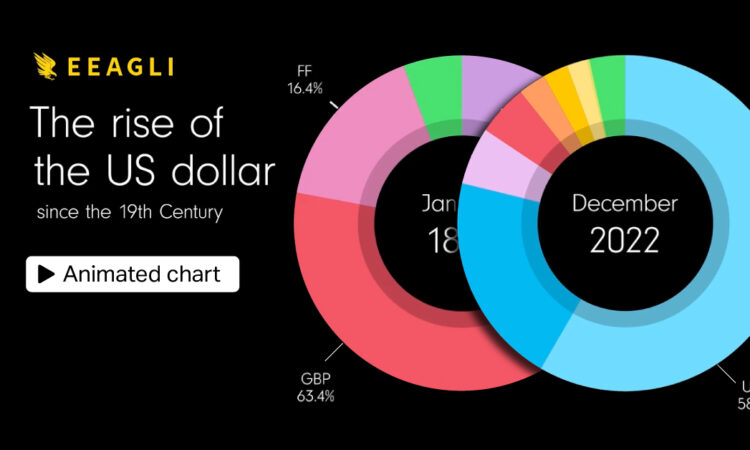

Visualizing the Rise of the U.S. Dollar Since the 19th Century

As the world’s reserve currency, the U.S. dollar made up 58.4% of foreign reserves held by central banks in 2022, falling near 25-year lows.

Today, emerging countries are slowly decoupling from the greenback, with foreign reserves shifting to currencies like the Chinese yuan.

At the same time, the steep appreciation of the U.S. dollar is leading countries to sell their U.S. foreign reserves to help prop up their currencies, in turn buying currencies such as the Australian and Canadian dollars to help generate higher yields.

The above animated graphic from James Eagle shows the rapid ascent of the U.S. dollar over the last century, and its gradual decline in recent years.

Dollar Dominance: A Brief History

In 1944, the U.S. dollar became the world’s reserve currency under the Bretton Woods Agreement. Over the first half of the century, the U.S. ran budget surpluses while increasing trade and economic ties with war-torn countries, expanding its influence as the world’s store of value.

Later through the 1960s, the U.S. dollar share of global foreign reserves rapidly increased as political allies stockpiled the dollar.

By 2000, dollar dominance hit a peak of 71% of global reserves. With the creation of the European Union a year earlier, countries such as China began increasing the share of euros in reserves. Between 2000 and 2005, the share of the dollar in China’s foreign exchange reserves fell by an estimated 15 percentage points.

The dollar began a long rally after the global financial crisis, which drove central banks to cut their dollar reserves to help bolster their currencies.

Fast-forward to today, and dollar reserves have fallen roughly 13 percentage points from their historical peak.

The State of the World’s Reserve Currency

In 2022, 16% of Russia’s export transactions were in yuan, up from almost nothing before the war. Brazil and Argentina have also begun adopting the Chinese currency for trade or reserve purposes. Still, the U.S. dollar makes up 80% of Brazil’s reserves.

Yet while the U.S. dollar has decreased in share of foreign reserves, it still has an immense influence in the world economy.

The majority of trade is invoiced in the U.S. dollar globally, a trend that has stayed fairly consistent over many decades. Between 1999-2019, 74% of trade in Asia was invoiced in dollars and in the Americas, it made up 96% of all invoicing.

Furthermore, almost 90% of foreign exchange transactions involve the U.S. dollar thanks to its liquidity.

However, countries are increasingly finding alternative options than the dollar. Today, Western businesses have begun settling trade with China in renminbi. Looking further ahead, digital currencies could provide options that don’t include the U.S. dollar.

Even more so, if the U.S. share of global GDP continues to shrink, the shift to a multipolar system could progress over this century.

This article was published as a part of Visual Capitalist’s Creator Program, which features data-driven visuals from some of our favorite Creators around the world.