D-Keine

This year’s most significant trend in financial markets has been the sharp rise in interest rates. During the beginning of the year, long-term interest rates rose very sharply as investors braced for more interest rate hikes over the years to come. More recently, the short end of the yield curve has steepened as the rate hikes have accelerated, causing immense inversion in the yield curve.

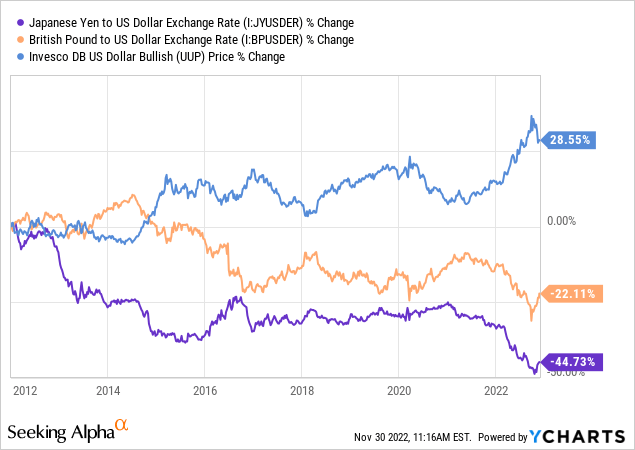

A side effect of the dramatic increase in US interest rates has been the immense appreciation of the US dollar compared to almost all other currencies. Earlier this year, I warned of a potential significant rise in the dollar’s value regarding the Invesco ETF (NYSEARCA:UUP) in “UUP: Why The US Dollar Could Explode Higher Despite Rising Inflation.” Since then, the dollar index surged as the interest-rate gap between the US and other countries rose. The index peaked in October at an abnormally high level, creating a dollar-shortage liquidity crisis in many foreign banking systems. The US rate outlook has moderated since, due to the slowing economic outlook and, combined with Japan’s direct currency intervention, has lowered the dollar’s relative outlook.

The US dollar remains exceptionally high, far above its historical resistance levels. As previewed in October, a continued rise would likely spur a liquidity crisis in many foreign banking systems. This includes historically volatile monetary systems such as Turkey’s but even potentially established ones like Japan and Britain due to immense currency losses in those regions. See below:

November was the dollar’s worst month since 2010 as hawkish Fed expectations began to slip. US real interest rates have also started to moderate while some key commodity prices have risen slightly, negative factors for the dollar’s value.

Undoubtedly, the US dollar is pivotal today, similar to when I covered UUP last March. The “straddle” option strategy I explained in March delivered a ~145% return by the October expiry, as UUP rose quickly as anticipated. Looking forward, I believe the US dollar is due for similar volatility, opening the door for new option strategies or direct positioning opportunities on UUP. Of course, with the dollar at such an extreme, there is a large variety of potential outcomes depending largely on central bank policy outlooks, so such strategies carry a high degree of uncertainty.

Can Central Banks Become More Hawkish?

The strength of the US dollar over the past year is primarily driven by the Federal Reserve’s willingness to raise interest rates to combat inflation, combined with the unwillingness to do so by many other central banks. Turkey, Japan, and China are a few key countries (mainly the latter two) that have not increased or decreased rates despite global inflation. Many Asian countries, such as China and Japan, have much lower inflation than the US, partly because the region has not seen significant commodity shortages from the Russia-Ukraine war sanctions. Still, Japan’s 3.6% inflation is at its 40-year high, and China’s would likely also be higher if it were not for lockdowns, so their currencies are still devalued due to lower short-term rates.

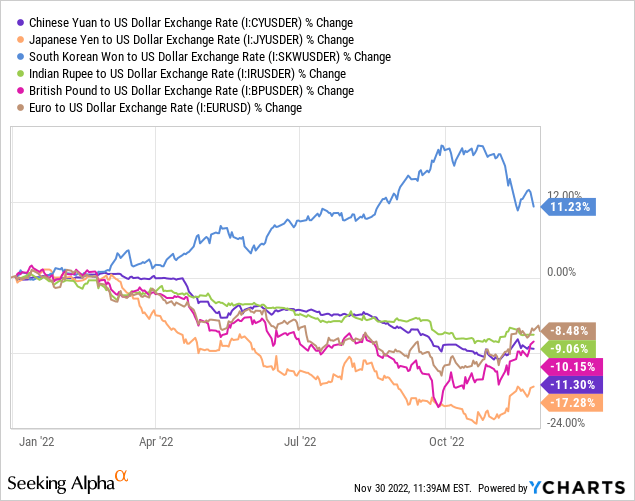

Almost all major currencies have declined against the US dollar this year, with the Korean won being one of the few exceptions due to Korea’s more aggressive rate hikes. The largest internationally traded currencies, the Euro, Yen, and Pound, have also risen sharply against the dollar over the past month. The Chinese Yuan and Indian Rupee have not risen materially but stopped declining while the Korean Won fell dramatically. See below:

This data illustrates a global shift in monetary policy outlooks. The sharp decline in the Korean Won against the dollar, combined with the fall in the dollar against others, indicates the change is not entirely Federal Reserve dependent. The shift implies that global central banks with more hawkish policies are likely to become less so over the coming year, whereas those that have kept rates low may begin to raise rates faster.

Japan’s BOJ is still not interested in interest rate hikes unless wages rise at a 3% annual pace. Europe’s ECB leader Christine Lagarde recently stated a willingness to continue interest rate hikes even if the economy slows. That said, inflation data has weakened slightly in most European countries this month, indicating a potential peak in inflation as in the US. China likely does not need any interest rate hikes to stop inflation since that is accomplished through the demand effect of its lockdown policies; however, that policy is also very bearish for the Yuan since it is impairing China’s exports.

The Energy Economic Demand Connection

The cornerstone of the market’s shift over the past two months is a decline in the economic demand outlook. The manufacturing PMI is trending lower in almost all G20 countries and is now in “negative outlook” territory for over half. That is an extremely strong indication that business and spending activity is set to slow globally in 2023, likely limiting the shortages which have caused high inflation.

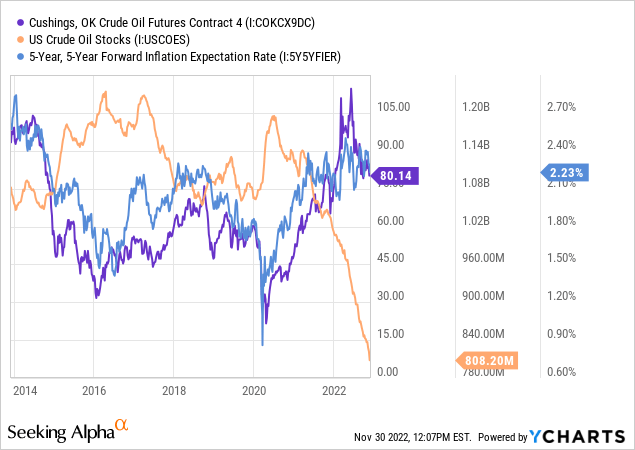

Fundamentally, inflation is primarily driven by high energy commodity prices (since mechanical labor drives the production and transportation of most goods). This is indicated clearly by the correlation between the inflation outlook and the price of crude oil:

In my view, the supply of oil (or lack thereof) has a much more significant and immediate impact on inflation than changes in interest rates. Changes in interest rates appear to have important implications for asset values but only impact economic demand slowly and indirectly. Of course, if the oil shortage causes inflation to rise and increases interest rates, the combined impact on economic demand is quite large.

The crude oil shortage has worsened dramatically in 2022. Prices fell mainly due to the utilization of the SPR reserve and “DUC wells,” but those factors can no longer boost commercial supplies, potentially exacerbating the US and global shortage in 2023 (as indicated by the immense fall in total US oil stocks). If the US economy does not slow sufficiently to lower demand for oil products (a significant decline due to oil’s great demand inelasticity), then oil prices may not rise. If the US (and global) economic demand remains relatively strong, energy prices may soar, causing higher inflation and interest rates. Unless the energy shortage ends (little evidence indicates that), economic demand must slow, or energy availability will fall dramatically.

Regarding the US dollar, the critical question today may no longer be, “who will hike interest rates faster?” but which economy will slow down quicker? Economic slowdowns generally lower real interest rates, causing exchange rate values to decline. Among G20 countries, the United States has the seventh lowest manufacturing PMI at 47.6. However, the Euro Area and the UK are slightly lower at 47.3 and 46.2, respectively. The US yield curve is highly inverted and at a 40+ year low, while Europe’s is relatively steep, potentially indicating a worse negative economic outlook for the US. Overall, I believe the economic situation has shifted against the US dollar.

The Bottom Line

The Invesco US Dollar ETF- UUP, is one of the easiest ways to speculate or hedge against changes in the US dollar’s value available to retail investors. The fund is essentially a basket of short positions on the Euro (57% of assets), the Yen, the Pound, the Canadian dollar, and a few more minor currencies. The ETF does not carry exposure to the Chinese Yuan, an essential factor because I believe the Yuan may continue to depreciate against the dollar due to accelerating lockdown-driven economic declines in China.

While the US Federal Reserve and other central banks’ outlooks influence UUP’s value, I believe that factor may be less critical today than earlier this year. Most major banks, including the Fed, are in “wait and see” mode and are not interested in changing policy outlooks unless there is a significant shift in economic prospects. I believe inflation may remain somewhat high globally due to persistent energy shortages, but it is becoming virtually sure that economic demand will decline in 2023. That change should limit the rate-hike outlook of the Fed and most global peers.

The economic outlook is falling for the US and Europe and at nearly the same pace, but the US yield curve is much more inverted – signaling a quicker end to interest rate hikes in the US. The US dollar is also very high and could create liquidity pressures if it rises, increasing the likelihood of direct or indirect currency intervention such as Japan’s in October. Overall, I believe this situation paints a bearish picture for the US dollar, giving me a bearish outlook on UUP.

Short Opportunity

I believe the US dollar could rise higher, but the weight of the evidence suggests its peak has likely occurred. Given its great height, the dollar’s reversal could be pretty sharp. One can bet directly against UUP by short-selling the ETF or buying an inverted fund like Invesco DB US Dollar Index Bearish Fund (UDN). Of course, UUP and UDN are not very volatile, so potential returns are quite small, even for significant currency moves. Speculators can use options, such as a long put option, to magnify returns with a definite possible loss.

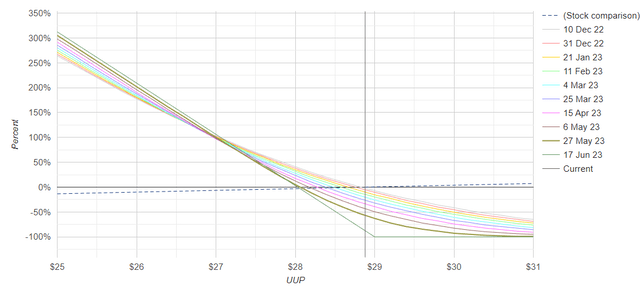

A June 16th at-the-money put option on UUP is currently worth around $1, meaning UUP would need to decline by around 3.5% for the option to have a positive breakeven. The potential returns after that would be decent. See the return chart below:

Potential Return of ATM June Put Option On UUP (OptionsProfitCalculator)

I believe this is a decent bet assuming the US dollar declines in value as expected. That said, currencies also have a habit of becoming range-bound for some time after reaching a prominent peak or trough. UUP is in that position today and may not quickly break back below $28, instead fluctuating between $28 and $30. A more complicated “Iron Condor” strategy may be more suitable if that occurs. Still, the US dollar is in uncharted territory and could be influenced by various factors, so a high degree of caution should be used in pursuing any options strategies on the US dollar.