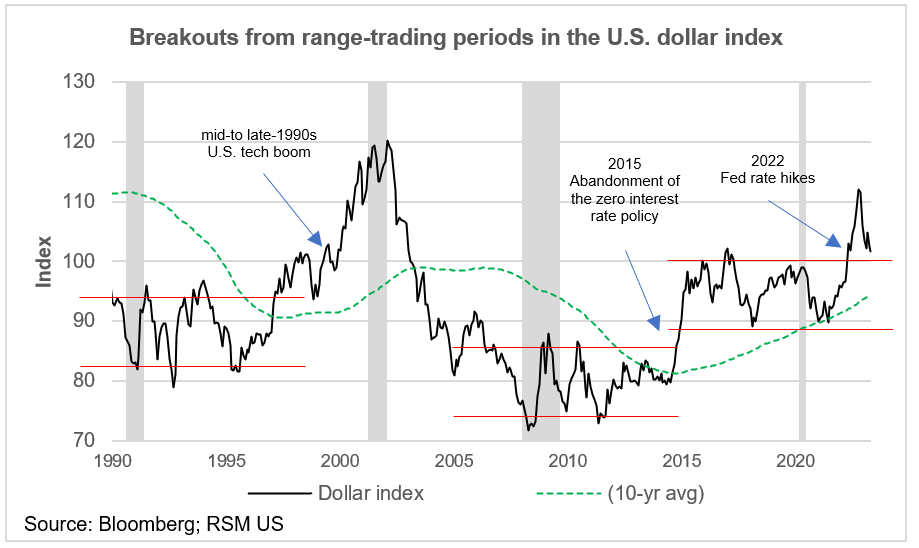

Since 1990, the dollar index (and the euro) have experienced three periods of trading within narrow ranges, interrupted by consequential events that have altered the demand for U.S. assets or the mix of monetary and fiscal policies.

As we show, the pattern of range-trading followed by a breakout of the exchange rates became apparent when advances in desktop computing created the technology boom in the 1990s.

A bust followed, along with a period of the dollar range trading at a lower level from 2005 to 2015, as the sluggish U.S. economic recovery trudged along.

Late 2015 was the next turning point when the Federal Reserve began to normalize interest rates while the monetary authorities in Europe and Japan kept rates at or below zero.

That shift in monetary policy provided a dramatic boost to the dollar as it quickly moved to a higher trading range that lasted until March of last year.

This most recent breakout was the result of the dramatic introduction of a dollar-friendly policy mix last year.

The American government was in the midst of the greatest fiscal response to an economic crisis since the Great Depression when the Federal Reserve rapidly hiked its policy rate. The dollar soared while the European Central Bank had a lagged response to inflation and the Bank of Japan maintained its yield-curve control.

The mix of tightening monetary policy and expansive fiscal spending would push U.S. interest rates higher. With interest rates still near zero in Japan and Europe, that would make the dollar and dollar-denominated assets that much more attractive.

Global investors looking for higher returns on investments in U.S. securities and business opportunities, augmented by the self-fulfilling higher currency return, flocked into dollar-denominated assets.

Where do we go from here?

The differences in monetary policy between the United States and Europe were unlikely to last forever, with the dollar’s peak most likely occurring last September and with the euro now trading back within its 2015-22 range.

We can attribute the strengthening of the euro over the past seven months to the shrinking spread between the policy rates of the Fed and the European Central Bank as the ECB continues to respond to its 10% inflation rate.

There is also the newfound ability of Europe to survive the winter with diminished supplies of energy and its efforts to expand NATO. All of this is buffered by the uncertainty surrounding the war in Ukraine.

We do not expect that an economic slowdown will drastically affect the relative policy mixes of the United States and its trading partners.

Instead, the most important factor with regard to exchange rate stability has been the synchronization of economic growth and the coordination of monetary policy among developed nations. This is unlikely to change.

There are bound to be deviations in policy (Japan’s likely end to yield-curve control) that will continue to affect individual currencies.

And there will be differences in the transaction demand for currencies, with the currencies of economies dependent on resource extraction (see Canada and Australia) more affected by trends in economic growth and in particular the price of energy (see Japan again).

Still, we need to recognize that there have been large jumps in the dollar’s value that we attribute to innovation breakthroughs or to financial busts or to consequential policy changes that have affected the demand for U.S. assets.

Since 2015, the range of dollar trading has been between $1.05 and $1.20 against the euro, with a $1.12 center of gravity.

By any measure, the dollar at $1.10 is within range of its longer-term average value. Its movements beyond here will be dependent on inflation, economic growth and monetary policy all relative to what happens in the rest of the world.

Whether it breaks out below or above its recent range will depend on the next round of innovation or the next crisis.

The next crisis could occur as early as June. The debt-ceiling debate will devolve into an existential crisis only if the Congress allows the United States to default on its debts this summer or if it allows the dollar to suffer from a thousand cuts if this stumbling block is allowed to exist in perpetuity.

There are no viable or readily available alternatives to the U.S. dollar being the reserve currency. The result would be chaos in international trade and finance, with the cost borne by American businesses and consumers.

We also expect to hear calls for the abandonment of the regulation provided by central banks and the abandonment of traditional currencies in favor of cryptocurrencies.

While crypto advocates can explain away the instability as growing pains, and yes, traditional currencies fluctuate according to their demand, that demand is based on economic and societal factors underlying the currency and not purely on speculative behavior.

Previous attempts to de-dollarize

The use by the United States, European Union and Japan of its prodigious financial and economic power to address the Russian invasion of Ukraine has rekindled the ideal of de-dollarization.

This is not exactly a new phenomenon. Latin American and Middle Eastern economies have attempted to exit the dollar-based system.

Since the 1970’s Latin American nations like Chile and Venezuela have tried to exit the dollar-based global financial order. Venezuela has for some time attempted to purchase oil in Chinese yuan.

During that past half century, Iraq and Libya attempted to find a solution through the euro and a pan-African solution.

And we should all remember the entreaties by Japan in the late 1980’s for the United States to consider a broader role for the yen before the bursting of the Japanese financial bubble.

That request was politely rebuffed by the Reagan administration. And one should expect no different from the current and subsequent American governments.

While we recognize that the international economy has been altered by geopolitical tensions, shifting supply chains and the return of industrial policy, we just do not see a major alternative to the rules-based system supported by the American dollar.

In fact, the only thing that would really alter the current international status quo would be an American default on its debt. But that is another story for another day.