Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD, JPY outperform as US shares fall

US shares were mostly lower overnight as big earnings reports drove the price action and the weaker sentiment saw risk-sensitive currencies weaken while safe havens like the US dollar and Japanese yen outperformed.

Financial firm Visa, luxury brand LVMH and car manufacturing Tesla all missed forecasts, although tech-giant Alphabet beat expectations.

The S&P 500 fell 0.2% while the tech-focused Nasdaq lost 0.4%.

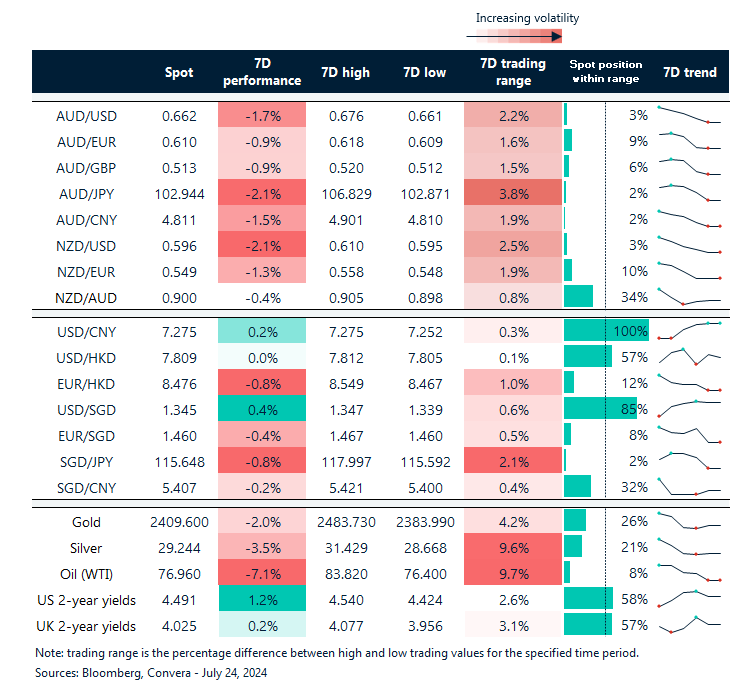

In FX markets, the stronger US dollar saw key currencies weaker.

The AUD/USD fell 0.5% to hit five-week lows while NZD/USD lost 0.4% to hit ten-week lows.

The euro and GBP also fell.

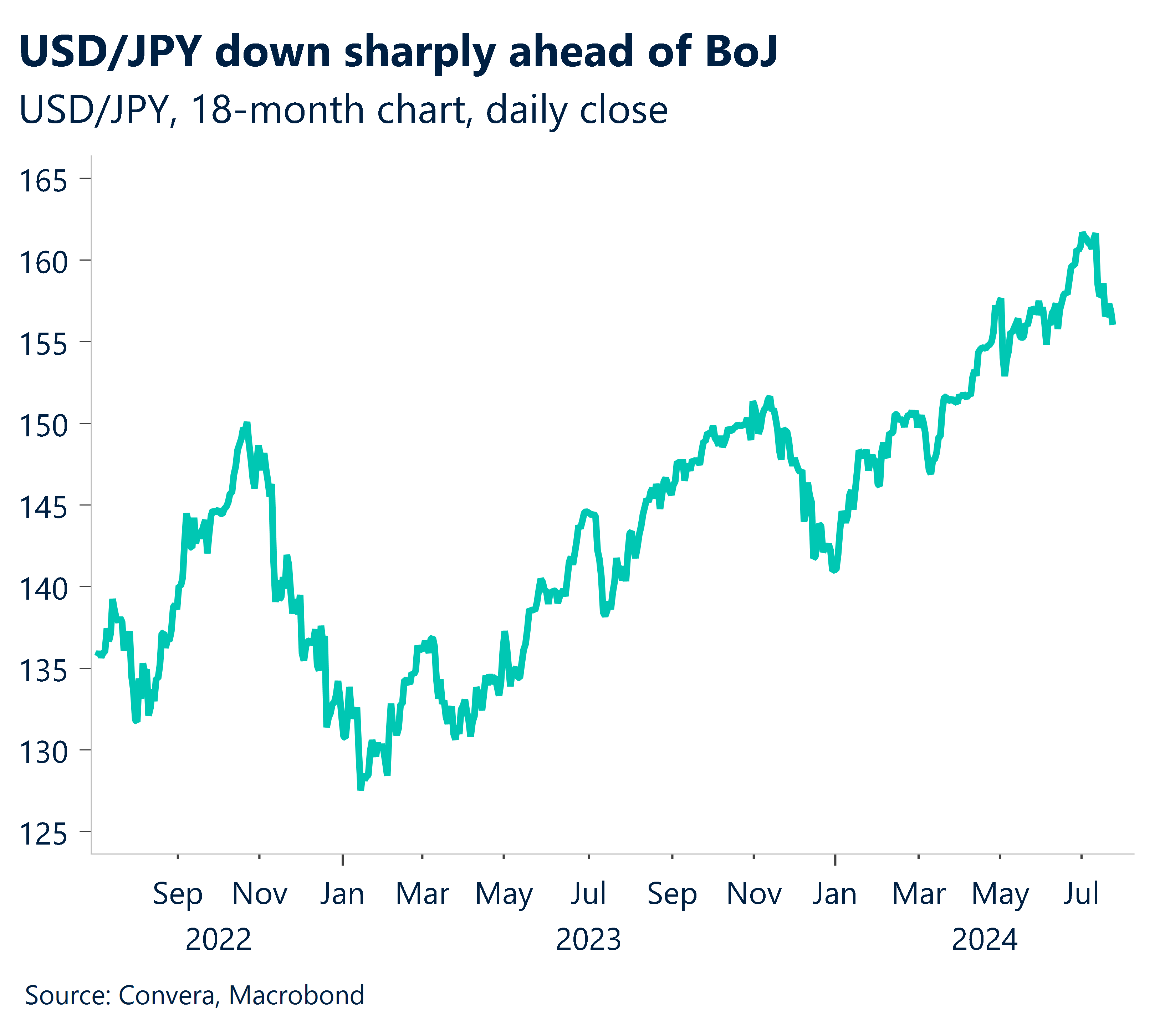

In Asia, the Japanese yen extended its recent recovery with the USD/JPY down 0.9%. The JPY surged against most other currencies. Tokyo CPI on Friday and next week’s Bank of Japan meeting are seen as key risks that might see the BoJ tighten policy further and boost the JPY.

The USD/CNH and USD/SGD were both flat.

PMI numbers to provide growth update

Today’s series of purchasing manager index updates will provide the latest reading on the global economy.

Australian PMI numbers are due at 9.00am AEST with Japan, Europe and US numbers all due later today.

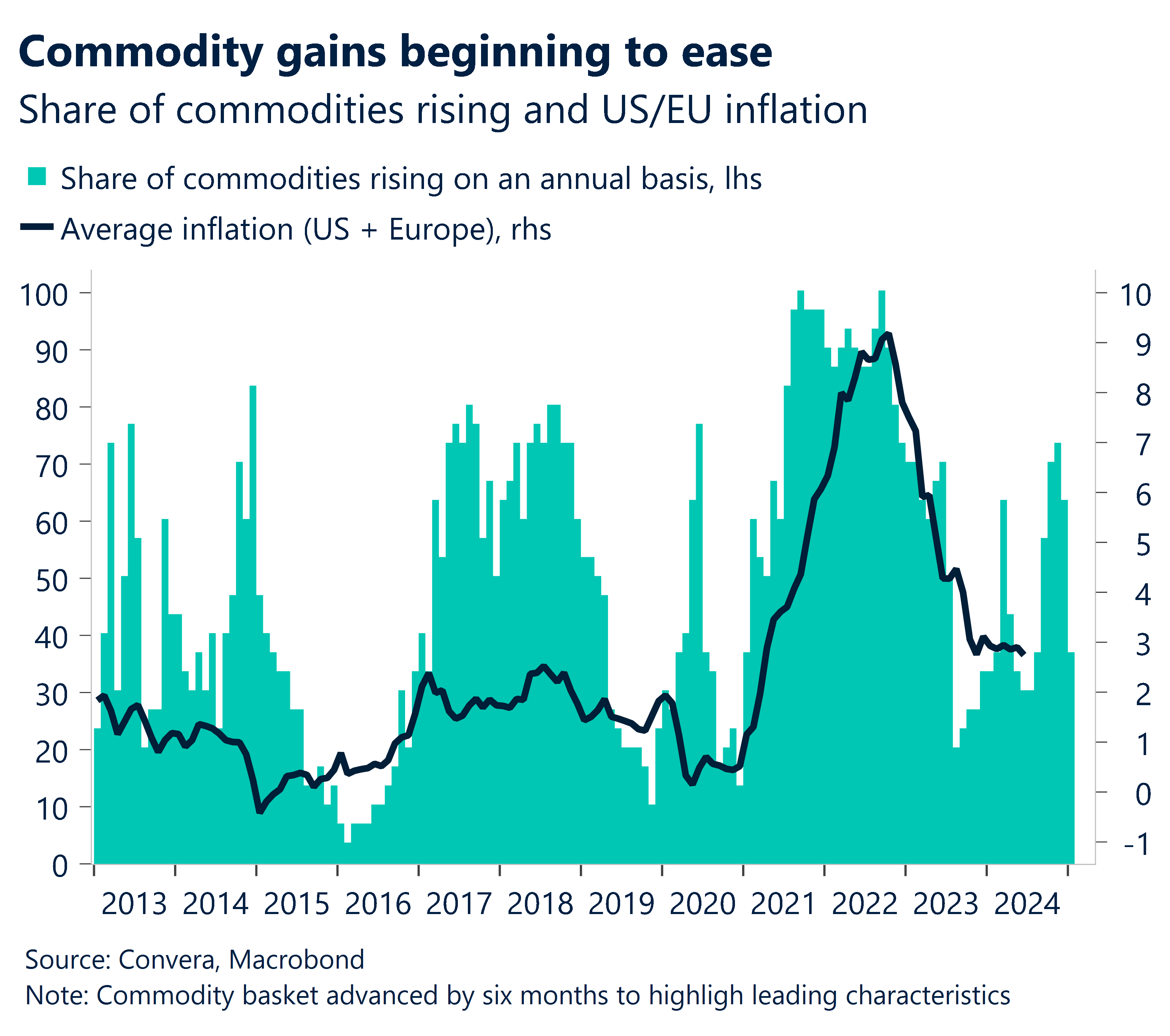

While global manufacturing activity rebounded in the first half of this year – lead by moderate rebounds in the US and China – the global manufacturing pulse eased last month.

Global manufacturing PMI fell from 51.0 in May to 50.9 in June.

A slowdown in manufacturing has recently been accompanied by a turn in commodity prices. As shown in the chart below, the rate of commodities making one-year highs recently peaked.

For the Australian dollar, a slowdown in global manufacturing and weaker commodity prices is an almost perfect storm for losses and has driven the recent two-cent drop from 0.6800 since 11 July.

On AUD/USD, key support is seen at 0.6600.

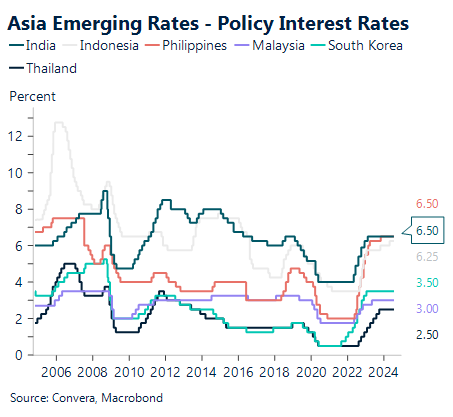

Ringgit outlook turns pessimistic as inflation rises

Asian FX has been mixed this week with the Chinese yuan weaker but the Japanese yen notably stronger.

The Malaysian ringgit has held on to recent gains near six-month highs versus the US dollar.

Looking to upcoming inflation data, as a result of the 55.8% increase in diesel prices to MYR3.35/liter from MYR2.15/liter as of June 10, we forecast headline CPI inflation to increase to 2.2% y-o-y in June from 2.0% in May.

June saw a likely recovery in food price inflation, but one that was probably somewhat restrained by reduced egg costs as a result of the government’s new subsidy package.

Aussie, kiwi at lows

Table: seven-day rolling currency trends and trading ranges

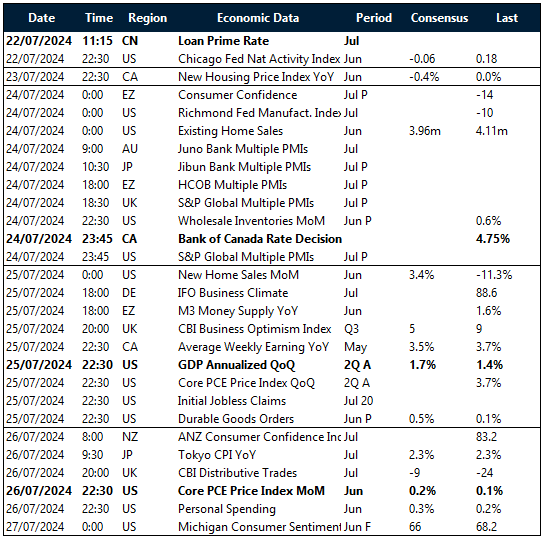

Key global risk events

Calendar: 22 – 27 July

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]