Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

US inflation cools, Asian currencies strengthen

US inflation cools, Asian currencies strengthen

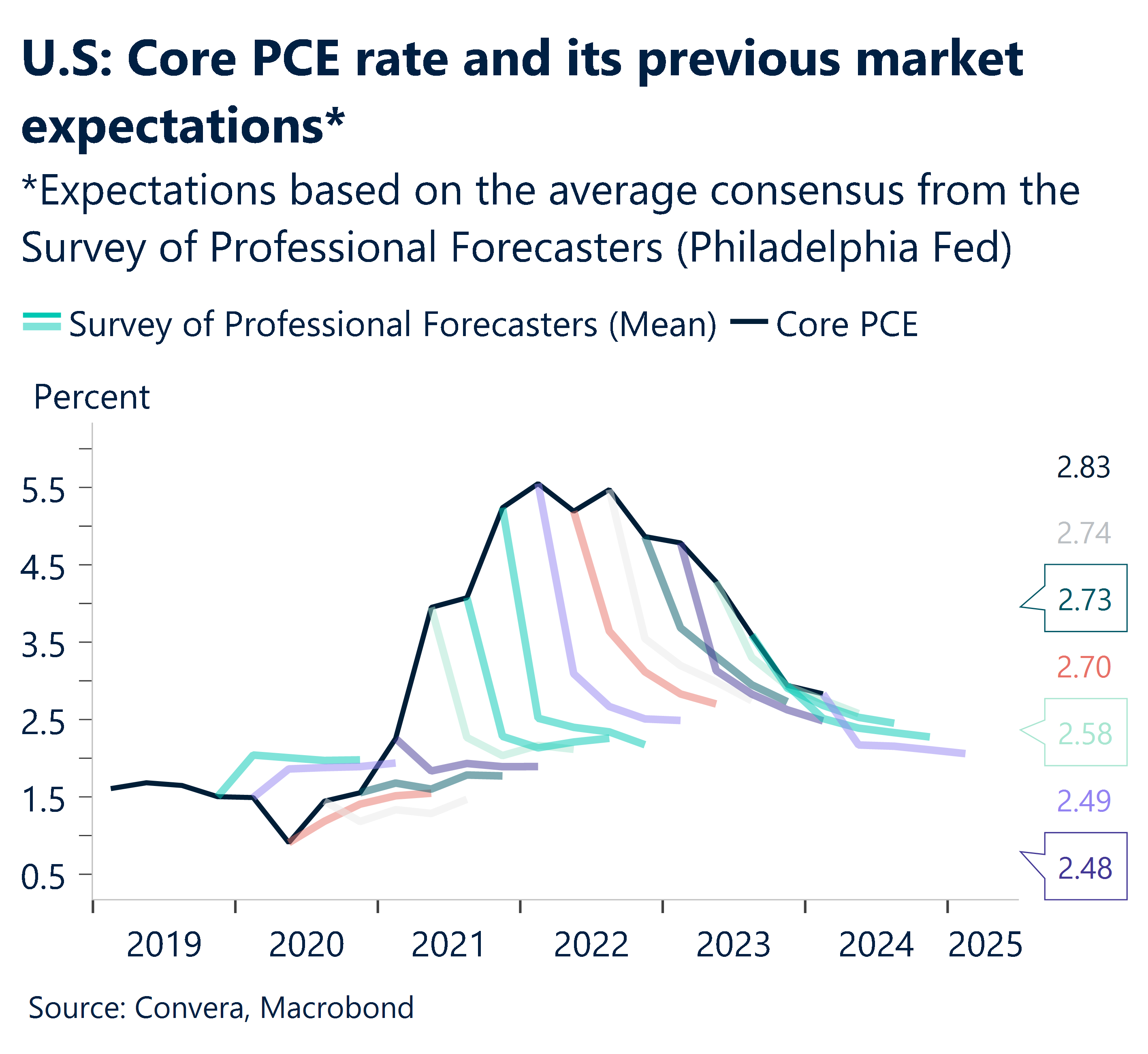

US core PCE inflation rose 0.08% MoM in May, coming in at the lower end of expectations. This data, along with currency movements in Asia, shaped market sentiment. USTs bear steepened despite weak PCE data.

The USD softened slightly, with yields and equity markets showing mixed reactions.

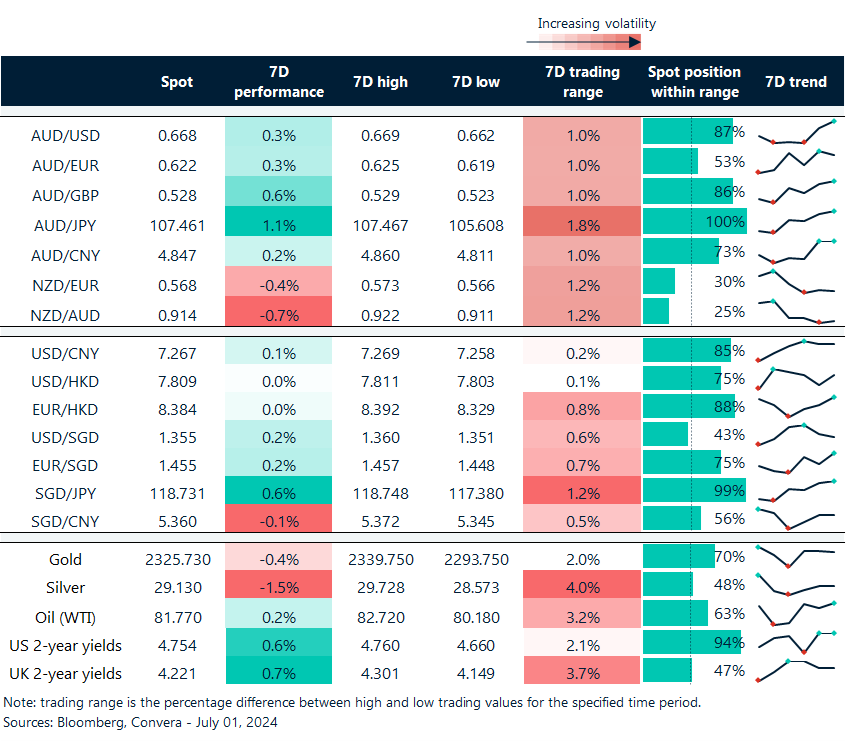

Asian currencies broadly strengthened, led by KRW (+0.68% by NY close), THB (+0.46%), supported by PBoC actions.

PBoC halts yuan weakening streak

The PBoC set a stronger yuan reference rate at 7.1268, halting a weakening streak in the past seven sessions.

CNH rose following the PBoC’s action and commitment to keeping the yuan stable.

The central bank stated it would prevent one-way moves in the currency.

KRW rebounded 0.68%, supported by the stronger CNH, as well as potential USD selling by local exporters (Source: Bloomberg) .

Elections and economic data key this week

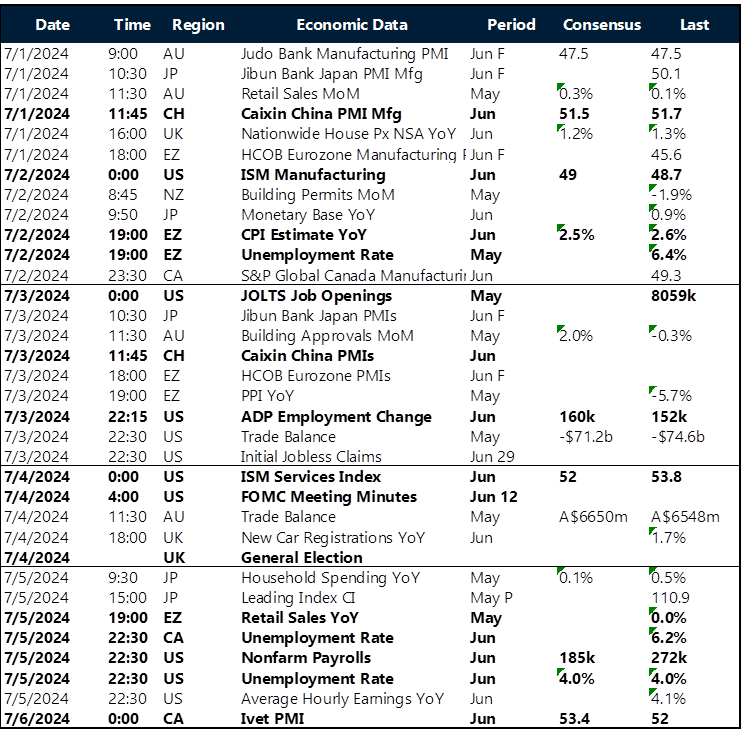

FX markets will be driven by central bank decisions and key economic data releases this week, with notable events from the United States, Japan, Europe, and China.

The week begins with important data from Japan, including the Bank of Japan’s Tankan survey and bank loan officers survey on Monday. These will be closely watched for insights into Japan’s economic health and potential monetary policy shifts.

In the United States, the ISM manufacturing index on Monday and the FOMC minutes release on Wednesday will be in focus. Federal Reserve Chair Powell’s speech on Tuesday could also provide important policy insights.

European inflation data, with Germany’s HICP & CPI flash on Monday and the Eurozone’s HICP flash on Tuesday, will be crucial for gauging price pressures in the region.

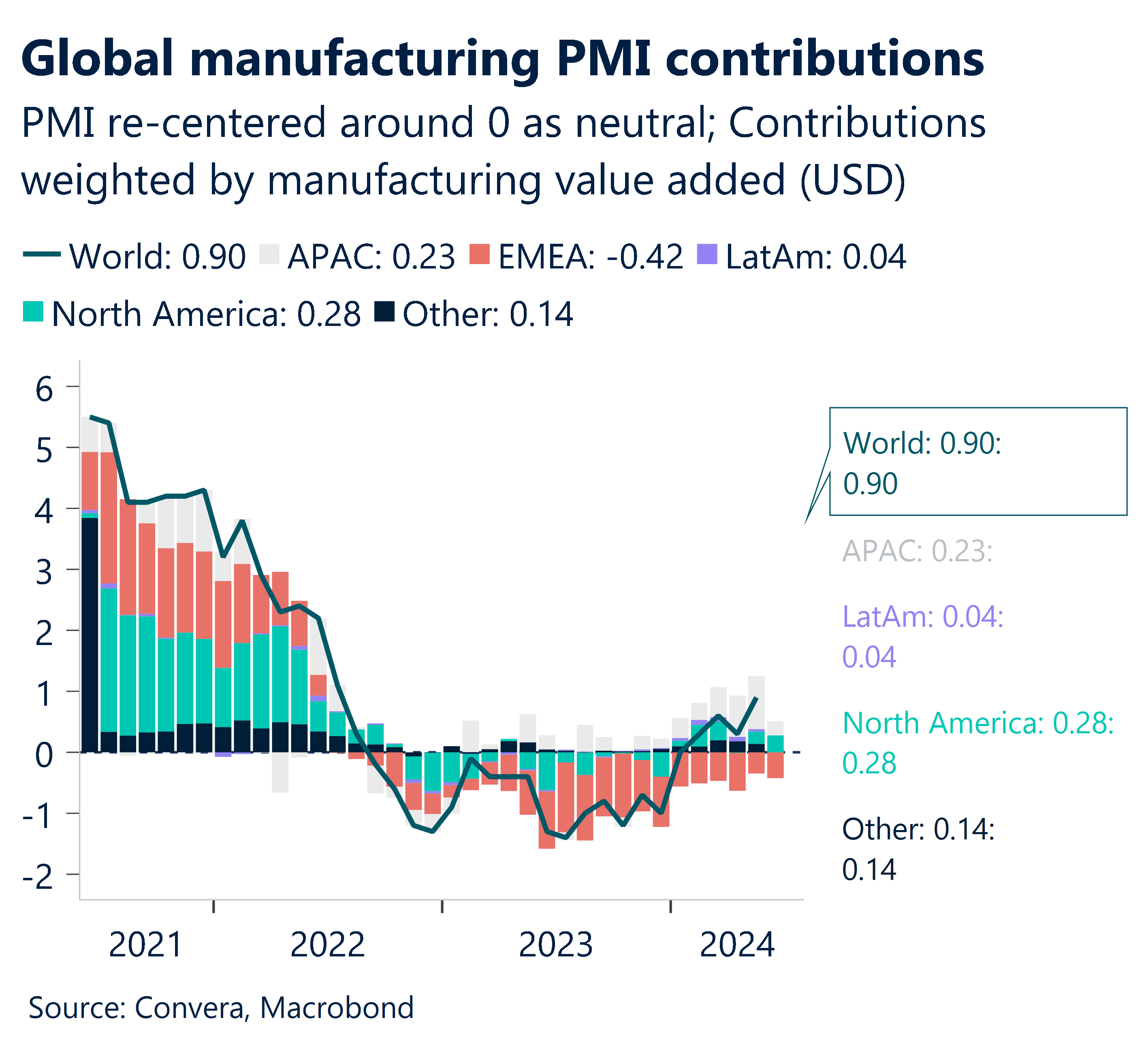

China’s PMI Manufacturing data on Monday will be closely monitored for signs of economic recovery in the world’s second-largest economy.

Key events:

First round of French elections on Sunday (June 30th)

UK elections on Thursday

ECB Forum in Sintra featuring central bank speakers

US jobs data release

China’s PMI manufacturing

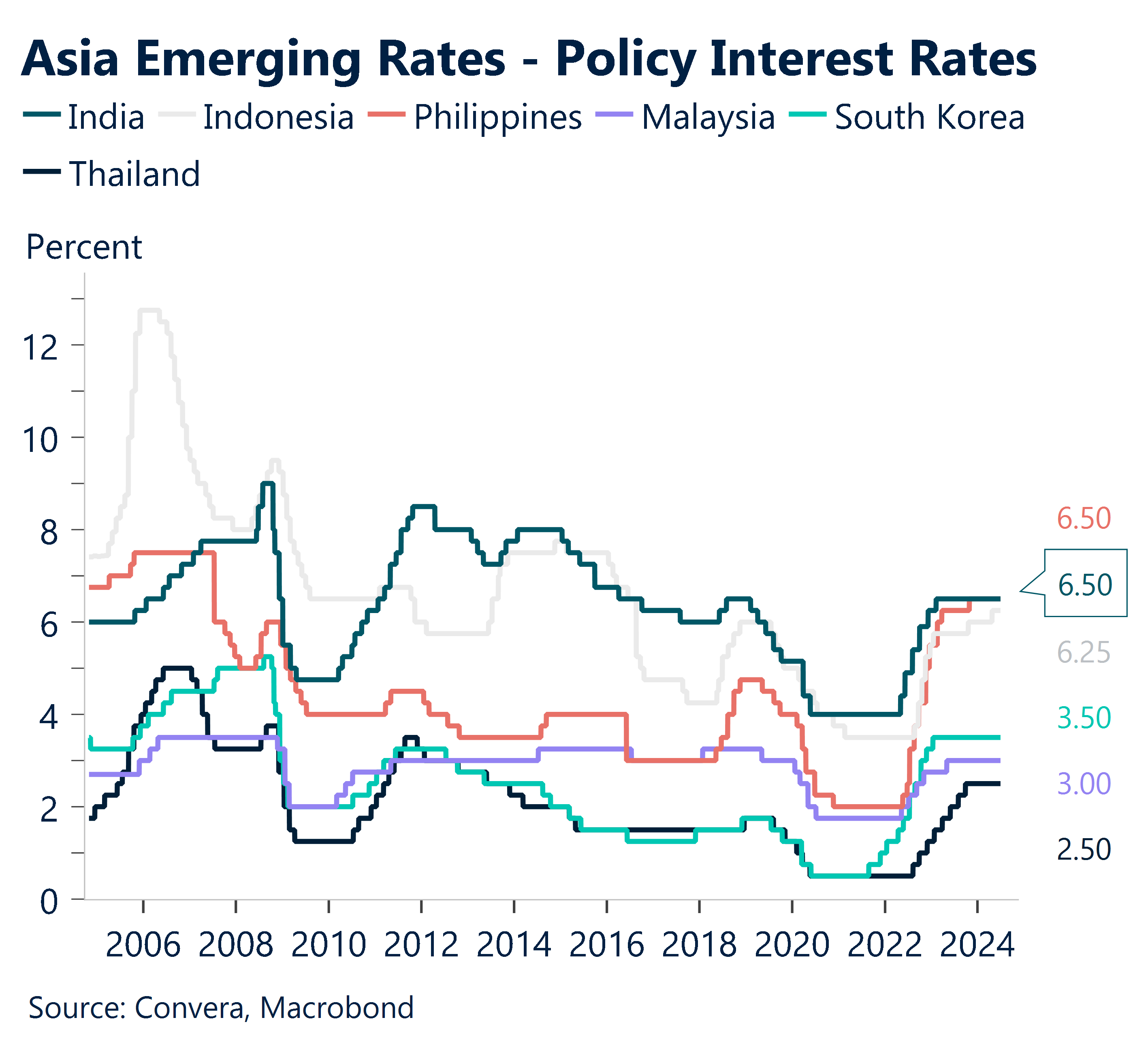

Indonesia inflation expected to ease, but core steady as BI holds rates

We anticipate that June’s headline CPI inflation will drop from 2.8% in May to 2.6% y-o-y due to a slowdown in the inflation of food prices, with lower prices for chicken and red onions offsetting higher costs for chilli. Nonetheless, core inflation, which was 1.9% year over year in June (May: 1.9%), indicating continued price increases for personal care and other services.

BI maintained its policy rate last week despite poor FX, and we have a fairly negative stance for IDR.

Asian FX higher after PBOC

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 24 – 29 June

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]