(Bloomberg) — Treasury yields continued their march higher, sapping appetite for stocks as traders tracked earnings news and an intensifying diplomatic push to contain the Israel-Hamas war.

Most Read from Bloomberg

Yields on 10-year US government bonds gained for a fourth day, pushing closer to reaching 5% for the first time since 2007.

US equity futures steadied after declines on Wall Street Wednesday, while Europe’s Stoxx 600 Index fell 0.7%. Tesla Inc. slid more than 7% in premarket trading after its third-quarter results missed already low expectations. On a brighter note, Netflix Inc. surged after posting the best quarter for subscriber growth in years.

In the Middle East, United Nations Secretary-General Antonio Guterres is due in Egypt, a day after US President Joe Biden’s visit to Israel, while UK Prime Minister Rishi Sunak has started a two-day trip to the region. Investor attention turns later to US data for fresh readings on the economy. Chair Jerome Powell rounds off another busy diary of speeches by Fed officials.

“US Treasuries have not been fulfilling their usual safe-haven role in recent days, with strong US data trumping worries about a deepening conflict in the Middle East,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “Instead, investors have been looking to gold and oil for a hedge against geopolitical risks.”

Read more: The 5% Bond Market Means Pain Is Heading Everyone’s Way

In currencies, the pound fell as much as 0.4% against the dollar amid concern that the Bank of England may hold off from another rate hike due to concerns over weakness in the UK economy. Israel’s shekel declined for a ninth day, its worst streak since 2020.

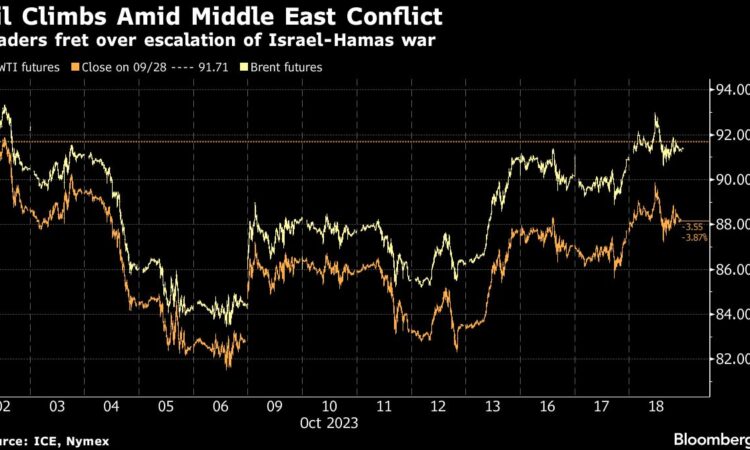

Oil prices slipped from a two-week high as the US eased crude sanctions against Venezuela, denting some of the price gains spurred by the conflict in the Middle East. Gold was steady after delivering gains of almost 7% on haven demand since the Oct. 7 attack by Hamas on Israel.

Key events this week:

-

US initial jobless claims, existing home sales, leading index, Thursday

-

Federal Reserve Chair Jerome Powell, Chicago Fed President Austan Goolsbee, Atlanta Fed President Raphael Bostic, Philadelphia Fed President Patrick Harker, Dallas Fed President Lorie Logan speak at different events, Thursday

-

Japan CPI, Friday

-

China loan prime rates, Friday

-

Philadelphia Fed President Patrick Harker speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 7:21 a.m. New York time

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average were little changed

-

The Stoxx Europe 600 fell 0.7%

-

The MSCI World index fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.2% to $1.0555

-

The British pound fell 0.1% to $1.2123

-

The Japanese yen was little changed at 149.82 per dollar

Cryptocurrencies

-

Bitcoin rose 0.6% to $28,437.5

-

Ether fell 0.6% to $1,553.62

Bonds

-

The yield on 10-year Treasuries advanced five basis points to 4.97%

-

Germany’s 10-year yield was little changed at 2.93%

-

Britain’s 10-year yield advanced four basis points to 4.69%

Commodities

-

West Texas Intermediate crude fell 1.1% to $87.35 a barrel

-

Gold futures fell 0.3% to $1,963 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Chiranjivi Chakraborty.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.