Miners, currency and a lack of special dividends all weighed on payouts between July and September.

Dividends for the year are expected to be lower than previously thought after a poor third quarter for income investors, according to the latest Dividend Monitor report by Computershare.

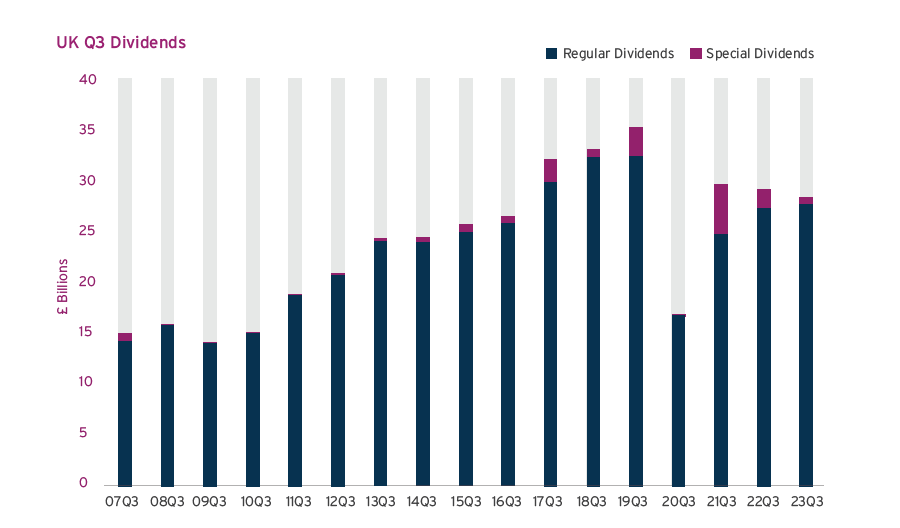

Income payouts by UK companies were 8.3% down in the third quarter on a headline basis to £27.5bn as lower-than-expected dividends from miners and a lack of special payments weighed on the numbers.

Indeed, income paid out by miners dropped by a quarter (£1.7bn) in the three months between July and September to £5.5bn. Stripping this out, underlying dividends for the rest of the market were up 7.2%.

Mark Cleland, chief executive of issuer services for the UK, Channel Islands, Ireland and Africa at Computershare, said: “Most mining companies typically pay dividends that vary with the commodity cycle, meaning payouts can rise and fall dramatically.”

Source: Dividend Monitor

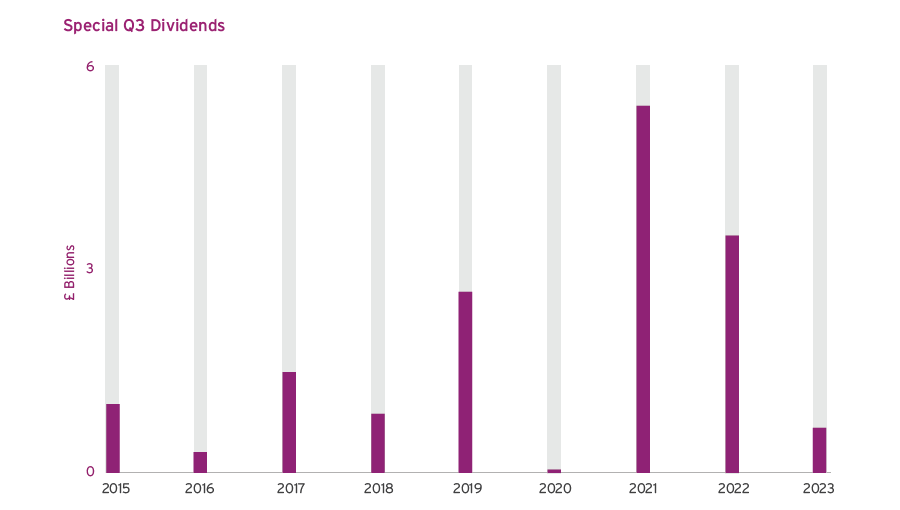

Companies also failed to replicate the amount of special dividends from last year. While these can be hard to predict, the report noted that they have been on a “shrinking trend” after a “bumper couple of years” following the pandemic in 2020.

Special dividends were down almost three quarters over the three months to September with £835m paid out – less than half the average paid out in the same quarter over the past decade.

Source: Dividend Monitor

Cleland noted that a lack of mergers and acquisitions (M&A) so far this year could have been a factor, as business disposals are “usually a catalyst for special payments”.

“The downward phase of the commodity cycle and the dissipation of the post-pandemic catch-up (when some companies used special dividends to make up for a lack of payments during early days of the outbreak)” were also to blame, he noted.

Currency also played a part in the lower third-quarter figures as the pound strengthened over the period against the dollar and euro, meaning dividends paid out in these currencies were comparatively lower than they would have been had the exchange rate not been a factor.

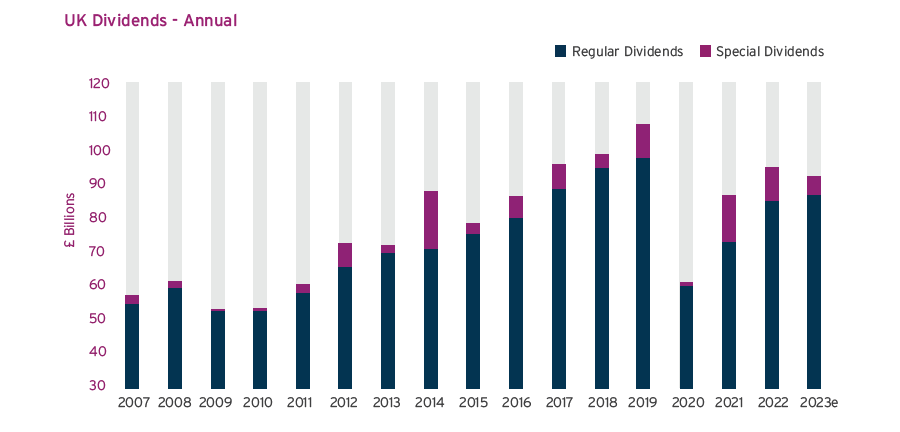

Overall, the disappointing numbers mean the firm now expects headline dividends including special payouts to fall by 3.4% to £90.6bn in 2023.

There was some good news for investors, however. Regular dividends excluding one-off payments were up 2.4% at £26.6bn in the third quarter, with utilities and banks making the biggest impact.

“Current reductions from mining companies are masking much better growth from the wider market, with the fourth quarter already delivering very encouraging growth,” Cleland said.

The report noted that it was “optimistic” about the fourth quarter, with expectations upgraded slightly after some payments were pushed back, while a weaker pound could also boost payouts.

This will not entirely offset the negative impact from miners, however, with the underlying growth rate for the full-year 2023 now set to reach 5.4% for the year: around 0.5 percentage points slower than the forecast three months ago. In total, regular dividends are expected to rise to £88.5bn for the year.

Source: Dividend Monitor

Looking further out, the outlook for dividends is becoming harder to predict, the report noted, as the rising cost of finance and tighter credit conditions will be “an important driver of company earnings and therefore dividend growth”.

“The banking and oil sectors remain healthy at present, but we anticipate a more challenging dividend environment ahead,” Cleland said. “Meanwhile, mining profits remain under pressure and, elsewhere, sectors sensitive to a hard-pressed consumer are more likely to feel the pinch.”