A comprehensive US-Saudi Arabia deal may place the world’s largest crude exporter firmly in the dollar camp, experts say, amid speculation that the kingdom could end oil sales in the currency.

US President Joe Biden’s administration is close to signing a security deal with the kingdom, according to a Wall Street Journal report that quoted official sources.

“The signing of a security treaty would further align Washington and Riyadh’s interests in the region and reverse the long-standing tough position US President Joe Biden had with the Saudi regime,” said Francesco Sassi, research fellow at Ricerche Industriali Energetiche in Bologna.

The potential agreement is part of a broader package that would encompass a civil nuclear agreement between the US and Saudi Arabia, as well as progress towards the creation of a Palestinian state and efforts to resolve the conflict in Gaza.

“The security deal would put the brakes on the Saudi-China partnership in terms of security and diplomatic outreach, further delaying any possible speculation of Saudi Arabia ending its use of the dollar,” Mr Sassi told The National.

The US is also pushing for closer ties with the UAE, the Arab world’s largest economy after Saudi Arabia, particularly in the field of artificial intelligence, to gain an edge over China in the global AI race.

In April, Abu Dhabi-based AI and cloud company G42 received a $1.5 billion investment from Microsoft, further bolstering the Emirates’ position as a regional technology hub.

Petrodollar deal speculation

Last week, reports emerged that the US-Saudi petrodollar agreement “expired”, suggesting the kingdom would move to sell oil in various currencies, not just dollars. Some reports even claimed the Chinese yuan would replace the dollar.

There was a significant increase in Google searches for the term “petrodollars” in the past two weeks, reaching an all-time high, Google Trends said.

This sharp increase was linked to viral stories that, on June 9, Saudi Arabia did not renew a secret 50-year agreement with the US to price oil in dollars. The reports, widely shared by crypto enthusiasts on social media, have since been dismissed by financial analysts and economists.

“Many crypto speculators desperately want to believe in the dollar’s demise. Confirmation bias encourages people to ignore what is realistic if their prejudices are seemingly confirmed. This is a poor investment strategy,” said Paul Donovan, chief economist of UBS Global Wealth Management.

“Oil has always traded in non-dollar currencies … Saudi Arabia’s riyal remains pegged to the dollar, and its stock of financial assets are dollar-focused. The dollar’s reserve status depends on how money is stored, not how transactions are denominated,” Mr Donovan said in a note on Friday.

About 80 per cent of global oil sales are conducted in dollars, and Saudi Arabia has traded oil exclusively in the currency as part of an informal agreement with the US.

In June 1974, the US and Saudi Arabia set up a joint commission for economic co-operation to help the kingdom spend its excess dollars on US products. A month later, Riyadh agreed to invest its oil revenue in US Treasuries, a fact kept confidential by the US government until 2016.

The deal came a year after the 1973 oil crisis, when several Arab oil-producing nations, including Saudi Arabia, imposed an embargo on oil exports to countries perceived as supporting Israel in the Arab-Israeli War.

“The US has been pressuring Saudi Arabia to sell crude oil in dollars to protect the dollar’s status since the 1970s and demanding Saudi Arabia purchase US bonds and arms,” said Shigeto Kondo, a senior researcher at the JIME Centre of the Institute of Energy Economics, Japan.

The kingdom increased its holdings in US Treasuries in March this year for the eighth straight month, reaching $135.9 billion, which was 3.66 per cent higher than the previous month, US government data shows.

But in the past two years, Saudi Arabia has considered trading in yuan, with Beijing emerging as the Arab country’s top trading partner and the biggest buyer of its crude.

Riyadh has been focused on maintaining a balance between its relationship with its primary security ally, the US, and its relationships with China and Russia, its key energy partner within Opec+.

Last year, China and Saudi Arabia signed a local currency swap agreement worth $7 billion as part of efforts to boost trade using their currencies and reduce reliance on the dollar.

More recently, Saudi Arabia became a participant in the mBridge project, a collaborative effort between several central banks to develop a new system for cross-border payments using central bank digital currencies.

It was launched in 2021 between the central banks of China, Hong Kong, Thailand and the UAE.

“It is true that China is asking Saudi Arabia to use the renminbi to settle its crude oil payments, but the Saudis would not want to take China’s offer seriously,” Mr Kondo said.

“The Saudi riyal is pegged to the dollar, making budget planning easier by receiving oil revenue in dollars. The dollar’s position as the world’s major reserved asset remains still dominant, which give little incentive for the Saudis to switch to other currencies.”

Dollar peg

Abu Dhabi Commercial Bank, the third-largest lender in the UAE, expects the Saudi riyal’s peg to the dollar to continue for the “near and medium term”.

“It anchors currency and macroeconomic stability, alongside inflation expectation,” said Monica Malik, the bank’s chief economist.

“The dollar peg is also vital for foreign direct investment inflows at a time when Saudi Arabia needs to increase overseas investment to support the transformation plan.”

Saudi Arabia requires hundreds of billions of dollars to transform its economy and move away from oil exports as part of its Vision 2030 programme.

The plan relies on attracting foreign investment, but some large-scale projects have not yet secured as much private funding as hoped.

At an event in April, Saudi Finance Minister Mohammed Al Jadaan said the kingdom would adapt to current economic and geopolitical challenges and “downscale” or “accelerate” some projects.

The role of the dollar in the global economy has been in focus recently due to the strong US economy, tighter monetary policy and increased geopolitical risks, all of which have boosted the currency’s value.

But economic fragmentation and the potential shift of global economic and financial activities into separate blocs have led some countries to use and hold other international and reserve currencies. Concerned with America’s frequent use of sanctions as a foreign policy tool, some states have explored using alternative currencies or payment systems.

Although the dollar remains the most dominant currency in the foreign exchange reserves of the world’s central banks, its share in these reserves has decreased from more than 70 per cent in 2000 to about 55 per cent in the last quarter of 2023, after accounting for exchange-rate and interest-rate adjustments, International Monetary Fund data shows.

The reduced role of the dollar over the past two decades has not been offset by the euro, yen or British pound, the fund said in a report last week.

Instead, non-traditional reserve currencies including the Australian dollar, Canadian dollar, Chinese renminbi, South Korean won, Singaporean dollar and Nordic currencies have increased their share, it added.

Last week, Russia’s central bank and the Moscow Exchange halted trading in dollar and euros in response to the latest round of US Treasury sanctions against the country’s financial infrastructure. The central bank told Russia’s RBC News that the yuan had become the predominant currency on the Moscow bourse, representing 54 per cent of currency trades in May.

In December 2023, Iran and Russia concluded an agreement to trade using their local currencies instead of the dollar. The agreement was finalised during a meeting between the governors of the countries’ central banks in Russia, Iran’s state media reported at the time.

Meanwhile, the Brics economic group, which includes China, India and Russia, has discussed the prospect of a Brics currency aimed at challenging the dominance of the dollar.

Yuan’s ascension

The yuan’s rise represents a shift in the global financial landscape towards a more multipolar system, challenging the historical dominance of western currencies and financial markets.

The yuan’s share as a global trade settlement currency has continued to grow, despite the shrinking overall trade pie amid China’s weakening exports to western countries.

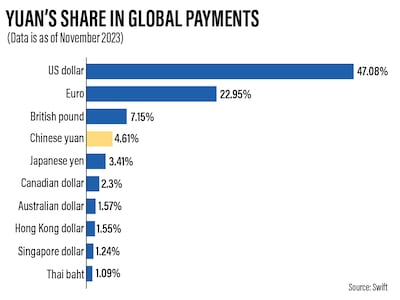

It is now the fourth most-transacted currency, having overtaken the Japanese yen last year, according to data from Swift.

China, the world’s second-largest economy, has been opening its financial markets gradually, but it still maintains some controls on the movement of money in and out of the country.

“While countries like India and China are looking to pay for oil in their own currencies, namely to reduce balance of payments pressures, a critical factor is the still limited size of investment option in these currencies and the lack of full yuan convertibility,” Ms Malik said.

China currently operates under a system of partial convertibility, especially for the capital account. This means the yuan can be used freely for current account transactions including trade in goods and services, but there are still restrictions on capital account transactions such as investments and loans.

Despite significant efforts by China to internationalise the yuan, it remains unable to challenge the dollar’s dominance as the world’s leading reserve currency and preferred safe haven asset.

The greenback makes up about 60 per cent of the world’s foreign exchange reserves, way ahead of the second-placed euro at only 20 per cent. About 88 per cent of all foreign currency transactions have the dollar on one side, while half of all international trade is conducted in dollars.

The US Dollar Index – a measure of its value against a weighted basket of major currencies – has gained more than 3 per cent this year amid growing geopolitical instability and a slowdown in some major economies.

Updated: June 19, 2024, 5:26 AM