165

By Yuefen Li, Economist and Special Advisor on South-South Cooperation and Development Finance, South Centre, Geneva

By Yuefen Li, Economist and Special Advisor on South-South Cooperation and Development Finance, South Centre, Geneva

This article was originally published in the Autumn/November 2023 edition of International Banker

The centrality of the US dollar in international monetary and economic systems since World War II has been overwhelming. It is a reserve currency, medium of exchange and unit of account. Some countries and regions have historically attempted to reduce their reliance on the dollar, dubbed de-dollarization. But none of these attempts were broad-based. Unhappiness with the dollar’s dominance and the power it grants Washington has been obvious, but none of the de-dollarization efforts to date have achieved meaningful outcomes. Therefore, the dominance and supremacy of the US dollar still comprise the current global narrative.

However, this time it is different. Discontent over the dollar’s supremacy is more widespread, geographically covering Southeast Asia, the Middle East and Latin America. Recent de-dollarization processes have also been multi-pronged, manifesting in different areas and channels. Above all, de-dollarization has become part of the policies and strategies of some countries.

But de-dollarization efforts do not mean the dollar’s demise is imminent or the currency’s sway has ended. Currently, there is no good alternative to the dollar. No substantial evidence demonstrates that the dollar’s supreme status is under threat.

Nevertheless, the disadvantages of overreliance on the dollar have been keenly felt, especially by developing countries. Many countries have started searching for alternatives to the dollar in trade invoicing, foreign-exchange (forex) reserves, modes of financial clearance, debt issuances, etc. De-dollarization also seems to reflect the sentiments and efforts of moving from a unipolar world toward a multipolar world in the face of deepening fragmentation, changing narratives and aspirations toward a new and more democratic international economic order.

Economic rationale for de-dollarization

Currently, not only states but also investors have been reassessing the dollar’s role in the global economy and its implications for the world’s financial system. De-dollarization is not a mood swing; there are economic reasons behind this trend.

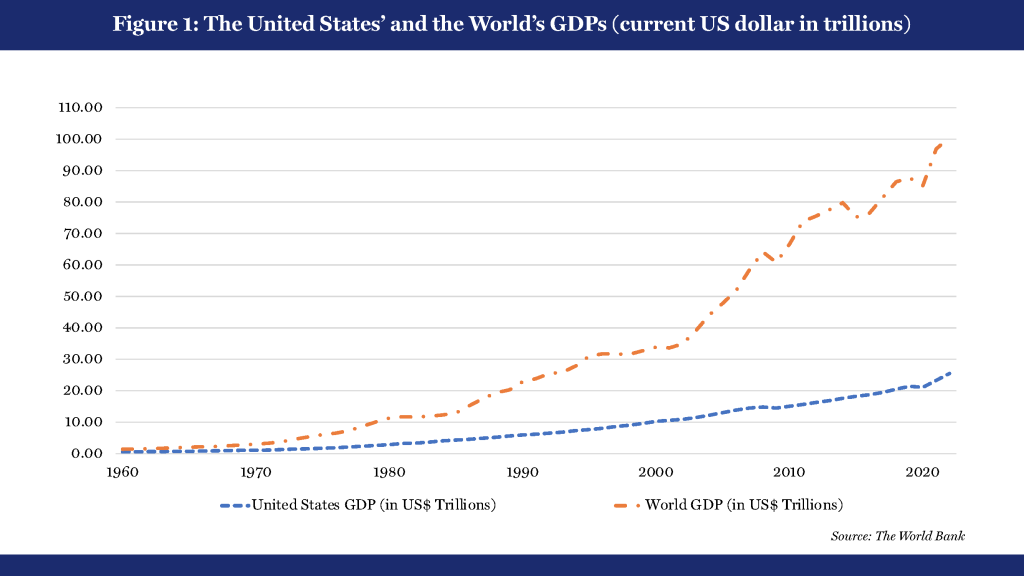

First, the asymmetry between the shrinking US economic weight in the world since World War II and the dollar’s growing dominant role has given rise to concerns related to global financial stability.

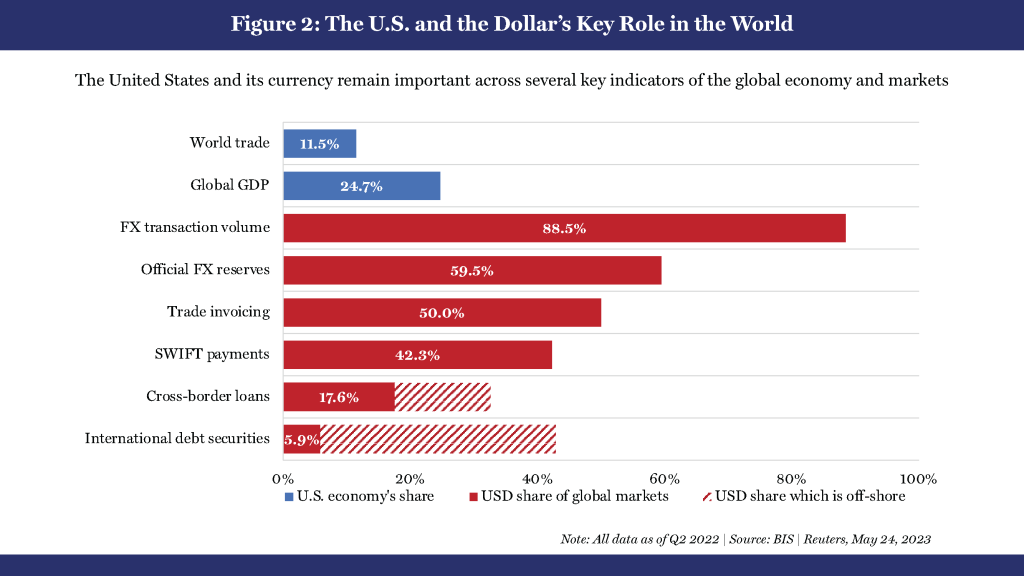

The US dollar’s shares in international foreign reserves, global trade invoicing, international debt securities and cross-border loans are many times greater than the United States’ shares of global gross domestic product (GDP) and international trade. As Akinci et al. pointed out, “There is a fundamental asymmetry between the shrinking exposure of the ‘real’ U.S. economy to global developments versus the growing global role of the U.S. dollar.… The asymmetry relies on [the] growing dominant role of the U.S. dollar while the U.S. economy is shrinking its importance both in terms of its weight as a share of global GDP and as a share of global trade.”1

It is mind-boggling to think about the potential risks of one country, with its share of global GDP reduced from around 45 percent to approximately 25 percent since World War II, still shouldering an oversized burden or responsibility for the performance of the world’s economy. Such a concentration of power in one country seems frightening to the rest of the world. Many scholars also believe the current dollar-dominated international financial system is skewed in the United States’ favor and is unsustainable. Nouriel Roubini stated that “sooner or later, an alternative will have to emerge to correct this imbalance that has been continuing since the Nixon shock in 1971!”2

Actions to weaponize the dollar for the promotion of US foreign policies or to put US economic interests above the rest of the world’s have been keenly felt, even suffered, by other countries, particularly developing countries, as their resilience to external shocks is weak. As John B. Connally, President Richard Nixon’s treasury secretary, said, “The dollar is our currency, but it’s your problem.” The dollar is a national currency, and the United States has full sovereignty to make monetary and fiscal decisions with global implications. Yet, there is no mechanism to compel a national government to consult with other countries that will be at the receiving end of the spill-over effects of its decisions. Nor does the international monetary system have the leverage to discipline the issuing countries of reserve currencies. This is indeed the world’s problem.

Secondly, there are concerns over transferring resources via the dollar from the periphery to the United States. The supremacy of the US dollar gives rise to global demand for it as a safe asset for foreign reserves and investments. This exorbitant dollar advantage allows the US to import foreign goods and services more often than not at low rates of return when compared to the sizeable excess return on US-backed capital exported back to the rest of the world, including interest income, portfolio equity positions and other capital exports in dollars.3

Some scholars have demonstrated that the US earns an important average excess return on its net foreign asset position. Gourinchas and Rey pointed out that US foreign liabilities are almost entirely in dollars, whereas approximately 70 percent of US foreign assets are in foreign currencies. Therefore, a 10-percent dollar depreciation represents, ceteris paribus, a transfer of around 5.9 percent of US GDP from the rest of the world to the United States. They went on to show that for the period 1952-2004, the indirect capital transfer from the world to the US owing to the special dollar status was “0.3 in 1952 to 0.73 in 1973, reached 1.09 in 1991 and, finally, 1.34 in 2004”.4

Mayer, on the other hand, pointed out that “developing economies as a group recorded negative return differentials and valuation losses during 2010–2019, implying a total return differential of about minus three percentage points between developing and developed economies and an annual average resource transfer from developing economies of about $800bn, or 3.3 per cent of their GDP”.5

Benefiting from these advantages, the negative impacts of the current US account and fiscal deficits tend to be muted to various degrees for the country. In other words, the US can afford to live beyond what its national GDP permits because of the dollar’s supremacy. However, this can give rise to global economic imbalances and vulnerabilities for countries that persistently run trade surpluses, including being trapped in exporting the international supply chain’s commodities or low-end products. Huge and persistent trade surpluses mean excessive domestic savings or suppression of consumption, resulting in less productive domestic investment and increasing foreign-exchange reserves in safe assets that are largely in dollars.

To borrow money cheaply in global markets and create it inexpensively domestically, then recycle dollars at higher returns, is one privilege granted to the US by its dollar. However, dollar privileges go beyond this.

The imposition of sanctions on Russia has triggered the fear of Washington using the dollar’s global dominance as a vehicle for its foreign-policy aims. Currently, the US has sanctioned approximately 40 countries. Some de-dollarization actions are in response to concerns over which country or enterprise will be the next sanctions target.

Modes of de-dollarization

Global trade has been based on the dollar since the end of World War II. Most commodities are priced and traded in US dollars, even though the actual trade may have nothing to do with the United States. Unsurprisingly, an important trend in de-dollarization has been to use alternative currencies for trade invoicing.

In the past two decades, many countries’ central banks have attempted to diversify their portfolios to shift away from the US dollar. Since the turn of the millennium,6 the share of the US dollar in global foreign-exchange reserves has declined by more than 10 percentage points. Compared with its peak of 85 percent in 1977, the US dollar’s slide in global foreign-exchange reserves has been significant.

In seeking a safe alternative to the dollar, central banks have been turning to gold and other currencies. The purchase of gold by central banks has reached a peak of 33 percent of the monthly global demand for gold, contributing to the sharp increase in the price of gold. 2022 saw central banks purchase a record amount of gold of 1,089 tons, the most since records began in 1950.7

The global cross-border payments infrastructure, dominated by the Society for Worldwide Interbank Financial Telecommunications (SWIFT) and the United States’ Clearing House Interbank Payments System (CHIPS), is essential for international financial activities and the realization of the dominant positions of reserve currencies; it is also an important vehicle for the imposition of financial sanctions. A few alternative systems have been developed by China, Russia, France, Germany and the United Kingdom, but they are not yet widely used.

China, India and South Africa are among the countries that have started to internationalize their currencies. Central bank digital currencies (CBDCs) have also been developed to help speed up settlements of cross-border transactions. According to the International Monetary Fund (IMF),8 as of July 2022, there were nearly 100 CBDCs in research or development stages, and two have been fully launched. Many countries are testing these digital currencies with the aim, among others, of using them in trade transactions in their own currencies. CBDCs can potentially reduce their countries’ reliance on the dollar in addition to digitalizing financing.

Conclusions

Even though the dollar’s share of the world’s central banks’ foreign-exchange reserves has declined, it is still dominant.

For trade invoicing and international transactions of foreign exchange, the dollar’s position has remained stable, at the level of almost 90 percent of global forex transactions, representing about $6.6 trillion in 2022, according to Bank for International Settlements (BIS) data. About 50 percent of global trade is invoiced in the dollar, even though the United States’ real share in world trade is much less.9

Regarding debt instruments, the dollar has recently significantly increased in international bond issuance.10According to the BIS, foreign-currency debt denominated in US dollars has remained around 60 percent since 2010. Regarding cross-border transmissions, more than 90 percent passed through SWIFT,11 suggesting an almost absolute monopoly.

Overall, recent developments in de-dollarization, even though broad-based, do not point to any imminent loss of the US dollar’s dominance. The biggest challenge to de-dollarization is that no single alternative currency meets the criteria for being the world’s leading reserve currency, a store of value, and a medium and means of payment.

However, owing to the increasing awareness of the economic and geopolitical rationales for de-dollarization and the fact that major developing countries have been at the forefront of the movement, the trend toward further de-dollarization seems unstoppable.

References

1 Federal Reserve Bank of New York (New York Fed): “The Dollar’s Imperial Circle,” Ozge Akinci, Gianluca Benigno, Serra Pelin and Jonathan Turek, December 2022, Staff Reports Number 1045.

2 Financial Times: “A bipolar currency regime will replace the dollar’s exorbitant privilege,” Nouriel Roubini, February 5, 2023.

3 Harvard University: “Global Imbalances and Policy Wars at the Zero Lower Bound,” Ricardo J. Caballero, Emmanuel Farhi and Pierre-Olivier Gourinchas, January 16, 2020, Page 9.

See also:

Policy Center for the New South: “The U.S. dollar’s ‘exorbitant privilege’ remains,” Otaviano Canuto, April 27, 2023, Policy Brief.

4 National Bureau of Economic Research (NBER): “From World Banker to World Venture Capitalist: U.S. External Adjustment and the Exorbitant Privilege,” Pierre-Olivier Gourinchas and Hélène Rey, in G7 Current Account Imbalances: Sustainability and Adjustment, Richard H. Clarida, editor, University of Chicago Press, May 2007.

See also:

Journal of International Economics: “Why do foreigners invest in the United States?”, Kristin J. Forbes, January 2010, Volume 80, Issue 1, Pages 3-21.

5 Review of World Economics: “The ‘exorbitant privilege’ and ‘exorbitant duty’ of the United States in the international monetary system: implications for developing countries,” Jörg Mayer, June 10, 2021, Volume 157, Pages 927–964.

6 European Central Bank (ECB)/Eurosystem: “The international role of the euro,” June 2022.

7 Financial Times: “US banking crisis pushes gold close to all-time high,” Harry Dempsey, May 5, 2023.

8 International Monetary Fund (IMF)/Finance & Development: “The Ascent of CBDCS,” Andrew Stanley, September 2022.

See also: Bruegel: “De-dollarisation,” Maria Demertzis, April 25, 2023.

9 International Monetary Fund (IMF): “Patterns in Invoicing Currency in Global Trade,” Emine Boz, Camila Casas, Georgios Georgiadis, Gita Gopinath, Helena Le Mezo, Arnaud Mehl and Miss Tra Nguyen, July 17, 2020, IMF Working Paper Number 20/126.

10 European Central Bank (ECB)/Eurosystem: “The international role of the euro,” June 2022.

11 Leibniz Institute for Financial Research SAFE: “The weaponization of global payment infrastructures: A strategic dilemma,” Andreas Nölke, 2022, SAFE White Paper Number 89, Frankfurt.

ABOUT THE AUTHOR

Yuefen Li is an Economist and Senior Advisor on South-South Cooperation and Development Finance for the Geneva-based South Centre. Ms. Li is a former United Nations Independent Expert on Debt and Human Rights. Before joining the United Nations in 1990, she was a Lecturer at the University of International Business and Economics in Beijing, China.