- Chinese banks are helping to aid Russia’s invasion of Ukraine, the US alleges.

- The US is considering sanctions to cut Chinese banks off from the dollar, according to The Wall Street Journal.

- However, it may speed up de-dollarization efforts by China and Russia.

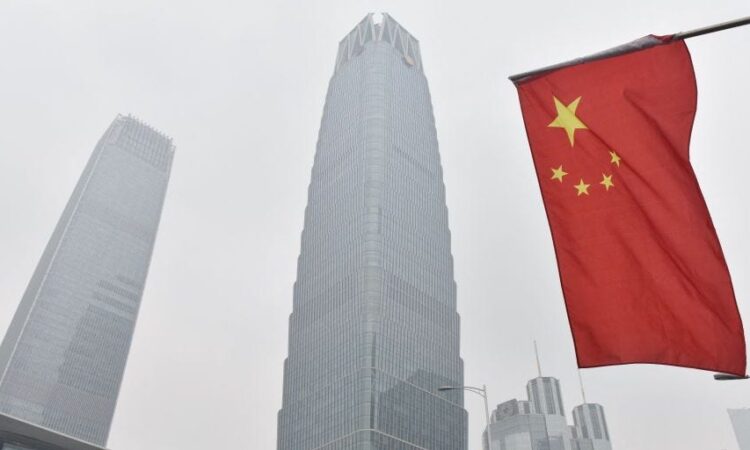

The US is drawing up sanctions that could cause some Chinese banks to lose access to the dollar, according to The Wall Street Journal.

The measures are being taken to prevent what the US sees as China’s support for Russia’s invasion of Ukraine, the outlet reported, citing people familiar with the matter.

Last week, Secretary of State Antony Blinken accused China of providing Russia with crucial technology parts for its weapons industry.

“We see China sharing machine tools, semiconductors, other dual-use items that have helped Russia rebuild the defense industrial base that sanctions and export controls had done so much to degrade,” he said at a press conference following the G7 foreign ministers meeting in Italy.

According to Chinese customs data, trade between the two countries reached a high of $240 billion in 2023, with China becoming one of Russia’s largest goods suppliers since Western companies left the Russian market after the country’s 2022 invasion of Ukraine.

A Chinese embassy spokesperson previously told Reuters that China was not a party to the war in Ukraine and that usual trade between China and Russia should not be interfered with or restricted.

Amid reports that Russia had developed ways of circumventing the sanctions, the US last year sought to punish banks and other organizations facilitating the trade.

The Journal reported that new sanctions on Chinese banks were being considered as an escalatory option in case other diplomatic attempts to curb exports from China fail.

The report comes as Blinken heads to China Tuesday, where he is likely to address US allegations that China is secretly intensifying its support for Russia’s invasion.

The plan could backfire

Cutting banks off from access to the dollar would have huge implications for China, with its economy already in a precarious state after a property market debt crisis.

But it could also backfire on the US by speeding up de-dollarization efforts.

In response to previous sanctions, Russia and China intensified efforts to create exchange mechanisms that don’t rely on the dollar.

China doesn’t want to get rid of the dollar entirely, but to diminish its dominance and create security for its economy if the US decides to impose even greater sanctions.

The Financial Times last August reported that economies in the “global south” that have long criticized US dominance over the financial system are increasingly keen to use currencies and exchange platforms that don’t require the US currency.

Alexandra Prokopenko, a fellow at the Carnegie Russia Eurasia Center think tank, told The Wall Street Journal that regional Chinese banks had emerged that had little involvement in dollar exchanges.

“Payment chains are slowly being rebuilt,” Prokopenko told the outlet. “Both Russians and Chinese are constantly adapting to the new conditions.”

The US is betting that China’s financial links to the US are stronger than its relationship with Russia.

“There is underused leverage by the West, especially given the dollar and euro dominance in the financial system,” Maria Snegovaya, a senior fellow at the Center for Strategic and International Studies told the Journal.