Released: 2023-11-17

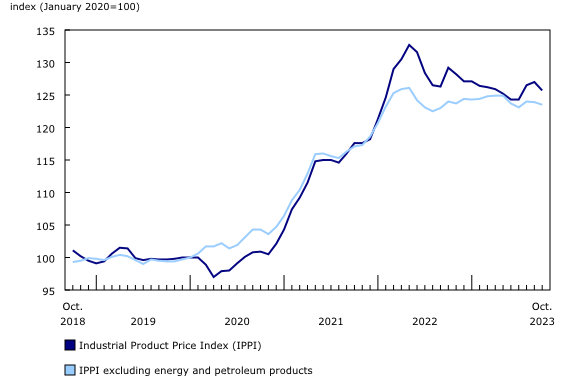

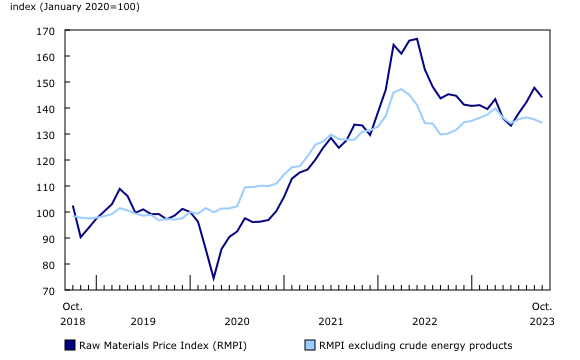

Prices of products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), fell 1.0% month over month in October and were 2.7% lower than in October 2022. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), declined 2.5% on a monthly basis in October 2023 and fell 0.8% year over year.

Industrial Product Price Index

The IPPI fell 1.0% month over month in October, following a rise of 0.4% in September. Excluding energy and petroleum products, the IPPI decreased 0.3%.

Prices for energy and petroleum products fell 5.7% month over month in October, after posting four months of consecutive increases. Lower prices were widespread among refined petroleum products, particularly finished motor gasoline (-8.4%), which was mainly responsible for the decline in this group. Prices for diesel fuel (-3.9%) and light fuel oils (-4.8%) also contributed to the decrease, but to a lesser extent. These decreases were partially influenced by lower prices for conventional crude oil (-3.7%), the primary input for refined petroleum products. Lower prices for finished motor gasoline were also influenced by weak demand and abundant inventories of gasoline in North America.

The price of softwood lumber fell 6.4% in October, the largest monthly decrease since March 2023 (-6.7%). Lower lumber prices were partially impacted by ongoing weak seasonal demand. High interest rates also continued to dampen real estate activities.

Prices for intermediate food products fell 1.9% month over month in October. Lower prices for canola oil (-7.5%), soybean oil (-9.4%), and oilseed cake and meal (-3.0%) were mainly behind the monthly decrease in this category. Canola oil prices fell partly due to a decline in both domestic consumption and exports. Increases in both domestic and global production put downward pressure on soybean prices. According to Agriculture and Agri-Food Canada, annual Canadian soybean production is expected to increase 2.7% in 2023, to 6.7 million tonnes. According to the U.S. Department of Agriculture’s October World Agricultural Supply and Demand Estimates report, global soybean production is expected to rise by 7.9% for the 2023/2024 crop year compared with the 2022/2023 crop year.

Prices for primary non-ferrous metal products decreased 1.2% month over month in October. Prices for unwrought nickel and nickel alloys (-5.9%) and unwrought copper and copper alloys (-3.0%) both fell on a monthly basis. The decreases were in part due to elevated supply of both metals and Chinese public holidays in October lowering industrial consumption. Prices for the precious metals group, including unwrought gold, silver, and platinum group metals, and their alloys (-0.9%), also fell in October. Although rising tensions in the Middle East contributed to gradual price increases throughout most of the month, the strong US dollar and signals of continued high interest rates caused precious metal prices to slide from late September to early October. In contrast, prices for unwrought aluminum and aluminum alloys were up 2.9%. Strong demand and falling inventories played a part in higher aluminum prices.

Prices for pulp and paper products rose 1.5% in October, mainly on higher prices for wood pulp (+8.2%). Strong demand put upward pressure on price movement, as did a global price increase announcement from the world’s largest pulp producer in Brazil.

Year over year

The IPPI decreased 2.7% year over year in October.

Prices for energy and petroleum products declined 16.7% on a year-over-year basis in October, led by diesel fuel (-24.6%), finished motor gasoline (-12.8%) and aviation fuel (-24.7%).

Excluding energy and petroleum products, the IPPI declined 0.4% year over year in October. Key downward contributors to the movement were lower prices for softwood lumber (-22.6%), wood pulp (-24.6%), ammonia and chemical fertilizers (-24.2%) and unwrought nickel and nickel alloys (-17.1%).

Partially moderating the decline in October, prices rose on a year-over-year basis for unwrought gold, silver and platinum group metals, and their alloys (+11.6%), fresh and frozen beef and veal (+23.0%) and light-duty trucks, vans and sport utility vehicles (+3.3%).

Raw Materials Price Index

In October, the RMPI fell 2.5% on a monthly basis.

Prices for crude energy products decreased 4.7% in October, mainly on lower prices for conventional crude oil (-3.7%). Crude oil prices were highly volatile in October, with ongoing geopolitical instability in the Middle East having an upward impact on prices, while falling demand and concerns about future demand had a mostly negative impact on prices, pushing the monthly price down compared with September.

Prices for metal ores, concentrates and scrap declined 1.6% in October, mainly on lower prices for nickel ores and concentrates (-5.7%), as well as gold, silver, and platinum group metal ores and concentrates (-2.1%).

Prices for hogs were down in October (-3.6%) for the second consecutive month, with ample supply going into the fourth quarter of 2023 and relatively slow seasonal demand in the fall. In contrast, prices for cattle and calves (+1.6%) rose in October, as tight domestic supply continues to push prices upward. On a yearly basis, cattle slaughter counts decreased in both Canada and the United States in October. Further down the supply chain, Canadian beef cold storage has also been falling for two consecutive quarters since the first quarter of 2023, and US storage in September was 20.1% lower compared with the same month in the previous year.

Year over year

The RMPI decreased 0.8% year over year in October.

The downward movement in October was led by crude energy products (-6.0%), including conventional crude oil (-2.7%) and natural gas (-19.4%).

Other key downward contributors to the movement in October included canola (-20.2%), nickel ores and concentrates (-13.8%), and wheat (-22.8%).

Key upward contributors to the movement in October were higher prices for cattle and calves (+31.5%), and gold, silver and platinum group metal ores and concentrates (+11.6%).

Note to readers

The Industrial Product Price Index (IPPI) and the Raw Materials Price Index (RMPI) are available at the Canada level only. Selected commodity groups within the IPPI are also available by region.

With each release, data for the previous six months may have been revised. The indexes are not seasonally adjusted.

The IPPI reflects the prices that producers in Canada receive as goods leave the plant gate. The IPPI does not reflect what the consumer pays. Unlike the Consumer Price Index, the IPPI excludes indirect taxes and all costs that occur between the time a good leaves the plant and the time the final user takes possession of the good. This includes transportation, wholesale and retail costs.

Canadian producers export many goods. Canadian producers often indicate goods’ prices in foreign currencies, especially in US dollars, which are then converted into Canadian dollars. This is particularly the case for motor vehicles, pulp and paper products, and wood products. Therefore, fluctuations in the value of the Canadian dollar against its US counterpart affect the IPPI. However, the conversion to Canadian dollars reflects only how respondents provide their prices. This is not a measure that takes into account the full effect of exchange rates.

The conversion of prices received in US dollars is based on the average monthly exchange rate established by the Bank of Canada and available in Table 33-10-0163-01 (series v111666275). Monthly and annual variations in the exchange rate, as described in the release, are calculated according to the indirect quotation of the exchange rate (for example, CAN$1 = US$X).

The RMPI reflects the prices paid by Canadian manufacturers for key raw materials. Many of those prices are set on the world market. However, as few prices are denominated in foreign currencies, their conversion into Canadian dollars has only a minor effect on the calculation of the RMPI.

Products

Statistics Canada launched the Producer Price Indexes Portal as part of a suite of portals for prices and price indexes. This webpage provides Canadians with a single point of access to a variety of statistics and measures related to producer prices.

The video “Producer price indexes” is available on the Statistics Canada Training Institute webpage. It introduces Statistics Canada’s producer price indexes: what they are, how they are made and what they are used for.

Increased sample size for certain series

Effective with the release of April 2023 data, the sample size for certain IPPI and RMPI indexes has been increased to improve their quality. The complete list of these indexes can be obtained upon request.

Next release

The industrial product and raw materials price indexes for November will be released on December 19.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).