US pressures Saudi Arabia to sell oil in dollars, not Chinese yuan, amid Israel negotiations

The United States is negotiating behind the scenes with Saudi Arabia, pressuring the country to keep selling its oil in dollars.

Washington is concerned that Riyadh may price its crude in other currencies, particularly China’s renminbi.

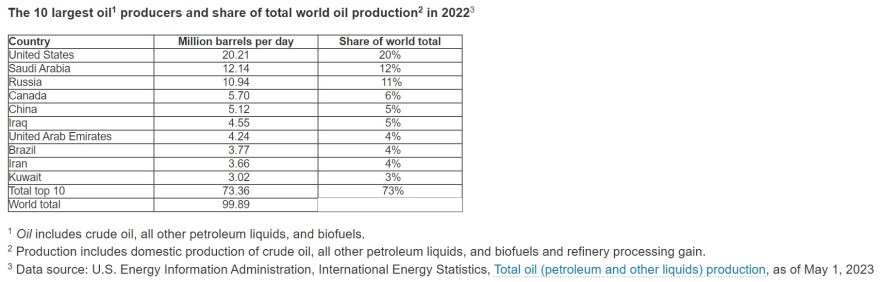

Saudi Arabia is one of the world’s top three oil producers. Since the 1970s, Riyadh has agreed to sell its crude in dollars, helping maintain the greenback’s hegemonic status as the global reserve currency.

The Wall Street Journal reported that the US is working on a diplomatic deal in which Saudi Arabia would agree to normalize relations with Israel’s apartheid regime.

In return, Riyadh wants Washington to pledge to always protect it, as well as help in developing a nuclear program.

Although the negotiations are ostensibly about Israel-Palestine, the Wall Street Journal noted that the US is using the deal to pressure “Saudi Arabia to impose limits on its growing relationship with China”.

“The Biden administration is seeking assurances from Saudi Arabia that it will distance itself—economically and militarily—from China”, the newspaper added, citing anonymous US officials.

In terms of Saudi-Chinese relations, Washington has three main demands, according to the Wall Street Journal:

- “assurances that Riyadh will use U.S. dollars, not Chinese currency, to price oil sales”,

- “assurances from Saudi Arabia that it won’t allow China to build military bases in the kingdom”, and

- “limitations on Saudi Arabia using technology developed by China’s Huawei”.

While many analysts have speculated that the US military will gradually leave West Asia, to prioritize the new cold war, the report emphasized that President Joe Biden’s “focus on the deal [with Saudi Arabia] is a reflection of his view that America has to remain a central player in the Middle East to contain Iran, isolate Russia for its war in Ukraine and thwart efforts by China to supplant Washington’s interests in the region”.

How the petrodollar system helps maintain US dollar hegemony

The petrodollar system has been a key pillar holding up the hegemony of the US currency.

The fact that countries that import oil need dollars to pay for it ensures steady demand for Washington’s currency around the world.

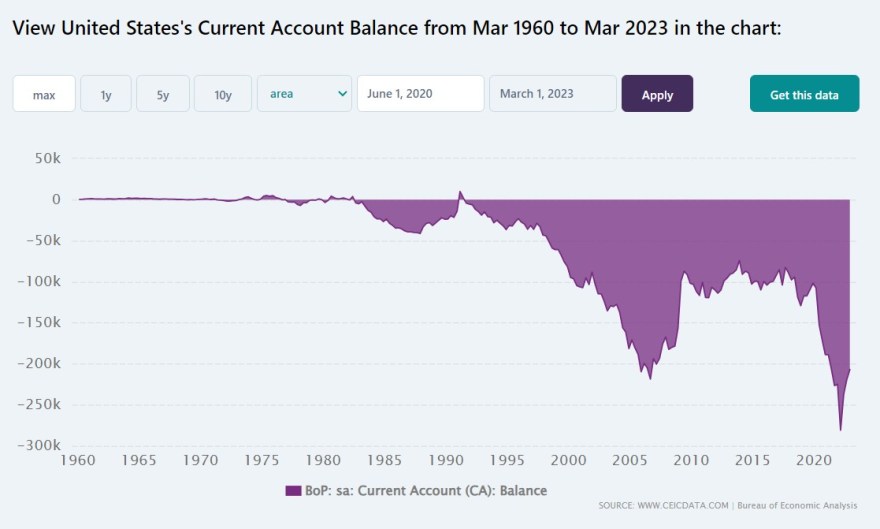

This stabilizes the dollar, helping to finance the massive current account deficit the United States has maintained for decades.

When most countries have a consistent trade deficit, their national currency depreciates against the currency they use to pay for imports. As the local currency weakens, this makes imports more expensive and exports cheaper, encouraging the country to balance its trade.

However, the United States has long been able to maintain a gargantuan trade deficit with the rest of the world because there is so much demand for its currency.

The petrodollar system is one important reason for this high demand for dollars (among several other factors – such as overwhelming US military power, the impression that the currency is a stable store of value, open capital markets with many investment opportunities, etc.).

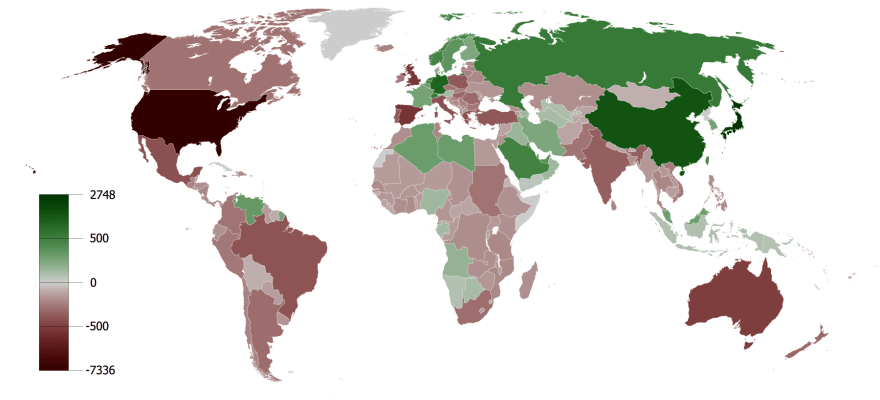

Countries by their current account balance, averaged from years 1980 to 2008 (red is a deficit, green is a surplus)

When Saudi Arabia has a glut of dollars, it has historically deposited them in the US banking system, which in turn uses the excess currency to fund more loans.

Saudi Arabia’s central bank also invests excess dollars it receives from crude sales in the purchase of Treasury securities, effectively financing US government spending.

As Geopolitical Economy Report previously noted:

In 1974, [US President Richard] Nixon sent his Treasury secretary, William Simon, to Saudi Arabia. “The goal” of the trip, Bloomberg explained, was to “neutralize crude oil as an economic weapon and find a way to persuade” Saudi Arabia “to finance America’s widening deficit with its newfound petrodollar wealth”.

Washington signed a historic agreement with Riyadh, pledging to protect the Gulf monarchy in return for Saudi Arabia selling its oil exclusively in dollars, depositing those petrodollars in US commercial banks, and investing in Treasury bonds.

Bloomberg explained: “The basic framework was strikingly simple. The U.S. would buy oil from Saudi Arabia and provide the kingdom military aid and equipment. In return, the Saudis would plow billions of their petrodollar revenue back into Treasuries and finance America’s spending”.

Saudi Arabia moves closer to China, and discusses potentially selling its oil in yuan

China is Saudi Arabia’s largest trading partner, and the two nations have developed closer relations in recent years.

For a decade, Beijing has bought more oil from the Persian Gulf than the United States. The region is very important for China’s energy security, providing the East Asian giant with one-third of its energy needs.

This March, China helped broker a historic rapprochement between Saudi Arabia and Iran. Washington was furious about the peace breakthrough, and has pushed Riyadh to re-join its aggressive containment strategy against Tehran.

Chinese President Xi Jinping visited Saudi Arabia in December 2022, where he signed agreements with the Gulf Cooperation Council (GCC) and Arab League.

In Riyadh, Xi announced that “China will continue to import large quantities of crude oil from GCC countries, expand imports of liquefied natural gas … and make full use of the Shanghai Petroleum and Natural Gas Exchange as a platform to carry out yuan settlement of oil and gas trade”.

Saudi Arabia’s finance minister confirmed for the first time in public this January that Riyadh is indeed considering selling oil in other currencies.

However, although there has been a lot of speculation about this in the financial press, the Saudi government has not publicly announced any plans to price its crude in yuan or any other currency.

In 2021, Saudi Arabia became an official dialogue partner of the Shanghai Cooperation Organization (SCO). The SCO is an important institution promoting Eurasian integration, and fellow members include China, Russia, India, and Pakistan.

Iran became a full member of the SCO this July.

Saudi Arabia is among of the three biggest oil producers in the world (along with the US and Russia). Iran has long been one of the top 10 producers of crude.