- This weekly round-up brings you the latest stories from the world of economics and finance.

- Top economy stories: China’s GDP growth forecasts upgraded; Eurozone recession fears grow; UK narrowly avoids start of recession.

1. IMF upgrades China’s growth forecasts

The International Monetary Fund (IMF) has upgraded its GDP growth forecasts for China in 2023 and 2024. It now expects China’s economy to grow by 5.4% this year, up from its previous forecast of 5%.

However, the IMF also warns of slower growth next year, projecting that China’s GDP will expand by 4.6% in 2024 – up from a 4.2% forecast in October – due to weakness in the property sector and subdued export demand.

The upward revision to growth forecasts is attributed to China’s approval of a 1 trillion yuan ($137 billion) sovereign bond issue and measures to support the economy.

“We have revised up growth by 0.4 percentage points in both years relative to our October projections, reflecting stronger than expected growth in the third quarter and the new policy support that was recently announced,” IMF First Deputy Managing Director Gita Gopinath said.

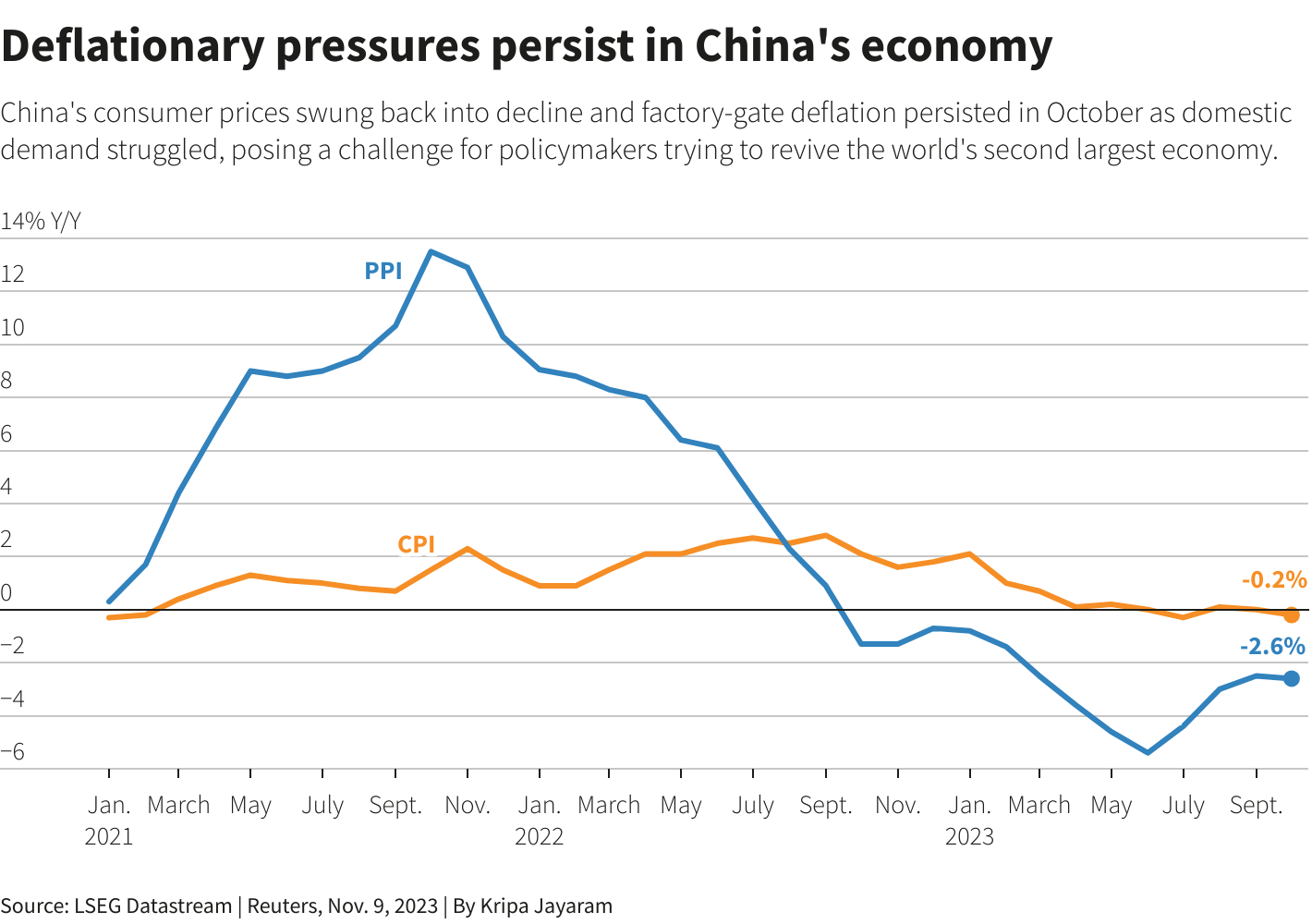

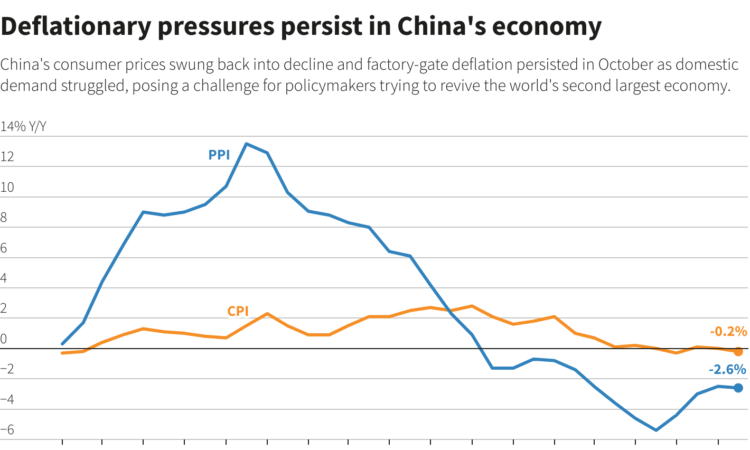

It came as China’s consumer price index dropped 0.2% in October from a year earlier – and 0.1% lower than in September. The producer price index fell 2.6% year-on-year in October, 0.1 percentage points less than economists had predicted.

Meanwhile, China’s imports grew 3.0% in October compared with a year earlier – defying expectations and ending 11 months of decline. However, recent year-on-year contractions in exports accelerated to 6.4%, compared with a 6.2% decline in September.

2. Eurozone recession fears grow

Eurozone recession fears are intensifying as a downturn in business activity accelerates.

Demand in the services industry has weakened further according to new figures, raising concerns of a possible recession.

The composite purchasing managers’ index fell to 46.5 in October, marking the fifth consecutive month it has been below 50 – the level separating growth from contraction.

Manufacturing activity has also taken a step back, with new orders contracting at one of the steepest rates on record.

Services activity in Germany, the largest economy in Europe, began receding again in October. France and Italy also experienced shrinking services sectors.

Retail sales in the 20-country currency union fell 0.3% month-on-month and by 2.9% year-on-year in September, indicating weak consumer demand and further highlighting the prospect of a recession.

The Eurozone economy shrank 0.1% in the third quarter compared with the previous three months.

3. News in brief: Stories on the economy from around the world

The UK economy failed to grow in the third quarter, with a 0% change in GDP. Analysts had expected a contraction of 0.1% and say the UK has narrowly avoided the start of a recession. Meanwhile, British house prices rose for the first time in six months in October, according to mortgage lender Halifax.

Real wages (those adjusted for inflation) in Japan fell for the 18th consecutive month in September, dropping by 2.4% from a year earlier, according to data from the Ministry of Health, Labour and Welfare.

Inflation in Mexico eased again in October – for the ninth month in a row – keeping it at its lowest level for more than two-and-a-half years. But the 4.26% figure for Latin America’s second-largest economy is still above the central bank’s target of 3%.

The financial services industry is facing several future risks, including vulnerabilities to cyberattacks due to artificial intelligence and new financial products creating debt.

The World Economic Forum’s Centre for Financial and Monetary Systems works with the public and private sectors to design a more sustainable, resilient, trusted and accessible financial system worldwide.

Learn more about our impact:

- Net zero future: Our Financing the Transition to a Net Zero Future initiative is accelerating capital mobilization in support of breakthrough decarbonization technologies to help transition the global economy to net zero emissions.

- Green Building Principles: Our action plan for net zero carbon buildings offers a roadmap to help companies deliver net zero carbon buildings and meet key climate commitments.

- Financing biodiversity: We are convening leading financial institutions to advance the understanding of risks related to biodiversity loss and the opportunities to adopt mitigation strategies through our Biodiversity Finance initiative.

Want to know more about our centre’s impact or get involved? Contact us.

Government spending helped the Philippine economy grow by 5.9% year-on-year in the third quarter, while inflation slowed in October for the first time in three months.

German industrial production fell by 1.4% month-on-month in September, reflecting the impact of a recent decrease in incoming orders.

Peru’s central bank has lowered its benchmark interest rate by 25 basis points to 7%. It is the third consecutive cut as the country eases borrowing costs to help it out of a recession.

4. More on finance and the economy on Agenda

Agenda is running a series of articles on different aspects of central bank digital currencies (CBDCs), written by Sandra Waliczek, the World Economic Forum’s Blockchain and Digital Assets lead:

While rising numbers of countries are considering CBDCs, how are they different from cryptocurrencies and stablecoins? Waliczek explains that CBDCs are issued and backed by a central bank, giving consumers guaranteed protection, although some concerns remain around data protection and online privacy.

Ensuring data privacy and consumer protection are of paramount concern in discussions around CBDCs. Complex coding systems involving cryptography as well as legal frameworks will be key to embedding privacy and keeping customer data safe. For more details, dive into the Forum’s Digital Currency Governance Consortium White Paper Series.