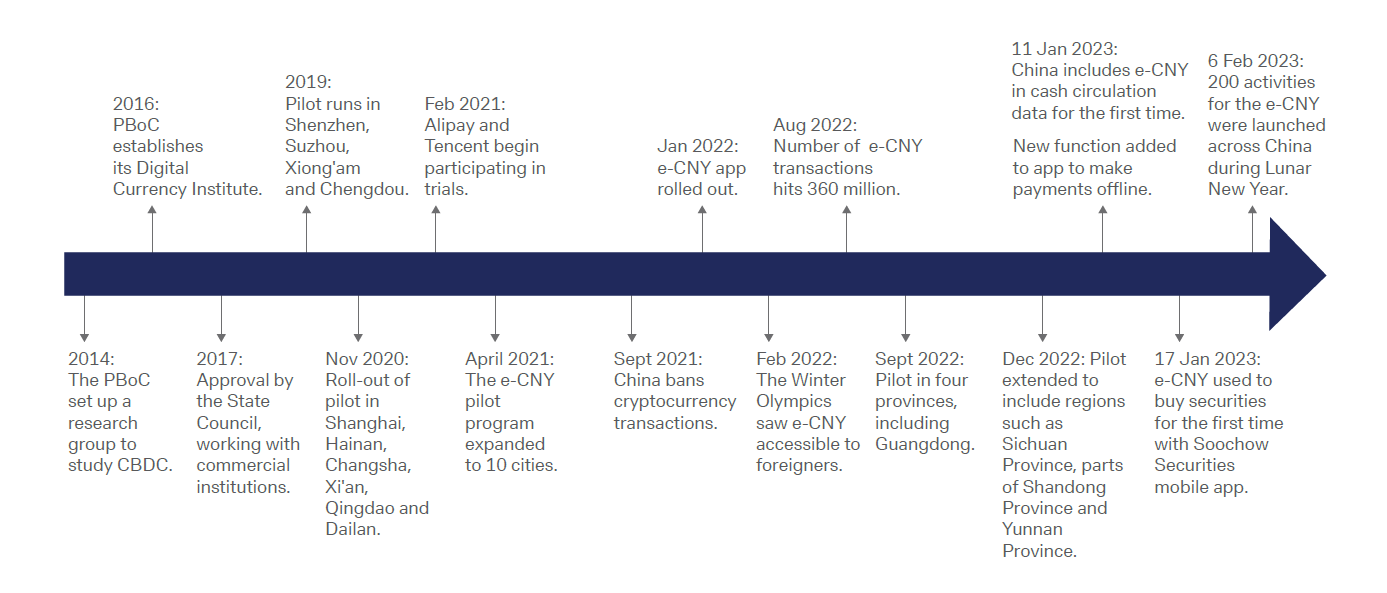

Figure 2: Timeline of the development of China’s CBDC

Sources: Deutsche Bank, PBoC

As the authors note, China has credentials for successful CBDC experimentation – a young, tech-savvy population and – since the mid-2000s – a direct switch from physical cash to mobile payments, now established as the payment method of choice with 65% of all transactions in 2022. Both the government and the PBoC have provided backing and infrastructure to support e-CNY usage. Fintech platforms Alipay and Tencent joined in February 2021, when both began participating in trials to offer services through the e-CNY.

Yet China’s domestic uptake is also sluggish. In June 2021, fewer than 71 million digital wallet transactions were recorded, with a value of RMB 34.5 billion, equivalent to 0.04% of total RMB in circulation. By August 2022 monthly transactions were at 360 million, valued at over RMB 100 billion, but last December saw e-CNY transactions still only represent 0.13% of currency in circulation.

Early CBDC adopters also include the East Caribbean, Nigeria and Jamaica. In April 2021, the Eastern Caribbean launched DCash, the first digital currency used in a monetary union, with eight of nine member states participating. The CBDC has no transaction fees and aims to facilitate digital money transfers made to consumers and merchants. An early setback in January 2022 saw the DCash programme crash due to an ‘expiring certificate’ on the Hyperledger Fabric that hosts the CBDC, and the digital currency was offline for eight weeks. The Eastern Caribbean Central Bank intends to introduce an e-commerce function so businesses can accept DCash via websites and in February engaged a local marketing agency to promote the scheme.

Nigeria became the first African nation to launch a CBDC in October 2021, with the release of the eNaira. Initially only individuals with a bank verification number could open a wallet (about 26% of the population). While the Central Bank of Nigeria targeted eight million users by August 2022, fewer than one million Nigerians (of 220 million) adopted the digital currency. A cash crunch last December, when insufficient new banknotes were printed to replace withdrawn ones, sparked major demand for alternative payments – including the eNaira. Reports show there was a 63% surge in the value of eNaira transactions to 22 billion Naira and 13 million more wallets have been opened since October.

Jamaica followed, launching its own CBDC – the Jam-Dex – in July 2022 through digital wallet the Lynk app, while the Bank of Jamaica offered a $16 incentive for the first 100,000 users. Activating wallets required users to upload one government-issued photo ID and a copy of their taxpayer registration number. The Bank of Jamaica also implemented a public education programme under the banner “No Cash, No Problem.” By August 2022, there were more than 120,000 users and over 2,300 merchants on the Lynk platform. More recent rollouts to new wallet providers saw JN Bank onboarded last December, after receiving US$1m in CBDC from the central bank.