By Stuart Talman, XE currency strategist

Friday’s US session was punctuated by busy newsflow with the release of the retail sales report and Uni of Michigan consumer sentiment survey, the commencement of 1Q US earnings season and speeches from multiple Fed officials.

Following encouragingly softer-than-expected key inflation reads on Wednesday and Thursday which weighed on the US dollar, the final session of the week delivered a dollar rebound.

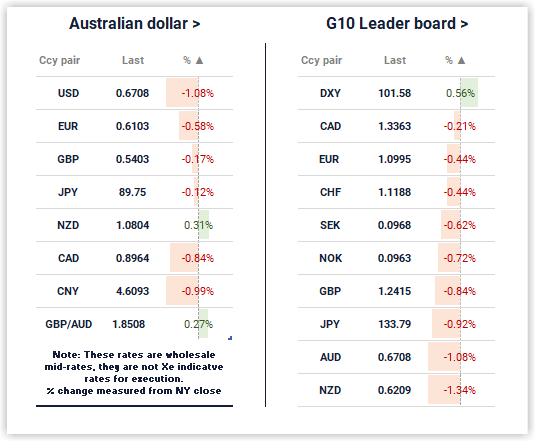

Having ripped through 63 US cents 24 hours earlier, the New Zealand dollar reversed all of Thursday’s gains, falling back through 62 US cents. Shedding over 1.30%, the Kiwi was the worst performer amongst its G10 peers.

The Kiwi was also the worst weekly performer, declining over half-a-percent against the dollar.

Against the other majors, the week’s largest losses occurred versus the CAD (-1.66%), the EUR (-1.43%) and the AUD (-1.12%).

The Kiwi’s sole weekly gain occurred against the JPY (+0.64%).

Heading into the final session for the week, NZDUSD was on track to log its first weekly close above 0.63 since the second week of February having mostly traded in a tight 0.6290-0.6310 range throughout Friday’s Asian and European sessions.

However, the New York morning brought an aggressive U-turn.

The catalyst – a speech from Federal Reserve Governor, Christopher Waller.

A noted hawk, Waller spoke to the lack of progress the Fed has made in returning inflation to their 2% target, flagging that more rate hikes would likely be needed. He had this to say:

Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further. How much further will depend on incoming data on inflation, the real economy, and the extent of tightening credit conditions.

This is clearly not aligned to both the bond market or stock market, the former pricing in circa half-a-percent of cuts before year-end, the latter extending higher in hopes of a soft landing or at worst, a mild recession.

Waller also commenting:

Another implication from my outlook and the slow progress lately is that, as of now, monetary policy will need to remain tight for a substantial period of time, and longer than markets anticipate.

The Fed, the bond market, the stock market – all have differing views.

Renowned investor, Marty Zweig famously said in 1970: “Don’t fight the Fed.”

Waller’s words had an immediate impact – bond yields and the dollar ripped higher. The yield on the policy sensitive US 2-year bond ending the week above 4% for the first time in over a month whilst the yield on the benchmark 10-year bond reclaimed territory north of 3.50%.

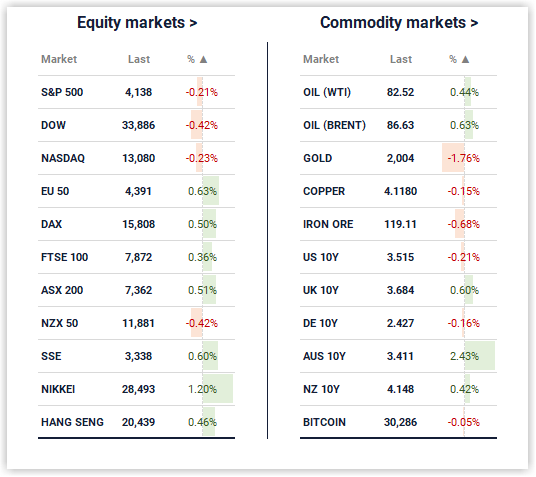

US equities, which have performed well through the first 3½ months ended the week on softer footing but maintain their upside bias – the S&P500 gaining +0.79% for the week, the Dow +1.20%, and the +Nasdaq, 0.29%.

Bond yields have based as stability returned to the US banking sector, tracking back up into the upper region of the past month’s range.

If Waller’s comments prove an accurate representation of the broader FOMC, leading to the Fed hiking at the 03 May meeting, with perhaps more to come, bond yields will extend higher whilst nervous equity market bulls exit the 2023’s 1H rally.

Incoming data flow will dictate when the Fed enters its next cycle phase from tightening to pausing.

Last week’s soft CPI and PPI data points and the week prior’s ISM PMIs, JOLTS and ADP Employment downside misses suggest the Fed is one more 25bps hike away from pausing.

This could prove incorrect should inflation not meaningfully recede in the months ahead whilst the US economy remains resilient.

In this scenario, bond yields remain bid, the dollar supported, the Kiwi fails to break through major resistance near 64 US cents, trading closer to 0.60…..perhaps below.

US data flow is quiet this week, the focus shifting to 1Q US earnings season which commenced with the big banks on Friday. Broadly speaking, earnings have come in stronger than expected over the past few quarters, indicative of a robust and resilient US economy.

It will be interesting to view the market’s reaction should this trend continue.

Will risk assets rally on the view that the US economy experiences a mild recession, or will they sell-off on expectations of further Fed rate hikes, required to further cool demand to rein in multi-decade high inflation.

Or we may finally see widespread earnings misses and downgrades as the lag effects of monetary policy materialise.

US earnings, macro-economic data flow and Fed rate hike expectations likely dictate the market’s next key directional move over the next few weeks.

Busier economic calendars in the EU and UK deliver PMIs, and jobs numbers, CPI and retail sales for the UK economy. The euro and pound continue to outperform, NZDGBP trades at 6-month lows whilst NZDEUR logs 18-month lows.

Thursday’s 1Q CPI report is the major local event.

Directionally, the Kiwi remains directionless.

The final two days of last week threatened an important topside breakout above 63 US cents, but Friday failed to deliver the required upside extension.

Push-pull dynamics are likely to continue…..expectations are for price action to remain constrained between the prevailing 0.6140 to 0.0.6300 range.

Select chart tabs

Stuart Talman is Director of Sales at XE. You can contact him here.