From Australia’s pilot projects to Jamaica’s JAM-DEX, the UK’s budding Britcoin and China’s ever-expanding e-CNY, there is significant movement in central bank digital currencies (CBDCs) globally.

Here, we take a journey around the world in CBDCs. Which countries are experimenting? Which have already implemented? And where is there resistance?

AUSTRALIA | CHINA | HONG KONG | UNITED STATES |

UNITED KINGDOM | SINGAPORE | EUROPE | OTHER JURISDICTIONS

For more on CBDCs and what they mean for financial institutions, consumers and businesses worldwide, see our related insight The Future of Money: Will Central Bank Digital Currencies reshape the payments industry?

Australia

CROSS BORDER AND WHOLESALE PILOTS COMPLETE, RETAIL PILOT UNDERWAY

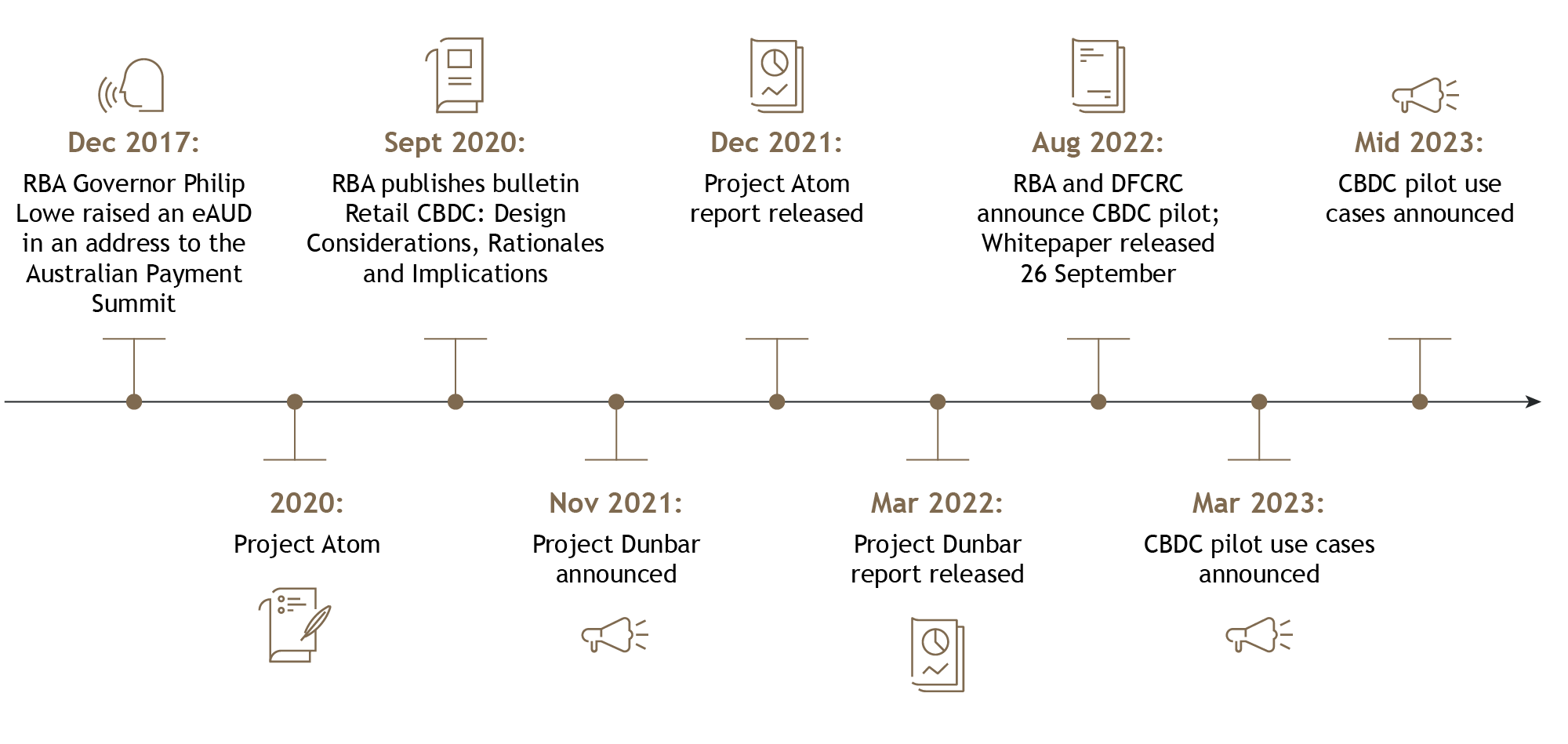

The Reserve Bank of Australia (RBA) is actively researching CBDC as a complement to existing forms of money. The RBA first raised the idea of an eAUD in a speech in 2017 – a time when it was considering the pros and cons. A number of projects have followed. These have looked at various possible use cases and explored the potential benefits, opportunities and challenges associated with CBDC. They have also examined the design and development of a CBDC if a decision was ever taken to implement one.

- Wholesale CBDC – Project Atom: In 2021, the RBA concluded Project Atom, demonstrating the potential for a wholesale CBDC and asset tokenisation to improve efficiency, risk management and innovation in wholesale financial market transactions. The RBA collaborated with the Commonwealth Bank of Australia, National Australia Bank, Perpetual and ConsenSys, with input from King & Wood Mallesons, to develop a proof of concept for the issuance of a tokenised form of CBDC. This could be used by wholesale market participants for the funding, settlement and repayment of a tokenised syndicated loan on an Ethereum-based Distributed Ledger Technology (DLT) platform. The report released in December 2021 lays the groundwork to explore the technological and legal architecture needed for CBDC payments to contribute to the digital economy.

- Cross border CBDC – Project Dunbar: The RBA with the Bank for International Settlements (BIS), Bank Negara Malaysia, Monetary Authority of Singapore and the South African Reserve Bank together conducted Project Dunbar, exploring whether using a shared DLT platform for issuing multiple wholesale CBDCs could improve the efficiency, speed and transparency of cross-border payments. This project showed that enabling financial institutions to directly hold and transact in CBDCs from different jurisdictions on a shared platform could reduce the reliance on intermediaries and, correspondingly, the costs and time taken to process cross-border transactions.

- Retail pilot projects – Digital Finance Cooperative Research Centre: Most recently, the RBA launched its research project exploring use cases and business models the issuance of a CBDC could support. The project is also an opportunity to further explore some of the technological, legal and regulatory considerations associated with a CBDC. A white paper published in September 2022 invited people to apply to participate in pilots which were selected in early 2023. A report will follow in mid-2023.

Prior work by the RBA has suggested that there was not yet a compelling case for a retail CBDC in Australia. As the RBA’s research has evolved it seems that this may no longer be the case.

Australia’s evolving CBDC exploration

The framework for the future of money is also evolving in Australia. In December 2022, updating and strengthening Australia’s payments system was announced in the Australian Government’s agenda to modernise Australia’s financial system, and consultation on a Strategic Plan for the Payments System which will consider stablecoins, commenced. The Australian Treasury’s Token Mapping consultation paper, released in February 2023, is also a “foundational step” for establishing a framework for reform for the crypto sector.

In March 2023, Senator Andrew Bragg introduced a private senators’ bill to introduce a licensing regime for the Australian crypto asset sector and impose reporting obligations on authorised deposit-taking institutions (ADI) in relation to CBDCs. If passed, the bill would require digital asset exchanges, custody services and stablecoin issuers to be licensed.

China

RETAIL E-CNY LAUNCHED IN 2020

The People’s Bank of China (PBOC) began piloting its retail CBDC, e-CNY, in 2020. The pilot started in 4 major cities: Shenzhen, Suzhou, Xiongan and Chengdu. Since the pilot started the value of transactions made using e-CNY has surpassed 100 billion yuan, and PBOC has expanded the pilot to include the entirety of 4 provinces: Guangdong, Jiangsu, Hebei and Sichuan. At the end of 2022, the PBOC reported that there was 13.61 billion yuan of e-CNY in circulation, representing 0.15% of the total volume of yuan in circulation.

There is no current date for a nationwide launch of e-CNY, however companies including Alibaba and Tencent have integrated e-CNY into their systems as a payment option. Alipay and WeChat have e-CNY functionality, greatly expanding the use case for the digital yuan. The PBOC has developed a digital wallet app in which e-CNY is stored. The app can be installed on smartphones to enable payments via QR codes, near-field communication tapping and other methods.

At this stage the pilot has mainly been used for domestic retail payments, however PBOC has indicated that it intends to encourage use in corporate and personal business transactions, as well as finance, taxation, and government spending. There are reports that e-CNY has been used to buy securities.

PBOC has identified several benefits of e-CNY:

- reducing transaction costs and times for domestic and international payments

- reducing the costs associated with printing, circulating, and eventually replacing damaged physical money

- enhancing its control of money supply and currency circulation

- increasing the usage of renminbi to price and settle global trade transactions and financing

- increasing the visibility of its uses, which can help to decrease money laundering, tax evasion, and allow PBOC better data to base policy decisions on

- improving financial inclusion by allowing digital payments in rural areas that have more limited infrastructure.

The PBOC has also considered the application of a wholesale CBDC alongside the Hong Kong Monetary Authority.

HONG KONG

RETAIL E-HKD PILOT AND MBRIDGE UNDER WAY

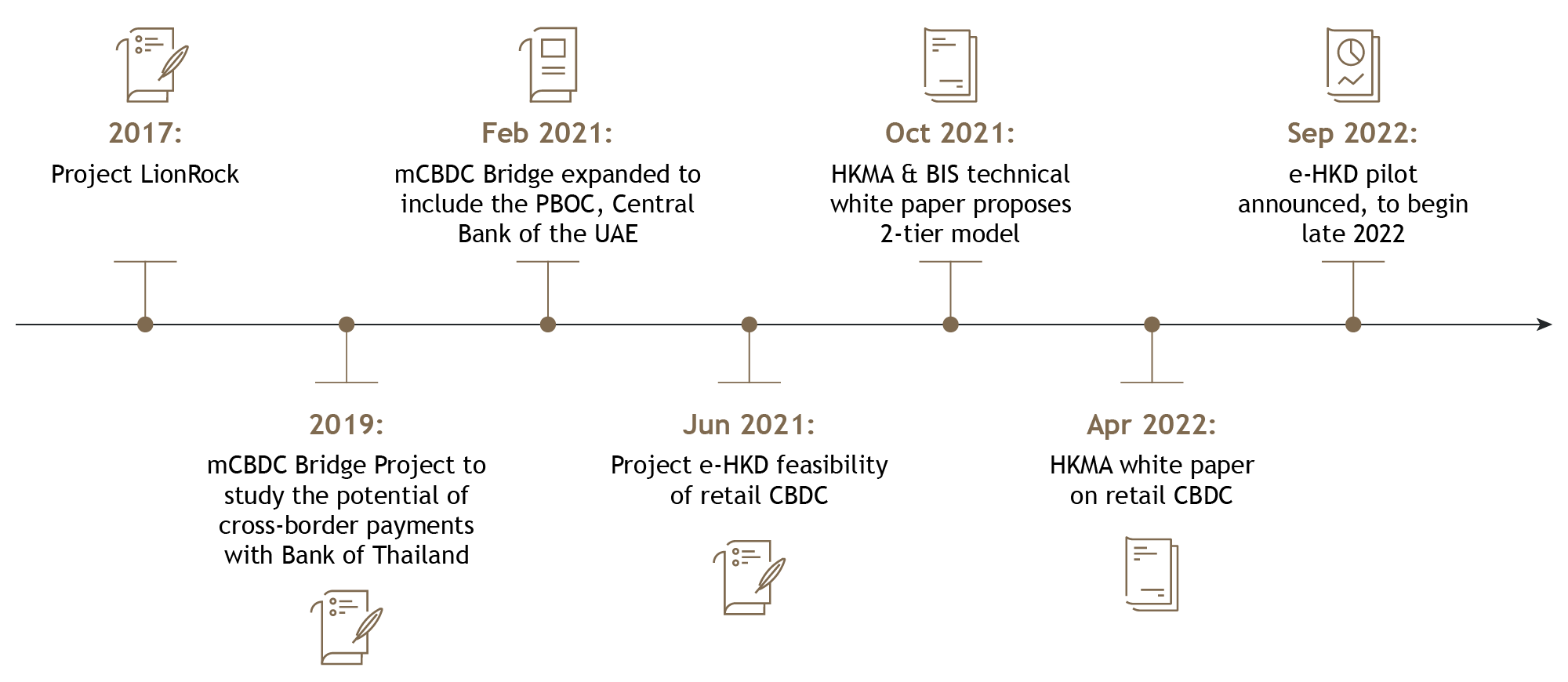

The Hong Kong Monetary Authority (HKMA) first considered the application of a CBDC in 2017 with Project LionRock, considering a wholesale CBDC. HKMA has since undertaken a number of studies, leading to the pending introduction of a retail CBDC:

- mBridge (initially Project Inthanon-LionRock): Around 20 commercial banks, with King & Wood Mallesons as lead counsel, participated in the Bank for International Settlements’ mBridge trial which found that a CBDC platform can address the major pain points of cross-border payments, including the high cost, low speed, and operational complexities. In 2019, the study was launched, looking into the potential of wholesale CBDC for cross-border payment with the Bank of Thailand. In 2021 it was renamed Multiple CBDC Bridge (mBridge) and expanded to include PBOC and the Central Bank of the United Arab Emirates. The report was released in 2022 and the next phase is now under way.

- Project e-HKD: HKMA launched a study of a retail e-HKD in June 2021. A technical whitepaper produced in collaboration with the BIS International Hub Hong Kong Centre followed in October The proposal included a 2-tier model, comprising a wholesale system involving the central bank and a retail system enabling commercial banks to circulate e-HKD. HKMA noted several key areas for consideration for a retail e-HKD, including:

- privacy considerations

- interoperability with conventional and other market infrastructure

- performance and scalability

- cybersecurity

- managing compliance requirements such as anti-money laundering considerations

- ensuring operational robustness and resilience

- considering the potential application for existing businesses.

- e-HKD policy and design: In April 2022 HKMA published a policy and design whitepaper addressing the potential benefits and challenges of a retail CBDC including design considerations and some potential use cases. Concerns noted include:

- vulnerability to cyber-attacks and system outages

- the perception of increasing competition in the payments market and adverse impacts on commercial bank’s funding and their ability to supply credit.

Some of the potential benefits of a retail CBDC include:

- improving the availability and usability of central bank money

- positioning for the challenges of new forms of money

- supporting innovation and meeting future payment needs in a digital economy

- improving resilience and efficiency of the payment system

- reinforcing the transmission of monetary policy.

In September 2022 HKMA announced that it would commence the second ‘rail’ of its ‘three-rail’ approach to piloting retail CBDC e-HKD in November 2022. The second rail focuses on application research and pilots. The third rail, which is to follow later, will set the timeline for launching e-HKD.

On 18 May 2023, the HKMA announced the commencement of the e-HKD pilot programme, with 16 firms selected to participate.

Given the plethora of convenient retail payment options in Hong Kong, that would require an rCBDC that would address some existing pain points, open up new or innovative use, provide complementarity with private money, or is more convenient than existing payment options.” – HKMA, e-HKD Policy & Design Perspective

UNITED STATES

REVIEW OF WHOLESALE & RETAIL OPTIONS UNDER WAY

The Federal Reserve has made no decisions on whether to pursue a US CBDC, however it has been exploring the potential benefits and risks of CBDCs more generally. Its key focus is on whether a CBDC could improve an already safe and efficient domestic payments system.

In January 2022, the Federal Reserve released a discussion paper examining the pros and cons of a potential retail CBDC.

The initial analysis found that a US CBDC, if one were created, would best serve the needs of the United States if it was:

A CBDC could potentially serve as a new foundation for the payment system and a bridge between different payment services, both legacy and new, according to the research.

The current Federal administration has highlighted its support for the Federal Reserve’s work in reviewing a potential CBDC. The Treasury will lead an interagency working group to consider the potential implications of a CBDC. In March 2022 President Biden signed Executive Order 14067 Ensuring Responsible Development of Digital Assets, placing a high level of importance on research and development efforts into a potential CBDC.

The White House released a technical evaluation report in September 2022. This report evaluated some potential design options against the priorities that the US Government has for a potential CBDC, which includes expanding equitable access to the financial system, preserving the role of physical cash, only collecting data that is strictly necessary, remaining sustainable and providing a good customer experience. The US is considering the application of both wholesale and retail CBDCs as a part of this work.

In November 2022, the Federal Reserve Bank of New York and its New York Innovation Centre initiated a 12-week pilot project (known as Project Cedar) to test the feasibility of wholesale CBDCs in the US. The future use of CBDCs in the US is not, however, without controversy. US Senator Ted Cruz introduced a bill in March 2023 to prohibit the US Federal Reserve from introducing a retail CBDC. Similarly, Governor Ron DeSantis has announced legislation to ban the use of CBDCs in Florida.

- Regional efforts: The Federal Reserve Bank of Boston in collaboration with the Massachusetts Institute of Technology Digital Currency Initiative published the Project Hamilton Phase 1 report in February 2022. Project Hamilton aims to explore the use of existing and new technologies to build and pilot hypothetical CBDC platforms. The Phase 1 report presented initial technological research into CBDCs and resulted in the production of research and code in relation to a high-performance transaction processor. Phase 2 will explore high-security issuance, systemwide auditability, programmability, privacy and compliance, resilience against denial-of-service attacks and the technical roles for intermediaries.

If the US pursued a CBDC, there could be many possible benefits, such as facilitating efficient and low-cost transactions, fostering greater access to the financial system, boosting economic growth, and supporting the continued centrality of the US within the international financial system. However, a US CBDC could also introduce a variety of risks, as it might affect everything ranging from the stability of the financial system to the protection of sensitive data.” – US, White House Office of Science and Technology Policy, September 2022

UNITED KINGDOM

FROM RESISTANCE TO EMBRACING THE BRITCOIN

The Bank of England (BoE) has long explored the introduction of a CBDC, including considering how a CBDC might work. It was initially resistant to the idea of introducing one. The House of Lords released a report in January 2022 which found that there was no convincing case for introducing a retail CBDC in the UK.

However, the tide appears to have turned. While the Bank of England is yet to decide whether to introduce a digital pound it has explored the potential across a few initiatives, including:

- Digital Pound consultation. The Bank of England is exploring the policy case for a retail digital pound CBDC. As part of this process, in February 2023 the Bank of England published a joint consultation paper with HM Treasury, as well as a technology working paper. In that consultation paper, the BoE and HM Treasury conclude that ‘it is likely that a digital pound will be needed in the future’, representing a major shift in thinking as to the future of retail CBDCs in the UK. The BoE and HM Treasury now intend to move to Phase 2 of their work on the digital pound—the design phase—to evaluate the technological feasibility of a digital pound and determine the design architecture to implement it. The BoE and HM Treasury are inviting responses on their consultation paper with a deadline of 7 June 2023.

- Multi-jurisdiction trial: A wholesale CBDC collaboration between BoE, the Bank of Canada’s Project Jasper and the Monetary Authority of Singapore’s Project Ubin successfully tested the application of a cross-border, cross-currency settlement system using distributed ledger technology.

- CBDC Taskforce: Since April 2021, BoE has worked with HM Treasury as a part of the Central Bank Digital Currency Taskforce to explore a potential CBDC. It had previously released a discussion paper on the topic in March 2020, with the general feedback received supporting continued examination of CBDCs, however highlighting that the use case in particular needed further research, refinement and articulation. In June 2021 BoE released a discussion paper on new forms of digital money, which discussed the potential impact and use of CBDCs as well as systemic stablecoins.

- Ongoing consultations: In November 2021 BoE released a series of next steps for their work researching CBDCs, including the announcement of a consultation in 2022 to assess the use case for a CBDC and the merits of further work to develop an operational and technology model. The aim of this consultation is to inform the decision that the BoE and HM Treasury will make as to whether they would move into a development phase which would span several years. If it is decided to move ahead with a CBDC, the earliest launch date would be in the second half of the 2020’s. In February 2022, BoE announced that it was working with MIT on a 12 month research project related to CBDCs.

SINGAPORE

POTENTIAL FOR WHOLESALE BUT NO COMPELLING CASE FOR RETAIL

There has been a clear focus on establishing payment links, not necessarily in CBDC form. The 2023 Singapore-India link is an example. While research continues, Singapore clearly appears focused on various types of cross-border payment links.

In 2021 the Monetary Authority of Singapore (MAS) explored how a common platform for multi-wholesale CBDCs could enable cheaper, faster and safer cross-border payments, via the collaborative Project Dunbar. The RBA, BIS Innovation Hub, Bank Negara Malaysia and the South African Reserve Bank were all part of the project. The project successfully developed working prototypes, achieving its aim of proving that the concept of multi-wholesale CBDCs was technically viable. MAS has also been a part of several other wholesale CBDC trials, including Project Jasper-Ubin with the Bank of Canada and the Onyx-based m-CBDC experiment with Banque de France which involved multiple CBDC.

MAS has been actively researching options for a retail CBDC. In 2021, MAS ran a Global CBDC challenge competition with IMF, World Bank, ADB, UNCDF, UNHCR, UNDP and OECD, seeking innovative retail CBDC solutions to enhance payment efficiencies and promote financial inclusion. In November 2021 MAS published its first initial assessment of a potential retail CBDC. The major inferences from this work were that there weren’t strong economic motivations for, or unmanageable monetary and financial stability considerations against, a retail CBDC in Singapore, as well as an acknowledgement that emerging technologies and global competitive forces could lead to a stronger case for a retail CBDC.

Notwithstanding the fact that the MAS sees no “urgent case” for the introduction of a retail CBDC, Singapore pressed ahead with a limited trial of a purpose-bound digital SGD at the 2022 Singapore FinTech Festival, allowing for the use of a digital SGD in select environments.

[Wholesale CBDCs] have the potential to radically transform cross-border payments, which today are slow, expensive, and opaque. The case for a retail CBDC in Singapore is not compelling for now, given well-functioning payment systems and broad financial inclusion.” – MAS managing director Ravi Menon, August 2022

EUROPE

DIGITAL EURO (RETAIL CBDC) INVESTIGATION UNDER WAY, RESULT DUE OCT 2023

In October 2020, the European Central Bank (ECB) published a High-Level Task Force report on a potential retail CBDC, also known as a digital Euro. This was followed by a public consultation concluding in April 2021, and the launch of an investigation phase in July 2021 This phase involves considering what a digital Euro may look like, its design and distribution, and the impact it could have on the market.

The investigation phase is due to finish in October 2023, at which point the ECB’s Governing Council will decide whether to proceed with the realisation phase and developing and testing a digital Euro. Key factors that are being considered include the potential impact a digital Euro could have on the banking sector, and the potential privacy implications.

Several reports have been released during the investigation phase, including a report on payment preferences in March 2022, key objectives and design considerations in July 2022 and a progress report in September 2022. The progress report noted several key areas for consideration, including:

- The transfer mechanism

- Privacy implications

- Tools to control the amount of a digital Euro in circulation.

The next part of the investigation phase will involve exploring design and distribution options.

ECB is supportive of work to modernise and test wholesale CBDCs, highlighting that a version of a digital settlement system between banks has existed in some form for decades and stressing the need to preserve the stability of monetary and payments systems. It was reported in February 2023 that making the case to the public for the adoption of a CBDC would be a key focus of the meeting of the Governing Council of the ECB, indicating the further support of the ECB to CBDCs generally.

We want to ensure that central bank money remains available for the public to use everywhere in the euro area for their day-to-day transactions – not just in its physical form, but in digital form too.” – ECB Executive Board member Fabio Panetta, September 2022

OTHER JURISDICTIONS

FROM THE SAND DOLLAR TO THE JAM-DEX

Several jurisdictions have officially launched retail CBDCs.

- The Sand Dollar: The Central Bank of the Bahamas was the first central bank to introduce a full-fledged CBDC in October 2020; the Sand Dollar. The aim of the Sand Dollar is to further financial inclusion goals and promote the public’s access to payments. This is particularly important given that the island topography of the Bahamas makes the distribution of cash and provision of financial services difficult and costly.

- DCash: The Eastern Caribbean Currency Union, comprising Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, St. Kitts and Nevis, Saint Lucia, and St. Vincent and the Grenadines, launched its digital currency in March 2021. DCash is designed to speed up transactions and serve people without bank accounts.

- e-Naira: Nigeria launched its CBDC, e-Naira, in October 2021. The eNaira is stored in a digital wallet and can be used for contactless in-store payments, as well as for transferring money. Critics have stated that the requirement to have a national identification number and a smartphone to access and use eNaira will mean that some unbanked people won’t be able to access the benefits of having a CBDC.

- JAM-DEX: The Bank of Jamaica launched Jam-Dex in June 2022, and was the first central bank to recognise its CBDC as legal tender. The aim of the Jam-Dex is to facilitate greater financial inclusion, increase transaction velocity while reducing the cost of banking for the Jamaican people.