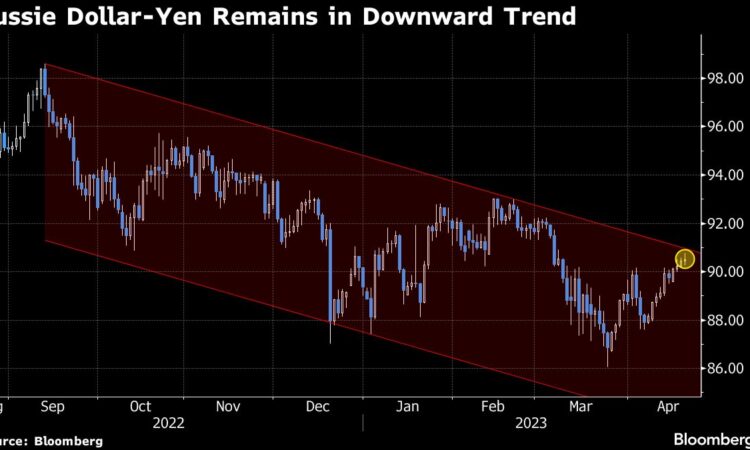

(Bloomberg) — This week may prove crucial for the currency market’s favorite sentiment gauge — the risk-sensitive Australian dollar versus the haven yen — as investors wait to see if it can finally break out of its seven-month downtrend.

Most Read from Bloomberg

The Aussie dollar-yen is in focus after it rebounded from a one-year low last month as traders put aside concerns over the global banking sector. However, the pair may renew its decline if data on Wednesday show Australian inflation cooled off in the first quarter and if the Bank of Japan leaves room for hawkish tweaks to its super-easy policy at Friday’s meeting.

“I am cautious about extrapolating Aussie dollar-yen strength too far,” says John Bromhead, a currency strategist at Australia & New Zealand Banking Group Ltd. in Sydney. “We are trading toward the top of recent ranges in equities and we think there is some value in short positions in Aussie-yen as we approach the start of May, which is typically a period of seasonal weakness for the Aussie.”

A drop in the Aussie dollar-yen may also prove to be a canary in the coal mine for other risk-sensitive currency pairs given concerns about a recession in the US later this year. Over in equities a rally looks to have stalled with the S&P 500 on the cusp of climbing into a technical bull market.

While new BOJ Governor Ueda said earlier this month the central bank’s policy is appropriate, that hasn’t stopped some investors from predicting he will at least end up tweaking yield curve control. That’s because he’s already admitted to seeing positive signs in prices and wages, keeping the door open for a yen rally should the central bank keep alive bets on possible pivot.

Ueda Faces BOJ Bets That Won’t Go Away at Debut Decision

Meanwhile, an Australian inflation surprise could firm up expectations for the Reserve Bank’s next monetary policy decision on May 2. Minutes of the central bank’s April meeting signaled it needs additional data before it can decide on whether another 25 basis points rate increase is required.

“Aussie-yen will find further support in the near term if the market needs to price in more of a chance of another rate hike by the RBA,” says David Forrester, senior FX strategist at Credit Agricole CIB Singapore Branch, “However, upside will be limited by investor reluctance to get short the yen given the lingering risks of a sudden change by the BOJ, the return of US banking concerns and the US debt ceiling.”

Forrester sees the pair declining to 87 over the next three to six months. It was it was at 89.75 on Friday.

Here are the key Asian economic data due this week:

-

Monday, April 24: Singapore CPI, Taiwan industrial production

-

Tuesday, April 25: South Korea 1Q GDP

-

Wednesday, April 26: Australia 1Q CPI, New Zealand trade balance, South Korea consumer confidence, Singapore industrial production

-

Thursday, April 27: New Zealand business confidence, South Korea business surveys

-

Friday, April 28: Bank of Japan policy decision, Japan retail sales and industrial production, Australia 1Q PPI, New Zealand consumer confidence, South Korea industrial production, Taiwan 1Q GDP, Thailand trade and BoP current account balances

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.