We are seeking to fill two positions on our editorial team: An editor/researcher and a membership editor. Apply by Oct. 2, 2022.

$300 billion is a big number, even for a country the size of Russia. The United States and its allies froze roughly that amount belonging to Russia’s central bank’s foreign currency reserves (equivalent to about 35 percent of Russian GDP), froze assets of a wide range of individuals and Russian banks, and severely limited Russia’s access to the SWIFT payment system. We have seen such measures selectively applied to countries such as Afghanistan, Iran, and Venezuela in the past, but this sanctions package is unprecedented, not only due to its scope and magnitude but also because it targets a major world power. The action represents a tectonic shift from the policy of neutrality, signaling to the world that each country’s access to their reserves could become contingent on their foreign policy. In response, Russia has sought to rely on non-dollar payment systems and to exhaust non-dollar reserve assets, joining Iran and other countries sanctioned by the United States in pursuing alternatives.

Do these historic sanctions signal the end of the dollar’s dominance? We believe that any imminent change is highly unlikely. Paradoxically, the recent events may have even buttressed reliance on the dollar and highlighted its appeals: deep and liquid capital markets; tradability and convertibility; and network effects. In the long run, any alternative needs to be able to compete on those metrics.

A Slow Decline in the Dollar’s Dominance Since 2000

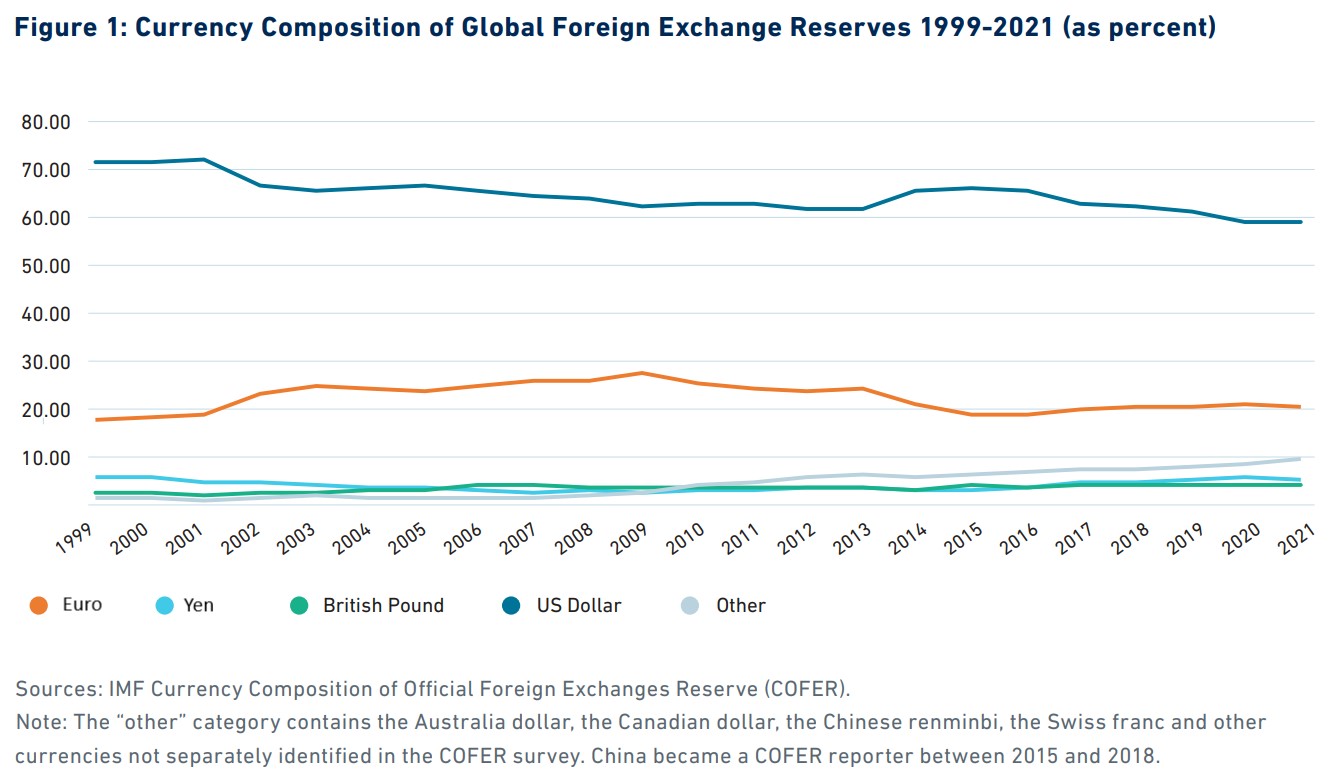

The role of the dollar has been declining for the past two decades, with its share of reserve currencies down from 70 percent to 60 percent over that period, as shown in Figure 1. A detailed analysis of the International Monetary Fund’s Currency Composition of Official Foreign Reserves data shows that a quarter of the decline in the dollar is a shift into the Chinese renminbi, as well as nontraditional reserve currencies. The shift into nontraditional reserves is broad-based and now stands at nearly 10 percent of total identified reserves at the end of 2021.

Two key factors drive this erosion. First is the growing liquidity in many currencies outside the big four (dollar, pound sterling, yen, and euro), which historically did not have deep markets — markets with an abundant supply of investable assets with low transaction costs. However, falling transaction costs — following the advent of electronic trading platforms, automated market making, and automated liquidity management — have deepened these markets, thereby enabling currency reserve managers to comfortably deal in currencies outside the big four. In plain English, it has become much easier to use other currencies with the rise of technology and harmonized global regulation.

The second factor driving the dollar’s erosion as a reserve currency is a growing push by reserve currency mangers towards active reserve management due to the demarcation of “investment tranche” from “liquidity tranche.” The latter is the classic reserve pool held to meet the worst-case scenario requirement in a balance of payments crisis. Today, the investment tranche is sizeable and these funds do not need to be invested with the same conservative approach. For example, among the 55 emerging market economies for which the International Monetary Fund conducts its reserve adequacy analysis, 30 had excess reserves as of year-end 2017. In these countries, total reserves exceeded the minimum adequate reserve levels by 58 percent on average, thereby providing a sizeable investment tranche. And, as this investment tranche is less constrained in both asset-class choices and currency risk, non-dollar assets can be accommodated in larger shares.

Other changes contributing to the dollar’s slow erosion as the world’s dominant currency are also underway. Foreign cargo used to be priced predominantly in dollars, but that is changing after the outbreak of war in Ukraine. Russia is now invoicing its commodity exports to “non-friendly” nations in rubles. Saudi Arabia is open to China paying for oil in renminbi. We are starting to see efforts to move away from the dollar in the invoicing realm. And, of course, China’s rise as the largest trading partner for many nations increases their need for renminbi assets.

Do Post-Ukraine Financial Sanctions Represent a Regime Change?

The decline of the dollar’s dominance appears already to be set in motion, and we expect these forces to continue, particularly following the Western respond to the war in Ukraine.

The actions to freeze Russian reserves have raised alarms in global financial markets. Indeed, it has been reported that the Chinese finance ministry had been put on alert and called for risk scenarios. Will the centrality of the dollar change dramatically following its deployment as a weapon in the recent conflict in Ukraine? We think not.

There are three core reasons that the dollar will largely retain its dominant position, much to the chagrin of America’s adversaries.

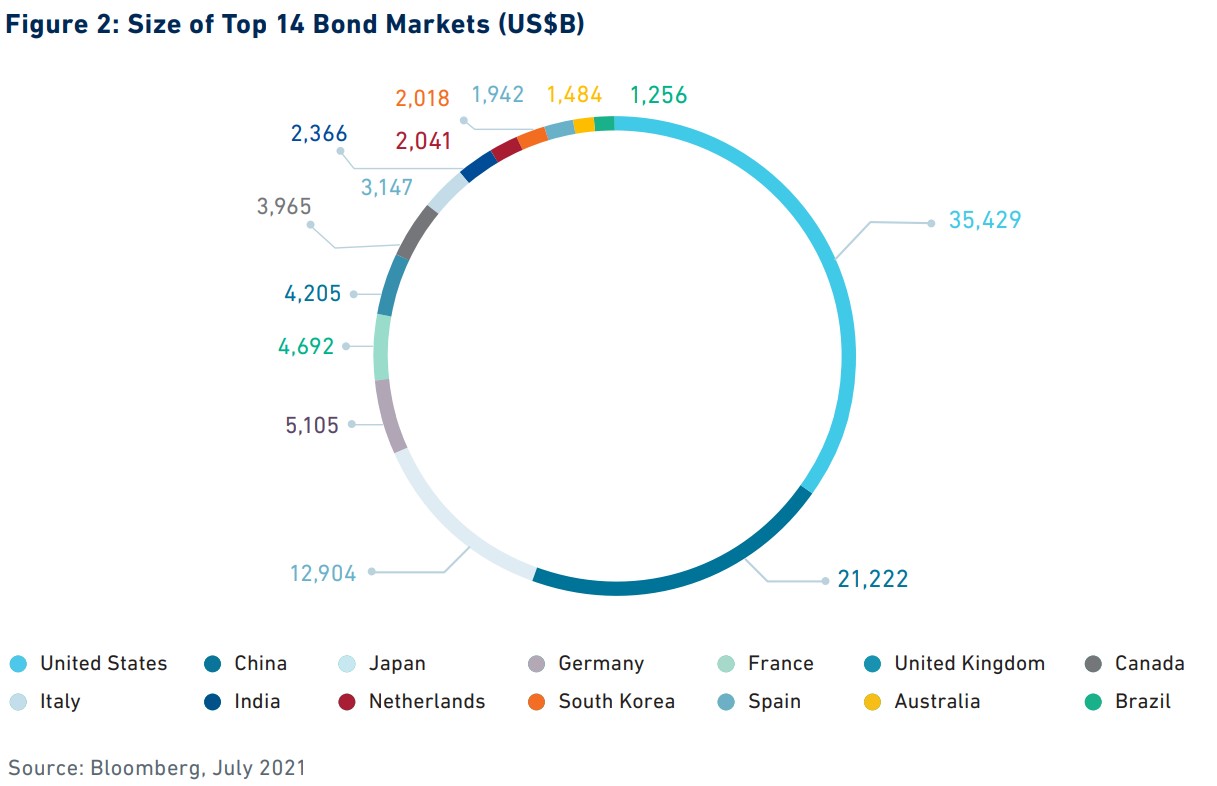

The first is liquidity. It is difficult to find true alternatives to dollar-denominated reserves given the depth and liquidity of the U.S. financial market and its reliably positive Treasury bond yields. As depicted in Figure 2, the overall size of bond markets outside of the U.S. alliance system is minimal, making it very difficult to realize meaningful diversification.

Second, desirable reserve currencies need to be dependably tradable, or convertible into other currencies, and backed by governments with robust financial institutions and legal limitations to unfettered executive power. Markets believe that the dollar amply possess these traits, which makes transitioning to an alternative reserve currency extremely challenging.

Third, the complexity of recreating the whole ecosystem in a different currency renders a regime change unlikely. Indeed, the decline in dollar reserves has advanced at a glacial pace, taking more than 22 years to decrease by only 10 percent. It is hard to see a dramatic acceleration in the pace of dollar decline given the difficulty in disassembling the complex dollar-based ecosystem of trade invoicing, credit, and reserve status.

To further illustrate these points and the limits of the recent Russian sanctions on the dollar’s hegemony, it is useful to evaluate some possible alternatives as the world’s dominant currency.

Are Other G7 Currencies a Viable Alternative?

As liquidity improves and markets deepen, we see a continuation of the slow 20-year trend diversification into other developed market currencies such as the Australian and Canadian dollars. However, we do not see potential for a meaningful acceleration of the trend away from the U.S. dollar and into other reserve currencies outside the big four. The more likely source of an accelerated diversification away from dollar is for the euro to regain some of share in reserve portfolios. The euro reserve share dropped from 28 percent in 2009 to just 21 percent in 2021. As part of the transition away from the dollar, we believe that the euro is increasingly well-positioned to regain much of its lost share for several reasons: reduced fears of an Economic and Monetary Union breakup reduces catastrophic euro tail risk; elevated bond issuance to fund fiscal deficits coupled with a reduction in the bond purchases by the European Central Bank increases bond supply available for public purchase; and improved prospects for euro interest rates to move reliably back into positive territory improves expected returns. Overall, however, the pace of diversification is likely to remain slow as these G7 currencies are unlikely to attract substantial new capital from political opponents, given the “reserve-currency-as-weapon” example set by the Russian sanctions.

Could the Renminbi or Gold Dethrone the Dollar?

The renminbi and gold are definitely more politically acceptable to countries outside the West. However, these contenders have their own limitations as well.

Russia’s experience over the last 15 years provides some meaningful insights in this regard. During this time period, Russia was determined to reduce exposure to the dollar and rotated heavily into gold and the renminbi, as shown in Figure 3. However, neither choice provided the reserve functionality of dollar-allied reserves. On the one hand, gold reserves are simply not “user-friendly” in large quantities. Central bank gold reserves were traditionally held in deposit in New York or London, but there had been a push by Russia and others to store gold domestically in order to prevent it being subject to U.S. sanctions. However, even if physical gold is held domestically, it still requires an international transaction to convert it into foreign currency for payment purposes. In short, gold performs well on safety but falls short on liquidity.

On the other hand, the renminbi clearly offers a potential long-term alternative and will likely attract some additional reserves from its political allies in the wake of the Russian sanctions. But Chinese capital markets still do not provide the features required by reserve managers. China’s willingness to shut down swaths of its economy, impose or remove capital controls, or change convertibility into non-Chinese assets makes dollar-allied assets relatively more attractive. For that reason, even Russia’s reserve allocation to renminbi quickly peaked at about 14.7 percent of reserves, according to Macrobond (see Figure 3). It is our view that the renminbi’s attraction as a reserve currency will only grow at a sluggish pace for the foreseeable future.

Can Digital Assets Provide a Globally Attractive Alternative?

It is possible that digital assets will emerge that are beyond the reach of geopolitical influence, and yet still mimicking features of classical reserves in terms of safety and liquidity. While none of the current blockchain-based crypto-assets or stablecoins yet meet those standards sufficiently, future innovations could deliver a more credible alternative. In fact, Mark Carney’s speech highlighted the possibility of a consortium of central bank-backed digital currencies as a potential alternative to the dollar. We believe that the origin and design of most digital assets are likely to reinforce — not undermine — the dollar’s dominance in the medium term. The dollar is the primary fiat currency underpinning most stablecoins, as they are backed by U.S. Treasury bills and/or other low-risk dollar money market instruments. In addition, most of the innovation in this sector is embedded within the U.S. economy, despite the concept of non-territoriality. Thus, it is very difficult to dethrone the dollar as the reserve currency of choice.

Reserve Reduction as an Option for Reducing Dollar Dominance

Given the limited options for reserve diversification, the one major potential change in the response to the weaponization of the of global finance could be an overall reduction in official reserves.

Could countries simply liquidate reserves to reduce the effects of the dollar’s hegemony? We see clear incentives for such a reduction given the limited structural options for diversification. On the surface, it appears that the action of selling off reserve assets to reduce overall reserve levels would likely be a threat to dollar dominance. However, the expected impact of such an action on the dollar is very difficult to predict, in large part because it depends on how and where the former reserves are invested and where imports are sourced. To determine the impact of a general reduction in reserves, it is important to determine the resulting changes in the global web of trade and portfolio flows. These changes are impossible to model, however. Therefore, the impact of a reduction in the level of reserves as a way to counter the threat of dollar weaponization is highly uncertain.

Residual Risks to the Current Order

While we do not see a dramatic acceleration of the pace of decline in the dollar’s dominance, it is critical to consider even modest changes in the context of the current broader slide toward global economic fragmentation along competing political and economic blocs. U.S. Treasury Secretary Janet Yellen’s “friend shoring” is not new. A 2021 White House Report on “supply chain resilience” forecast resilience strategies for industries such as semiconductor, pharmaceuticals and others. Recent International Monetary Fund research shows that technology fragmentation alone can lead to losses of nearly 5 percent of GDP for many countries. Seen in this context, even a modest increase in the pace of fragmentation in the global financial order could amplify the negative impacts from the fragmentation of real economic activities from friend shoring or other forms of de-globalization across industries and technologies.

One clear conclusion from the extraordinary weaponization of the dollar in the Ukraine war is that it serves to increase incentives toward financial fragmentation. Although the ability to move away from the current dollar-centric system is structurally limited for now, that structure can change over time. The economic costs of such change, particularly when considered alongside the broader effects of global fragmentation, may be very high indeed.

Elliot Hentov is the head of macro policy research and Aaron Hurd is senior FX portfolio manager at State Street Global Advisors. Ramu Thiagarajan is senior investment adviser at State Street Corporation.

Photo by taxrebate.org.uk