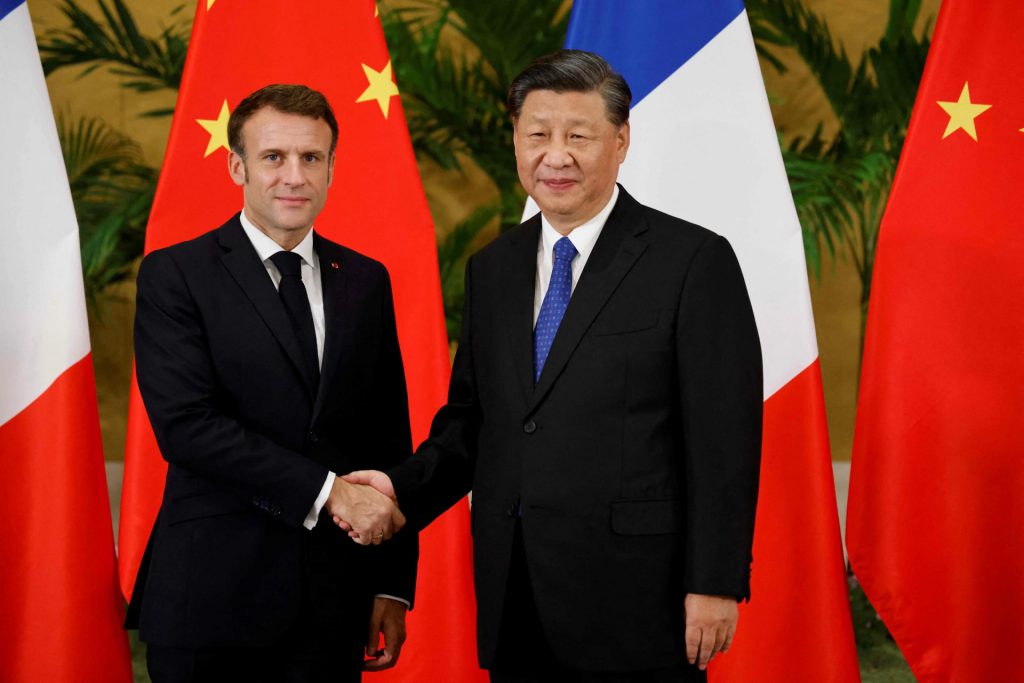

The BRICS alliance is looking at a possible expansion by adding new countries into the bloc. Around 19 countries have expressed their interest to join the group and nine nations have formally submitted their applications. Belarus is the only European country to have shown a desire to enter BRICS and accept the new currency. Apart from Belarus, France is now looking to join the summit in August in South Africa. If France joins BRICS, it could be the first country in Europe to accept the soon-to-be-released currency for global trade.

Also Read: BRICS Bank That Was Built To Challenge U.S. Dollar Now Needs USD

So what could happen to the U.S. dollar if countries in Europe begin to accept the new currency? In this article, we will highlight how the geopolitical and financial landscape could realign if Europe accepts BRICS currency.

BRICS: What Could Happen If Europe Accepts the New Currency?

Accepting BRICS currency could signal a shift in Europe’s geopolitical alliances and economic partnerships. It could indicate a desire for closer ties with emerging economies and a reduced reliance on traditional economic powers like the U.S. and Canada.

Also Read: BRICS: Iraq Bans U.S. Dollar, Egypt Ditches USD, France & Pakistan Pay With Chinese Yuan

A common currency could potentially boost trade and investment between Europe and the BRICS countries. With a unified currency, it may become easier and more cost-effective to conduct business, leading to increased economic collaboration and exchange of goods and services. This could reduce the demand for the dollar, potentially leading to a depreciation of its value.

If the currency proves to be strong, it could challenge the U.S. dollar as the global reserve currency. However, integrating the new currency involves risks, including volatility, inflationary pressures, and different fiscal policies. Europe needs to carefully assess the economic risks and benefits before considering such a significant financial change.

Also Read: BRICS: 30 Countries Participate to Ditch the U.S. Dollar as Global Reserve Currency

In conclusion, the U.S. dollar could be hit if Europe begins to accept the BRICS currency. Moreover, taking on the U.S. dollar is a herculean task as it is the strongest currency in the global markets.