Once again, Hong Kong has been feeling the liquidity pinch from sustaining the Hong Kong dollar (HKD) peg on the back of rising US interest rates. Capital outflows have forced up the Hong Kong Interbank Offered Rate (HIBOR) and put a squeeze on the Hong Kong stock market (Exhibit 1). The good news is that when the US interest rate cycle starts to ease, this liquidity squeeze should fade.

As we have long argued, the HKD-US dollar currency peg (or the Link Exchange-Rate System, LERS) is sustainable as long as there is the political resolve to maintain it and the Hong Kong Monetary Authority (HKMA) has the tools and resources to defend it (see here and here). Pegging the HKD against the renminbi (RMB) is still not an advisable alternative, in our view.

Slower HK banks widen interest-rate spread

When the US Federal Reserve (Fed) started raising interest rates in March 2022, the HKMA followed in lockstep under the HKD peg arrangement, in theory to prevent interest rate arbitrage (see below). The peg also has a built-in self-adjusting mechanism that requires the HKMA to buy HKD when it is under persistent downward pressure (and sell HKD when it is under persistent upward pressure) to keep the HKD-USD exchange rate within the Convertibility Undertaking range of HKD 7.75–7.85 per US dollar.

However, interest rate arbitrage can still arise because the banks in Hong Kong do not necessarily follow the HKMA’s interest rate action. Movement of the market’s interest rate depends on interbank liquidity, or the aggregate balance. Until late 2022, Hong Kong banks lagged their US counterparts in raising interest rates due to ample liquidity in Hong Kong (here) (Exhibit 2).

The Hong Kong banks’ delayed action in following the US interest rate trend between March and late 2022 caused a widening of the USD-HKD interest rate spread. This in turn prompted many market players to engage in foreign exchange carry trades – borrowing low interest rate HKD to buy high interest rate USD – as postulated by the interest rate parity theory under open capital account and cross-border asset substitutability conditions.

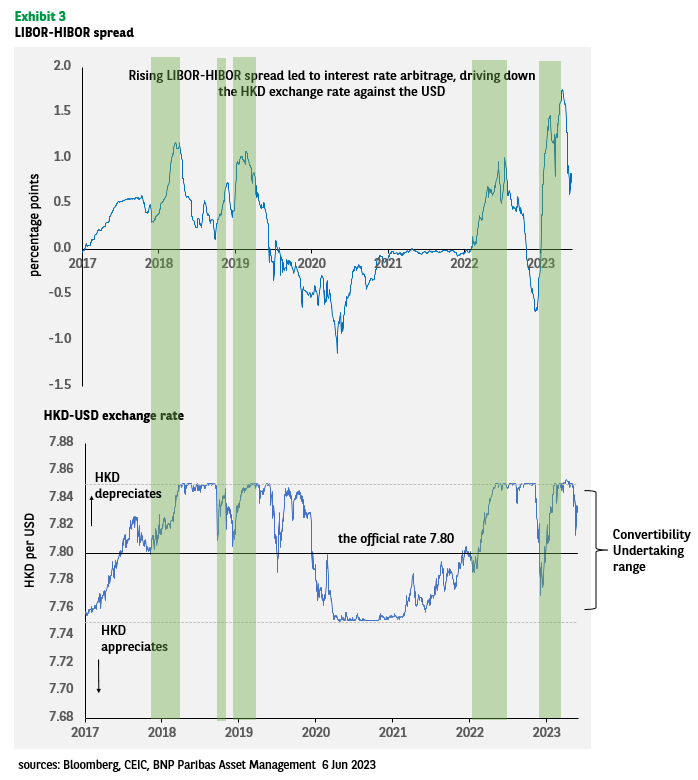

The resultant capital outflows put downward pressure on the HKD exchange rate, triggering the HKMA’s automatic buying of HKD. This happens every time the HK-US rate spread widens (Exhibit 3).

Capital outflows also reduce the aggregate balance, forcing Hong Kong banks to raise interest rates to catch up with the US rate trend. The resultant decline in the HK-US rate spread reverses the capital outflow incentive, thus providing support for the HKD and restoring its stability towards the 7.8 official rate (see Exhibit 3).

Liquidity may tighten further

At the time of writing, the HIBOR-London Interbank offered rate (LIBOR) spread is still at almost one percentage point. This, combined with poor sentiment on the Chinese market, means the incentive for capital outflows could remain.

The currently low aggregate balance is not unprecedented. During the Asian Financial Crisis in 1997-98, Hong Kong’s aggregate balance dropped to about HKD 2.5 billion, reflecting a significant squeeze on Hong Kong’s interbank liquidity. As a result, the 3-month HIBOR rose to more than 15%, curbing the incentive for capital outflows.

Currently, the 3-month HIBOR is still only 4.8%. So, if capital outflows persist, the aggregate balance will fall further and HIBOR will rise further. All else being equal, the equalisation of HIBOR and LIBOR (or even HIBOR overshooting LIBOR) should eventually reverse the incentive for capital outflows.

However, since the HKD peg is not going to be dismantled, HIBOR could continue to rise and remain volatile for as long as the Fed keeps the prospect of further rate hikes on the table. Clearly, when the exchange rate is not going to change, nominal interest rates must move to absorb the shocks and capital flows.

HKD-RMB peg?

There are calls on Hong Kong to ditch the US dollar and switch to a peg against the RMB. Despite Hong Kong’s increasing economic integration with mainland China, this does not appear to be an advisable alternative at this point because the HKD is a hard currency under an open capital account while the RMB is a soft currency under a closed capital account.

A HKD-RMB peg also means that Hong Kong would have to follow China’s monetary policy, a move that would not be credible for retaining international confidence before China’s monetary policy management matures.

Crucially, pegging the HKD to the RMB also means China would have to make the RMB fully convertible into the HKD, which means indirectly opening China’s capital account to accommodate the changing demand and supply conditions of the HKD. However, opening the capital account fully is not yet on Beijing’s policy agenda.

The ability of the HKD-USD peg to come through various global economic and financial shocks with manageable negative local market consequences highlights the credibility of the peg. High interest rate and economic volatility is a practicable price to pay for anchoring international confidence and eliminating foreign exchange risk in Hong Kong’s small open economy on which domestic macroeconomic policies do not have effective influence (here).

Disclaimer

![]()

Please note that articles may contain technical language. For this reason, they may not be suitable for readers without professional investment experience. Any views expressed here are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may take different investment decisions for different clients. This document does not constitute investment advice. The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns. Investing in emerging markets, or specialised or restricted sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions). Some emerging markets offer less security than the majority of international developed markets. For this reason, services for portfolio transactions, liquidation and conservation on behalf of funds invested in emerging markets may carry greater risk.