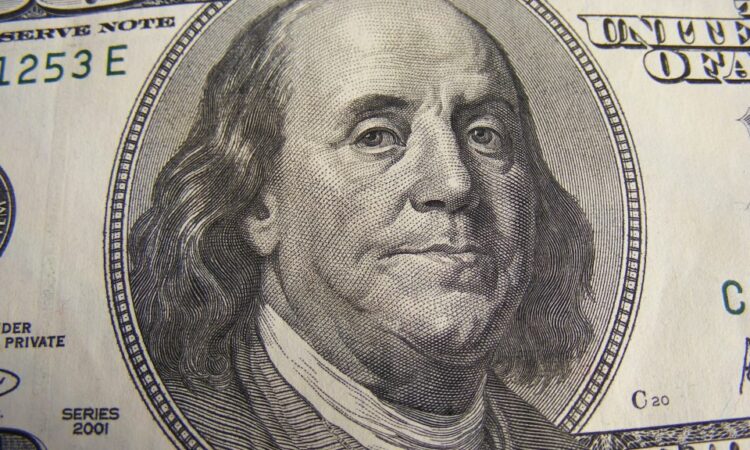

The U.S. dollar experienced a downturn against the majority of local currencies in the forex markets, including that of BRICS. The Russian ruble outperformed the U.S. dollar this month after recovering to 88.60 from 101. The U.S. dollar index (DXY) is now at 103 on Tuesday and remains in the red for two consecutive days. This is the lowest the USD has been since August this year. The dip comes at a time when the BRICS alliance is looking to promote local currencies by ditching the U.S. dollar for global transactions.

Also Read: AI Predicts Gold Price for December 2023 (XAU/USD)

Leading currencies like the Euro, Pound, Yen, Chinese Yuan, and the ruble, among others, came on top of the U.S. dollar this week. Gold prices climbed above the $2,000 mark on Monday and the development is adding pressure on the USD’s prospects.

Read here to know how many sectors in the U.S. will be affected if BRICS stops using the dollar for trade. The move could have lasting implications leading to a paradigm shift in the global economic sector. The dominance of the U.S. in the world’s financial affairs will also be impacted immensely.

Also Read: BRICS: Why Is the Indian Rupee Crashing Against the US Dollar?

BRICS: U.S. Dollar Hits 3-Months Low While Local Currencies Rise

The U.S. dollar hit a 3-month low against a basket of local currencies on Tuesday. Forex traders are now unwinding their positions before this week’s U.S. and Europe’s inflation data. Longing the U.S. dollar at this crucial stage is risky, therefore, traders are selling their positions before the CPI data is released.

Also Read: BRICS: De-Dollarization Gaining Steam in Developing Countries

BRICS countries are also looking to settle oil payments in local currencies and end reliance on the U.S. dollar. The move will impact the USD’s prospects and lose control of the oil sector that it currently dominates. Read here to know why BRICS member UAE is looking to use local currencies for oil settlements and not the U.S. dollar.