Taliban Foreign Minister Amir Khan Muttaqi meets with China’s Foreign Minister Wang Yi

Taliban officials attended China’s Belt & Road Forum last week. What is the economic likelihood for economic development in Afghanistan?

By Farzad Ramezani Bonesh, with additional comments by Chris Devonshire-Ellis

Introduction

Although Afghanistan’s economy had experienced reasonable growth until 2001, from the US invasion until now, it has declined and become a dependent, consumption economy, relying on the import of goods from supportive nations and what foreign aid it could muster. In 2000, Afghanistan was enjoying GDP growth rates of 8%. By 2003 that had plummeted into a strong and immediate recession.

Today, with the Taliban in power from August 2021, and the analytical assistance of countries such as China and Russia, the evident collapse of the economy during the US occupation was revealed. Drought, loss of crops, loss of human capacity, the immediate suspension of foreign aid, international financial relations, sanctions, political instability and insecurity, migration and internally displaced persons, together with shocks caused by Covid put a strongly negative effect on the country’s economy.

Although the immediate presence of the Taliban being in power had negative effects on business, industry, the unemployment rate, a mass departure of the upper and middle class society, and declines in domestic production, investment, produced a 20.7% decrease in Afghanistan’s GDP in 2021. Since then however, the conditions in Afghanistan have changed.

The Taliban’s Approach to Afghanistan’s Economy

During the Taliban’s tenure in 1990, its economic performance in Afghanistan was very destructive. But in the new era, these conditions have also changed. It appears that the new generation of Taliban leaders, with the experience of the previous round, now have an increasingly serious view of the national economy and do not want a destructive economic performance to be their Achilles’ heel.

Accordingly, although there remain difficulties, today’s Taliban pursue efforts, policies, and strategies in both domestic and foreign fields. Although the Taliban leaders priority is not the Afghani economy, their attention to solving the challenges in this field has increased.

The leader of the Taliban, Mullah Hibatullah Akhundzada, has given decrees in the economic sector, such as the ease of businessmen’s work, the growth of industries and domestic production, trade, and self-sufficiency. Meanwhile, the presence of Mullah Abdul Ghani Baradar, the economic deputy of the Taliban prime minister, being at the head of the economic apparatus has been able to show a significant impact on the policy-making and implementation of strategies and tactics. From this point of view, the economy is one of the fundamental pillars of the Taliban government, and efforts to strengthen Afghanistan in the economic field are necessary for governance.

In this approach, the Taliban in Afghanistan’s domestic sector is focused on increasing government revenue through customs management and tax collection, fighting administrative corruption, controlling foreign exchange rates, and paying attention to increasing production.

In the most recent World Bank report concerning Afghanistan’s 2023 economy, there are also positive signs of inflationary decreases, currency stability, better cash flow management (such as paying salaries on time), improved access to bank deposits, and an increase in domestic income with better management of collection of taxes.

Over the past two years, Taliban officials have sought to address revenue shortfalls by cracking down on corruption in key areas such as customs and relations with the private sector and foreign investors.

Despite humanitarian aid, increased commercial activities, prohibiting the use of foreign currencies while rehabilitating the Afghani currency, introducing strict restrictions on the exit of the US dollar from Afghanistan, and criminalization of online trading, the Afghan currency compared to the main commercial currencies in the first half of 2023, only substantially slowed its spiralling decrease in value. Proper fiscal management also crept in for the first time in decades. Between March 2022 and March 2023, the Taliban earned about US$2.2 billion, due to the effective collection of taxes in Afghanistan.

Restrictions against smuggling imports and capital flight, restrictions on banking transactions to prevent the collapse of banks, macroeconomic management, and so on also indicate some recent successes.

In addition, during the past two years, the Taliban have implemented various infrastructure and economic projects, such as the production of solar electricity in Kabul, and six other energy projects at a cost of US$75 million. The signing of a memorandum of cooperation with a number of institutions, have included the reconstruction of the Salang Road, a vital connectivity tunnel in the Hindu Kush, and the Jabal al-Sarraj cement plant, with US$200 million invested in by Qatari businesses. Productivity doubled this year.

In order to increase its acceptance, the Taliban has imposed more control over the price of food and raw materials, a 50% reduction in the tax on food imports, signed a US$200 million contract with Kazakhstan to supply grain, and encouraged farmers to grow food crops while banning cultivated opium.

Afghanistan Infrastructure Developments

The Qosh Tepa Canal, one of the largest water supply canals in Afghanistan on the Amu Darya River, is under construction. It is 285 km long, has a 100 meter width and is scheduled to be completed by 2028. The canal is expected to provide 20 billion cubic meters of water transfer capacity, making Afghanistan close to being self-sufficient in agriculture.

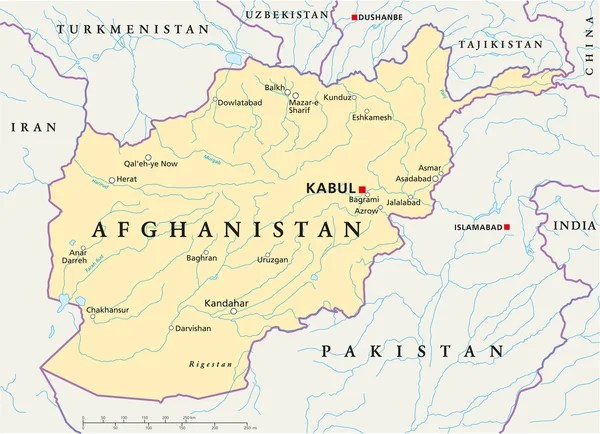

In addition, the Uzbekistan-Afghanistan-Pakistan transit rail project has received the green light, being a 760km route from Termiz in Uzbekistan via Mazar-e-Sharif, to Karachi Port on Pakistan’s Gulf coast.

The construction of the third section of the Khaf-Herat railway is already underway, and when complete will connect Afghanistan to Iran, and via the Caspian Sea, to Europe.

Foreign Investment

The emphasis of officials like Mullah Baradar is to accelerate the process of attracting domestic and foreign investment; and encouraging the private sector to invest and increase cooperation. It is having some success – 21 foreign investors have been registered in Afghanistan so far in 2023. That was the primary driver for Afghani officials to attend the third Belt & Road Forum. They have also been active in attending similar events such as SPIEF in Russia. These overseas visits, attendance at meetings, and negotiations have played an effective role in the economic-oriented foreign policy of the Taliban.

The Taliban want the lifting of Western US economic sanctions, and increased aid, as well as the resumption of projects related to climate change, and recognition by other countries. For example, since 2021, Taliban leaders have been seeking China’s consent for Afghanistan to join the Belt & Road Initiative, and the expansion of the Pakistan-China CPEC multi-billion dollar investments and infrastructure projects into Afghanistan. That was finally a done deal in May this year.

Future Infrastructure Projects

With Afghanistan now part of the BRI, opportunities such as infrastructure development projects such as the on-going development of the Torkham-Hayratan railway, and a thermal electricity production with a capacity of 400 megawatts have been proposed to Beijing. The Taliban considers the idea of a direct road between China and Afghanistan through the Wakhan corridor to be feasible, although that may be some way off yet.

From the Taliban’s point of view, the BRI can be Afghanistan’s gateway to the regional economy and meet the need for providing a strong and independent financial base.

In addition, the increase in bilateral trade with Afghanistan’s neighbors, the opening of China’s air corridor between Urumqi and Kabul, the transfer of commercial cargo through the Afghanistan-China Economic Corridor, attracting new foreign investment of US$7 billion dollars, the growth of Afghanistan’s exports, and the 36% increase in imports in the first five months of 2023 are all noteworthy.

Afghanistan’s 2023 Foreign Trade

From January to May 2023, and the last available reliable data, Afghanistan’s total exports reached US$730 million, an increase of 9% compared to the same period last year. If taken over 2023 as a whole, this would be indicative of Afghani exports amounting to about US$1.75 billion.

Textiles and coal grew by 38% and 16%, respectively. Afghanistan’s largest markets are Pakistan (59% of total exports) and India (23%). Afghanistan’s imports from January to May 2023 increased by 36%, reaching US$1.3 billion. Food products (about a quarter of imports) showed a growth of 4.5% while and minerals (including fuel) grew by 20%.

Otherwise, Iran with 21%, Pakistan (18%), China (18%) and Russia (10%) remain the most important countries of import origin. During 2023, Afghanistan showed a trade deficit and an increase in its negative trade balance.

Afghanistan’s Challenges and the Taliban Approach

Although the Taliban is trying to take over the economic management of Afghanistan, the actions of the Taliban authorities and their direct and indirect approaches have also had negative consequences on the economy. After the Taliban came to power in Afghanistan, the GDP dropped by 35% and the per capita income decreased by 28% until the end of 2022.

The Taliban has not yet been able to form its own financial institutions and practically has no monetary policy. Still, Western, and Islamic-sourced foreign aid, contributions from the United Nations (US$1 billion in H1 2023) have helped stabilize the economy and supported the Afghani currency.

However, high dependence on foreign aid and the risk of aid reduction due to Taliban societal restrictions could see Western aid reduced by 30% in 2023. If so, the per capita income of Afghan citizens will decrease from US$512 in 2020 to US$332 in 2024.

The World Bank has stated this month that Afghanistan’s economy is fragile. According to the bank, Afghanistan’s service sector decreased by 6.5% in 2022, and the agricultural sector decreased by 6.6%. The industrial sector also saw a contraction of 5.7%.

Inflation, while negative in October, has significantly reduced from the previous peak of 18.3% in April. However, this decrease in the inflation rate does not necessarily mean a decrease in poverty, nor an increase in people’s purchasing power, and a negative inflation rate is more indicative of the depth of the recession.

Afghanistan is facing the largest humanitarian crisis in the world – somewhat neglected now due to Ukraine and Israel taking the headlines amongst US weariness of Afghanistan following their embarrassing retreat in 2021. But the problem hasn’t gone away -the risk of starvation of 29.2 million people remains serious.

Afghanistan needs about US$3.2 billion in aid, but humanitarian aid organizations have repeatedly warned that the amount of aid is currently insufficient. If this continues, any large wave of displaced people and refugees will have destructive effects on the country’s economy and impact neighbouring Pakistan, Iran, and India.

The future growth of Afghanistan therefore depends on improving the human capital of education and the participation of women in the workforce. Here, Taliban policies are harmful to the economy. The ban on women’s education and work will lead to an economic loss of up to US$1 billion, or up to 5% of the country’s GDP. Damage to the long-term economic and social development of Afghanistan will also accelerate the “brain drain”. An estimated 80% of Afghanistan’s economy depends on the role of women. Yet strict laws are having a negative effect on international aid to Afghanistan.

The ban on poppy cultivation for opium exports has also resulted in a loss of about US$1 billion of annual income, while if support mechanisms are not provided for Afghan farmers, the negative consequences such as the disappearance of 700,000 jobs in the last two years and the influx of people to the neighbors will also increase.

The lack of international recognition of the Taliban, the lack of reliable stability, and the vague and uncertain political future in Afghanistan’s future political landscape are the biggest obstacles for domestic and foreign investors in Afghanistan’s economy.

The Taliban has not provided the groundwork as yet for the meaningful participation of ethnic groups, other religions, women or the inclusive government; meaning it has failed to gain international recognition and remains in a ‘grey’ area of international dialogue with limited room for manoeuvre.

The Taliban Vision

The Taliban’s track record has not been successful in public welfare, entrepreneurship, unemployment rate control, and significant investment attraction. The Taliban is still not a legitimate government; and tends to prioritize its authoritarian attitude and military capabilities. Therefore, the lack of access to a comprehensive, unified government has a negative effect on the country’s economic outlook.

A high unemployment rate of nearly 30% also paralyzes the domestic economy. The danger of increasing Afghans’ departure from the country due to the inability of the Taliban, and a new wave of migration from Afghanistan increases the internal and external opposition to the Taliban. It is inadvertently creating Afghanistan’s own internal pressure.

Externally, the lasting effects of US sanctions and the freezing and subsequent partial dispersal of Afghani Central bank assets held in the United States to victims of 9-11 families continue to weaken the central bank and continue to cause problems in international transactions.

Over the past two decades, huge financial aid from the international community, drug income, and cash donations from Afghan immigrants have been important sources of finance to strengthen Afghanistan’s economy. But all these resources are also at risk, especially as Afghan family members abroad repatriate US$1 billion back to Afghanistan every year.

Despite the concerns about the diversion of aid to consolidate power, the bypassing of some controls by the Taliban, the aid of international institutions and actors, the expansion of sanctions exemptions, international conferences for financial aid to Afghanistan, the injection of cash into the Afghan economy, can be fundamental to stabilize future conditions. Any worsening of the economic crisis, famine, human and food crisis, and the resulting consequences can become the basis for further weakening of the economic management of the Taliban.

Afghanistan’s economy is fragile. However, the private sector in Afghanistan can be an effective driver for development. Therefore, the reactivation of the Central Bank of Afghanistan and the private sector will be very important.

Afghanistan’s GDP is difficult to measure, but with real GDP growth forecasted at 1.3% in 2023 and 0.4% in 2024. The prospects of Afghanistan’s economy depend on security, political stability inside Afghanistan, and the coordination of actors and international institutions.

Any kind of insecurity, lack of human capital, organizational weakness, corruption, and geostrategic rivalry of most foreign actors will cause further weakness in Afghanistan’s economy.

The behavior of the Taliban government and the lack of a constitution have subsequently had a negative effect, despite the bright spots. The on-going risk of civil war with the opposition, further divergence of disaffected commanders and non-Pashtun members of the Taliban, the deterioration of the military situation, and the movement toward civil war could all result in devastating effects on the economy.

The Taliban at some point need to provide a rather more liberal approach to the Afghani society, although it has to be recognized they are still going through a process of de-weaponising rural areas to diminish the risk of future civil war. When that process has been completed, it would be an opportune moment to unfreeze Afghani assets held overseas, reintroduce less, not more restrictions on the workforce and embark upon a national development and reform process across all layers of society – something the Chinese are very familiar with.

Related Reading

About Us

Silk Road Briefing is written and produced by Dezan Shira & Associates. As global geopolitics change the way supply chains are developing, we provide regional analysis of the emerging trends and where opportunities for foreign investors are. Our firm provides market research and intelligence for issues affecting all the Belt and Road Initiative countries with assistance from our wide business network of over 100 regional offices. To learn more about how we can help your business evaluate the changing dynamics, email us at [email protected] or visit www.dezshira.com