(Bloomberg) — Equity markets started the week on a hesitant note as President Joe Biden and Republican House Speaker Kevin McCarthy prepared to meet Monday in a bid to iron out road blocks in debt-ceiling negotiations.

Most Read from Bloomberg

Talks have whipsawed between progress and deadlock for days as time runs out to reach a deal. Stocks gave up gains on Friday after Republicans temporarily walked out. Treasury Secretary Janet Yellen said Sunday the chances are “quite low” that the US can pay all its bills by mid-June, underscoring the urgency of the situation.

Futures on the S&P 500 edged lower and contracts on the Nasdaq 100 were flat. Treasury 10-year yields ticked lower and the dollar was steady. Europe’s stock benchmark was little changed. Crude oil retreated for a third day and iron ore extended a slide.

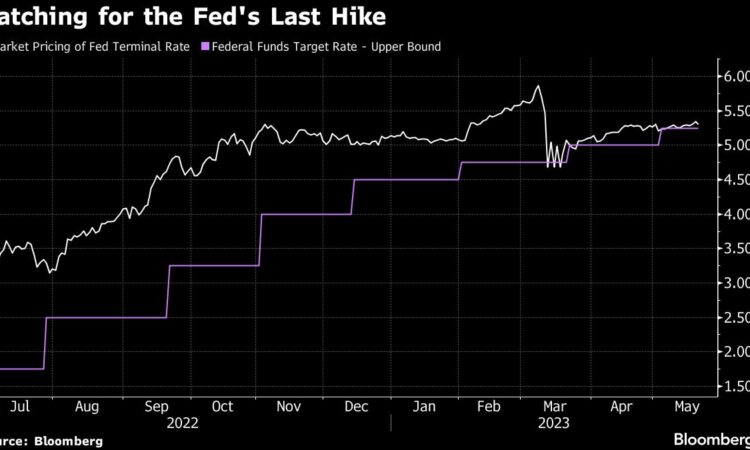

Traders also remain fixated on the path for Fed’s benchmark rate, with bets for a hike in June trimmed to 25% as Jerome Powell signaled a pause.

“The US debt ceiling, and the price action in US banks, are going to dominate the narrative,” Chris Weston, head of research at Pepperstone Group Ltd., wrote in a research note. “Market pricing is firmly back to thinking the Fed will pause.”

Asian shares rose after Biden hinted at improving relations with China. Hong Kong stocks led gains, with the Hang Seng Index jumping more than 1%, pushed higher by technology companies. Historically cheap valuations following consecutive weekly declines added further support. The region-wide rally also saw Japanese, South Korean and mainland China stocks climb, but excluded Australian blue chips.

“I think you’re going to see that begin to thaw very shortly,” Biden said of ties between the US and China in Sunday comments after a Group-of-Seven summit in Japan. He added that his administration was considering whether to lift sanctions on Chinese Defense Minister Li Shangfu.

Meanwhile, Greek bonds rose and the country’s equity benchmark outperformed after Prime Minister Kyriakos Mitsotakis pummeled his opposition in Sunday’s national election, moving a step closer to getting another four-year term. The result sent a signal to markets that investment-friendly policies will continue.

Debt Talks

Biden and McCarthy are scheduled to meet in Washington Monday following a “productive” call between the pair over the weekend. Yet one Republican negotiator is insisting on a multi-year spending limit. Even though the debt limit deadline is more than a week away, the effective deadline for a deal may be much sooner. That’s because lawmakers have to pass whatever Biden and McCarthy can agree to, and that process may take several days.

Stocks are primed to drop if the US fails to raise the debt limit and delays government payments, according to UBS strategists. Although it’s unlikely, if the US formally defaults and delays all payments beyond principal payments for a week, the S&P 500 will fall as much as 20% toward 3,400, the team led by Jonathan Pingle said.

Key events this week:

-

Eurozone consumer confidence, Monday

-

Fed presidents speaking are James Bullard, Raphael Bostic and Thomas Barkin, Monday

-

Eurozone S&P Global Eurozone Manufacturing & Services PMI, Tuesday

-

US new home sales, Tuesday

-

Dallas Fed President Lorie Logan speaks, Tuesday

-

Fed issues minutes of May 2-3 policy meeting, Wednesday

-

Bank of England Governor Andrew Bailey speaks, Wednesday

-

US initial jobless claims, GDP, Thursday

-

Interest rate decisions in Turkey, South Africa, Indonesia, South Korea, Thursday

-

Tokyo CPI, Friday

-

US consumer income, wholesale inventories, durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 was little changed as of 8:18 a.m. London time

-

S&P 500 futures fell 0.1%

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average fell 0.2%

-

The MSCI Asia Pacific Index rose 0.7%

-

The MSCI Emerging Markets Index rose 0.5%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0799

-

The Japanese yen was little changed at 137.91 per dollar

-

The offshore yuan fell 0.2% to 7.0401 per dollar

-

The British pound fell 0.2% to $1.2417

Cryptocurrencies

-

Bitcoin was little changed at $26,834.77

-

Ether rose 0.2% to $1,809.53

Bonds

-

The yield on 10-year Treasuries declined two basis points to 3.65%

-

Germany’s 10-year yield was little changed at 2.42%

-

Britain’s 10-year yield declined one basis point to 3.98%

Commodities

-

Brent crude fell 1% to $74.81 a barrel

-

Spot gold fell 0.1% to $1,975.09 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Tassia Sipahutar.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.