There are 3 big reasons why the dollar’s dominance against other currencies won’t be waning anytime soon

-

The US dollar will not lose its dominance to other currencies, according to the Carson Group.

-

Recent actions by Russia and China have led some to speculate that the US dollar is at risk of losing its reserve currency status.

-

“The US dollar’s dominant role is not going to end any time soon, especially since there’s no good alternative,” the Carson Group said.

The US dollar’s dominant role as the world’s reserve currency is not going to end anytime soon, according to a Tuesday note from the Carson Group.

Recent agreements between China and Russia, combined with rising tensions between those two countries and the US, have sparked speculation that the US dollar is going to lose its dominance within the next decade.

“The intensifying geopolitical contest between Washington and Beijing will inevitably be felt in a bipolar global reserve currency regime,” economist Nouriel Roubini said earlier this year.

But according to Carson Group’s global macro strategist Sonu Varghese, the US dollar’s role in the global economy is not at risk of ending.

“The US dollar’s dominant role is not going to end any time soon, especially since there’s no good alternative,” Varghese wrote.

Detailed below are the three big reasons why the US dollar will stay resilient despite ongoing threats from global currencies, according to the Carson Group.

1. “The World has confidence in the US, and thereby the US dollar”

“The US has the world’s deepest and most liquid financial markets thanks to the following: the size of the US economy, the strength of the US economy, open trade and capital flows, with fewer restrictions than a lot of other countries, and strong rule of law and property rights, with a history of enforcing them,” Varghese said.

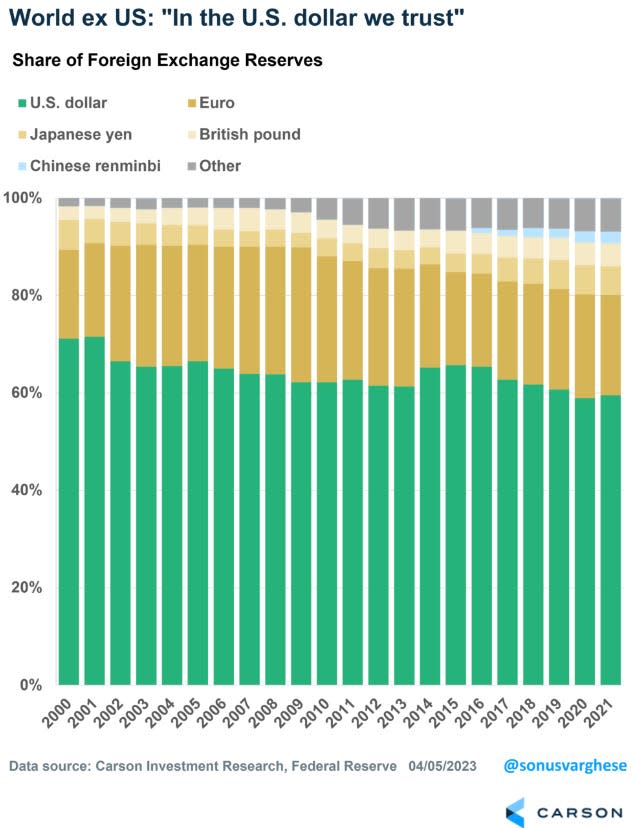

“This is why, despite the US making up just about 25% of the world economy, about 60% of global foreign currency reserves are denominated in USD,” Varghese said.

While the US dollar’s made up 71% of global foreign currency reserves in 2000, it’s current level of 60% is three times larger than the euro’s 21%, and more than ten times the size of the yen’s 6% and British pound’s 5%.

2. “The US dollar is dominant in trade and international finance”

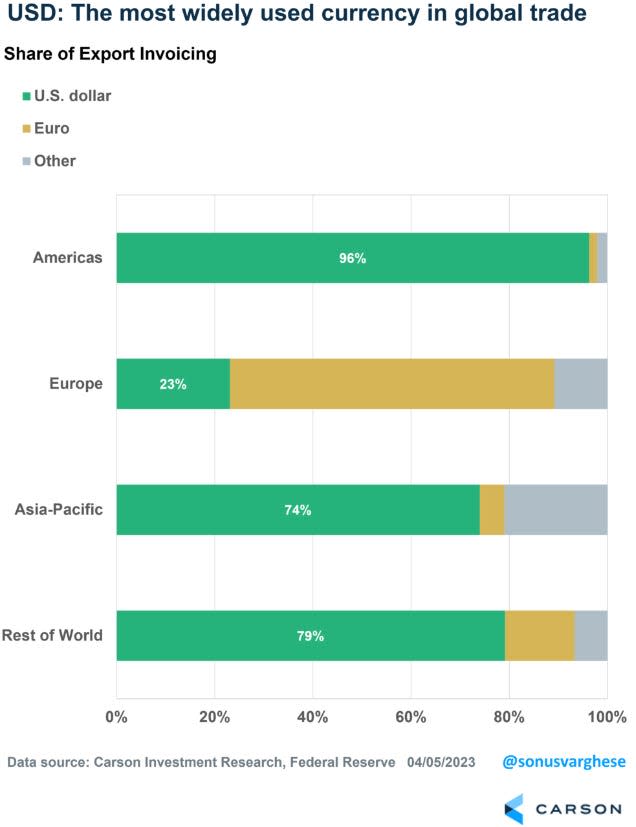

“The USD is the world’s most popular medium of exchange when it comes to trade, even beyond North & South America. Outside of Europe, where the euro is naturally dominant, more than 70% of exports are invoiced in US dollars. That’s not likely to change anytime soon, especially with so many countries and companies involved,” Varghese said.

“Network effects can be extremely hard to dislodge. It won’t be easy to convince people across the world that they have to move their assets from the US dollar to another currency, let alone make the switch without any risk.”

3. “The US is willing to maintain massive trade deficits”

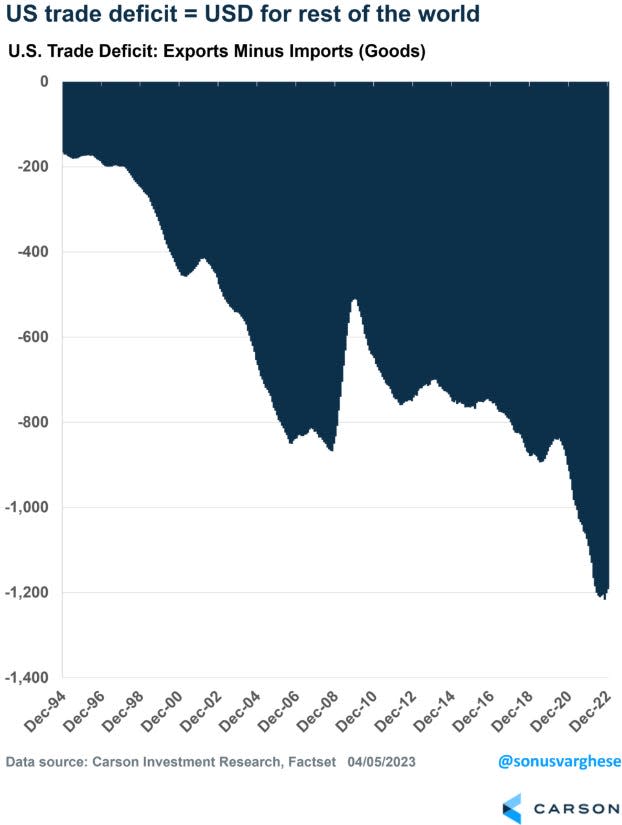

Americans bought $3.3 trillion in goods from foreign countries in 2022.

“In an ideal world, foreigners would turn around and use those dollars to purchase stuff made in the USA, and trade would be balanced, Varghese said.

But that’s not the case. Instead, foreign countries only bought $2.1 trillion of goods from America in 2022. That’s a big trade deficit that the US is willing to maintain, and it leaves foreigners holding onto a lot of US dollars that it needs to put somewhere.

“Foreigners turn around and buy the safest, most liquid security in the world: US treasuries. Some of them also simply hold USD in cash. These are liabilities of the US government that the US is more than willing to issue. No other country, including the Eurozone, looks remotely capable or willing to do that anytime soon,” Varghese said.

Read the original article on Business Insider