With total assets of £75.5bn (€78.7bn) at the end of March this year, The Universities Superannuation Scheme (USS), is one of the largest pension funds in the United Kingdom. It might also be the most high-profile scheme in the country, although that is difficult to establish by some objective measure.

USS is so often in the news because the retirement future of its members – nearly 530,000 academics and employees of 330 participating institutions – is regularly subject to fierce debates and tough negotiations.

These have intensified particularly over the past five years, as the employer and employee representatives navigated a series of proposed rises in pension contributions. When negotiations have failed, at least temporarily, members of the scheme often went on strike around the country, generating much publicity.

While the debates and the negotiations take place, the work to secure the retirement income of USS members, by investing the assets of the scheme, continues relentlessly.

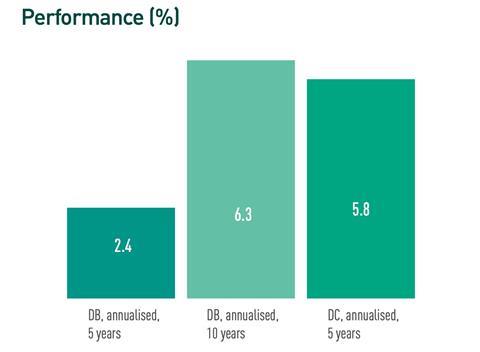

Last year was a difficult one for USS, as it was for most of its peers. The scheme’s total assets fell 16%. However, it also reported a £7bn surplus for the defined benefit (DB) scheme, for the first time since 2008, based on the 2020 valuation.

It also reported that it outperformed its DB liability proxy and that the defined contribution (DC) part of the scheme performed better than most UK DC master trusts. The latter was driven primarily by investments in private assets, with USS being among the first pension institutions in the UK to introduce those types of investments into a DC scheme portfolio.

USS Investment Management (USSIM), a wholly owned subsidiary of the trustee of the scheme, is the organisation that is responsible for designing and implementing the pension scheme’s strategic asset allocation, as well as for managing the portfolio daily. It acts as a fiduciary manager for the scheme.

Central to the investment process of the scheme is USSIM’s investment strategy and advice (ISA) team.

The team currently consists of 18 people, but it is growing. It is led by Mirko Cardinale, who joined USSIM as head of multi-asset allocation and was appointed head of ISA when this new team was set up at the end of 2018.

“The trustees will set perimeters within which the strategic allocation can operate, but this is not a benchmark, it is a high-level construct. The actual strategic asset allocation is fully delegated to us”

Cardinale is a former consultant at Willis Towers Watson and worked in senior asset allocation roles at Aviva Investors and Russell Investments. He has a PhD in finance from Imperial College London.

“The team has a very broad responsibility. We are responsible for investment advice to the non-executive bodies of USS. We are also responsible for the strategic and dynamic asset allocation as well as the day-to-day portfolio management of both the DB and DC sections of USS,” Cardinale says.

The current setup of the ISA team goes back to when the USSIM was undergoing a change in leadership after the retirement of former CIO Roger Gray, who had spent a decade in the role.

“As part of the transition, USS wanted to create a team that worked as a CIO office. The choice was to not replace Roger on a like-for-like basis but to set up a team that would report directly to the CEO,” adds Cardinale.

The ISA team is divided into four smaller teams. One of the four teams carries out the investment-advice function, a key component of the agreement between the trustee and USSIM.

The portfolio strategy team leads the strategic asset allocation process, while the ‘strategy delivery’ team carries out the day-to-day portfolio management. The dynamic asset allocation team runs an overlay programme aimed at generating extra value for the DB section, within the risk budget..

In designing the asset allocation strategy, the ISA team follows a classic three-level approach, the first being the setting of the investment objectives and risk parameters. The second level deals with setting an investment strategy that will meet those risk-return objectives, and third level is managing the portfolio to ensure that it is in line with those objectives and constraints.

“We have carried out some changes recently in terms of the investment governance structure, so although the process is similar to other institutions, there are some important aspects that make it quite distinct,” says Cardinale.

One of the unique aspects of the USS model is the way the scheme looks at performance. Cardinale says: “Rather than overly focusing on a single metric, the performance of USSIM as an investment manager is assessed according to a comprehensive set of factors.”

This is to ensure that the objectives of USSIM as an investment manager are aligned with those of USS.

“The pension scheme has multiple objectives, one of which is improving the funding position. That is one of the objectives against which the performance of USSIM is measured. Essentially, our performance is measured in a holistic way,” Cardinale says.

Another unique aspect is how the relationship between the trustee and its investment management subsidiary relates to risk management. “We have worked to strengthen the connection between our risk management and the risk appetite of the trustee,” Cardinale continues.

“We need to work out the risk capacity from the point of view of the ability of the scheme’s sponsor to potentially make additional contributions to the scheme. The risk capacity assessment very much focuses on the strength of the covenant. From there, we can define an acceptable level of funding risk, which then becomes a risk parameter for USSIM as an asset manager.”

This may seem a straightforward approach, but not all delegation models work in that way. In the ‘old’ investment governance model, the assessment of the fiduciary manager was based on the risk relative to a reference portfolio, which was based, in turn, on the scheme’s funding position.

“In theory, if everything works, the risk level run by the fiduciary manager should be consistent with the risk appetite of the trustee, but in reality something often gets lots in translation. With this new model, nothing does. The risk assessment, by design, is consistent with the risk appetite of the trustee,” Cardinale adds.

The third element that makes this model unique, according to Cardinale, is the extent of delegation that USSIM enjoys.

“There is no prescriptive strategic asset allocation approved by the trustee. The trustees will set perimeters within which the strategic allocation can operate and, for the DB section, a theoretical high-level investment strategy consistent with the actuarial valuation. The design of a comprehensive strategic allocation spanning the full universe of asset classes is fully delegated to USSIM.”

The stamp of approval on the asset allocation strategy is given by an asset allocation committee, which is chaired by Cardinale and is made up of the other executives at USSIM and the CEO.

In practice, to design the asset allocation strategy USSIM combines quantitative analysis and judgment – the latter being an “extremely important” element, according to Cardinale.

“Rather than relying on one model, we have a suite of models and apply layers of judgment on the results of the various models. We do not to use the traditional optimisation approach. Instead, we use a framework where we try to narrow down from the whole universe of potential portfolios and focus on a few candidates,” adds Cardinale. A good dose of scenario analysis complements the more traditional deterministic and stochastic modelling techniques.

The new investment governance framework went live last year, but it did not cause significant changes to the actual composition of the portfolio, which was already well-diversified, says Cardinale.

The team has been focusing on diversification and inflation protection for some time. One of the most recent and most significant additions to the asset allocation toolkit is the greater allocation to foreign currency. The scheme has moved away from the concept of forex hedging to look at currencies as a different asset class.

This is because, says Cardinale, sterling tends to be very procyclical and, as such, an allocation to a diversified basket of foreign currencies can help protect the portfolio at times of stress.

With the new framework, USSIM set explicit strategic targets for interest rates and inflation hedging and has been gradually increasing the hedging to take advantage of the spike in bond yields.

“To manage liability hedge ratios, we do not just buy inflation-linked bonds. We look at a diversified set of instruments that have liability hedging,” Cardinale says. The institution has built a large allocation to US Treasury inflation-protected securities, (TIPS) as well as euro-denominated inflation-linked bonds. However, through its private markets programme, USSIM has specifically focused on acquiring long-duration, inflation-protected assets, such as ground rents, but also other inflation-linked private credit instruments.

USS at a glance

- Assets: £75.5bn (€78.7bn)

- Locations: Liverpool and London

- DC assets: £2.4bn

- Participating employers: 330

- Members: 528,074

- 223,229 active

- 220,506 deferred

- 84,339 retired

- Established in 1974

Source for all: USS, end-March 2023

The UK LDI crisis of September 2023 was felt at USS but it was far less affected than others. Many UK DB funds became forced sellers of assets to cover margin calls as their leveraged LDI strategies, largely consisting of derivatives, were hit by the sudden and extreme spike in Gilt yields.

“Our view is that there is no perfect hedge to liabilities, so it is a question of managing risks. We manage liquidity through an internal team… The key is to make sure that risks are not concentrated”

“But we are different from most UK DB funds in the sense that the scheme is still open to new accrual by members, which means that it is appropriate to retain a greater portion of liquid growth assets and have lower hedge ratios,” says Cardinale.

“Our view is that there is no perfect hedge to liabilities, so it is a question of managing risks and sizing them appropriately. We manage liquidity through an internal team. We have growth assets, which include a large, diversified exposure to private markets. We have leverage but it is managed prudently. We have a framework that minimises the risk of running out of collateral. The key is to make sure that risks are not concentrated,” he adds.

USSIM favours internal management of the assets because it allows the organisation to design truly bespoke mandates. One example is the recently launched, internally-managed equity strategy known as ‘long-term real return’.

This is focused on finding companies that generate sustainable cashflows and provide some degree of inflation protection. “The objective is to keep up with the market, rather than outperform, but with a lower degree of risk,” says Cardinale.

There is still a role for external managers – for instance, USSIM has a passive climate-tilted equity mandate. But many active mandates, from equities to credit and government bonds, are run internally.

USS aims for its investments to reach carbon neutrality in 2050, but most recently the scheme appeared in court to defend the credibility of its strategy to divest from the fossil-fuel industry. Two members of the scheme sought to sue the scheme for its continued support of the industry, but last year the lawsuit was blocked by London’s High Court and in July this year the UK’s Court of Appeal ruled again in favour of USS.

Only last year, USS had announced a climate tilt affecting £5bn-worth of the equity portfolio and earlier this year it vowed to be ‘more rigorous’ in its stewardship.

Cardinale’s team contributes to the key decisions regarding USS’s climate ambitions. “We look at the consistency of our investment strategy with our target, both from a top-down and bottom-up perspective. The former is the hardest challenge. I do not think anyone has really cracked the top-down part of the task,” says Cardinale.

In trying to do so, USSIM is working with the University of Exeter on a project to ‘rethink’ climate scenarios, according to Cardinale. The project aims to develop decision-useful climate scenarios in a multi-disciplinary approach. This autumn, the university will release the initial results of the projects.